Black Monday 5 Aug (Vix at 65, Nikkei -13%, SP and Nasdaq at -3%), Thursday 8 Aug SP posted its best day since Nov 2022

WEEKLY TRENDS

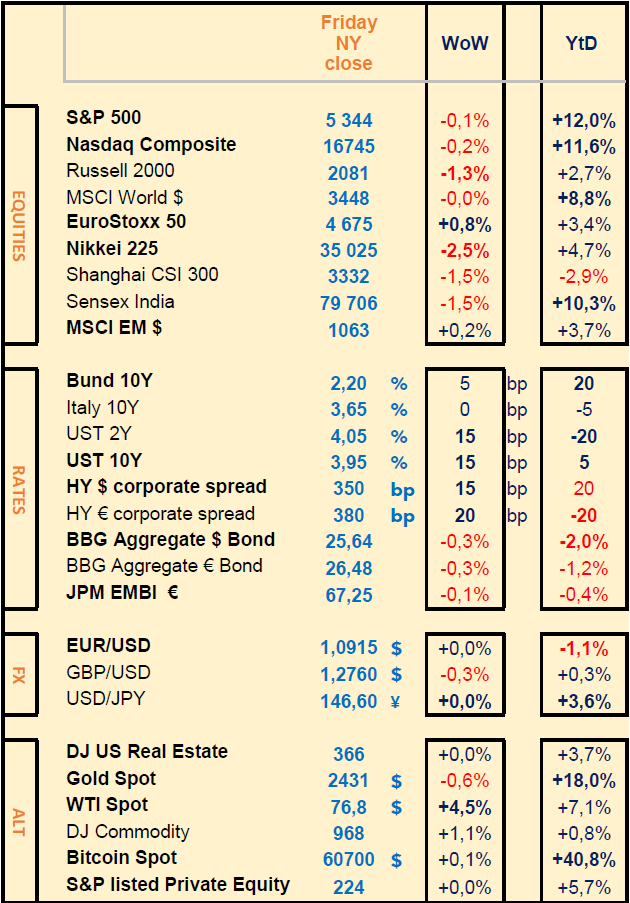

·The stock market had another Black Monday last week, amplified as usual in such situations by Margin Calls. FX, Gold and Stocks are always the most impacted as representing the most liquidity and the most invested)

·The major stock indices closed the week modestly lower after recovering on Thursday from the biggest sell-off in 2 years. The S&P was down 10% from its peak, the Nasdaq was down 16% from its All Time High, the Vix (Stocks Volatility Index) briefly touched 65.7 before closing the week at 20

·JPY carry trades are to be blamed for the moment as well as subsequent Margin Calls (JPM said 75% of all carry trades were now unwound)

WEEKLY TRENDS

·The stock market had another Black Monday last week, amplified as usual in such situations by Margin Calls. FX, Gold and Stocks are always the most impacted as representing the most liquidity and the most invested)

·The major stock indices closed the week modestly lower after recovering on Thursday from the biggest sell-off in 2 years. The S&P was down 10% from its peak, the Nasdaq was down 16% from its All Time High, the Vix (Stocks Volatility Index) briefly touched 65.7 before closing the week at 20

·JPY carry trades are to be blamed for the moment as well as subsequent Margin Calls (JPM said 75% of all carry trades were now unwound)

MARKETS

Equities

US Q2 earnings are up 12% YoY vs consensus of 9%.

SP500 down 10% from its peak, Nasdaq down 16% from its peak.

Q2 earnings releases (stock WoW performance):

+++ Palantir (+21%) Galderma (+14%) Uber (+25%) Eli Lilly (+18%) Costco (+7%) Novo Nordisk (+9%) TSMC (+10%)

- - - Puma (-20%) Super Micro Computer (-19%) Commerzbank (-10% due to higher risk provisions) Airbnb (-7%)

M&A: L’Oreal bought 10% of the Swiss Galderma (for CHF 1.6bn)

