China’s new measures supported the stock markets but failed to support Oil, impacted by Saudi’s giving up its $100 target

WEEKLY TRENDS

WEEKLY TRENDS

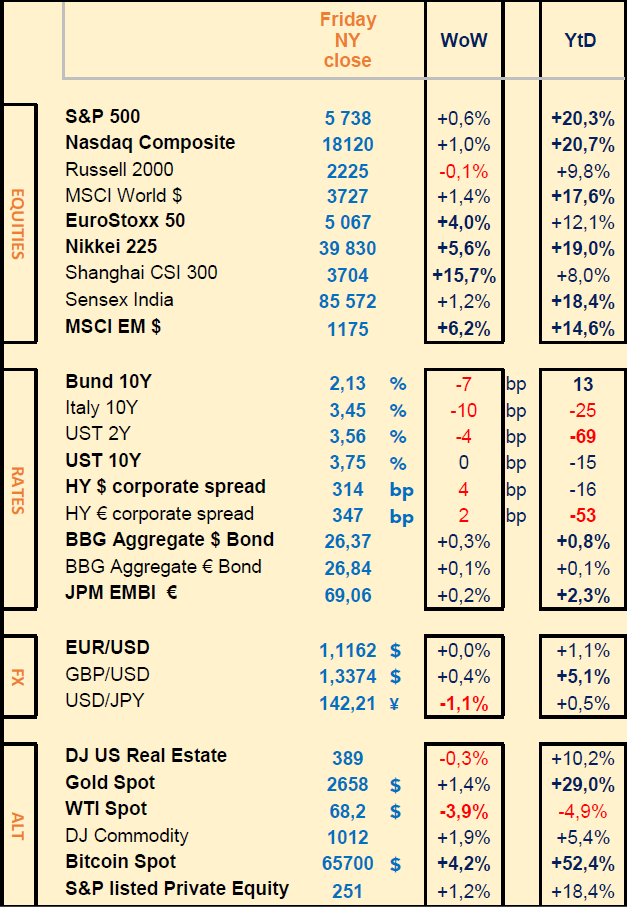

- Ahead of the corporate earnings season starting mid-October with US banks and Tesla first, last week was all about China’s new economic measures. The PBOC first decided to lower rates (-20bps), to lower its reserve requirements of large banks and to revitalise the troubled Chinese real estate market possibly through new bond issues to fund its stimulus plans. Investors cheered the decisions that mostly benefited the Tech and the Luxury sectors (short covering). The CSI300 is up almost 16% on the week

- US Micron Technology (MU) released in-line earnings for its Q4 and revised their next quarter’s earnings higher, MU was up over 18% WoW

- US August PCE inflation data was released at 2.2% vs 2.5% in July (Core excluding food and energy is at 2.7% vs 2.6% in July)

MARKETS

Equities

Luxury and Tech sectors outperformed last week while Financials and Energy sectors underperformed

Q2 earnings releases last week (stock WoW performance) :

+++ Micron Tech (+18%), Accenture (+4%), Trigano (+16%)

- - - Cintas (-1%), Costco (-2%), H&M (-5%), Nordic semiconductor (-25%), Ubisoft (-14%)

M&A: Moncler (+20%) Bernard Arnault bought indirectly 10%; Intel (+9%) on acquisition’s rumours from Qualcomm

NB: LVMH (+19%), Kering (+18%) benefited from China’s new measures

Total (-4%), BP (-5%), Shell (-5%), Eni (-4) on Saudi’s article in the FT giving up its $100 target

Analysts: AMS-Osram (+28%) on UBS upgrade; Super Micro Computer (-8%) on Hindenburg paper

Rates

US curve (2-10 years) continued to steepen last week (+20bps) with short end US Treasuries (2 years) lowered by 5bps

US

PCE inflation for August was released last week at +2.2% annualised vs 2.5% prior and 2.7% for the Core excl. food & energy vs 2.6% prior

Commodities

Crude Oil lowered last week, off by around 4% (WTI and Brent) on expectations the OPEC+ members would be ready to increase their production

Gold new ATH (All Time High), Copper above $10 000 per ton, Zinc +7%, all following China’s measures euphoria. Coffee (+7%) on Brazil production worries due to drought and fires

