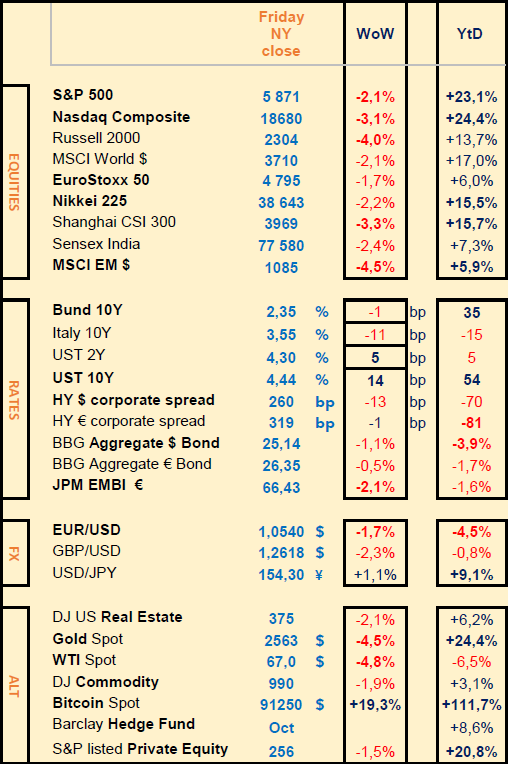

Reality check after J. Powell’s speech, US Oct inflation and RFK Jr nomination, led to markets corrections, boosted Bitcoin

WEEKLY TRENDS

WEEKLY TRENDS

- After new record highs on Nov 11 among thinner market liquidity, the nomination of R.F. Kennedy Jr. brought a cold shower onto the pharma stocks

- J. Powell proved to be in no rush to cut rates again, while the US economy is resilient, impacting Tech stocks the most

- The IEA reported that global Oil supply will exceed demand by 1m barrels a day in 2025

- Stronger October US PPI / CPI added pressure onto Treasuries, leading to higher US yields which benefitted the USD, leading to lower Gold, Oil prices and lower EM assets

- Demand for BTC does not seem to end, having the $100k mark in sight

- Next week, investors will focus on Nvidia’s Q3 earnings and outlook releases, to be reported on Wednesday evening (the last of Mag7 stocks to report Q3 earnings)

MARKETS

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Shopify (+25%), Siemens Energy (+19%), Alstom (+13%), Walt Disney (+16%), Continental (+12%), ASML (+2%)

- - - AbbVie (-17%), Bayer (-16%), BMW (-7%), RTL (-15%), Thales (-6%)

NB: Pharma stocks impacted by the nomination of anti-vaccine RFK Jr. : Moderna (-21%), Sanofi (-5%), Merck (-6%), GSK (-6%), Pfizer (-7%)

Rates

US curve (2-10 years) steepening raised by 10bps to 15bps. US 10yr yield ended the week higher at 4.30% (+15bps) while the 2 yr rose to 4.30% (+5bps). CME FedWatch tool shows a 60% probability of a 25bps FED cut in Dec and a total of 3 reductions of 25bps in 2025.

Commodities

Oil price is down after OPEC+ new forecast for global demand growth is lower at 1.82m barrels a day vs 1.93m previously, while IEA sees supply exceeding demand by 1m barrels a day in 2025

Gold price corrected following higher US Bond yields and a stronger USD

US

CPI in Oct at 2.6% vs 2.4% prior, Core CPI unchanged at 3.3%; PPI in Oct at 2.4% vs 2.3% prior, Core PPI at 3.1% vs 3% prior

EU

Germany Zew economic sentiment index for November decreased to 7.4 vs 13.2 expected and 13.1 prior, meanwhile Chancellor Scholz called president Putin to enter talks on Ukraine tin order o end the war

Crypto

BTC is up almost 20% on the week (Trump’s plan for further deregulation of cryptos is still fuelling strong demand for BTC)

Nota Bene

Argentina’s monthly inflation dropped to 2.7%, the lowest in 3 years (Reminder: monthly inflation was 25% when Milei took office)

According to JPM, last week saw the largest retail investors buying flow since March 2022, (NB their average performance YTD has been 3.7%)

CALENDAR

WHAT ANALYSTS SAY

Goldman Sachs, 15 Nov 2024 - Briefings

· What Trump's policies could mean for the Fed

How will the policies of president-elect Donald Trump impact monetary policy? Rob Kaplan, vice chairman at Goldman Sachs and former president of the Federal Reserve Bank of Dallas, discusses the prospects of the economy with Goldman Sachs Research's Allison Nathan in this week's episode of Goldman Sachs Exchanges.

What was it like serving as a Federal Reserve official during Trump's first term?

What you had to learn to do is be prepared to assess new fiscal policies — tax cuts, tariffs, and others — and try to incorporate them in your outlook.

