Last week: Powell reassured the financial markets - Coming next: April 2nd US tariffs implementation only matters now

WEEKLY TRENDS

WEEKLY TRENDS

- With the Q4 corporate earnings releases almost finished, attention last week was placed on Trump’s negotiations, with UA over a potential nuclear power takeover, with the UK over an £800m a year tax affecting Sillicon Valley’s giants, and last but not least, focused on 5 central banks monetary policy committee decisions together with Friday’s “3 witches” quarterly options expiries

- The FED reassured investors despite seeing a slower growth and a higher inflation. BACEN (Brazil) raised its Selic rate by 100bps to 14.25%. The SNB delivered a 25bp rate cut while the BOJ remained on hold and so did the BOE, but the latter warned on the profound uncertainty the World economy is facing right now

- Take profits in EU’s defense stocks (Rheinmetall, Saab, Thales, Leonardo) together with new US sanctions imposed on Iran oil exports led to a stock rotation into oil related stocks (Shell, Exxon, Chevron).

MARKETS

Equities

Q4 earnings released (weekly stock performance):

Prudential (+2%), Vinci (+1%)

Micron Tech (-6%), Accenture (-5%), Nike (-5%), Fedex (-5%)

NB: Deutz is up +30%, Thyssenkrupp +10% after the German parliament voted Merz new spending plan; Sodexo is down -16% on poor outlook

Analysts:

Swissquote (BNP ‘o/w’ target CHF425); Vicat (Barclays ’o/w’ target €71); Eiffage (Barclays ’o/w’ target €162); L’Oreal (RBC ’o/w’ target €420); Saint-Gobain (Barclays ’o/w’ target €122); Lloyds Bank (HSBC ’buy’ target £85); Moncler (Citi ’buy’ target €71); Leonardo (MS ‘o/w’ target €60); Schneider Electric (RBC ‘o/w’ target €270); Sanofi (GS ’neutral’ target €120) ; Remy Cointreau (JPM ‘u/w’ €46)

Rates

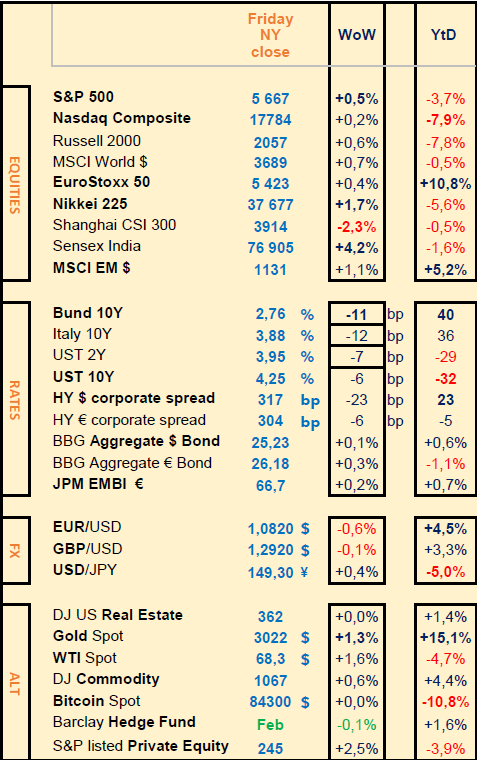

US curve (2-10 years) steepening unchanged at 30bps. Bond yields lower across the board.

HY corporate spreads lower too

Commodities

Oil price up (US sanctioned a Chinese refinery and oil tankers fleet involved in oil trade with Iran)

Gold price higher (despite a higher USD but benefitted from lower yields)

UK

BOE’s inflation forecast at 3.75% in Q3, growth forecast at +0.25% in Q1

Cryptos

$650m ETF inflows last week (after an $900m outflows previously)

Under the watch

Mar-a-Lago plan implementation (see the following press articles)

Nota Bene

Mag7 P/E at 25x, S&P 493 P/E at 19x (lowest spread since 2020)

CALENDAR

Q4 Corporate earnings:

US: Gamestop (25 March), Chewy (26), Lululemon (27)