Crypto

BTC continued its ascension (+4%) ETFs cumulated $600m of net inflows last week ($385m on Thursday only) ETH (+3%), SOL (+8%)

Nota Bene

US Money Markets saw a massive $121bn inflow last week ($6.424trn)

Golden Week (Oct 1-7) Chinese markets closed

Most crowded trades (BofA) + Mag7 + Gold + 2 yr UST- China Equities

CALENDAR

WHAT ANALYSTS SAY

GOLDMAN SACHS, 27 September 2024 - Briefings

Author: GS Securities, GS Asset Management

Key takeaways

· How to hedge portfolios ahead of the US presidential election

· The Fed's rate cuts are a relief for real estate

· AI stocks aren't in a bubble

How to hedge ahead of the US presidential election

It's common for investors to hedge their portfolios ahead of US presidential elections, according to Shawn Tuteja, who oversees ETF and custom baskets volatility trading within Goldman Sachs Global Banking & Markets. “Investors – especially professional investors – hate to lose money around foreseen events, because that can be a lot harder to justify,” Tuteja says. “As such, it's common to see people put on hedges into election day and around election day. This drives the prices of options higher, and thus leads to a higher VIX.”

After an election, market volatility and the VIX Index, used as a barometer for market uncertainty, tend to cool off. But even as they do, “big moves can happen under the surface,” Tuteja says. He points out that the correlations among S&P 500 sectors fell sharply after the 2016 and 2020 elections.

Tuteja explains that “as the winner takes office, their specific policy agenda becomes more relevant.” This dynamic can be seen in the disparate performance of the Goldman Sachs Democratic Policy and Republican Policy baskets following the 2016 election results. Given this post-election dynamic, “it might not be enough to put on broad-market hedges,” Tuteja says. “If you're looking to hedge, it's really important to put on specific hedges to the positions in your actual portfolio.”

Are falling interest rates a salve for real estate?

The Federal Reserve has begun its long-awaited interest rate cutting cycle, providing some relief to rate-sensitive sectors. The US commercial real estate sector should see some relief as rates on floating-rate loan portfolios reset lower, although much of the lower rates have already been priced in, Lotfi Karoui, who leads the credit, mortgages, and structured products team for Goldman Sachs Research, says on Goldman Sachs Exchanges. “The bulk of CRE loans are actually fixed-rate structures, and so they are a lot more linked to the belly or the back end of the curve as opposed to the level of policy rates,” Karoui says. “And so the relief has been delivered already, strictly speaking.”

Meanwhile, the CRE market is still facing a record amount of maturing loans, but a pickup in transactions and the lower rates should help stabilize values, says Jeff Fine, global co-head of Alternatives Capital Formation in the firm's Asset & Wealth Management business. “We should be able to manage through much of that wall. Not all of it,” Fine says. “And so there will be equity loss in certain of those places, but it's not going to be industry-wide the way it was coming out of the financial crisis.”

AI stocks aren't in a bubble

The soaring performance of a handful of tech stocks has prompted investors to ask: Are AI stocks in a bubble?

Despite their meteoric rise, these companies aren't caught up in a bubble, writes Peter Oppenheimer, Goldman Sachs Research's chief global equity strategist and head of macro research in Europe. But that shouldn't stop investors from diversifying, particularly to other sectors that will enjoy AI-related benefits.

The technology sector has generated 32% of the global equity returns and 40% of the US equity market returns since 2010. Oppenheimer says this comes down to stronger financial fundamentals rather than irrational market speculation. The global tech sector's earnings per share have risen about 400% from its peak before the great financial crisis, while all other sectors together have risen 25% during that span.

That said, the unusual concentration of market capitalization among a few companies is unusual and is a risk to investors, Oppenheimer writes. “With markets being increasingly dependent on the fortunes of so few, the collateral damage of stock-specific mistakes is likely to be particularly high,” he writes. He points out that there are plenty of companies outside the tech sector that have high margins and returns on investment, that reinvest for future growth, and that have strong balance sheets.

Healthcare and biotech companies, meanwhile, are also likely to benefit from AI innovation. Likewise banks and financial companies may be able to improve their return on equity by adopting AI. New consumer products and services are likely to emerge, eventually, on the back of these technologies. There are signs that AI will provide better cybersecurity, and allow for the development of much more sophisticated robotics.

