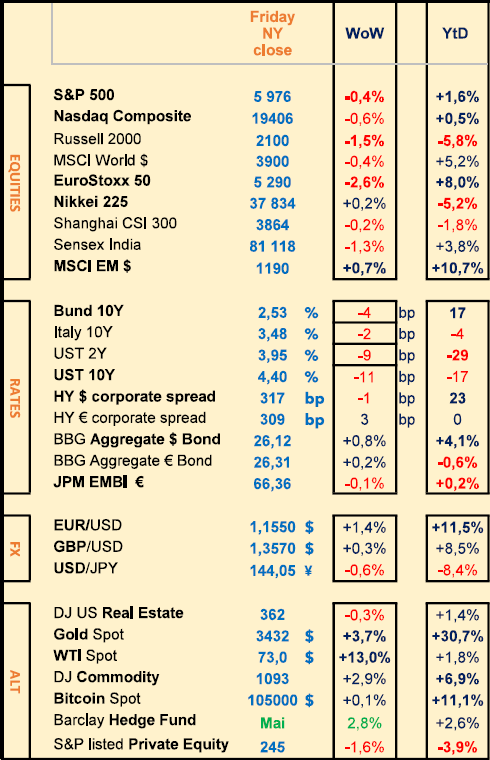

Last week: Israel-Iran military attacks - US inflation (May CPI, PPI) - Oil & Gold prices surged by +13%, 4% respectively

WEEKLY TRENDS

WEEKLY TRENDS

- Israel pulled the trigger on Iran last Thursday after a 30 year wait. Stock markets sold off on Friday across the board, and the safe haven flows into Bonds were offset by the inflationary fears of a widened Middle East military conflict

- May US inflation was released slightly cooler than expected (Core CPI at 2.8% vs 2.9% expected, still way above the FED’s target at 2%)

- Note that the safe havens, USD and USTs (US Treasuries) did not react as they should have on Friday (Treasuries actually sold off on Friday and the USD gained a mere 0.3%)

- WTI went up by 7% on Friday and 13% over the week, so much for Trump’s desire to see it much lower

- Next week, we shall have many Central Banks’ rate decisions: BoJ on Tuesday, the FED on Wednesday (no change expected) SNB (-25bps expected) and the BOE on Thursday (no change expected).

MARKETS

Equities

Q1 corporate earnings released (WoW stock performances):

Oracle (+21% Cloud activity), Adobe (-6%), Inditex (-5%)

NB weekly performances:

Total (+5%), BE Semi conductor (+11%)

Swiss RE (-6%), UBS (-6%), Deutsche Boerse (-6%)

Analysts:

Bayer (HSBC ‘buy’ target €32), IMCD (JPM ‘o/w’ target €162)

Rates

US curve (2-10 years) steepening stable at 45bps (Bond yields mildly lower across the board)

HY corporate spreads stable at 315-310 bps (US/EU)

Commodities

Oil price higher (+13%) among Middle East tensions affecting Iran oil production and Persian Gulf disorder (a third of World’s oil tankers and 20% of World’s LNG / Qatar go through the Hormuz strait)

Gold price higher (+3.5%) due to the Israel-Iran repeated attacks

US

May CPI at 2.8% Core and May PPI at 3% Core (moderating inflation)

Under the watch

Gold’s share of global CB reserves reached 23% in Q2, the highest level in 30 years (it doubled in 6 years). Meanwhile the USD’s share declined by 10% to 45%, while the EUR’s share stands at 16% (declined by 2%).

Nota Bene

Stablecoin Circle IPO was THE stock market event last week, with an IPO priced at $31 and a closing price on Friday at $134.

IBEX 35 (YTD returned +20% while EU50 returned +8%) mostly due to Spanish banks performances (e.g. Caixa at +45%)

Advent made a $3.7bn takeover bid for Spectris

CALENDAR

Central Banks rate decisions:

BOJ (17 June); FED / FOMC (18 June); SNB and BOE / MPC (19 June)

Macro Data releases:

UKMay CPI and RPI (18 June); EU: May CPI (18 June)

WHAT ANALYSTS SAY

DNCA Investments, 12 June 2025

Authors : Pierre Pincemaille, General Secretary AM

The most pessimistic among us often say that two things are inevitable in life: taxes and death. Unable to find a cure for the latter, Donald Trump has decided to tackle taxes with his Big and Beautiful Bill. This bill (1,117 pages long!) brings together the main priorities set out in his programme and threatens to further increase the deficit and inflate public debt. It took friendly pressure from the president on his own party and confirmation of the most pessimistic predictions for this bill to be passed by the House of Representatives by a single vote (215 to 214). After this hard-fought vote, it now heads to the Senate, with the aim of ratification before the symbolic date of 4 July.