EU: H&M (27 March)

Macro economic data: US PCE Deflator for February (28 March)

WHAT ANALYSTS SAY

The rumoured “Mar-a-Lago plan”

Banque Heritage, 19 March 2025

Author: JC Rochat, Banque Heritage’s Chief Investment Officer

The new Trump administration has been firmly in control since its inauguration at the end of January. While observers and markets were expecting changes, they remained sceptical about how and when they would be implemented. We now have a clearer picture. The central theme, led by techno-entrepreneurs, is that of a profound rebalancing of the economy, with a disengagement of the public sector and a return in force of the private sector.

The immediate focus is on geopolitics, tariffs and the dismantling of the state apparatus - three areas that crystallise the tensions likely to affect the economic situation. Pro-business reforms, such as deregulation, tax cuts and potentially lower tariffs, will come later.

The deterioration in the business climate points to an economic slowdown in 2025. The rebound in activity should accelerate in 2026, on the eve of the midterm elections.

For some weeks now, there are rumours of a major plan known as the ‘Mar-a-Lago plan’. This would involve a major monetary realignment, including a restructuring of sovereign debt, accompanied by the creation of a sovereign wealth fund fed by seized bitcoins and revalued gold from Fort Knox.

Several versions of this plan are currently being studied. In short, it would aim to encourage massive and productive investment in the United States. This encouragement would be accompanied by the possibility of exchanging Treasury bonds held by foreign central banks for new perpetual debt that does not generate interest income. A form of disguised restructuring... In exchange, generous participants would benefit from exemption from customs duties and/or US military protection.

The main aim of these manoeuvres would be to lower the value of the dollar and reduce the absolute level of public debt.

One of Donald Trump's great characteristics is his ability to disrupt. Confirmation of the existence of the Mar-a-Lago project could have far-reaching consequences for all currencies, markets and commodities.

Against this backdrop, and more than ever, we recommend broadly diversifying asset portfolios, being agile in managing allocations and maintaining a significant proportion of decorrelated assets, particularly to protect against market risks.

Banque Syz, 18 March 2025

Author: CH Monchau, Banque Syz, Chief Investment Officer

In 1985, French, German, Japanese, British, and American ministers agreed at the Plaza in New York to devalue the dollar, history could repeat itself at Trump's estate.

The primary objective of the agreement was to address persistent trade imbalances that had developed due to the overvalued dollar. A strong dollar made U.S. exports expensive on the world market while making foreign imports cheaper in the United States, contributing to a widening trade and current account deficit and a reduction in manufacturing activity. Recognizing that unilateral action would be insufficient, the countries involved agreed to a coordinated intervention. The plan was to allow their respective currencies to appreciate against the U.S. dollar in order to alleviate the competitive disadvantage suffered by American manufacturers.

In the months following the agreement, the coordinated intervention produced tangible results. The dollar lost up to 25% of its value, reducing the cost of U.S. exports and gradually restoring U.S. competitiveness in global markets. American manufacturers began to benefit from a surge in demand as their products became relatively cheaper abroad.

Following the aggressive intervention and significant depreciation of the dollar caused by the Plaza Accord, concerns grew about the excessive weakness of the US dollar and its destabilizing effects. In response, in 1987, the same group of nations met again at the Louvre Palace in Paris, leading to the signing of the Louvre Accord. This agreement marked a strategic shift from rapid devaluation to a policy of stabilization, with the participating countries committing to moderating their interventions and maintaining the currency levels at a more sustainable equilibrium. The Louvre Accord effectively halted the depreciation of the dollar, thus marking the end of the Plaza Accord.

Today, discussions are underway on a potential new multilateral agreement known as the Mar-a-Lago Agreement. This proposed agreement would seek to rebalance global trade, currently disrupted by an overvalued U.S. dollar relative to other currencies, and create a more balanced trading environment, ultimately improving the competitiveness of U.S. exports and strengthening domestic manufacturing. At its core, the proposal calls for the United States to offer security guarantees and privileged access to its markets, particularly in the G7, the Middle East, and Latin America, in exchange for these partners adopting measures to rebalance the global value of the U.S. dollar, expand the U.S. industrial base, and help address fiscal challenges by swapping existing government debt for ultra-long-term Treasury bonds.

