Last week: Powell stood up to Trump - EU/Japan stocks vs US (1-0) - ECB cut by 25bps (7th cut in a row)

WEEKLY TRENDS

WEEKLY TRENDS

- Tariffs negotiations started with Japan and with Italy last week. Japanese negotiator left the US without any tangible deal, while negotiations with China are in a stand still, but China appointed a new International trade negotiator

- Meanwhile, FED chairman Powell warned last week that tariffs are significantly larger than anticipated, pushing back the idea of a ‘FED Put’ to bail out US stock markets. US Treasury Secretary Bessent indicated that discussions to replace Powell would start in the Fall (Powell mandate ends in May 2026)

- ECB decided as expected to cut its base rates for the 7th time in a row last week, to 2.25% vs Fed at 4.25%-4.50% and vs BoE at 4.5%

- S&P500 Q1 corporate earnings releases continued with 60 last week, and another 115 this coming week. Banks seem to have generated record profits while Semi-conductors beat expectations but orders books are an issue (due to tariffs).

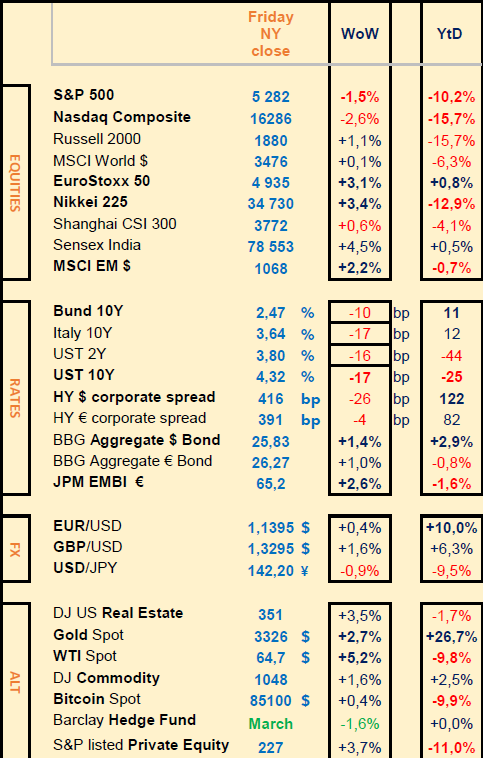

MARKETS

Equities

Q1 corporate earnings released (WoW stock performances):

GS (+4%), BofA (+5%), Citi (+3%), Rio Tinto (+3%), Netflix (+5%)

LVMH (-7%), ASML (-2%), Bunzl (-23%)

Best performers: German Datagroup (+40%, to be bought by KKR), Eli Lilly (+15%, good test results on new obesity drug Orforglipron)

Worst performers: Bunzl (-23%, on poor outlook and cancelled its share buyback programme) UnitedHealth (-24%,due to US budget cuts)

Analysts:

Schneider Elec (Citi ‘buy’ target €245) ASML (HSBC ’buy’ target €855) BNPP (GS ’buy’ target €96)

LVMH (MS ‘mkt weight target €590) Euronext (GS ’sell’ target €103) Kuehne Nagel (GS ’sell’ target CHF183)

Rates

US curve (2-10 years) steepening stable at 52bps. (Bond yields lower across the board).

HY corporate spreads slightly lower at 390/415 bps (EU/US)

Commodities

Oil price up (+5%) new US sanctions on Iranian oil importers

Gold price up (+2.5%) helped by a weaker USD and GS latest projection ($4000 within 12 months)

China

Q1 GDP +5.4% vs 5.1% expectations (Retail sales in March +5.9% YoY, Industrial output +7.7%)

Under the watch

Stocks rebound (50% retracement from 7 April lows and record highs on 19 Feb; SP500 at around 5500 and EU600 at around 520)

Nota Bene

VUCA (new acronym for Volatility, Uncertainty, Complexity and Ambiguity, that describes the current situation markets are in at the moment).