Markets facing the fiscal abyss

By coincidence, Moody's decided at the same time to downgrade the United States' sovereign rating from AAA to AA1, now forecasting a deficit of 9% of GDP within 10 years, compared with 6.4% in 2024. As a reminder, S&P had preceded it in 2011 and Fitch in 2023. The reaction of the markets on the day of the announcement suggests that this decision was widely expected: yields on 10 and 30-year government bonds ended the session lower after an initial upward movement.

But if Moody's downgrade had little impact, it was mainly because fiscal anxiety had affected the markets well before this decision. According to the CRFB2, the extension of tax credits dating back to 2017 (Tax Cuts & Jobs Act) combined with new relief measures is expected to cost between $3.3trn and $5.2trn over 10 years, depending on whether certain measures are temporary or permanent. The result: a buying strike by international investors in 2025, a lacklustre auction at the end of May that pushed the 30-year US bond back above the psychological 5% mark, and the 2027 Microsoft bond now trading at a negative spread relative to the US government bond with the same maturity. Even the IMF has made a media intervention calling for a reduction in the US budget deficit.

Unsurprisingly, the rise in US bond yields on long maturities goes hand in hand with the rebuilding of the term premium.

The ‘invisible hand’ of the market, theorised by Adam Smith, or its contemporary version of bond watchdogs, has done its work in the face of the ‘fiscal abomination’, to use Elon Musk's recent words : the 10-year annualised performance of long-term US sovereign bonds is at an all-time low (-1%). The asset class is now in the same situation as equities in 2009 (-3.4%, the worst 10-year annualised performance since 1939) or commodities in June 2018 (-7.7%).

Such an accumulation of underperformance, coupled with the potential return of international investors attracted by higher yields (10-year real rates at their highest since 2008) and the implementation in the second half of the year of the Supplementary Leverage Ratio (SLR) reform easing constraints on US banks regarding the holding of government securities, should theoretically enable the world's deepest bond market to emerge from the penalty box.

Rothschild & Co Bank, 13 June 2025

Author: Amaya Gutierrez, Head of Investments and Portfolio Advisory

The luxury sector is faltering. Faced with macroeconomic headwinds, growing price pressure and geopolitical tensions, this industry, once synonymous with glamour, is experiencing a sharp slowdown – particularly in key markets such as China. However, while many brands are buckling under the pressure, two icons of the sector are managing to come out on top: Hermès and Ferrari.

Price increases are reaching their limits. Between 2019 and 2023, more than 80% of the growth in the luxury market was driven by price increases. But this strategy is now showing signs of running out of steam. What once guaranteed success now risks alienating new customers, particularly in the aspirational segment, which is particularly price-sensitive.

Trade conflicts between the United States, China and Europe, the threat of new tariffs and geopolitical instability – particularly in Eastern Europe and the Middle East – are further heightening uncertainty. Brands relying on scalable mass production are under increasing pressure. Conversely, Hermès, with its artisanal expertise and bespoke products, and Ferrari, with its exclusive automobiles, prove that true added value not only justifies high prices but also builds lasting customer loyalty.

Digital channels and new generations. As traditional luxury codes are being challenged, a new growth dynamic is emerging: Millennials and Generation Z are redefining the contours of the market. Today, they already account for more than half of global luxury goods consumption. By 2030, Millennials, Generation Z and Generation Alpha are expected to account for 80% of global spending in this sector.

But what are they looking for? Personalisation, sustainability and immersive digital experiences. Luxury is now becoming experiential – through exclusive trips, unique events and digital collectibles. Brands such as Vacheron Constantin, which are collaborating with blockchain start-ups such as Arianee to offer NFTs as certificates of authenticity for their watches, are already paving the way for new uses. At the same time, another market is developing at the opposite end of the generational spectrum: older consumers, benefiting from longer life expectancy and a better quality of life, are increasingly investing in cultural experiences and forms of luxury focused on personal enrichment.

Hermès and Ferrari: a relationship above all else, more than just a transaction. In a market increasingly dominated by transactional logic, Hermès and Ferrari stand out for their desire to build lasting relationships with their customers. Both companies focus on long-term loyalty and adopt a strategy based on value rather than volume. They avoid aggressive pricing policies while maintaining strong pricing power.

