Last week : Zelenskiy-Trump Friday clash, US PCE inflation, S&P negative outlook for France, Nvidia Q4 earnings release

WEEKLY TRENDS

WEEKLY TRENDS

- On the seventh week of Q4 earnings releases, Nvidia showed very strong results but not enough for Wall Street analysts. The stock lost 9% over the week, so did Dell with -11%

- Amid uncertainty over the new US tariffs, possibly 25% on future EU imports, 25% on Canada and Mexico, additional taxes on imports from China, presumably starting on Monday, the stock markets’ correction continues

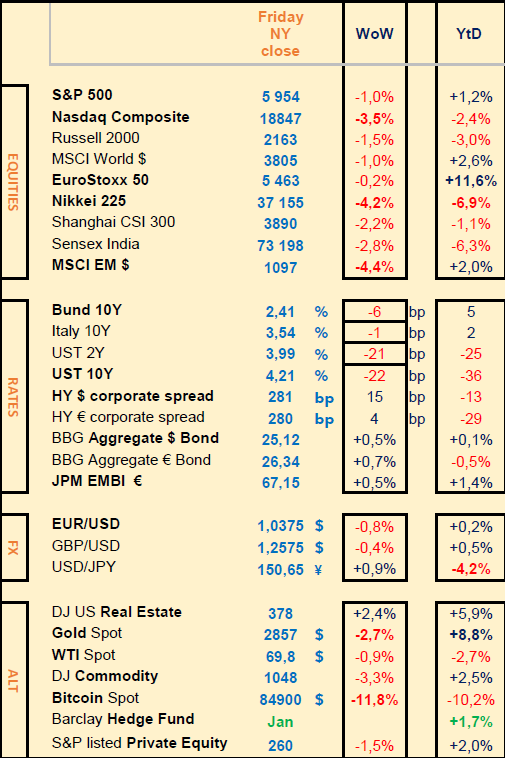

- The Nasdaq is now in negative territory since Jan 1st, the S&P is above water and only the EU indices keep a double digit return so far. US bond yields are lower and HY corporate spreads higher

- Note that the US PCE inflation was released as expected and that S&P put France’s LT debt rating under a negative outlook

- Friday’s televised clash between Zelenskiy and Trump can only put more uncertainty over an already unclear US tariffs situation which does not bode well for extreme risky assets like Cryptos

MARKETS

Equities

Q4 earnings released (weekly stock performance):

Home Depot (+3%), RR (+21%), Holcim (+4%), Allianz (+2%), Engie (+7%)

Dell (-11%), Nvidia (-9%), BASF (-1%), Worldline (-19%), WPP (-14%)

Analysts:

Swiss Re (Citi ‘buy’ target CHF165); Worldline (Citi ’buy’ target €10); Eiffage (Jefferies ‘buy’ target €119); Inbev (BNP ‘o/w’ target €75)

WPP (Barclays ‘mkt weight’ target £7.80); Neste (BNP ‘neutral’ target €10)

Rates

US curve (2-10 years) steepening stable at 22bps. Bond yields lower with US yields down the most at -20bps

HY corporate spreads higher across the board

Commodities

Oil price lower, WTI breaking the $70 mark

Gold price lower on a stronger USD and a lower US inflation data

US

Jan PCE Deflator released as expected at 2.5% vs 2.6% prior

Cryptos

Big outflows for the BTC ETFs last week (-$1.1bn) Spot BTC is back to where it was before Trump’s election victory. Initiated move on the Bybit $1.5bn ETH and stETH theft news last week.

Under the watch

Possible US waiver on new tariffs that could be applied to the UK

Nota Bene

Stocks corrections after 52-week high: MicroStrategy -56%, ETH -46%, Tesla -43%, Coinbase -41%, Palantir -33%, BTC -24%, Nvidia -22%

China is to inject $55bn of fresh capital into several large banks

CALENDAR

Q4 Corporate earnings:

US: Broadcom, Costco, Merck (6 March)

EU: Bunzl (3), Thales (4), Bayer, Dassault Aviation (5), Reckitt (6)

Macro data releases:

US: Feb NFP job report (7 March)

Central Bank decision: ECB (6 March) expected to cut rates by 25bps

WHAT ANALYSTS SAY

Wellington Management, 20 Feb 2025

Authors : Tom Horsey, European Equity Strategist at Wellington Management

While at the end of last year many strategists were still favouring US equities in the run-up to 2025, it is European stocks that have so far come out on top. Since the beginning of January, the MSCI EMU index, which includes more than 200 companies from across Europe, has risen by almost 8.5%, while the MSCI USA is up by just 3.5%.

Tom Horsey, who is responsible for developing and managing the European equity strategy at Wellington Management, is taking a contrarian approach to European equities. According to the manager, the valuation differences between certain European and American companies, which sometimes have very similar profiles, can also be a source of opportunities.