CALENDAR

Easter Monday:

Markets closed: Euronext

Markets open: NYSE

Q1 corporate earnings:

US Tesla, Halliburton (22), Alphabet, P&G, Merck (24), AbbVie (25)

EU SAP (22), EssilorLuxotica, Danone, Reckitt (23), Nestlé, Roche, Thales, Sanofi, BNPP (24), Safran (25)

WHAT ANALYSTS SAY

JULIUS BAER, 16 April 2025

Author : Yves Bonzon, Group Chief Investment Officer, Julius Baer

President Trump is tackling the US macroeconomic imbalances by treating the symptoms rather than the root causes of the problems.

The erratic price movements illustrate how difficult, if not impossible, it is to anticipate the direction of the markets at the moment.

Tariffs are just the first phase of a much more ambitious plan to strengthen US national security. In order to remain the world's leading power, the US wants to reduce its dependence on budget deficits. The combined impact of the negative fiscal impulse, higher costs of imported goods for US households and the negative wealth effect due to falling asset prices has considerably increased the likelihood of a US recession.

In light of recent developments, Julius Baer's Investment Committee has decided to switch to the economic contraction/inflation-push asset allocation regime, by far the most difficult to recognise and anticipate.

The sharp general decline in equity markets in recent days has probably shortened the duration of the bear market; in other words, the market could well reach its lowest point in 2025. Unlike market tops, market bottoms are events, and we'll do our best to define that point when we get there. For now, our plan remains to not buy the dips and sell the rises until we get a bullish signal, such as in October 2022.

We are continuing to strengthen the construction of portfolios.

Even before the announcements on 2 April, we had begun to reduce our exposure to US equities and turn our attention to Switzerland, Europe and China. We believe this was the right decision and recommend continuing to shift portfolios in this direction.

This week, we decided to further hedge our exposure to US equities by 1.5% in the Balanced profiles. In addition, we decided to increase our exposure to gold from 4% to 5% and to benchmark currencies. These measures are in line with our strategy in the economic contraction/inflation regime and further strengthen the construction of our portfolios. At the same time, our portfolios are still well positioned to benefit from further rebounds if the White House continues its policy reversals.

Although the daily data on the current price of an equity portfolio can be unpleasant to watch at times like these, it is worth remembering that prudence does not mean taking refuge in cash. Cash also carries risks of currency depreciation, government capital controls and financial repression.

A well-diversified portfolio offers better protection against these risks and enables investors not to miss out on ‘bearish’ rallies, or even the first phase of the next up-cycle in equities.

BANQUE HERITAGE, 16 April 2025

Author: Jean-Christophe Rochat, Chief Investment Officer, Head of AM, Banque Heritage

Although Germany briefly recovered from the pandemic, the momentum quickly faded. The invasion of Ukraine brutally highlighted the structural shortcomings of the German economic model: massive energy dependence on Russia, and critical exposure to Chinese demand for its industrial exports. With the US presidential election, a new factor of uncertainty has been added: a version 2.0 of the Trump administration, with more unpredictable and outspoken positions, which is further upsetting the global geopolitical and economic balance.

Washington is returning to muscular interventionism and working on a geostrategic remodelling based on three poles: the Americas, Asia and a pan-European Russia. Europe, and more specifically the European Union (EU), is largely left out of this scheme. As for Germany, it is absent from American plans, relegated to the periphery of a global chessboard on which it had long believed it had influence.

The European Union applies a common customs tariff at its external borders, harmonised across the 27 Member States. This system is the result of a long technocratic process, structured around a few key principles: classification of products, determination of the origin of goods, integration of existing trade agreements, and application of anti-dumping measures. The European Commission proposes and the EU Council decides by qualified majority after consulting the Parliament.

Faced with this coherent package, the Trump administration is up against a powerful adversary with strategic market depth. For Washington, the stakes are less in consumer goods than in services, particularly those of the Magnificent 7. Its strategy aims to fracture European unity, relying on ideological affinities with certain member states such as Italy, Hungary, the Netherlands and Slovakia. The Italian Prime Minister's forthcoming trip to Washington will provide a real-life test of the 27's resilience in the face of American trade pressure.