Export to China : ASML (+6%) could be exempted from US restrictions

Rates

2 year US Treasury yield increased slightly by 15bps WoW

Inversion of the US curve, 2yr/10yr inversion was flat at 10bps

US

July ISM Services (51.4) meant less possibility of a US hard landing

China

July Caixin PMI (general Manufacturing slipped to 49.8 from 51.8 in June)

Japan

Last Monday was the worst day for the Nikkei since the 1987 Black Monday crash (NB in 1990 the Nikkei lost 21% in Feb/Mar, in 2008 it lost 23% Sep/Oct, in 2013 it lost 21% May/Jun, in 2020 it lost 23% Feb/Mar

Commodities

WTI up 4.5% last week, Gold was slightly impacted by somewhat higher US bond yields

Copper continued to lose ground (-20% since its peak in May) same trend for Aluminium and Zinc, following the weak Caixin PMI Manufacturing,

Nota Bene

Warren Buffet now has 25% invested in cash equivalent ($235bn in US TBills $42bn in cash) the Fed has $195bn TBills on its Balance Sheet

Vix (Stocks volatility index) hit 65 last Monday, a record since1990

HY corporate spreads are up 15-20bps

CALENDAR

·Corporate Q2 earnings : in the US Cisco (14 Aug) in Hong Kong Tencent (14 Aug)

·Data releases : US July CPI (14Aug) Retail Sales and Ind. Production (15 Aug) China July Retail Sales and Ind. Production (15 Aug)

WHAT ANALYSTS SAY

·Rockefeller Global family Office - Flash market update, global margin calls, unwinding the yen carry trades

·BlackRock - Comments on recent market volatility

Rockefeller, 5 August 2024 - Global margin calls, unwinding the yen carry trades

Authors: Jimmy C. Chang, CFA

At the market close on Friday, August 2, the S&P 500 Index was off 5.7% from its all-time-high of 5,667 reached on July 16. There were some debates on whether the Fed should have started cutting the fed funds rate at the July FOMC (Federal Open Markets Committee) meeting, and if the next move should be a 50-bp reduction. The consensus was still expecting an economic soft-landing, and the big question going into the weekend was whom Vice President Kamala Harris would pick as her running mate.

Sentiments took a sharp turn for the worse on Sunday evening when the Nikkei 225 Index opened down 6%. By the end of the trading session on Monday morning Eastern Daylight Time, the Nikkei 225 Index had plunged 12.4% for its worst day since the Black Monday crash of 1987. The yen appreciated to 143.8 yen/dollar, up 2.2% for the session and 12.8% since hitting a 38-year low versus the U.S. dollar (161.7 yen/dollar) on July 3. These violent movements in Japan started a contagion across global markets and sent the CBOE Volatility Index (VIX), a measure of the S&P 500 Index’s implied volatility, to as high as 65.7 - an elevated level last seen in March 2020 when markets were hit due to a global pandemic.

As usual, when the market runs into a crisis – real or imagined – many market pundits’ first reactions were to ask the Fed for a bailout. Wharton Professor Jeremey Siegel was featured on TV calling for an emergency 75-bp cut in the fed funds rate followed by another 75-bp cut at the September FOMC meeting. At the time of this writing, the market has priced in nearly five 25-bp rate cuts by year-end 2024.

Investor sentiment began to stabilize following the release of the ISM Services data at 10 am – the 51.4 headline reading showed that the services economy was still in expansion, as were the Employment (51.1) and New Orders (52.4) components. However, the Prices Paid component also moved higher sequentially from 55.1 to 57.0, signalling that the Fed still needs to be on guard with inflation.

I have the following observations and thoughts:

· The sharp equity sell-offs across the globe appear to be more technically driven. It has a lot to do with the unwinding of the yen carry trades where investors borrowed Japanese yen at much lower interest rates and converted the proceeds to higher yielding currencies (e.g., the U.S. dollar) to invest in stocks, bonds, or even cryptocurrencies. Up until a few weeks ago, the yen’s persistent devaluation versus the dollar and Big Tech stocks’ strong performance had made the yen carry trades for tech stocks immensely popular and profitable. However, as the yen started to appreciate due to expectations of more aggressive rate cuts in the U.S., it became more expensive to repay the loans, and some investors started to close out their carry trades – sell tech positions and convert the proceeds back to yen to repay the loan. As the unwinding of the carry trades gathered momentum, it put more downward price pressure on tech stocks and pushed the yen even higher.