After the election result was known, we saw investors' expectations shift toward fewer rate cuts in 2025, the presumption being that policies that will be implemented will on net be inflationary. How does the Fed grapple with that?

Well, I think I'd be careful. We just don't know yet what these policies are going to look like.

My strong advice outside the Fed — and if I were at the Fed — is: Let's be risk managers, not prognosticators. Let's slow down. We're not going to have good clarity on some of these policies maybe until spring of next year.

What does it all mean for markets? What, if anything, should investors be paying more attention to?

Some of the folks around the new administration have said: We want to reprivatize the economy. I think what they mean is: You may see less government-directed spending.

You may see an effort to improve productivity through regulatory reform, and an effort to create more organic GDP growth. That could mean, interestingly, that topline GDP growth might actually be lower, but you might see corporate earnings benefit more.

· Has China's property market reached the bottom?

China's leadership has, in recent weeks, moved aggressively to support the world's second largest economy, in part by stabilizing the housing market.

“We are finally at an inflection point of the ongoing downward spiral in the housing market,” writes Yi Wang, who leads the China real estate team in Goldman Sachs Research. “This time is different from the previous piecemeal easing measures, in our view.”

More than $1 trillion of additional fiscal stimulus could be injected to help stabilize the housing market in the coming years, according to Goldman Sachs Research.

The scale of the problem is huge: Our researchers estimate that China's unsold inventory of housing would amount to RMB 93 trillion ($13 trillion) if it were fully built. For comparison, there will be an estimated total of about RMB 9 trillion in property sales this year.

The housing market is still in a precarious position, and much depends on the government's follow-through on support.

Without intervention, Goldman Sachs Research estimates that property values may be at risk of falling by another 20% or 25%, which would drop them to about half of the peak in prices.

But the government moves are positive nonetheless, and our analysts now estimate that property prices may stabilize by late 2025.

UBS, 7 November 2024 - Shifting back from politics to economics

Authors: Constantin Bolz, CFA, Strategist ; Matthew Carter, Strategist

Key message

The dollar has seen a resurgence after Donald Trump's election victory and US economic resilience. While near-term USD strength may linger, we think the medium-term direction remains lower. Near-term FX volatility may offer opportunities for tactical investors to generate income through options strategies, but we believe investors with excess dollars should reduce on strength and diversify, including into gold.

House view

· A second Trump term and Republican control of Congress has led to a 6% rise in the DXY Index since the start of September.

· Gains followed expectations that President-elect Trump will enact dollar-positive policies such as domestic tax cuts and tariffs.

· The DXY Index is trading out of line with its historical pattern versus 10-year Treasury yields—at around 107, it is overshooting the yield-implied 105 level.

· Markets appear to underestimate Fed cuts by end-2025 (around 70bps priced versus our 125bps expectation) while overestimating euro area rate reductions.

· Contrary to Trump's first term, trading partners are better prepared for tariffs, while worse US debt dynamics and slowing US activity should weigh on the dollar.

· We see near-term opportunities to generate income in currencies, especially selling the risks of falls in EURUSD and GBPUSD, and the risks of a rising USDCHF.

· Investors with excess dollars should use periods of dollar strength to hedge dollar assets and switch cash and fixed income exposure to other currencies

· Gold prices and the USDCNY should rise in an adverse tradewar scenario where US tariffs surpass expectations and dampen Chinese growth.

Investment view

While near-term dollar strength could persist, we believe investors should diversify their USD holdings, as the currency's strength eases over the medium term.

We like the Swiss franc, the euro, the British pound, and the Australian dollar.

We also recommend an allocation to gold of up to 5% within a balanced USD portfolio.

World Gold Council, 12 November 2024 - Under pressure

Authors: WGC, November report

Election response:

The first week of November saw gold move lower after hitting a new all-time-high on the first of the month.

According to our Gold Return Attribution Model (GRAM), gold was pressured lower by strength in the US dollar and momentum factors including the lagged gold price, gold ETF outflows which were coming off an exceptionally strong month, and a drop in COMEX net managed money net longs – reflecting the likely unwind of pre-election hedges.

Global gold ETFs shed an estimated US$809mn (12t) during the first week of November, with the bulk of outflows stemming from North America, which were partially offset by strong Asian inflows. Potentially signalling renewed fears around the resumption of the trade war between the US and China. Additionally, COMEX net positioning also fell 74 tonnes, an 8% drop from the prior week.

Looking ahead:

The US election results have taken a bit of a knee-jerk sting out of gold’s impressive y-t-d rally. Suggested reasons are a continued strengthening in bond yields and the US dollar, risk-on sentiment in equity markets, a boost to cryptocurrencies and a quelling of geopolitical tensions. These factors might presage a welcome pause, even a healthy near-term retracement, for gold.