Against this backdrop, Germany remains particularly vulnerable. In 2024, 10.5% of its exports - or 163.4 billion euros - went to the United States, its leading trading partner. Most of this trade was in cars ($24.3 billion), medical and biological products ($12.4 billion) and packaged medicines ($8.38 billion).

Forced by the urgency of the situation, Merz is adopting a more offensive style. The message was clear: ‘the world will not wait’. Germany is thus entering a new phase, marked by decisions long considered unthinkable. On the economic front, the sacrosanct ‘debt brake’ enshrined in the Constitution has been partially lifted.

In strategic terms, Germany is now assuming a position of power. It has become Ukraine's third-largest arms supplier, breaking a historic taboo on the export of heavy weapons. Berlin is aiming even higher: to make the Bundeswehr the backbone of Europe's conventional forces by 2030. In this context, Germany is making a real comeback at the helm of the EU. The change is tangible, assertive and potentially lasting.

BLACKROCK, 14 April 2025

Authors: Jean Boivin, Wei Li, BlackRock Investment Institute

The consideration of some financial risks and costs of tariffs has put a check on the U.S. approach.

· We extend our tactical horizon to dial up risk-taking

· Global markets endured extraordinary volatility last week. A spike in long-term U.S. Treasury yields was one factor seeming to drive a change in tactics

· U.S. tariffs will likely lower growth in Europe, but greater fiscal spending may limit the drag

The 90-day pause of tariffs on most countries and exemption of key tech imports suggest the U.S. administration is taking some account of financial risks and costs as well as a country’s willingness to engage. It shows there are factors that could put a check on the administration’s maximal tariff stance.

As a result, late last week we extended our tactical horizon back to six to 12 months to dial up risk. Yet we still think tariffs can hurt growth and lift inflation, and major uncertainty remains.

Big Calls

Tactical:

US equities (Policy uncertainty may weigh on growth and stocks in the near term. Yet we think U.S. equities can regain their global leadership. We think the underlying economy and corporate earnings are still solid and supported by mega forces such as AI).

Japanese equities (We are overweight. Ongoing shareholder-friendly corporate reforms remain a positive. We prefer unhedged exposures given the yen’s potential strength during bouts of market stress).

Selective in Fixed Income (Persistent deficits and sticky inflation in the U.S. make us underweight long-term U.S. Treasuries. We also prefer European credit – both investment grade and high yield – over the U.S. on more attractive spreads).

Strategic:

Infrastructure equity and private credit (We see opportunities in infrastructure equity due to attractive relative valuations and mega forces. We think private credit will earn lending share as banks retreat – and at attractive returns).

Fixed Income granularity (We prefer DM government bonds over investment grade credit given tight spreads. Within DM government bonds, we favor short- and medium-term maturities in the U.S., and UK gilts acrossan maturities).

Equity granularity (We favor emerging over developed markets yet get selective in both. EMs at the cross current of mega forces – like India and Saudi Arabia – offer opportunities. In DM, we like Japan as the return of inflation and corporate reforms brighten the outlook).

Equities

Q1 corporate earnings released (WoW stock performances):

GS (+4%), BofA (+5%), Citi (+3%), Rio Tinto (+3%), Netflix (+5%)

LVMH (-7%), ASML (-2%), Bunzl (-23%)

Best performers: German Datagroup (+40%, to be bought by KKR), Eli Lilly (+15%, good test results on new obesity drug Orforglipron)

Worst performers: Bunzl (-23%, on poor outlook and cancelled its share buyback programme) UnitedHealth (-24%,due to US budget cuts)

Analysts:

Schneider Elec (Citi ‘buy’ target €245) ASML (HSBC ’buy’ target €855) BNPP (GS ’buy’ target €96)

LVMH (MS ‘mkt weight target €590) Euronext (GS ’sell’ target €103) Kuehne Nagel (GS ’sell’ target CHF183)

Rates

US curve (2-10 years) steepening stable at 52bps. (Bond yields lower across the board).

