Yearend rebalances in EU-US Bond yields, Small-Large caps, among elevated UA-RU tensions and a new US administration

WEEKLY TRENDS

WEEKLY TRENDS

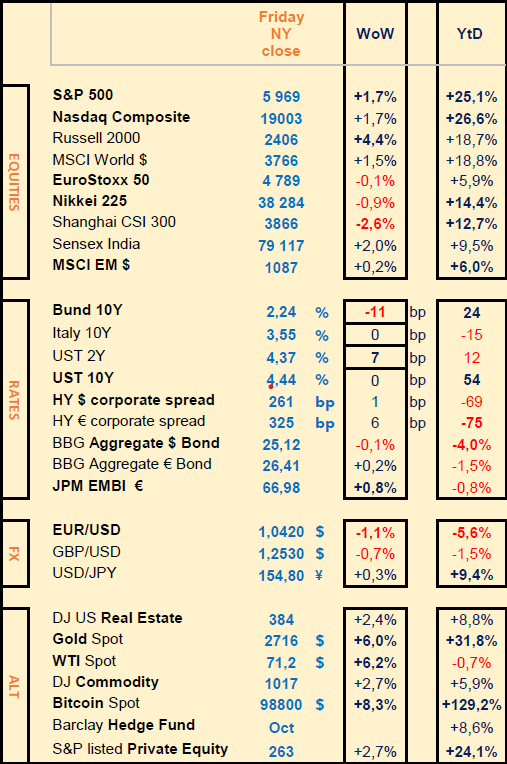

- New record high for the BTC at $99,000 last week. Gold and Oil prices are also on the high side, amid elevated tensions in Ukraine and Trump’s new administration list (SEC president to be replaced on Jan 20 by a new market friendly president, an ex Hedge Fund billionaire as Treasury Secretary)

- As corporate earnings releases for Q3 are coming to an end, investors will have in their sight the US PCE data as well as the last FOMC (FED) minutes, both to be released next Wednesday

- Last week macro data showed a surging US PMI vs an economic contraction euro zone PMI data in Nov, leading to lower EUR/USD, higher UST 2yr yield and lower German Bund yield

- Stock rotation resumed with small caps back in favour, while China and EU stocks remain heavy

MARKETS

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Snowflake (+33%), UK Sage (+21%), Thyssenkrupp (+14%), French Soitec (+10%), Walmart (+7%), Nvidia (+2%)

- - - Target (-18%), UK JD Sports (-21%), French Elior (-34%)

NB: US Small caps are back in fashion (Russell +4.5% last week -7% vs SP500 at +1.7%, resumed rotation), China stocks remained disappointing (-2.5%), so did the EU50 (just negative at -0.1%)

Rates

US curve (2-10 years) steepening lowered by 8bps to 7bps. US 2yr yield ended the week higher at 4.37% (+7bps) while the 10yr stayed flat. On the contrary German Bund yield lowered by 11bps, pushing EUR/USD lower.

Commodities

Oil price is up (+6%) on renewed and elevated tensions in Ukraine, despite a stronger USD

Gold price also higher (+6%) despite a stronger USD and higher 2yr Treasuries yield, on renewed tensions in Ukraine

US

PMI in Nov at 55.3 (30 month high) showing an economic expansion (Services PMI released at 57)

EU

PMI in Nov at 48.1 (10 month low) showing an economic contraction

CPI in Oct rose 0.3% following -0.1% in Sep (YoY at 2% vs 1.7% in Sep)

Crypto

BTC hit an ATH at $99000 last week (Gary Gensler is to be replaced Jan 20 by a Wall Street friendlier SEC president)

Nota Bene

Top assets by market cap: Gold ($18trn), Nvidia ($3.5trn), Apple ($3.4trn), Microsoft ($3.1trn), Alphabet ($2.2trn), Amazon ($2.1trn), BTC ($1.9trn)

US budget deficit hit $257bn in Oct (+400% YoY vs $66bn a year ago)

US corporate bond spreads at lowest in 26 years (below 2007 GFC level)

CALENDAR

WHAT ANALYSTS SAY

Goldman Sachs, 22 Nov 2024 - Briefings

· The US economy is on track for another strong year

US GDP is forecast to outperform expectations in 2025. The world's largest economy is forecast to outperform economist expectations again next year, according to Goldman Sachs Research.