Luxury requires substance – and character. The road ahead remains fraught with challenges. In the short term, revenues are likely to remain under pressure. However, thanks to a clear strategy, a constant capacity for innovation and a deep understanding of their brand identity, Hermès and Ferrari are not content to simply follow the evolution of the luxury market: they are redefining it.

JP Morgan AM, 10 June 2025

Author: Fiona Harris, Head of US Equity Investment Specialist International

One important difference compared to the pandemic era is that tariffs are self-inflicted. During the Covid period, when the government said it would do whatever it took to get the United States through it and everyone was receiving cheques, the measures taken were intended to support and help you. Today, however, tariffs are not supporting or helping you! They are doing the opposite. So there is a sense that a collapse in US consumption could potentially occur and that the economy could go into recession. The level of tariffs will probably be higher at the end of the year than when we started. However, the increase in tariffs could be absorbed by most companies, as their margins are still comfortable on average. We have margins of 13% in the United States and corporate balance sheets are strong. Companies that have survived the Covid pandemic know how to deal with this kind of situation. They know how to act quickly. And that is very important.

As for the recovery phase that occurred in the markets between mid-April and mid-May, it is interesting to note that there were plenty of surprises. However, the initial shock was severe – and now the markets seem to be getting used to the idea that they must expect the unexpected. ‘Over the past 3 months, more than 30 companies have announced plans to reinvest in the US, for a total of nearly $2trn.’

These 30 large companies are active in many different sectors, including healthcare and technology, and include both American and non-American companies. Donald Trump's negotiations on customs duties have had at least this one positive effect: companies are investing in the United States. Some of these companies are talking about a supply chain in which medicines for sale in the United States will be manufactured in the United States. The approach to the subject is different from what it was before. Previously, some pharmaceutical companies, for example, produced a huge amount of medicines abroad and then sent them back to the United States.

Investors are selling US equities and buying European or global equities – at J.P. Morgan Asset Management, we are seeing that our clients continue to buy US equities. We have recorded £26bn in net inflows into our US equity portfolio since the beginning of the year up to last week, i.e. between the start of 2025 and mid-May. We have also recorded positive net inflows into our US equity portfolio over the last three years. This sets us apart from many of our peers. J.P. Morgan Asset Management clients are therefore buying US equities.

In addition, companies continue to announce major investments in the US. And this is something that will pay dividends for years to come. So this is not a one-off effect. If the factory is built, there will then be workers and money circulating in the local economy. Instead of being spent somewhere in Europe, that money will be spent in the United States. This will have a multiplier effect. Not everything is rosy at the moment, but the situation is not as negative as we sometimes hear. I think that right now and in the long term, US corporate earnings growth will continue to outpace that of European companies and emerging markets. US corporate earnings exceed those of other markets.

Companies could also benefit from tax deductions for production and investment in the US. The administration is talking about reducing corporate tax, but mainly for companies that invest and manufacture in the United States. So, first there would be the impact of manufacturing in the United States. Then, once companies have started more activities, their profits will be taxed less in a second phase. The S&P 500 is expected to increase by 6 to 7% per year, not 20% or more.

Equities

Q1 corporate earnings released (WoW stock performances):

Oracle (+21% Cloud activity), Adobe (-6%), Inditex (-5%)

NB weekly performances:

Total (+5%), BE Semi conductor (+11%)

Swiss RE (-6%), UBS (-6%), Deutsche Boerse (-6%)

Analysts:

Bayer (HSBC ‘buy’ target €32), IMCD (JPM ‘o/w’ target €162)

Rates

US curve (2-10 years) steepening stable at 45bps (Bond yields mildly lower across the board)

HY corporate spreads stable at 315-310 bps (US/EU)

Commodities

Oil price higher (+13%) among Middle East tensions affecting Iran oil production and Persian Gulf disorder (a third of World’s oil tankers and 20% of World’s LNG / Qatar go through the Hormuz strait)

Gold price higher (+3.5%) due to the Israel-Iran repeated attacks

US

May CPI at 2.8% Core and May PPI at 3% Core (moderating inflation)

Under the watch

Gold’s share of global CB reserves reached 23% in Q2, the highest level in 30 years (it doubled in 6 years). Meanwhile the USD’s share declined by 10% to 45%, while the EUR’s share stands at 16% (declined by 2%).