HY corporate spreads slightly lower at 390/415 bps (EU/US)

Commodities

Oil price up (+5%) new US sanctions on Iranian oil importers

Gold price up (+2.5%) helped by a weaker USD and GS latest projection ($4000 within 12 months)

China

Q1 GDP +5.4% vs 5.1% expectations (Retail sales in March +5.9% YoY, Industrial output +7.7%)

Under the watch

Stocks rebound (50% retracement from 7 April lows and record highs on 19 Feb; SP500 at around 5500 and EU600 at around 520)

Nota Bene

VUCA (new acronym for Volatility, Uncertainty, Complexity and Ambiguity, that describes the current situation markets are in at the moment).

CALENDAR

Easter Monday:

Markets closed: Euronext

Markets open: NYSE

Q1 corporate earnings:

US Tesla, Halliburton (22), Alphabet, P&G, Merck (24), AbbVie (25)

EU SAP (22), EssilorLuxotica, Danone, Reckitt (23), Nestlé, Roche, Thales, Sanofi, BNPP (24), Safran (25)

WHAT ANALYSTS SAY

- JULIUS BAER: It is important to remember that we are dealing with probabilities, not certainties

- BANQUE HERITAGE: Germany is facing an economic and geostrategic turning point that requires it to reinvent itself.

- BLACKROCK: Our take on the US tariff pause

JULIUS BAER, 16 April 2025

Author : Yves Bonzon, Group Chief Investment Officer, Julius Baer

President Trump is tackling the US macroeconomic imbalances by treating the symptoms rather than the root causes of the problems.

The erratic price movements illustrate how difficult, if not impossible, it is to anticipate the direction of the markets at the moment.

Tariffs are just the first phase of a much more ambitious plan to strengthen US national security. In order to remain the world's leading power, the US wants to reduce its dependence on budget deficits. The combined impact of the negative fiscal impulse, higher costs of imported goods for US households and the negative wealth effect due to falling asset prices has considerably increased the likelihood of a US recession.

In light of recent developments, Julius Baer's Investment Committee has decided to switch to the economic contraction/inflation-push asset allocation regime, by far the most difficult to recognise and anticipate.

The sharp general decline in equity markets in recent days has probably shortened the duration of the bear market; in other words, the market could well reach its lowest point in 2025. Unlike market tops, market bottoms are events, and we'll do our best to define that point when we get there. For now, our plan remains to not buy the dips and sell the rises until we get a bullish signal, such as in October 2022.

We are continuing to strengthen the construction of portfolios.

Even before the announcements on 2 April, we had begun to reduce our exposure to US equities and turn our attention to Switzerland, Europe and China. We believe this was the right decision and recommend continuing to shift portfolios in this direction.

This week, we decided to further hedge our exposure to US equities by 1.5% in the Balanced profiles. In addition, we decided to increase our exposure to gold from 4% to 5% and to benchmark currencies. These measures are in line with our strategy in the economic contraction/inflation regime and further strengthen the construction of our portfolios. At the same time, our portfolios are still well positioned to benefit from further rebounds if the White House continues its policy reversals.

Although the daily data on the current price of an equity portfolio can be unpleasant to watch at times like these, it is worth remembering that prudence does not mean taking refuge in cash. Cash also carries risks of currency depreciation, government capital controls and financial repression.

A well-diversified portfolio offers better protection against these risks and enables investors not to miss out on ‘bearish’ rallies, or even the first phase of the next up-cycle in equities.

BANQUE HERITAGE, 16 April 2025

Author: Jean-Christophe Rochat, Chief Investment Officer, Head of AM, Banque Heritage

Although Germany briefly recovered from the pandemic, the momentum quickly faded. The invasion of Ukraine brutally highlighted the structural shortcomings of the German economic model: massive energy dependence on Russia, and critical exposure to Chinese demand for its industrial exports. With the US presidential election, a new factor of uncertainty has been added: a version 2.0 of the Trump administration, with more unpredictable and outspoken positions, which is further upsetting the global geopolitical and economic balance.