In short, the idea is for the United States to provide the world with security and market access, while the rest of the world cooperates to lower the dollar, thereby strengthening U.S. exports and revitalizing domestic manufacturing.

Two key instruments are at the heart of the agreement.

The first is the use of targeted tariffs. Under this instrument, the United States would impose tariffs on imports from countries that do not commit to implementing policies aimed at strengthening their own currencies against the dollar. These tariffs are designed to serve a dual purpose: they raise vital government revenue while creating economic incentives for partner countries to adjust their monetary policies.

The second instrument is the creation of a sovereign wealth fund dedicated to accumulating foreign currency, thus exerting additional downward pressure on the dollar. In addition, a mechanism associated with the agreement involves swapping existing US government debt for new, longer-dated instruments: 100-year Treasury bonds. This debt swap would not only ease fiscal pressures by extending debt maturities, but would also contribute to the rebalancing of global monetary flows, favoring longer-dated bonds.

Together, these instruments form the backbone of the Mar-a-Lago Agreement. By relying on tariffs to force trading partners to adjust their policies and by using a sovereign wealth fund to actively intervene in currency markets, the agreement seeks to correct the overvalued dollar. In doing so, it aims to rebalance trade balances, revitalize domestic manufacturing, and facilitate a more balanced global financial order, while preserving the dollar's essential role in international finance.

The Trump team is willing to accept short-term economic pain as a necessary catalyst for long-term structural gains. While tariffs historically tend to strengthen currencies, the approach taken here is to use them as a trigger: the temporary pain of rising export costs should force global partners to negotiate and prompt them to adjust their own monetary policies, ultimately realigning trade balances in favor of the United States.

In addition, the plan provides a tiered incentive structure for international partners. Countries would be categorized as “green,” “yellow,” or “red” based on their willingness to participate in the monetary intervention. “Green” countries would receive military protection and tariff relief but would be required to adhere to the agreement, while countries in the “yellow” or “red” categories could face transactional penalties or other restrictions. This categorization creates clear and quantifiable incentives for global partners to align with U.S. objectives, thereby reinforcing the coordinated nature of the intervention.

A sustained weakening of the dollar could prove to be a tailwind for commodities. It could also have implications for regional, style, and sector leadership within global equities. For example, resource-rich countries and value sectors could regain relative strength relative to the United States and growth sectors.

Both the Plaza Accord and the proposed Mar-a-Lago agreement underscore the powerful role that monetary adjustments can play in shaping economic policy and global financial dynamics. The Plaza Accord explicitly sought a devaluation of the US dollar through coordinated intervention to address trade imbalances. In contrast, the Mar-a-Lago proposal represents a broader strategy aimed primarily at rebalancing trade relations among nations, a framework within which a correction in the value of the US dollar would naturally follow. Together, these initiatives underscore ongoing efforts to harness monetary policy for economic revitalization and enhanced international cooperation.

Equities

Q4 earnings released (weekly stock performance):

Prudential (+2%), Vinci (+1%)

Micron Tech (-6%), Accenture (-5%), Nike (-5%), Fedex (-5%)

NB: Deutz is up +30%, Thyssenkrupp +10% after the German parliament voted Merz new spending plan; Sodexo is down -16% on poor outlook

Analysts:

Swissquote (BNP ‘o/w’ target CHF425); Vicat (Barclays ’o/w’ target €71); Eiffage (Barclays ’o/w’ target €162); L’Oreal (RBC ’o/w’ target €420); Saint-Gobain (Barclays ’o/w’ target €122); Lloyds Bank (HSBC ’buy’ target £85); Moncler (Citi ’buy’ target €71); Leonardo (MS ‘o/w’ target €60); Schneider Electric (RBC ‘o/w’ target €270); Sanofi (GS ’neutral’ target €120) ; Remy Cointreau (JPM ‘u/w’ €46)

Rates

US curve (2-10 years) steepening unchanged at 30bps. Bond yields lower across the board.