Broadly speaking, a contrarian approach means that we look for companies whose shares are trading at a low price, for which expectations are also low, but which have solid balance sheets. In short, stocks of companies that are often not really up to date, but that continue to be profitable and have attractive prospects.

Now, some people think that being a contrarian means buying shares whose price has fallen sharply - it's not that simple. We don't buy distressed assets and we don't try to time what you might call relief rallies.

As regards the more specific situation of European equities, which are evolving in an economic environment that remains difficult overall, we are looking to see whether the difficulties of certain companies are cyclical or more structural in nature. In the automotive sector, for example, we are staying away from German vehicle manufacturers at the moment. On the other hand, a company like Michelin seems interesting to us. Even if vehicles continue to gain market share, this will be to the advantage of this tyre manufacturer, as tyres often wear out more quickly with electric vehicles, due to the weight of the batteries, than with combustion cars.

At the end of last year, we often heard the argument that European equities were certainly much cheaper than US equities, but that there were also good reasons for this. Is it a good idea to buy European shares just because they are cheap?

Every stock we hold in our portfolio has to be held for positive reasons. We never buy stocks simply because they are cheaper than others. Examples of stocks and sectors in which we invest include food and retail companies. In the US, a company like Walmart is growing its profits by around 10% a year and its shares are currently trading at an earnings multiple of around 33x. In the UK, a company like Tesco is growing earnings at around the same rate, 9% a year, but is trading at an earnings multiple of just 13x. The question arises as to the reasons for this discrepancy.

Still in the food sector, a stock like Nestlé is becoming attractive again, not least because of its developments in healthy nutrition. And this Swiss group continues to post surprisingly positive growth.

We have not decided to apply a specific home bias in favour of UK equities, as we adopt a bottom-up approach to stock selection. In terms of valuation, many UK equities remain cheap despite the fact that only a small proportion of their revenues are generated in the UK.

We've already mentioned the food sector. Other interesting sectors to watch include construction and defence. Although some stocks in these industries can be expensive, many are trading at very attractive valuations. This is an ideal environment for stock pickers. Particularly when you consider that the US is exerting strong pressure on European NATO members to increase their defence spending

Novartis and Roche are among the top ten holdings in our fund. If we compare these two stocks with Novo Nordisk, we can see that the Danish group did very well until the middle of last year thanks to its anti-obesity treatments. On the other hand, its portfolio of medicines is much less diversified and is subject to strong competition. In comparison, Novartis trades at a much lower earnings multiple and has a much more diversified drug pipeline. There are two reasons in Roche's favour. Firstly, the Group faces little risk from the so-called ‘patent cliff’. Secondly, it has a large number of products in the diagnostics field.

Industry is also strongly represented in our fund, accounting for more than a third of the total. The European industry is a good place to find shares at attractive prices. There is a real chance of finding industrial companies in Europe that are market leaders in their sector and that are trading at attractive prices.

BlackRock Management, 24 Feb 2025

Authors: Jean Boivin, Head of the BII; Wei Li, Global Chief Investment Strategist, BII

U.S. equities have long outperformed their global peers. Some pin that on tech’s greater share in its market, bigger fiscal spend in recent years and energy independence, but we would attribute it more to deeper capital markets and relative deregulation that promote risk-taking.

We think the U.S. can keep its edge, even if the S&P 500 has lagged so far this year. Yet we believe Europe can close some of the return gap. With a lot of bad news priced into European equities, even prospects of good news could help them push higher. One example: Possible de-escalation in the Ukraine war. Reduced reliance on Russian gas brought European energy prices down from 2022’s highs. A form of peace agreement could lower energy prices further, boosting European growth and lowering inflation. This is just one of several catalysts we think could broaden U.S. equity strength to Europe.

We eye other catalysts for European equities as well. We expect more defense spending as the U.S. has stated Europe is no longer a primary security priority. The EU now has an air of urgency that typically spurs action.

In Germany, the weekend’s election result could herald fiscal loosening – though it’s a long and uncertain road there. Still sluggish euro area growth and easing inflation gives the European Central Bank room to cut rates more this year, we think.

So, we go neutral Europe’s stocks and still favor European financials – a preference that also served us well last year.

Yet Europe still faces multiple structural issues, from lagging competitiveness to potential U.S. tariffs – justifying some of Europe’s hefty valuation discount, we think.

Our assessment of the U.S. is unchanged: we expect mega-cap tech and other AI-linked stocks to keep driving U.S. equity returns, especially as AI adoption grows.

But we also see signs of earnings strength broadening beyond tech.

Analysts now expect tech to deliver 18% earnings growth this year versus 11% for the broader index, LSEG data show – a smaller gap vs. 2024. We think risk assets could also weather the higher growth and higher inflation mix we see as increasingly possible.