UBS, 25 September 2024 - Investing in emerging markets

Author: Michael Bolliger, CIO Global Emerging Markets; Themis Themistocleous, CIO EMEA, Tilmann Kolb, CFA, analyst

· The Fed started its interest-rate-cutting cycle last week, an important step on the path toward a soft landing. Emerging market (EM) assets performed well throughout August and September, underlining the positive impact from a weaker US dollar and falling yields. However, EM equities showed the path to a soft landing may be bumpy.

· Emerging market assets remain exposed to growth and trade worries. China’s economic struggles, the conflict in the Middle East, the war in Ukraine, the recent slump in oil prices, and domestic politics can tarnish the positive backdrop of lower global yields and an expected softening of the US dollar.

· Against this setup, we keep recommending a focus on bottom-up opportunities in emerging markets.

In the emerging market space, we also should not assume that what happened in the past will happen again in the future. There is only a small sample of Fed cutting cycles, while some aggregate indices measuring EM asset classes didn’t exist a few decades ago, and these indices have experienced composition modifications. The rise of China’s and India’s weights in the MSCI Emerging Markets index (equity) or the addition of high credit rating sovereign issuers from the GCC to the EMBI Global Diversified index (hard currency sovereign credit) have changed the index composition over time. Moreover, other dynamics may have a bigger impact than the exact timing of what the Fed does: The Fed’s first rate cut in July 2019, for example, was followed by a recession starting in February 2020, but the recession occurred because of the pandemic.

We therefore can only make limited statements around what the start of Fed easing cycles means for emerging market assets. For equities, the evidence is inconclusive: In the past six Fed-cutting cycles, the average performance of the MSCI EM Index in the first six months after the Fed started to cut was slightly positive at +4.9%. But there are instances where EM equities struggled as well during the early phases of a Fed cutting cycle . For hard currency credit, falling benchmark yields were supportive, leading to positive performance in the last five cutting cycles. Emerging market currencies also tended to deliver positive total returns over a six-month horizon. Once again, though, we warn against relying too much on the limited historical precedence to draw strong conclusions for the future.

Equities: We rate emerging market stocks as Neutral in our global equity strategy. Rate cut cycles in the US have in the past led to a more benign external environment for emerging market stocks, especially if US economic growth remains resilient, as suggested by our baseline scenario. By geography, we rate the Philippines and South Korea as Most Preferred. Key risks include a strong US dollar, an uptick in geopolitical tensions, and a pronounced US recession.

Credit: We expect emerging market bonds to benefit from easing financial conditions and from a decent growth outlook, notwithstanding the possibility of further near-term volatility as markets ponder US recession risks. China’s economic malaise and weakening oil prices point to higher downside risks for commodity-related names. While spreads are currently at our target levels and still offer elevated yields, there is little room for error and vulnerabilities to growth, inflation, political, and geopolitical shocks appear elevated.

FX: Moderating US economic activity and the Fed having started its rate-cutting cycle should provide a supportive global backdrop for emerging market currencies. Still, domestic politics continue to pose risks for some of the highest-yielder currencies like the Mexican peso and the Brazilian real. Investors with allocations to the Turkish lira should still look to benefit from the recent positive momentum for this carry trade in the coming weeks, but they should also be ready to stay nimble as economic activity slows and the current account balance likely turns negative again in the coming months. Positioning for CNY weakness against currencies with safe-haven qualities like the USD or the CHF is one way to prepare for US election risks, in our view.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Luxury and Tech sectors outperformed last week while Financials and Energy sectors underperformed

Q2 earnings releases last week (stock WoW performance) :

+++ Micron Tech (+18%), Accenture (+4%), Trigano (+16%)

- - - Cintas (-1%), Costco (-2%), H&M (-5%), Nordic semiconductor (-25%), Ubisoft (-14%)

M&A: Moncler (+20%) Bernard Arnault bought indirectly 10%; Intel (+9%) on acquisition’s rumours from Qualcomm

NB: LVMH (+19%), Kering (+18%) benefited from China’s new measures

Total (-4%), BP (-5%), Shell (-5%), Eni (-4) on Saudi’s article in the FT giving up its $100 target

Analysts: AMS-Osram (+28%) on UBS upgrade; Super Micro Computer (-8%) on Hindenburg paper

Rates

US curve (2-10 years) continued to steepen last week (+20bps) with short end US Treasuries (2 years) lowered by 5bps