Nota Bene

Stablecoin Circle IPO was THE stock market event last week, with an IPO priced at $31 and a closing price on Friday at $134.

IBEX 35 (YTD returned +20% while EU50 returned +8%) mostly due to Spanish banks performances (e.g. Caixa at +45%)

Advent made a $3.7bn takeover bid for Spectris

CALENDAR

Central Banks rate decisions:

BOJ (17 June); FED / FOMC (18 June); SNB and BOE / MPC (19 June)

Macro Data releases:

UKMay CPI and RPI (18 June); EU: May CPI (18 June)

WHAT ANALYSTS SAY

- DNCA: US tax trajectory: from point A (AA) to point B (BB)

- Rothschild & Co Bank: Hermès and Ferrari - Resilient icons of global luxury

- JP Morgan AM: "Our clients continue to buy US equities"

DNCA Investments, 12 June 2025

Authors : Pierre Pincemaille, General Secretary AM

The most pessimistic among us often say that two things are inevitable in life: taxes and death. Unable to find a cure for the latter, Donald Trump has decided to tackle taxes with his Big and Beautiful Bill. This bill (1,117 pages long!) brings together the main priorities set out in his programme and threatens to further increase the deficit and inflate public debt. It took friendly pressure from the president on his own party and confirmation of the most pessimistic predictions for this bill to be passed by the House of Representatives by a single vote (215 to 214). After this hard-fought vote, it now heads to the Senate, with the aim of ratification before the symbolic date of 4 July.

Markets facing the fiscal abyss

By coincidence, Moody's decided at the same time to downgrade the United States' sovereign rating from AAA to AA1, now forecasting a deficit of 9% of GDP within 10 years, compared with 6.4% in 2024. As a reminder, S&P had preceded it in 2011 and Fitch in 2023. The reaction of the markets on the day of the announcement suggests that this decision was widely expected: yields on 10 and 30-year government bonds ended the session lower after an initial upward movement.

But if Moody's downgrade had little impact, it was mainly because fiscal anxiety had affected the markets well before this decision. According to the CRFB2, the extension of tax credits dating back to 2017 (Tax Cuts & Jobs Act) combined with new relief measures is expected to cost between $3.3trn and $5.2trn over 10 years, depending on whether certain measures are temporary or permanent. The result: a buying strike by international investors in 2025, a lacklustre auction at the end of May that pushed the 30-year US bond back above the psychological 5% mark, and the 2027 Microsoft bond now trading at a negative spread relative to the US government bond with the same maturity. Even the IMF has made a media intervention calling for a reduction in the US budget deficit.

Unsurprisingly, the rise in US bond yields on long maturities goes hand in hand with the rebuilding of the term premium.

The ‘invisible hand’ of the market, theorised by Adam Smith, or its contemporary version of bond watchdogs, has done its work in the face of the ‘fiscal abomination’, to use Elon Musk's recent words : the 10-year annualised performance of long-term US sovereign bonds is at an all-time low (-1%). The asset class is now in the same situation as equities in 2009 (-3.4%, the worst 10-year annualised performance since 1939) or commodities in June 2018 (-7.7%).

Such an accumulation of underperformance, coupled with the potential return of international investors attracted by higher yields (10-year real rates at their highest since 2008) and the implementation in the second half of the year of the Supplementary Leverage Ratio (SLR) reform easing constraints on US banks regarding the holding of government securities, should theoretically enable the world's deepest bond market to emerge from the penalty box.

Rothschild & Co Bank, 13 June 2025

Author: Amaya Gutierrez, Head of Investments and Portfolio Advisory

The luxury sector is faltering. Faced with macroeconomic headwinds, growing price pressure and geopolitical tensions, this industry, once synonymous with glamour, is experiencing a sharp slowdown – particularly in key markets such as China. However, while many brands are buckling under the pressure, two icons of the sector are managing to come out on top: Hermès and Ferrari.

Price increases are reaching their limits. Between 2019 and 2023, more than 80% of the growth in the luxury market was driven by price increases. But this strategy is now showing signs of running out of steam. What once guaranteed success now risks alienating new customers, particularly in the aspirational segment, which is particularly price-sensitive.

Trade conflicts between the United States, China and Europe, the threat of new tariffs and geopolitical instability – particularly in Eastern Europe and the Middle East – are further heightening uncertainty. Brands relying on scalable mass production are under increasing pressure. Conversely, Hermès, with its artisanal expertise and bespoke products, and Ferrari, with its exclusive automobiles, prove that true added value not only justifies high prices but also builds lasting customer loyalty.