HY corporate spreads lower too

Commodities

Oil price up (US sanctioned a Chinese refinery and oil tankers fleet involved in oil trade with Iran)

Gold price higher (despite a higher USD but benefitted from lower yields)

UK

BOE’s inflation forecast at 3.75% in Q3, growth forecast at +0.25% in Q1

Cryptos

$650m ETF inflows last week (after an $900m outflows previously)

Under the watch

Mar-a-Lago plan implementation (see the following press articles)

Nota Bene

Mag7 P/E at 25x, S&P 493 P/E at 19x (lowest spread since 2020)

CALENDAR

Q4 Corporate earnings:

US: Gamestop (25 March), Chewy (26), Lululemon (27)

EU: H&M (27 March)

Macro economic data: US PCE Deflator for February (28 March)

WHAT ANALYSTS SAY

The rumoured “Mar-a-Lago plan”

- Banque Heritage: behind-the-scenes

- Banque Syz: is a new monetary accord feasible?

Banque Heritage, 19 March 2025

Author: JC Rochat, Banque Heritage’s Chief Investment Officer

The new Trump administration has been firmly in control since its inauguration at the end of January. While observers and markets were expecting changes, they remained sceptical about how and when they would be implemented. We now have a clearer picture. The central theme, led by techno-entrepreneurs, is that of a profound rebalancing of the economy, with a disengagement of the public sector and a return in force of the private sector.

The immediate focus is on geopolitics, tariffs and the dismantling of the state apparatus - three areas that crystallise the tensions likely to affect the economic situation. Pro-business reforms, such as deregulation, tax cuts and potentially lower tariffs, will come later.

The deterioration in the business climate points to an economic slowdown in 2025. The rebound in activity should accelerate in 2026, on the eve of the midterm elections.

For some weeks now, there are rumours of a major plan known as the ‘Mar-a-Lago plan’. This would involve a major monetary realignment, including a restructuring of sovereign debt, accompanied by the creation of a sovereign wealth fund fed by seized bitcoins and revalued gold from Fort Knox.

Several versions of this plan are currently being studied. In short, it would aim to encourage massive and productive investment in the United States. This encouragement would be accompanied by the possibility of exchanging Treasury bonds held by foreign central banks for new perpetual debt that does not generate interest income. A form of disguised restructuring... In exchange, generous participants would benefit from exemption from customs duties and/or US military protection.

The main aim of these manoeuvres would be to lower the value of the dollar and reduce the absolute level of public debt.

One of Donald Trump's great characteristics is his ability to disrupt. Confirmation of the existence of the Mar-a-Lago project could have far-reaching consequences for all currencies, markets and commodities.

Against this backdrop, and more than ever, we recommend broadly diversifying asset portfolios, being agile in managing allocations and maintaining a significant proportion of decorrelated assets, particularly to protect against market risks.

Banque Syz, 18 March 2025

Author: CH Monchau, Banque Syz, Chief Investment Officer

In 1985, French, German, Japanese, British, and American ministers agreed at the Plaza in New York to devalue the dollar, history could repeat itself at Trump's estate.

The primary objective of the agreement was to address persistent trade imbalances that had developed due to the overvalued dollar. A strong dollar made U.S. exports expensive on the world market while making foreign imports cheaper in the United States, contributing to a widening trade and current account deficit and a reduction in manufacturing activity. Recognizing that unilateral action would be insufficient, the countries involved agreed to a coordinated intervention. The plan was to allow their respective currencies to appreciate against the U.S. dollar in order to alleviate the competitive disadvantage suffered by American manufacturers.

In the months following the agreement, the coordinated intervention produced tangible results. The dollar lost up to 25% of its value, reducing the cost of U.S. exports and gradually restoring U.S. competitiveness in global markets. American manufacturers began to benefit from a surge in demand as their products became relatively cheaper abroad.

