Central Banks cutting rates, US CPI Nov released higher, Bond yields up across the board, M&A keeps thriving

WEEKLY TRENDS

WEEKLY TRENDS

- December is the month of central banks decisions. Last week we had the Bank of Canada and the SNB with -50bps each, followed by the ECB with -25bps while Australia remained on hold with a February cut likely

- US CPI for Nov was released up slightly at 2.7% vs 2.6% prior and proved that the 2% target will remain challenging to achieve

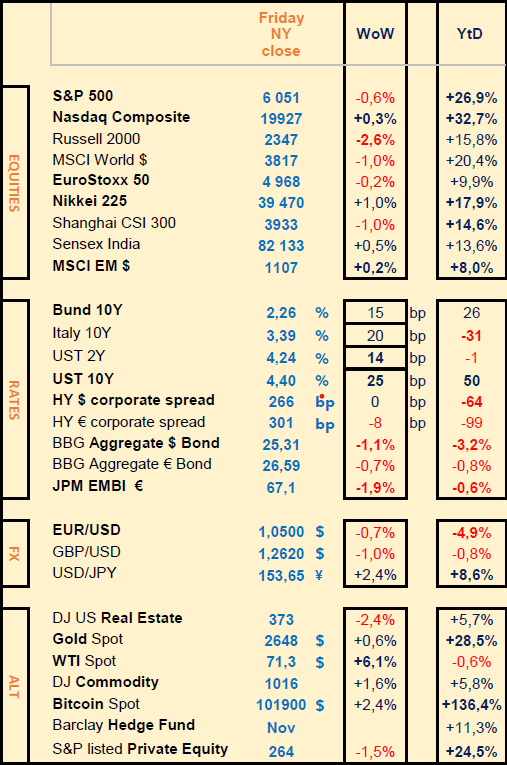

- Bond yields were up 15 to 20bps across the board. US Treasuries yield inversion is back up at +10bps. USD is stronger with resurgent UST yields. SME stocks continue to weaken (Russell 2000 at -2.5% last week, after -1.1% the previous week) while M&A is back in force

- The ‘Trump trade’ remains well in favour with Tesla being the clear winner (+75% since Trump elections and +12% last week), Amazon (+15%), Apple and Alphabet (+11%), Meta and Microsoft (+9%)

- Next week the FOMC will decide on the FED funds rate, most likely to have it reduced by -25bps

MARKETS

Equities

Q3 earnings releases last week (stock WoW performance) :

+++ Broadcom (+25%), German Ciena (+22%), UK Currys (+15%)

- - - Oracle (-11%), Adobe (-15%), Costco (-1%), Charles Schwab (-4%)

M&A:

CompuGroup (+30%) CVC bids 22 € per share; FirstGroup (+8%) acquired RATP Dev Trans London; Corp Fin Alba (+74%) the March family buys back all shares at an 80% premium

Rates

US curve (2-10 years) steepening increased by 5bps to 10bps. Bond yields increased across the board, HY corporate spread remained flat in USD. All eyes on the FED decision next week, expectations at large are for a -25bp cut.

CB rate decisions

Bank of Canada and SNB reduced their rates by -50bps, the ECB reduced its rate by -25bps and the Reserve Bank of Australia stayed put

Commodities

Oil price largely increased (due to potential new US sanctions against Russia while China eases monetary policy stance, first time since 2011)

Gold price slightly higher (+0.5%) despite higher US Treasuries yields

US

CPI in Nov slightly increased to 2.7% vs 2.6% prior (Core is at 3.3%) reminding the markets that the 2% target will remain tough to reach

Crypto

BTC stays well above the $100k mark. Trump confirmed reserve plans (acquiring 1m BTC over 5 years). Microsoft shareholders rejected a proposal to invest in BTC while MicroStrategy continued its large purchases

Nota Bene

Moody’s downgraded France credit rating unexpectedly in its timing on Friday just after new PM was named. Downgraded by one notch from Aa2 to Aa3 and outlook reduced from stable to negative, the agency is anticipating a debt to gdp ratio at 120% in 2027.

CALENDAR

WHAT ANALYSTS SAY

CA Indosuez Wealth Management, 10 Dec 2024 - Gold market structure & trends

Authors: Jerome Van der Bruggen, CIO PB, Degroof Petercam

RATE CUTS COULD BE DELAYED BUT ARE UNLIKELY TO BE STOPPED

Given that the Fed continues to aim for a 2% inflation rate, it means that a terminal rate of 3.5% would neither be accommodative nor restrictive. Meanwhile, the US is projected to achieve a soft landing, with growth normalising around 2%. With growth that is still robust and further loosening in sight, the backdrop for equities remains positive. The bond market, which was again affected by inflation and global growth upward repricing in 2024, may regain interest in 2025 but benefiting more shorter to intermediate bonds as opposed to long-dated bonds, which remain vulnerable to concerns about term premia and public debt sustainability.