Digital channels and new generations. As traditional luxury codes are being challenged, a new growth dynamic is emerging: Millennials and Generation Z are redefining the contours of the market. Today, they already account for more than half of global luxury goods consumption. By 2030, Millennials, Generation Z and Generation Alpha are expected to account for 80% of global spending in this sector.

But what are they looking for? Personalisation, sustainability and immersive digital experiences. Luxury is now becoming experiential – through exclusive trips, unique events and digital collectibles. Brands such as Vacheron Constantin, which are collaborating with blockchain start-ups such as Arianee to offer NFTs as certificates of authenticity for their watches, are already paving the way for new uses. At the same time, another market is developing at the opposite end of the generational spectrum: older consumers, benefiting from longer life expectancy and a better quality of life, are increasingly investing in cultural experiences and forms of luxury focused on personal enrichment.

Hermès and Ferrari: a relationship above all else, more than just a transaction. In a market increasingly dominated by transactional logic, Hermès and Ferrari stand out for their desire to build lasting relationships with their customers. Both companies focus on long-term loyalty and adopt a strategy based on value rather than volume. They avoid aggressive pricing policies while maintaining strong pricing power.

Luxury requires substance – and character. The road ahead remains fraught with challenges. In the short term, revenues are likely to remain under pressure. However, thanks to a clear strategy, a constant capacity for innovation and a deep understanding of their brand identity, Hermès and Ferrari are not content to simply follow the evolution of the luxury market: they are redefining it.

JP Morgan AM, 10 June 2025

Author: Fiona Harris, Head of US Equity Investment Specialist International

One important difference compared to the pandemic era is that tariffs are self-inflicted. During the Covid period, when the government said it would do whatever it took to get the United States through it and everyone was receiving cheques, the measures taken were intended to support and help you. Today, however, tariffs are not supporting or helping you! They are doing the opposite. So there is a sense that a collapse in US consumption could potentially occur and that the economy could go into recession. The level of tariffs will probably be higher at the end of the year than when we started. However, the increase in tariffs could be absorbed by most companies, as their margins are still comfortable on average. We have margins of 13% in the United States and corporate balance sheets are strong. Companies that have survived the Covid pandemic know how to deal with this kind of situation. They know how to act quickly. And that is very important.

As for the recovery phase that occurred in the markets between mid-April and mid-May, it is interesting to note that there were plenty of surprises. However, the initial shock was severe – and now the markets seem to be getting used to the idea that they must expect the unexpected. ‘Over the past 3 months, more than 30 companies have announced plans to reinvest in the US, for a total of nearly $2trn.’

These 30 large companies are active in many different sectors, including healthcare and technology, and include both American and non-American companies. Donald Trump's negotiations on customs duties have had at least this one positive effect: companies are investing in the United States. Some of these companies are talking about a supply chain in which medicines for sale in the United States will be manufactured in the United States. The approach to the subject is different from what it was before. Previously, some pharmaceutical companies, for example, produced a huge amount of medicines abroad and then sent them back to the United States.

Investors are selling US equities and buying European or global equities – at J.P. Morgan Asset Management, we are seeing that our clients continue to buy US equities. We have recorded £26bn in net inflows into our US equity portfolio since the beginning of the year up to last week, i.e. between the start of 2025 and mid-May. We have also recorded positive net inflows into our US equity portfolio over the last three years. This sets us apart from many of our peers. J.P. Morgan Asset Management clients are therefore buying US equities.

In addition, companies continue to announce major investments in the US. And this is something that will pay dividends for years to come. So this is not a one-off effect. If the factory is built, there will then be workers and money circulating in the local economy. Instead of being spent somewhere in Europe, that money will be spent in the United States. This will have a multiplier effect. Not everything is rosy at the moment, but the situation is not as negative as we sometimes hear. I think that right now and in the long term, US corporate earnings growth will continue to outpace that of European companies and emerging markets. US corporate earnings exceed those of other markets.

Companies could also benefit from tax deductions for production and investment in the US. The administration is talking about reducing corporate tax, but mainly for companies that invest and manufacture in the United States. So, first there would be the impact of manufacturing in the United States. Then, once companies have started more activities, their profits will be taxed less in a second phase. The S&P 500 is expected to increase by 6 to 7% per year, not 20% or more.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.