I do not expect the Fed to implement an emergency rate cut as it would send a message of panic and potentially do more harm than good. An emergency rate cut in the face of less than a 10% drawdown in the S&P 500 Index would also create more moral hazard and damage the Fed’s credibility. The weakening U.S. dollar and rapidly falling Treasury yields are also de facto easing for the economy.

· The U.S. economy is slowing as intended by the Fed to dampen inflation. While rising unemployment rates have started to flash warnings of an incipient recession, economic data overall are calling for measured rather than aggressive easing. The Fed also would like to avoid appearing political with aggressive easing ahead of the general election.

· The current pullback in equities is nothing unusual given the market’s historical volatility. According to my colleague Doug Moglia’s work, since 1970, the maximum intra-year drawdown averaged 14% and has a median of 10.5%. More than half of this 55-year period had intra-year pullbacks of greater than 10%.

· Given that we have entered the seasonally weaker period of the year in the face of elevated political, geopolitical, and policy uncertainties, the market’s corrective phase may not yet be over. Technically speaking, the S&P 500 Index should have more support at its rising 200-day moving average, which is currently at 5,012. Based on the Street’s $243 projected earnings per share for 2024, the implied price-to-earnings ratio at 5,012 would be 20.6 times, which is high but not stretched.

· In the final analysis, with equity valuations at the index level remaining elevated, the market pullback does not necessarily mean a compelling buying opportunity, although it may be true with some stock-specific ideas. In a fully invested portfolio, staying put during periods of heightened volatility such as today may be the prudent thing to do. Remember the adage, “Don’t try to catch a falling knife".

BlackRock, 5 August 2024 - Comments on recent market volatility

Authors: EMEA investment strategy

We think that the market has overreacted to a small number of weaker-than-expected data releases and some idiosyncratic earnings headlines over the past week. We advocate staying invested throughout this period of market volatility, leaning into portfolio diversifiers and quality equities.

Fundamentally, we’ve seen a handful of weaker-than-expected data points, not a drastic change to the macro outlook, in our view. While markets are now pricing in five US Federal Reserve (Fed) rate cuts by year-end, we stick to the view that the bank will cut by 25bps in September, absent an outsized macro shock in the meantime.

While some have drawn comparison to 2001, when the Fed cut rates intra-meeting and tech stocks had benefited from a strong run of positive sentiment, this is not 2001. While that rate cutting cycle began with a 50bp inter-meeting move, it came at a time when rates were in more restrictive territory (6.5%), non-farm payrolls (NFPs) tilted into negative territory, and energy prices were high. Today, we have growth data pointing to stagnation rather than contraction (in fact, Q2 GDP surprised to the upside) and energy prices are under control. Consumer confidence is low, which has been a characteristic of the Q2 earnings season, but spending data remains relatively resilient and is simply normalising from post-Covid trends, in our view.

Fundamentals (earnings) remain solid. US equities have exited their earnings recession and at this stage of the Q2 reporting season are posting double-digit EPS growth (12%), led by healthcare (29%) and tech (20%).The European earnings picture is a little more mixed but is nonetheless on an improving trajectory: EPS growth for the eurozone is at -3% so far this season, with around half of sectors posting positive growth, including real estate, materials, healthcare and financials. We have been of the view that as fundamentals improve and more sectors post positive earnings, there is a greater role for earnings to play in returns – and a case for market breadth to increase, rather than seeing a rotation out of tech/AI.

The tech rally has been underpinned by improving earnings, so we don’t see this as a bubble.

The lead up to the tech bubble at the turn of the millennium saw valuations increase by 300% from 1995 to 2000, while earnings per share rose 110% over the same period. This time around, the mix between valuations and earnings increases has been much more proportional: the former is up 53%, while the latter has risen 35% since the trough at the end of 2022. Overall, the more balanced move in both earnings and valuations suggests that we’re not in the same scenario as the dot-com crash. We expect investors will remain laser-focused on profitability. One of the key concerns this earnings season has been the potential for unprofitable capex spending – in our view, it is likely too early to make a judgement on this, however, continued profitability and high-quality business models within the sector remain attractive.