US GDP is expected to grow 2.5% on a full-year basis, compared with 1.9% for the consensus forecast of economists surveyed by Bloomberg. “Recession fears have diminished, inflation is trending back toward 2%, and the labor market has rebalanced but remains strong,” David Mericle, chief US economist in Goldman Sachs Research.

3 key policy changes following the Republican sweep in Washington are predicted to affect the economy:

Tariff increases on imports from China and on autos may raise the effective tariff rate by 3 to 4 percentage points.

Tighter policy may lower net immigration to 750,000 per year, moderately below the pre-pandemic average of 1 million per year.

The 2017 tax cuts are expected to be fully extended instead of expiring and there will be modest additional tax cuts.

While the expected policy changes are significant, Mericle doesn't anticipate that they will substantially alter the trajectory of the economy or monetary policy. Goldman Sachs Research forecasts the Federal Reserve will continue to cut the funds rate down to a terminal rate of 3.25-3.5% (the policy rate is 4.5% to 4.75% now).

· Equities and the dollar have upside in 2025

"We still think you've got some upside to equities. You've got some upside to the dollar. You've got some outperformance of non-US bonds and European bond yields falling relative to the US." Dominic Wilson, senior advisor in Global Markets Research.

· European energy storage: a new multi-billion-dollar asset class

Europe is rapidly transitioning towards renewable energy sources like wind and solar power, which are projected to provide 72% of the continent's electricity by 2050, up from 30% today, according to Bloomberg NEF data.

However, the intermittent nature of renewables creates challenges in ensuring a reliable and consistent power supply.

Large-scale energy storage is emerging as a solution — and an investment opportunity — to smooth out the imbalances caused by the variability of wind and solar generation.

“These technologies are positioned for the structural change to renewables that is happening in the electricity markets,” says Ingmar Grebien, who leads GS Pearl Street in Goldman Sachs Global Banking & Markets, of large-scale energy storage.

“That makes them an interesting new asset class to invest in, and also a great hedge for players that already have existing classic, renewable portfolios,” he says.

Europe's energy storage capacity is expected to surge from 15 gigawatts in 2023 to around 375 gigawatts by 2050, according to Bloomberg NEF.

Building this capacity will require up to $250 billion in investment and a significant evolution of the sector, Grebien and his team estimate.

UBS, 21 November 2024 - Roaring 20s: The next stage

Authors: CIO, GWM

Roaring 20s — what’s next?

We’re halfway through the decade we describe as the “Roaring 20s,” an uncertain period of lockdowns, war, and sharp rate rises that also saw the rise of AI and US corporate profits up nearly 70%. We focus on investment ideas that can endure through contrasting potential outlooks—whether positive as lower US taxes, deregulation, and AI’s growth support markets, or negative should higher tariffs for key countries like China, excessive deficits, and intensified conflicts weigh on markets.

– Position for lower rates. With room for further rate cuts through 2025 in Asia, we expect quality ASEAN dividend-yielders to outperform, including Indonesian banks and select Philippines and Singapore banks. We also favor select high quality REITs.

– More to go in stocks. Asia ex-Japan is Attractive; we see mid-teen returns for MSCI Asia ex-Japan by end-2025. However, Asia’s exposure to tariff risks means we like industry leaders with tech advantages, large domestic markets, and defensive high yielders.

– Seize the AI opportunity. AI will likely see potential revenues of over USD 1.1tr by 2027. Focus on megacap tech, and private companies in the enabling layer for now—such as Taiwanese foundries with a strong tech edge and limited substitution risks.

– Invest in power and resources. AI power usage, industrial electrification, and decarbonization will all spur electricity demand— we like investing in transmission, distribution, data centers, transport, and energy storage.

– Sell further dollar strength. We expect USDJPY to fall to 145 by end-2025, with narrowing yield differentials to drive yen strength. The USDCNY should rise towards 7.5 by end-2025. The INR, IDR, and PHP should be resilient if trade tensions intensify.

– Go for gold. Gold is poised to gain on lower rates, persistent geopolitical risks, and government debt concerns. We also like transition metals as rising demand for it to generate power likely meets constrained supply.