US

PCE inflation for August was released last week at +2.2% annualised vs 2.5% prior and 2.7% for the Core excl. food & energy vs 2.6% prior

Commodities

Crude Oil lowered last week, off by around 4% (WTI and Brent) on expectations the OPEC+ members would be ready to increase their production

Gold new ATH (All Time High), Copper above $10 000 per ton, Zinc +7%, all following China’s measures euphoria. Coffee (+7%) on Brazil production worries due to drought and fires

Crypto

BTC continued its ascension (+4%) ETFs cumulated $600m of net inflows last week ($385m on Thursday only) ETH (+3%), SOL (+8%)

Nota Bene

US Money Markets saw a massive $121bn inflow last week ($6.424trn)

Golden Week (Oct 1-7) Chinese markets closed

Most crowded trades (BofA) + Mag7 + Gold + 2 yr UST- China Equities

CALENDAR

- Corporate earnings : US Nike (1 Oct), Levi Strauss (2 Oct); Europe Tesco (3 Oct), JD Wetherspoon (4 Oct)

- Macro: China September PMI (30 Sep), US September ISM (1 Oct), September NFP job report (4 Oct)

WHAT ANALYSTS SAY

- Goldman Sachs - Briefings

- UBS - Investing in emerging markets

GOLDMAN SACHS, 27 September 2024 - Briefings

Author: GS Securities, GS Asset Management

Key takeaways

· How to hedge portfolios ahead of the US presidential election

· The Fed's rate cuts are a relief for real estate

· AI stocks aren't in a bubble

How to hedge ahead of the US presidential election

It's common for investors to hedge their portfolios ahead of US presidential elections, according to Shawn Tuteja, who oversees ETF and custom baskets volatility trading within Goldman Sachs Global Banking & Markets. “Investors – especially professional investors – hate to lose money around foreseen events, because that can be a lot harder to justify,” Tuteja says. “As such, it's common to see people put on hedges into election day and around election day. This drives the prices of options higher, and thus leads to a higher VIX.”

After an election, market volatility and the VIX Index, used as a barometer for market uncertainty, tend to cool off. But even as they do, “big moves can happen under the surface,” Tuteja says. He points out that the correlations among S&P 500 sectors fell sharply after the 2016 and 2020 elections.

Tuteja explains that “as the winner takes office, their specific policy agenda becomes more relevant.” This dynamic can be seen in the disparate performance of the Goldman Sachs Democratic Policy and Republican Policy baskets following the 2016 election results. Given this post-election dynamic, “it might not be enough to put on broad-market hedges,” Tuteja says. “If you're looking to hedge, it's really important to put on specific hedges to the positions in your actual portfolio.”

Are falling interest rates a salve for real estate?

The Federal Reserve has begun its long-awaited interest rate cutting cycle, providing some relief to rate-sensitive sectors. The US commercial real estate sector should see some relief as rates on floating-rate loan portfolios reset lower, although much of the lower rates have already been priced in, Lotfi Karoui, who leads the credit, mortgages, and structured products team for Goldman Sachs Research, says on Goldman Sachs Exchanges. “The bulk of CRE loans are actually fixed-rate structures, and so they are a lot more linked to the belly or the back end of the curve as opposed to the level of policy rates,” Karoui says. “And so the relief has been delivered already, strictly speaking.”

Meanwhile, the CRE market is still facing a record amount of maturing loans, but a pickup in transactions and the lower rates should help stabilize values, says Jeff Fine, global co-head of Alternatives Capital Formation in the firm's Asset & Wealth Management business. “We should be able to manage through much of that wall. Not all of it,” Fine says. “And so there will be equity loss in certain of those places, but it's not going to be industry-wide the way it was coming out of the financial crisis.”

AI stocks aren't in a bubble

The soaring performance of a handful of tech stocks has prompted investors to ask: Are AI stocks in a bubble?

Despite their meteoric rise, these companies aren't caught up in a bubble, writes Peter Oppenheimer, Goldman Sachs Research's chief global equity strategist and head of macro research in Europe. But that shouldn't stop investors from diversifying, particularly to other sectors that will enjoy AI-related benefits.