Japanese equities have borne the brunt of negative sentiment in Asia, bringing valuations down to more attractive levels.

The P/E ratio for Japanese equities is lower than the low reached in October 2023 and on par with the level when the TSE requested improvements to P/B ratios (one of the structural tailwinds that has contributed to positive sentiment towards Japanese equities over the past year). In our view, the fundamental case remains unchanged, with robust earnings in the latest reporting season and corporate reforms starting to come through.

For tactical trade ideas, we lean into ETF implementation, while keeping our quality focus through high-conviction alpha for core allocations.

We stay invested through this period of market volatility across fixed income and equities.

We maintain our conviction in developed market (DM) stocks:

combining the macro and the micro, rate cuts materialising and improvement in earnings keeps us focused on developed markets over emerging markets.

We lean into quality in equities.

Quality sectors have been over-punished in the past week, in our view, given that fundamentals remain strong. We focus on margin resilience and profitability and continue to like the tech and healthcare sectors as expressions of this quality view.

In fixed income, we are still more comfortable taking duration risk in Europe than the US, and in the UK – where market pricing of rate cuts (two more from the Bank of England by year-end) looks more realistic.

We see targeted duration views – the moves in US rates have been excessive, in our view, pricing in a more aggressive slowdown, and we therefore expect to see US and broader DM yields recover. Markets are pricing in three rate cuts by the European Central Bank (ECB) by year-end, versus our base case of two, but this pricing looks more fair than the US.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

US Q2 earnings are up 12% YoY vs consensus of 9%.

SP500 down 10% from its peak, Nasdaq down 16% from its peak.

Q2 earnings releases (stock WoW performance):

+++ Palantir (+21%) Galderma (+14%) Uber (+25%) Eli Lilly (+18%) Costco (+7%) Novo Nordisk (+9%) TSMC (+10%)

- - - Puma (-20%) Super Micro Computer (-19%) Commerzbank (-10% due to higher risk provisions) Airbnb (-7%)

M&A: L’Oreal bought 10% of the Swiss Galderma (for CHF 1.6bn)

Export to China : ASML (+6%) could be exempted from US restrictions

Rates

2 year US Treasury yield increased slightly by 15bps WoW

Inversion of the US curve, 2yr/10yr inversion was flat at 10bps

US

July ISM Services (51.4) meant less possibility of a US hard landing

China

July Caixin PMI (general Manufacturing slipped to 49.8 from 51.8 in June)

Japan

Last Monday was the worst day for the Nikkei since the 1987 Black Monday crash (NB in 1990 the Nikkei lost 21% in Feb/Mar, in 2008 it lost 23% Sep/Oct, in 2013 it lost 21% May/Jun, in 2020 it lost 23% Feb/Mar

Commodities

WTI up 4.5% last week, Gold was slightly impacted by somewhat higher US bond yields

Copper continued to lose ground (-20% since its peak in May) same trend for Aluminium and Zinc, following the weak Caixin PMI Manufacturing,

Nota Bene

Warren Buffet now has 25% invested in cash equivalent ($235bn in US TBills $42bn in cash) the Fed has $195bn TBills on its Balance Sheet

Vix (Stocks volatility index) hit 65 last Monday, a record since1990

HY corporate spreads are up 15-20bps

CALENDAR

·Corporate Q2 earnings : in the US Cisco (14 Aug) in Hong Kong Tencent (14 Aug)

·Data releases : US July CPI (14Aug) Retail Sales and Ind. Production (15 Aug) China July Retail Sales and Ind. Production (15 Aug)

WHAT ANALYSTS SAY

·Rockefeller Global family Office - Flash market update, global margin calls, unwinding the yen carry trades

·BlackRock - Comments on recent market volatility

Rockefeller, 5 August 2024 - Global margin calls, unwinding the yen carry trades

Authors: Jimmy C. Chang, CFA

At the market close on Friday, August 2, the S&P 500 Index was off 5.7% from its all-time-high of 5,667 reached on July 16. There were some debates on whether the Fed should have started cutting the fed funds rate at the July FOMC (Federal Open Markets Committee) meeting, and if the next move should be a 50-bp reduction. The consensus was still expecting an economic soft-landing, and the big question going into the weekend was whom Vice President Kamala Harris would pick as her running mate.