– Time for real estate. The global real estate outlook highly depends on fundamentals and rates. Within Asia, we prefer regional data center proxies, Tokyo real estate developers, quality Australia and Singapore REITs, and select Hong Kong retail REITs.

The Decade ahead

– While we believe the evolution of the "Five Ds" (deglobalization, demographics, digitalization, decarbonization, and debt) will be net-positive for global growth, we don’t rule out bouts of higher inflation and volatility that warrant diversification.

– Cash looks set to underperform all other asset classes—while equities and private markets offer the brightest prospective returns. Higher stock valuations and potential volatility in long-dated yields contrast with a growing private markets set—get in balance to manage these forces. Stocks have beaten cash in 86% and 100% of all 10- and 20-year holding periods, respectively, and by more than 200x overall since 1945. With falling rates, it’s crucial to move cash into high-quality fixed income or equity income strategies to secure more durable income. Annuities can also enhance income durability and stability.

Tikehau, 18 November 2024 - US High Yield focus

Authors: Tikehau Capital North America

Market commentary:

The U.S. high yield market gave up some momentum this month posting a loss of -0.5%.

While spreads tightened and Treasury yields rose the negative return was driven by losses in BB (-0.9%) and B (-0.4%) rated credits while CCCs were positive at +0.7%.

October marked the first monthly loss for high yield since April of this year.

Labor market concerns seemed to ease during the month combined with overall positive 3Q earnings in high yield corporates. Notably, the number of companies that warned of inflationary pressures going forward has declined since 2Q24.

Fund flows were positive this month with $1B flowing in bringing YTD volume to $17B which compares to an outflow of -$23B for the same 10 month period in 2023.

Default rates continue to decline with LTM rates at 0.6% which is about 1.5% lower than the beginning of the year and a low since June 2022. 2024 default forecasts have been lowered during the second half of this year to 1.25% and 2025 are projected to be in the range of 3%.

The Focus fund returned -0.7% in October with some outsized pressure on a retail credit (Staples) as well as pressure on some credits related to the Finance sector which we have since exited.

The Energy space, our largest sector in terms of exposure, saw positive momentum during the month.

We raised a decent amount of cash this month to manage fund flows and realized several long term gains. We also took the opportunity to exit lower coupon and longer duration holdings as evidence by our duration declining to just under 2 years.

We anticipate going forward the duration will increase back to around 2.5 years.

With a solid earnings calendar reported and decent fund flows during the month of October, our small to mid-cap names performed in line with the market.

We were pleased to see many of last month's names recover this month but not enough to put the portfolio into positive territory. When looking at all the positions we exited this month, since they were purchased the sales generated profits in the majority of the names. However, during the month of October only 15 out of 33 positions had positive price moves.

The average coupon of 8.4% will likely increase as many of the positions we have exited had lower coupons associated with those names.

With election results decided in November we suspect there willbe some opportunities to pick up strong credits that may be discarded due to investor political bias as opposed to fundamental analysis.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Snowflake (+33%), UK Sage (+21%), Thyssenkrupp (+14%), French Soitec (+10%), Walmart (+7%), Nvidia (+2%)

- - - Target (-18%), UK JD Sports (-21%), French Elior (-34%)

NB: US Small caps are back in fashion (Russell +4.5% last week -7% vs SP500 at +1.7%, resumed rotation), China stocks remained disappointing (-2.5%), so did the EU50 (just negative at -0.1%)

Rates

US curve (2-10 years) steepening lowered by 8bps to 7bps. US 2yr yield ended the week higher at 4.37% (+7bps) while the 10yr stayed flat. On the contrary German Bund yield lowered by 11bps, pushing EUR/USD lower.