The technology sector has generated 32% of the global equity returns and 40% of the US equity market returns since 2010. Oppenheimer says this comes down to stronger financial fundamentals rather than irrational market speculation. The global tech sector's earnings per share have risen about 400% from its peak before the great financial crisis, while all other sectors together have risen 25% during that span.

That said, the unusual concentration of market capitalization among a few companies is unusual and is a risk to investors, Oppenheimer writes. “With markets being increasingly dependent on the fortunes of so few, the collateral damage of stock-specific mistakes is likely to be particularly high,” he writes. He points out that there are plenty of companies outside the tech sector that have high margins and returns on investment, that reinvest for future growth, and that have strong balance sheets.

Healthcare and biotech companies, meanwhile, are also likely to benefit from AI innovation. Likewise banks and financial companies may be able to improve their return on equity by adopting AI. New consumer products and services are likely to emerge, eventually, on the back of these technologies. There are signs that AI will provide better cybersecurity, and allow for the development of much more sophisticated robotics.

UBS, 25 September 2024 - Investing in emerging markets

Author: Michael Bolliger, CIO Global Emerging Markets; Themis Themistocleous, CIO EMEA, Tilmann Kolb, CFA, analyst

· The Fed started its interest-rate-cutting cycle last week, an important step on the path toward a soft landing. Emerging market (EM) assets performed well throughout August and September, underlining the positive impact from a weaker US dollar and falling yields. However, EM equities showed the path to a soft landing may be bumpy.

· Emerging market assets remain exposed to growth and trade worries. China’s economic struggles, the conflict in the Middle East, the war in Ukraine, the recent slump in oil prices, and domestic politics can tarnish the positive backdrop of lower global yields and an expected softening of the US dollar.

· Against this setup, we keep recommending a focus on bottom-up opportunities in emerging markets.

In the emerging market space, we also should not assume that what happened in the past will happen again in the future. There is only a small sample of Fed cutting cycles, while some aggregate indices measuring EM asset classes didn’t exist a few decades ago, and these indices have experienced composition modifications. The rise of China’s and India’s weights in the MSCI Emerging Markets index (equity) or the addition of high credit rating sovereign issuers from the GCC to the EMBI Global Diversified index (hard currency sovereign credit) have changed the index composition over time. Moreover, other dynamics may have a bigger impact than the exact timing of what the Fed does: The Fed’s first rate cut in July 2019, for example, was followed by a recession starting in February 2020, but the recession occurred because of the pandemic.

We therefore can only make limited statements around what the start of Fed easing cycles means for emerging market assets. For equities, the evidence is inconclusive: In the past six Fed-cutting cycles, the average performance of the MSCI EM Index in the first six months after the Fed started to cut was slightly positive at +4.9%. But there are instances where EM equities struggled as well during the early phases of a Fed cutting cycle . For hard currency credit, falling benchmark yields were supportive, leading to positive performance in the last five cutting cycles. Emerging market currencies also tended to deliver positive total returns over a six-month horizon. Once again, though, we warn against relying too much on the limited historical precedence to draw strong conclusions for the future.

Equities: We rate emerging market stocks as Neutral in our global equity strategy. Rate cut cycles in the US have in the past led to a more benign external environment for emerging market stocks, especially if US economic growth remains resilient, as suggested by our baseline scenario. By geography, we rate the Philippines and South Korea as Most Preferred. Key risks include a strong US dollar, an uptick in geopolitical tensions, and a pronounced US recession.

Credit: We expect emerging market bonds to benefit from easing financial conditions and from a decent growth outlook, notwithstanding the possibility of further near-term volatility as markets ponder US recession risks. China’s economic malaise and weakening oil prices point to higher downside risks for commodity-related names. While spreads are currently at our target levels and still offer elevated yields, there is little room for error and vulnerabilities to growth, inflation, political, and geopolitical shocks appear elevated.

FX: Moderating US economic activity and the Fed having started its rate-cutting cycle should provide a supportive global backdrop for emerging market currencies. Still, domestic politics continue to pose risks for some of the highest-yielder currencies like the Mexican peso and the Brazilian real. Investors with allocations to the Turkish lira should still look to benefit from the recent positive momentum for this carry trade in the coming weeks, but they should also be ready to stay nimble as economic activity slows and the current account balance likely turns negative again in the coming months. Positioning for CNY weakness against currencies with safe-haven qualities like the USD or the CHF is one way to prepare for US election risks, in our view.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.