Sentiments took a sharp turn for the worse on Sunday evening when the Nikkei 225 Index opened down 6%. By the end of the trading session on Monday morning Eastern Daylight Time, the Nikkei 225 Index had plunged 12.4% for its worst day since the Black Monday crash of 1987. The yen appreciated to 143.8 yen/dollar, up 2.2% for the session and 12.8% since hitting a 38-year low versus the U.S. dollar (161.7 yen/dollar) on July 3. These violent movements in Japan started a contagion across global markets and sent the CBOE Volatility Index (VIX), a measure of the S&P 500 Index’s implied volatility, to as high as 65.7 - an elevated level last seen in March 2020 when markets were hit due to a global pandemic.

As usual, when the market runs into a crisis – real or imagined – many market pundits’ first reactions were to ask the Fed for a bailout. Wharton Professor Jeremey Siegel was featured on TV calling for an emergency 75-bp cut in the fed funds rate followed by another 75-bp cut at the September FOMC meeting. At the time of this writing, the market has priced in nearly five 25-bp rate cuts by year-end 2024.

Investor sentiment began to stabilize following the release of the ISM Services data at 10 am – the 51.4 headline reading showed that the services economy was still in expansion, as were the Employment (51.1) and New Orders (52.4) components. However, the Prices Paid component also moved higher sequentially from 55.1 to 57.0, signalling that the Fed still needs to be on guard with inflation.

I have the following observations and thoughts:

· The sharp equity sell-offs across the globe appear to be more technically driven. It has a lot to do with the unwinding of the yen carry trades where investors borrowed Japanese yen at much lower interest rates and converted the proceeds to higher yielding currencies (e.g., the U.S. dollar) to invest in stocks, bonds, or even cryptocurrencies. Up until a few weeks ago, the yen’s persistent devaluation versus the dollar and Big Tech stocks’ strong performance had made the yen carry trades for tech stocks immensely popular and profitable. However, as the yen started to appreciate due to expectations of more aggressive rate cuts in the U.S., it became more expensive to repay the loans, and some investors started to close out their carry trades – sell tech positions and convert the proceeds back to yen to repay the loan. As the unwinding of the carry trades gathered momentum, it put more downward price pressure on tech stocks and pushed the yen even higher.

I do not expect the Fed to implement an emergency rate cut as it would send a message of panic and potentially do more harm than good. An emergency rate cut in the face of less than a 10% drawdown in the S&P 500 Index would also create more moral hazard and damage the Fed’s credibility. The weakening U.S. dollar and rapidly falling Treasury yields are also de facto easing for the economy.

· The U.S. economy is slowing as intended by the Fed to dampen inflation. While rising unemployment rates have started to flash warnings of an incipient recession, economic data overall are calling for measured rather than aggressive easing. The Fed also would like to avoid appearing political with aggressive easing ahead of the general election.

· The current pullback in equities is nothing unusual given the market’s historical volatility. According to my colleague Doug Moglia’s work, since 1970, the maximum intra-year drawdown averaged 14% and has a median of 10.5%. More than half of this 55-year period had intra-year pullbacks of greater than 10%.

· Given that we have entered the seasonally weaker period of the year in the face of elevated political, geopolitical, and policy uncertainties, the market’s corrective phase may not yet be over. Technically speaking, the S&P 500 Index should have more support at its rising 200-day moving average, which is currently at 5,012. Based on the Street’s $243 projected earnings per share for 2024, the implied price-to-earnings ratio at 5,012 would be 20.6 times, which is high but not stretched.

· In the final analysis, with equity valuations at the index level remaining elevated, the market pullback does not necessarily mean a compelling buying opportunity, although it may be true with some stock-specific ideas. In a fully invested portfolio, staying put during periods of heightened volatility such as today may be the prudent thing to do. Remember the adage, “Don’t try to catch a falling knife".