Following the aggressive intervention and significant depreciation of the dollar caused by the Plaza Accord, concerns grew about the excessive weakness of the US dollar and its destabilizing effects. In response, in 1987, the same group of nations met again at the Louvre Palace in Paris, leading to the signing of the Louvre Accord. This agreement marked a strategic shift from rapid devaluation to a policy of stabilization, with the participating countries committing to moderating their interventions and maintaining the currency levels at a more sustainable equilibrium. The Louvre Accord effectively halted the depreciation of the dollar, thus marking the end of the Plaza Accord.

Today, discussions are underway on a potential new multilateral agreement known as the Mar-a-Lago Agreement. This proposed agreement would seek to rebalance global trade, currently disrupted by an overvalued U.S. dollar relative to other currencies, and create a more balanced trading environment, ultimately improving the competitiveness of U.S. exports and strengthening domestic manufacturing. At its core, the proposal calls for the United States to offer security guarantees and privileged access to its markets, particularly in the G7, the Middle East, and Latin America, in exchange for these partners adopting measures to rebalance the global value of the U.S. dollar, expand the U.S. industrial base, and help address fiscal challenges by swapping existing government debt for ultra-long-term Treasury bonds.

In short, the idea is for the United States to provide the world with security and market access, while the rest of the world cooperates to lower the dollar, thereby strengthening U.S. exports and revitalizing domestic manufacturing.

Two key instruments are at the heart of the agreement.

The first is the use of targeted tariffs. Under this instrument, the United States would impose tariffs on imports from countries that do not commit to implementing policies aimed at strengthening their own currencies against the dollar. These tariffs are designed to serve a dual purpose: they raise vital government revenue while creating economic incentives for partner countries to adjust their monetary policies.

The second instrument is the creation of a sovereign wealth fund dedicated to accumulating foreign currency, thus exerting additional downward pressure on the dollar. In addition, a mechanism associated with the agreement involves swapping existing US government debt for new, longer-dated instruments: 100-year Treasury bonds. This debt swap would not only ease fiscal pressures by extending debt maturities, but would also contribute to the rebalancing of global monetary flows, favoring longer-dated bonds.

Together, these instruments form the backbone of the Mar-a-Lago Agreement. By relying on tariffs to force trading partners to adjust their policies and by using a sovereign wealth fund to actively intervene in currency markets, the agreement seeks to correct the overvalued dollar. In doing so, it aims to rebalance trade balances, revitalize domestic manufacturing, and facilitate a more balanced global financial order, while preserving the dollar's essential role in international finance.

The Trump team is willing to accept short-term economic pain as a necessary catalyst for long-term structural gains. While tariffs historically tend to strengthen currencies, the approach taken here is to use them as a trigger: the temporary pain of rising export costs should force global partners to negotiate and prompt them to adjust their own monetary policies, ultimately realigning trade balances in favor of the United States.

In addition, the plan provides a tiered incentive structure for international partners. Countries would be categorized as “green,” “yellow,” or “red” based on their willingness to participate in the monetary intervention. “Green” countries would receive military protection and tariff relief but would be required to adhere to the agreement, while countries in the “yellow” or “red” categories could face transactional penalties or other restrictions. This categorization creates clear and quantifiable incentives for global partners to align with U.S. objectives, thereby reinforcing the coordinated nature of the intervention.

A sustained weakening of the dollar could prove to be a tailwind for commodities. It could also have implications for regional, style, and sector leadership within global equities. For example, resource-rich countries and value sectors could regain relative strength relative to the United States and growth sectors.

Both the Plaza Accord and the proposed Mar-a-Lago agreement underscore the powerful role that monetary adjustments can play in shaping economic policy and global financial dynamics. The Plaza Accord explicitly sought a devaluation of the US dollar through coordinated intervention to address trade imbalances. In contrast, the Mar-a-Lago proposal represents a broader strategy aimed primarily at rebalancing trade relations among nations, a framework within which a correction in the value of the US dollar would naturally follow. Together, these initiatives underscore ongoing efforts to harness monetary policy for economic revitalization and enhanced international cooperation.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.