New tariffs and U.S. policy shifts aimed at boosting growth, like deregulation, carry inflationary potential.

Markets have embraced our higher-for-longer rate view, yet we still see term premium rising more than currently priced as investors demand more return for the risk of holding long-term bonds – even if the administration’s focus on long-term yields and talks of pausing quantitative tightening could delay some of the rise for now.

We go further underweight long-term U.S. Treasuries as a result.

In China, apparent efficiency gains by AI startup DeepSeek have driven a surge in China’s tech sector. President Xi Jinping’s recent meeting with private sector business leaders could signal a more supportive regulatory backdrop, yet the broader environment of U.S.-China technology competition may present challenges. We evolve our tactical overweight to Chinese equities as tech excitement could keep driving returns, potentially reducing the odds of much-anticipated government stimulus. Over the longer term, we are more wary given structural challenges to China’s growth and tariff risks.

Bottom line: We stay overweight U.S. equities, even with their softer start to 2025. Yet we think their lead over global peers could narrow this year. We upgrade European stocks to neutral while going further underweight long-dated U.S. Treasuries.

Equities

Q4 earnings released (weekly stock performance):

Home Depot (+3%), RR (+21%), Holcim (+4%), Allianz (+2%), Engie (+7%)

Dell (-11%), Nvidia (-9%), BASF (-1%), Worldline (-19%), WPP (-14%)

Analysts:

Swiss Re (Citi ‘buy’ target CHF165); Worldline (Citi ’buy’ target €10); Eiffage (Jefferies ‘buy’ target €119); Inbev (BNP ‘o/w’ target €75)

WPP (Barclays ‘mkt weight’ target £7.80); Neste (BNP ‘neutral’ target €10)

Rates

US curve (2-10 years) steepening stable at 22bps. Bond yields lower with US yields down the most at -20bps

HY corporate spreads higher across the board

Commodities

Oil price lower, WTI breaking the $70 mark

Gold price lower on a stronger USD and a lower US inflation data

US

Jan PCE Deflator released as expected at 2.5% vs 2.6% prior

Cryptos

Big outflows for the BTC ETFs last week (-$1.1bn) Spot BTC is back to where it was before Trump’s election victory. Initiated move on the Bybit $1.5bn ETH and stETH theft news last week.

Under the watch

Possible US waiver on new tariffs that could be applied to the UK

Nota Bene

Stocks corrections after 52-week high: MicroStrategy -56%, ETH -46%, Tesla -43%, Coinbase -41%, Palantir -33%, BTC -24%, Nvidia -22%

China is to inject $55bn of fresh capital into several large banks

CALENDAR

Q4 Corporate earnings:

US: Broadcom, Costco, Merck (6 March)

EU: Bunzl (3), Thales (4), Bayer, Dassault Aviation (5), Reckitt (6)

Macro data releases:

US: Feb NFP job report (7 March)

Central Bank decision: ECB (6 March) expected to cut rates by 25bps

WHAT ANALYSTS SAY

- Wellington Management - European Equities February 2025

- BlackRock Investment Institute - Commentary weekly

Wellington Management, 20 Feb 2025

Authors : Tom Horsey, European Equity Strategist at Wellington Management

While at the end of last year many strategists were still favouring US equities in the run-up to 2025, it is European stocks that have so far come out on top. Since the beginning of January, the MSCI EMU index, which includes more than 200 companies from across Europe, has risen by almost 8.5%, while the MSCI USA is up by just 3.5%.

Tom Horsey, who is responsible for developing and managing the European equity strategy at Wellington Management, is taking a contrarian approach to European equities. According to the manager, the valuation differences between certain European and American companies, which sometimes have very similar profiles, can also be a source of opportunities.

Broadly speaking, a contrarian approach means that we look for companies whose shares are trading at a low price, for which expectations are also low, but which have solid balance sheets. In short, stocks of companies that are often not really up to date, but that continue to be profitable and have attractive prospects.

Now, some people think that being a contrarian means buying shares whose price has fallen sharply - it's not that simple. We don't buy distressed assets and we don't try to time what you might call relief rallies.

As regards the more specific situation of European equities, which are evolving in an economic environment that remains difficult overall, we are looking to see whether the difficulties of certain companies are cyclical or more structural in nature. In the automotive sector, for example, we are staying away from German vehicle manufacturers at the moment. On the other hand, a company like Michelin seems interesting to us. Even if vehicles continue to gain market share, this will be to the advantage of this tyre manufacturer, as tyres often wear out more quickly with electric vehicles, due to the weight of the batteries, than with combustion cars.

At the end of last year, we often heard the argument that European equities were certainly much cheaper than US equities, but that there were also good reasons for this. Is it a good idea to buy European shares just because they are cheap?