BlackRock, 5 August 2024 - Comments on recent market volatility

Authors: EMEA investment strategy

We think that the market has overreacted to a small number of weaker-than-expected data releases and some idiosyncratic earnings headlines over the past week. We advocate staying invested throughout this period of market volatility, leaning into portfolio diversifiers and quality equities.

Fundamentally, we’ve seen a handful of weaker-than-expected data points, not a drastic change to the macro outlook, in our view. While markets are now pricing in five US Federal Reserve (Fed) rate cuts by year-end, we stick to the view that the bank will cut by 25bps in September, absent an outsized macro shock in the meantime.

While some have drawn comparison to 2001, when the Fed cut rates intra-meeting and tech stocks had benefited from a strong run of positive sentiment, this is not 2001. While that rate cutting cycle began with a 50bp inter-meeting move, it came at a time when rates were in more restrictive territory (6.5%), non-farm payrolls (NFPs) tilted into negative territory, and energy prices were high. Today, we have growth data pointing to stagnation rather than contraction (in fact, Q2 GDP surprised to the upside) and energy prices are under control. Consumer confidence is low, which has been a characteristic of the Q2 earnings season, but spending data remains relatively resilient and is simply normalising from post-Covid trends, in our view.

Fundamentals (earnings) remain solid. US equities have exited their earnings recession and at this stage of the Q2 reporting season are posting double-digit EPS growth (12%), led by healthcare (29%) and tech (20%).The European earnings picture is a little more mixed but is nonetheless on an improving trajectory: EPS growth for the eurozone is at -3% so far this season, with around half of sectors posting positive growth, including real estate, materials, healthcare and financials. We have been of the view that as fundamentals improve and more sectors post positive earnings, there is a greater role for earnings to play in returns – and a case for market breadth to increase, rather than seeing a rotation out of tech/AI.

The tech rally has been underpinned by improving earnings, so we don’t see this as a bubble.

The lead up to the tech bubble at the turn of the millennium saw valuations increase by 300% from 1995 to 2000, while earnings per share rose 110% over the same period. This time around, the mix between valuations and earnings increases has been much more proportional: the former is up 53%, while the latter has risen 35% since the trough at the end of 2022. Overall, the more balanced move in both earnings and valuations suggests that we’re not in the same scenario as the dot-com crash. We expect investors will remain laser-focused on profitability. One of the key concerns this earnings season has been the potential for unprofitable capex spending – in our view, it is likely too early to make a judgement on this, however, continued profitability and high-quality business models within the sector remain attractive.

Japanese equities have borne the brunt of negative sentiment in Asia, bringing valuations down to more attractive levels.

The P/E ratio for Japanese equities is lower than the low reached in October 2023 and on par with the level when the TSE requested improvements to P/B ratios (one of the structural tailwinds that has contributed to positive sentiment towards Japanese equities over the past year). In our view, the fundamental case remains unchanged, with robust earnings in the latest reporting season and corporate reforms starting to come through.

For tactical trade ideas, we lean into ETF implementation, while keeping our quality focus through high-conviction alpha for core allocations.

We stay invested through this period of market volatility across fixed income and equities.

We maintain our conviction in developed market (DM) stocks:

combining the macro and the micro, rate cuts materialising and improvement in earnings keeps us focused on developed markets over emerging markets.

We lean into quality in equities.

Quality sectors have been over-punished in the past week, in our view, given that fundamentals remain strong. We focus on margin resilience and profitability and continue to like the tech and healthcare sectors as expressions of this quality view.

In fixed income, we are still more comfortable taking duration risk in Europe than the US, and in the UK – where market pricing of rate cuts (two more from the Bank of England by year-end) looks more realistic.

We see targeted duration views – the moves in US rates have been excessive, in our view, pricing in a more aggressive slowdown, and we therefore expect to see US and broader DM yields recover. Markets are pricing in three rate cuts by the European Central Bank (ECB) by year-end, versus our base case of two, but this pricing looks more fair than the US.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.