Washington is returning to muscular interventionism and working on a geostrategic remodelling based on three poles: the Americas, Asia and a pan-European Russia. Europe, and more specifically the European Union (EU), is largely left out of this scheme. As for Germany, it is absent from American plans, relegated to the periphery of a global chessboard on which it had long believed it had influence.

The European Union applies a common customs tariff at its external borders, harmonised across the 27 Member States. This system is the result of a long technocratic process, structured around a few key principles: classification of products, determination of the origin of goods, integration of existing trade agreements, and application of anti-dumping measures. The European Commission proposes and the EU Council decides by qualified majority after consulting the Parliament.

Faced with this coherent package, the Trump administration is up against a powerful adversary with strategic market depth. For Washington, the stakes are less in consumer goods than in services, particularly those of the Magnificent 7. Its strategy aims to fracture European unity, relying on ideological affinities with certain member states such as Italy, Hungary, the Netherlands and Slovakia. The Italian Prime Minister's forthcoming trip to Washington will provide a real-life test of the 27's resilience in the face of American trade pressure.

Against this backdrop, Germany remains particularly vulnerable. In 2024, 10.5% of its exports - or 163.4 billion euros - went to the United States, its leading trading partner. Most of this trade was in cars ($24.3 billion), medical and biological products ($12.4 billion) and packaged medicines ($8.38 billion).

Forced by the urgency of the situation, Merz is adopting a more offensive style. The message was clear: ‘the world will not wait’. Germany is thus entering a new phase, marked by decisions long considered unthinkable. On the economic front, the sacrosanct ‘debt brake’ enshrined in the Constitution has been partially lifted.

In strategic terms, Germany is now assuming a position of power. It has become Ukraine's third-largest arms supplier, breaking a historic taboo on the export of heavy weapons. Berlin is aiming even higher: to make the Bundeswehr the backbone of Europe's conventional forces by 2030. In this context, Germany is making a real comeback at the helm of the EU. The change is tangible, assertive and potentially lasting.

BLACKROCK, 14 April 2025

Authors: Jean Boivin, Wei Li, BlackRock Investment Institute

The consideration of some financial risks and costs of tariffs has put a check on the U.S. approach.

· We extend our tactical horizon to dial up risk-taking

· Global markets endured extraordinary volatility last week. A spike in long-term U.S. Treasury yields was one factor seeming to drive a change in tactics

· U.S. tariffs will likely lower growth in Europe, but greater fiscal spending may limit the drag

The 90-day pause of tariffs on most countries and exemption of key tech imports suggest the U.S. administration is taking some account of financial risks and costs as well as a country’s willingness to engage. It shows there are factors that could put a check on the administration’s maximal tariff stance.

As a result, late last week we extended our tactical horizon back to six to 12 months to dial up risk. Yet we still think tariffs can hurt growth and lift inflation, and major uncertainty remains.

Big Calls

Tactical:

US equities (Policy uncertainty may weigh on growth and stocks in the near term. Yet we think U.S. equities can regain their global leadership. We think the underlying economy and corporate earnings are still solid and supported by mega forces such as AI).

Japanese equities (We are overweight. Ongoing shareholder-friendly corporate reforms remain a positive. We prefer unhedged exposures given the yen’s potential strength during bouts of market stress).

Selective in Fixed Income (Persistent deficits and sticky inflation in the U.S. make us underweight long-term U.S. Treasuries. We also prefer European credit – both investment grade and high yield – over the U.S. on more attractive spreads).

Strategic:

Infrastructure equity and private credit (We see opportunities in infrastructure equity due to attractive relative valuations and mega forces. We think private credit will earn lending share as banks retreat – and at attractive returns).

Fixed Income granularity (We prefer DM government bonds over investment grade credit given tight spreads. Within DM government bonds, we favor short- and medium-term maturities in the U.S., and UK gilts acrossan maturities).

Equity granularity (We favor emerging over developed markets yet get selective in both. EMs at the cross current of mega forces – like India and Saudi Arabia – offer opportunities. In DM, we like Japan as the return of inflation and corporate reforms brighten the outlook).

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.