There was a sense that the pre-election run up in Treasury yields and the US dollar might have been exhausted and that a turn in the dollar might lead bond yields lower – as it has done on several occasions over the last two years. After all, the dollar is richly valued on a real effective exchange rate (REER) basis and a Trump administration is said to favour both a weaker exchange rate to encourage exports and lower interest rates to spur borrowing.

In summary:

gold’s negative reaction to both the US election results and a continued move higher in bonds yields and the US dollar is in our view a near-term phenomenon. Other drivers including lower sanctions risks, a renewed bullishness in equity markets and cryptocurrencies mask the underlying – and in our view – more fundamental concerns of:

· A world where protectionism is likely going to be more acute and current conflicts see no signs of abatement

· Equity markets are heavily concentrated and richly valued during the end of a business cycle

· Cryptocurrencies continue to be a marginal consideration and not a replacement for gold

· Western investors have, outside of futures, not added much gold this year and so there is unlikely a slew of sellers in the wings

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Shopify (+25%), Siemens Energy (+19%), Alstom (+13%), Walt Disney (+16%), Continental (+12%), ASML (+2%)

- - - AbbVie (-17%), Bayer (-16%), BMW (-7%), RTL (-15%), Thales (-6%)

NB: Pharma stocks impacted by the nomination of anti-vaccine RFK Jr. : Moderna (-21%), Sanofi (-5%), Merck (-6%), GSK (-6%), Pfizer (-7%)

Rates

US curve (2-10 years) steepening raised by 10bps to 15bps. US 10yr yield ended the week higher at 4.30% (+15bps) while the 2 yr rose to 4.30% (+5bps). CME FedWatch tool shows a 60% probability of a 25bps FED cut in Dec and a total of 3 reductions of 25bps in 2025.

Commodities

Oil price is down after OPEC+ new forecast for global demand growth is lower at 1.82m barrels a day vs 1.93m previously, while IEA sees supply exceeding demand by 1m barrels a day in 2025

Gold price corrected following higher US Bond yields and a stronger USD

US

CPI in Oct at 2.6% vs 2.4% prior, Core CPI unchanged at 3.3%; PPI in Oct at 2.4% vs 2.3% prior, Core PPI at 3.1% vs 3% prior

EU

Germany Zew economic sentiment index for November decreased to 7.4 vs 13.2 expected and 13.1 prior, meanwhile Chancellor Scholz called president Putin to enter talks on Ukraine tin order o end the war

Crypto

BTC is up almost 20% on the week (Trump’s plan for further deregulation of cryptos is still fuelling strong demand for BTC)

Nota Bene

Argentina’s monthly inflation dropped to 2.7%, the lowest in 3 years (Reminder: monthly inflation was 25% when Milei took office)

According to JPM, last week saw the largest retail investors buying flow since March 2022, (NB their average performance YTD has been 3.7%)

CALENDAR

- Corporate earnings: US Walmart (19 Nov), Nvidia (20); Europe Vinci (19), Sage (20); China PDD Holdings (21)

- Macro: EU CPI for Oct (19 Nov); US PMI Oct (22)

WHAT ANALYSTS SAY

- Goldman Sachs - Briefings (What Trump’s policies could mean for the FED; China’s property market may have reached inflection)

- UBS - Houseview Briefcase (Will the strong dollar persist?)

- World Gold Council - Under pressure

Goldman Sachs, 15 Nov 2024 - Briefings

· What Trump's policies could mean for the Fed

How will the policies of president-elect Donald Trump impact monetary policy? Rob Kaplan, vice chairman at Goldman Sachs and former president of the Federal Reserve Bank of Dallas, discusses the prospects of the economy with Goldman Sachs Research's Allison Nathan in this week's episode of Goldman Sachs Exchanges.

What was it like serving as a Federal Reserve official during Trump's first term?

What you had to learn to do is be prepared to assess new fiscal policies — tax cuts, tariffs, and others — and try to incorporate them in your outlook.

After the election result was known, we saw investors' expectations shift toward fewer rate cuts in 2025, the presumption being that policies that will be implemented will on net be inflationary. How does the Fed grapple with that?

Well, I think I'd be careful. We just don't know yet what these policies are going to look like.

My strong advice outside the Fed — and if I were at the Fed — is: Let's be risk managers, not prognosticators. Let's slow down. We're not going to have good clarity on some of these policies maybe until spring of next year.

What does it all mean for markets? What, if anything, should investors be paying more attention to?

Some of the folks around the new administration have said: We want to reprivatize the economy. I think what they mean is: You may see less government-directed spending.

You may see an effort to improve productivity through regulatory reform, and an effort to create more organic GDP growth. That could mean, interestingly, that topline GDP growth might actually be lower, but you might see corporate earnings benefit more.

· Has China's property market reached the bottom?

China's leadership has, in recent weeks, moved aggressively to support the world's second largest economy, in part by stabilizing the housing market.