Commodities

Oil price is up (+6%) on renewed and elevated tensions in Ukraine, despite a stronger USD

Gold price also higher (+6%) despite a stronger USD and higher 2yr Treasuries yield, on renewed tensions in Ukraine

US

PMI in Nov at 55.3 (30 month high) showing an economic expansion (Services PMI released at 57)

EU

PMI in Nov at 48.1 (10 month low) showing an economic contraction

CPI in Oct rose 0.3% following -0.1% in Sep (YoY at 2% vs 1.7% in Sep)

Crypto

BTC hit an ATH at $99000 last week (Gary Gensler is to be replaced Jan 20 by a Wall Street friendlier SEC president)

Nota Bene

Top assets by market cap: Gold ($18trn), Nvidia ($3.5trn), Apple ($3.4trn), Microsoft ($3.1trn), Alphabet ($2.2trn), Amazon ($2.1trn), BTC ($1.9trn)

US budget deficit hit $257bn in Oct (+400% YoY vs $66bn a year ago)

US corporate bond spreads at lowest in 26 years (below 2007 GFC level)

CALENDAR

- Corporate earnings: US Agilent (25 Nov), Dell, HP, Analog Devices (26) ; Europe Kingfisher (25), Compass (20), Easyjet (27)

- Macro: Germany IFO for Nov (25); US PCE Deflator for Oct, FOMC minutes (27 Nov); China PMI for Nov (30)

WHAT ANALYSTS SAY

- Goldman Sachs - Briefings (US economy, Equities and USD, European energy storage: a multi-billion dollar asset class)

- UBS - Year ahead 2025 (including an Asia outlook)

- Tikehau - US high yield market

Goldman Sachs, 22 Nov 2024 - Briefings

· The US economy is on track for another strong year

US GDP is forecast to outperform expectations in 2025. The world's largest economy is forecast to outperform economist expectations again next year, according to Goldman Sachs Research.

US GDP is expected to grow 2.5% on a full-year basis, compared with 1.9% for the consensus forecast of economists surveyed by Bloomberg. “Recession fears have diminished, inflation is trending back toward 2%, and the labor market has rebalanced but remains strong,” David Mericle, chief US economist in Goldman Sachs Research.

3 key policy changes following the Republican sweep in Washington are predicted to affect the economy:

Tariff increases on imports from China and on autos may raise the effective tariff rate by 3 to 4 percentage points.

Tighter policy may lower net immigration to 750,000 per year, moderately below the pre-pandemic average of 1 million per year.

The 2017 tax cuts are expected to be fully extended instead of expiring and there will be modest additional tax cuts.

While the expected policy changes are significant, Mericle doesn't anticipate that they will substantially alter the trajectory of the economy or monetary policy. Goldman Sachs Research forecasts the Federal Reserve will continue to cut the funds rate down to a terminal rate of 3.25-3.5% (the policy rate is 4.5% to 4.75% now).

· Equities and the dollar have upside in 2025

"We still think you've got some upside to equities. You've got some upside to the dollar. You've got some outperformance of non-US bonds and European bond yields falling relative to the US." Dominic Wilson, senior advisor in Global Markets Research.

· European energy storage: a new multi-billion-dollar asset class

Europe is rapidly transitioning towards renewable energy sources like wind and solar power, which are projected to provide 72% of the continent's electricity by 2050, up from 30% today, according to Bloomberg NEF data.

However, the intermittent nature of renewables creates challenges in ensuring a reliable and consistent power supply.

Large-scale energy storage is emerging as a solution — and an investment opportunity — to smooth out the imbalances caused by the variability of wind and solar generation.

“These technologies are positioned for the structural change to renewables that is happening in the electricity markets,” says Ingmar Grebien, who leads GS Pearl Street in Goldman Sachs Global Banking & Markets, of large-scale energy storage.

“That makes them an interesting new asset class to invest in, and also a great hedge for players that already have existing classic, renewable portfolios,” he says.

Europe's energy storage capacity is expected to surge from 15 gigawatts in 2023 to around 375 gigawatts by 2050, according to Bloomberg NEF.

Building this capacity will require up to $250 billion in investment and a significant evolution of the sector, Grebien and his team estimate.

UBS, 21 November 2024 - Roaring 20s: The next stage

Authors: CIO, GWM

Roaring 20s — what’s next?

We’re halfway through the decade we describe as the “Roaring 20s,” an uncertain period of lockdowns, war, and sharp rate rises that also saw the rise of AI and US corporate profits up nearly 70%. We focus on investment ideas that can endure through contrasting potential outlooks—whether positive as lower US taxes, deregulation, and AI’s growth support markets, or negative should higher tariffs for key countries like China, excessive deficits, and intensified conflicts weigh on markets.