Every stock we hold in our portfolio has to be held for positive reasons. We never buy stocks simply because they are cheaper than others. Examples of stocks and sectors in which we invest include food and retail companies. In the US, a company like Walmart is growing its profits by around 10% a year and its shares are currently trading at an earnings multiple of around 33x. In the UK, a company like Tesco is growing earnings at around the same rate, 9% a year, but is trading at an earnings multiple of just 13x. The question arises as to the reasons for this discrepancy.

Still in the food sector, a stock like Nestlé is becoming attractive again, not least because of its developments in healthy nutrition. And this Swiss group continues to post surprisingly positive growth.

We have not decided to apply a specific home bias in favour of UK equities, as we adopt a bottom-up approach to stock selection. In terms of valuation, many UK equities remain cheap despite the fact that only a small proportion of their revenues are generated in the UK.

We've already mentioned the food sector. Other interesting sectors to watch include construction and defence. Although some stocks in these industries can be expensive, many are trading at very attractive valuations. This is an ideal environment for stock pickers. Particularly when you consider that the US is exerting strong pressure on European NATO members to increase their defence spending

Novartis and Roche are among the top ten holdings in our fund. If we compare these two stocks with Novo Nordisk, we can see that the Danish group did very well until the middle of last year thanks to its anti-obesity treatments. On the other hand, its portfolio of medicines is much less diversified and is subject to strong competition. In comparison, Novartis trades at a much lower earnings multiple and has a much more diversified drug pipeline. There are two reasons in Roche's favour. Firstly, the Group faces little risk from the so-called ‘patent cliff’. Secondly, it has a large number of products in the diagnostics field.

Industry is also strongly represented in our fund, accounting for more than a third of the total. The European industry is a good place to find shares at attractive prices. There is a real chance of finding industrial companies in Europe that are market leaders in their sector and that are trading at attractive prices.

BlackRock Management, 24 Feb 2025

Authors: Jean Boivin, Head of the BII; Wei Li, Global Chief Investment Strategist, BII

U.S. equities have long outperformed their global peers. Some pin that on tech’s greater share in its market, bigger fiscal spend in recent years and energy independence, but we would attribute it more to deeper capital markets and relative deregulation that promote risk-taking.

We think the U.S. can keep its edge, even if the S&P 500 has lagged so far this year. Yet we believe Europe can close some of the return gap. With a lot of bad news priced into European equities, even prospects of good news could help them push higher. One example: Possible de-escalation in the Ukraine war. Reduced reliance on Russian gas brought European energy prices down from 2022’s highs. A form of peace agreement could lower energy prices further, boosting European growth and lowering inflation. This is just one of several catalysts we think could broaden U.S. equity strength to Europe.

We eye other catalysts for European equities as well. We expect more defense spending as the U.S. has stated Europe is no longer a primary security priority. The EU now has an air of urgency that typically spurs action.

In Germany, the weekend’s election result could herald fiscal loosening – though it’s a long and uncertain road there. Still sluggish euro area growth and easing inflation gives the European Central Bank room to cut rates more this year, we think.

So, we go neutral Europe’s stocks and still favor European financials – a preference that also served us well last year.

Yet Europe still faces multiple structural issues, from lagging competitiveness to potential U.S. tariffs – justifying some of Europe’s hefty valuation discount, we think.

Our assessment of the U.S. is unchanged: we expect mega-cap tech and other AI-linked stocks to keep driving U.S. equity returns, especially as AI adoption grows.

But we also see signs of earnings strength broadening beyond tech.

Analysts now expect tech to deliver 18% earnings growth this year versus 11% for the broader index, LSEG data show – a smaller gap vs. 2024. We think risk assets could also weather the higher growth and higher inflation mix we see as increasingly possible.

New tariffs and U.S. policy shifts aimed at boosting growth, like deregulation, carry inflationary potential.

Markets have embraced our higher-for-longer rate view, yet we still see term premium rising more than currently priced as investors demand more return for the risk of holding long-term bonds – even if the administration’s focus on long-term yields and talks of pausing quantitative tightening could delay some of the rise for now.

We go further underweight long-term U.S. Treasuries as a result.

In China, apparent efficiency gains by AI startup DeepSeek have driven a surge in China’s tech sector. President Xi Jinping’s recent meeting with private sector business leaders could signal a more supportive regulatory backdrop, yet the broader environment of U.S.-China technology competition may present challenges. We evolve our tactical overweight to Chinese equities as tech excitement could keep driving returns, potentially reducing the odds of much-anticipated government stimulus. Over the longer term, we are more wary given structural challenges to China’s growth and tariff risks.

Bottom line: We stay overweight U.S. equities, even with their softer start to 2025. Yet we think their lead over global peers could narrow this year. We upgrade European stocks to neutral while going further underweight long-dated U.S. Treasuries.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.