“We are finally at an inflection point of the ongoing downward spiral in the housing market,” writes Yi Wang, who leads the China real estate team in Goldman Sachs Research. “This time is different from the previous piecemeal easing measures, in our view.”

More than $1 trillion of additional fiscal stimulus could be injected to help stabilize the housing market in the coming years, according to Goldman Sachs Research.

The scale of the problem is huge: Our researchers estimate that China's unsold inventory of housing would amount to RMB 93 trillion ($13 trillion) if it were fully built. For comparison, there will be an estimated total of about RMB 9 trillion in property sales this year.

The housing market is still in a precarious position, and much depends on the government's follow-through on support.

Without intervention, Goldman Sachs Research estimates that property values may be at risk of falling by another 20% or 25%, which would drop them to about half of the peak in prices.

But the government moves are positive nonetheless, and our analysts now estimate that property prices may stabilize by late 2025.

UBS, 7 November 2024 - Shifting back from politics to economics

Authors: Constantin Bolz, CFA, Strategist ; Matthew Carter, Strategist

Key message

The dollar has seen a resurgence after Donald Trump's election victory and US economic resilience. While near-term USD strength may linger, we think the medium-term direction remains lower. Near-term FX volatility may offer opportunities for tactical investors to generate income through options strategies, but we believe investors with excess dollars should reduce on strength and diversify, including into gold.

House view

· A second Trump term and Republican control of Congress has led to a 6% rise in the DXY Index since the start of September.

· Gains followed expectations that President-elect Trump will enact dollar-positive policies such as domestic tax cuts and tariffs.

· The DXY Index is trading out of line with its historical pattern versus 10-year Treasury yields—at around 107, it is overshooting the yield-implied 105 level.

· Markets appear to underestimate Fed cuts by end-2025 (around 70bps priced versus our 125bps expectation) while overestimating euro area rate reductions.

· Contrary to Trump's first term, trading partners are better prepared for tariffs, while worse US debt dynamics and slowing US activity should weigh on the dollar.

· We see near-term opportunities to generate income in currencies, especially selling the risks of falls in EURUSD and GBPUSD, and the risks of a rising USDCHF.

· Investors with excess dollars should use periods of dollar strength to hedge dollar assets and switch cash and fixed income exposure to other currencies

· Gold prices and the USDCNY should rise in an adverse tradewar scenario where US tariffs surpass expectations and dampen Chinese growth.

Investment view

While near-term dollar strength could persist, we believe investors should diversify their USD holdings, as the currency's strength eases over the medium term.

We like the Swiss franc, the euro, the British pound, and the Australian dollar.

We also recommend an allocation to gold of up to 5% within a balanced USD portfolio.

World Gold Council, 12 November 2024 - Under pressure

Authors: WGC, November report

Election response:

The first week of November saw gold move lower after hitting a new all-time-high on the first of the month.

According to our Gold Return Attribution Model (GRAM), gold was pressured lower by strength in the US dollar and momentum factors including the lagged gold price, gold ETF outflows which were coming off an exceptionally strong month, and a drop in COMEX net managed money net longs – reflecting the likely unwind of pre-election hedges.

Global gold ETFs shed an estimated US$809mn (12t) during the first week of November, with the bulk of outflows stemming from North America, which were partially offset by strong Asian inflows. Potentially signalling renewed fears around the resumption of the trade war between the US and China. Additionally, COMEX net positioning also fell 74 tonnes, an 8% drop from the prior week.

Looking ahead:

The US election results have taken a bit of a knee-jerk sting out of gold’s impressive y-t-d rally. Suggested reasons are a continued strengthening in bond yields and the US dollar, risk-on sentiment in equity markets, a boost to cryptocurrencies and a quelling of geopolitical tensions. These factors might presage a welcome pause, even a healthy near-term retracement, for gold.

There was a sense that the pre-election run up in Treasury yields and the US dollar might have been exhausted and that a turn in the dollar might lead bond yields lower – as it has done on several occasions over the last two years. After all, the dollar is richly valued on a real effective exchange rate (REER) basis and a Trump administration is said to favour both a weaker exchange rate to encourage exports and lower interest rates to spur borrowing.

In summary:

gold’s negative reaction to both the US election results and a continued move higher in bonds yields and the US dollar is in our view a near-term phenomenon. Other drivers including lower sanctions risks, a renewed bullishness in equity markets and cryptocurrencies mask the underlying – and in our view – more fundamental concerns of:

· A world where protectionism is likely going to be more acute and current conflicts see no signs of abatement

· Equity markets are heavily concentrated and richly valued during the end of a business cycle

· Cryptocurrencies continue to be a marginal consideration and not a replacement for gold

· Western investors have, outside of futures, not added much gold this year and so there is unlikely a slew of sellers in the wings

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.