– Position for lower rates. With room for further rate cuts through 2025 in Asia, we expect quality ASEAN dividend-yielders to outperform, including Indonesian banks and select Philippines and Singapore banks. We also favor select high quality REITs.

– More to go in stocks. Asia ex-Japan is Attractive; we see mid-teen returns for MSCI Asia ex-Japan by end-2025. However, Asia’s exposure to tariff risks means we like industry leaders with tech advantages, large domestic markets, and defensive high yielders.

– Seize the AI opportunity. AI will likely see potential revenues of over USD 1.1tr by 2027. Focus on megacap tech, and private companies in the enabling layer for now—such as Taiwanese foundries with a strong tech edge and limited substitution risks.

– Invest in power and resources. AI power usage, industrial electrification, and decarbonization will all spur electricity demand— we like investing in transmission, distribution, data centers, transport, and energy storage.

– Sell further dollar strength. We expect USDJPY to fall to 145 by end-2025, with narrowing yield differentials to drive yen strength. The USDCNY should rise towards 7.5 by end-2025. The INR, IDR, and PHP should be resilient if trade tensions intensify.

– Go for gold. Gold is poised to gain on lower rates, persistent geopolitical risks, and government debt concerns. We also like transition metals as rising demand for it to generate power likely meets constrained supply.

– Time for real estate. The global real estate outlook highly depends on fundamentals and rates. Within Asia, we prefer regional data center proxies, Tokyo real estate developers, quality Australia and Singapore REITs, and select Hong Kong retail REITs.

The Decade ahead

– While we believe the evolution of the "Five Ds" (deglobalization, demographics, digitalization, decarbonization, and debt) will be net-positive for global growth, we don’t rule out bouts of higher inflation and volatility that warrant diversification.

– Cash looks set to underperform all other asset classes—while equities and private markets offer the brightest prospective returns. Higher stock valuations and potential volatility in long-dated yields contrast with a growing private markets set—get in balance to manage these forces. Stocks have beaten cash in 86% and 100% of all 10- and 20-year holding periods, respectively, and by more than 200x overall since 1945. With falling rates, it’s crucial to move cash into high-quality fixed income or equity income strategies to secure more durable income. Annuities can also enhance income durability and stability.

Tikehau, 18 November 2024 - US High Yield focus

Authors: Tikehau Capital North America

Market commentary:

The U.S. high yield market gave up some momentum this month posting a loss of -0.5%.

While spreads tightened and Treasury yields rose the negative return was driven by losses in BB (-0.9%) and B (-0.4%) rated credits while CCCs were positive at +0.7%.

October marked the first monthly loss for high yield since April of this year.

Labor market concerns seemed to ease during the month combined with overall positive 3Q earnings in high yield corporates. Notably, the number of companies that warned of inflationary pressures going forward has declined since 2Q24.

Fund flows were positive this month with $1B flowing in bringing YTD volume to $17B which compares to an outflow of -$23B for the same 10 month period in 2023.

Default rates continue to decline with LTM rates at 0.6% which is about 1.5% lower than the beginning of the year and a low since June 2022. 2024 default forecasts have been lowered during the second half of this year to 1.25% and 2025 are projected to be in the range of 3%.

The Focus fund returned -0.7% in October with some outsized pressure on a retail credit (Staples) as well as pressure on some credits related to the Finance sector which we have since exited.

The Energy space, our largest sector in terms of exposure, saw positive momentum during the month.

We raised a decent amount of cash this month to manage fund flows and realized several long term gains. We also took the opportunity to exit lower coupon and longer duration holdings as evidence by our duration declining to just under 2 years.

We anticipate going forward the duration will increase back to around 2.5 years.

With a solid earnings calendar reported and decent fund flows during the month of October, our small to mid-cap names performed in line with the market.

We were pleased to see many of last month's names recover this month but not enough to put the portfolio into positive territory. When looking at all the positions we exited this month, since they were purchased the sales generated profits in the majority of the names. However, during the month of October only 15 out of 33 positions had positive price moves.

The average coupon of 8.4% will likely increase as many of the positions we have exited had lower coupons associated with those names.

With election results decided in November we suspect there willbe some opportunities to pick up strong credits that may be discarded due to investor political bias as opposed to fundamental analysis.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.