US EXCEPTIONALISM PREVAILS

while the dollar’s dominance is being challenged by the emerging countries' desire to reduce their reliance on the currency, fears of “de-dollarisation” appear overstated. A final element helping to explain US exceptionalism is the strategic policymaking of US institutions that have implemented bold measures such as the 2017 Tax Cuts and Jobs Act (TCJA) or the 2022 CHIPS and Science Act. All this has helped US companies to show superior earnings growth compared to their global counterparts and underpinned the performance of the US stock market and the rising weight of US equites in global portfolios.

AI AND ELECTRIFICATION: TWO LONG LASTING THEMES

AI, despite high developing costs and increasing demand for energy, is set to drive productivity growth like past technological revolutions did in the past. Areas like generative AI, which creates new content from existing data, hold vast economic potential. By 2050, electricity output is expected to more than double and become greener, with 70% from non-fossil sources, up from 11% today. The sectors that will likely benefit from investments include renewable energy, energy storage, grid transformation, and electric vehicles.

AS CHINA REFORMS, ASEAN EMERGES

The shift in supply chains, spurred by US-China trade tensions, benefits ASEAN, which is also experiencing robust demographic growth, increased foreign direct investment (FDI), and market-friendly reforms. ASEAN’s dynamic economies are poised to continue driving global growth. We remain positive on a selection of EM equities, especially in Asia where growth potential is supported by an ongoing monetary easing cycle and the prospect of a Chinese stimulus that could act as a regional catalyst.

MULTI-ASSET PORTFOLIOS: THE BEST OF BOTH WORLDS

The goal of this approach is to provide capital appreciation by investing in a broad range of financial instruments, relying on the risk premium inherent to all asset classes. So, these portfolios are constructed to provide several attractive features that enable investors to see through the volatility of financial markets. They are balanced and designed to optimise returns relative to the risk taken. They are highly diversified both geographically and by sector, and include foreign currencies and commodities, like gold.

BlackRock, 10 Dec 2024 - Global Outlook 2025, building the transformation

Authors: Jean Boivin, Head of BlackRock Investment Institute ; Wei Lin, Global Chief of the BlackRock Investment Institute

· Financing the future

Sizeable capital will be needed as the transformation unfolds and that investment is happening now. We think private markets will play a vital rôle in financing the waves of transformation

· Rethinking investing

We think investors should focus more on themes and less on broad asset classes. Greater volatility points to a need to be more dynamic with portfolio allocations.

· Staying pro-risk

We have more conviction in U.S. equities outperforming their international peers. We recognize valuations are rich in U.S. equities but don’t see them as a near-term market driver.

· Tracking AI’s evolution

The AI theme has broadened out from our original concentrated AI scenario. We see private markets as key — not just in funding infrastructure but also in capturing potential future AI winners.

· Infrastructure for the long term

We favor infrastructure equity on a strategic horizon of five years and longer as a potential beneficiary of mega forces. Private markets can help bridge the gap between needed infrastructure and what governments and banks can finance alone.

· Intensifying fragmentation

We think a second Trump administration could reinforce geopolitical fragmentation and economic competition. Energy and low-carbon technology is now a key front in this competition and is shaking up companies globally.

· New diversifiers needed

We see the potential for assets like bitcoin to provide distinct sources of risk and return. With traditional diversifiers like bonds no longer working as before, investors have more reasons to be dynamic with portfolios.

Big calls

Tactical: US equities (bif tech backed by strong earnings) ; Japanese equities (stronger yen is at risk) ; selective fixed income (underweight long dated US Treasuries, overweight UK Gilts)

Strategic: Infrastructure equity and private credit (as banks retreat); fixed income granularity (short and medium term IG); equity granularity (EM like India and Saudia Arabia; Developed Markets like Japan)

World Gold Council, 13 Dec 2024 - Gold Outlook 2025

Authors: Jeremy De Pessemier, CFA, Asset Allocation Strategist; Johan Palmberg, Senior Quantitative Analyst

Our analysis is based on

Economic expansion (and its direct effect on consumer demand)

Risk and uncertainty (as a trigger for flows from investors looking for effective hedges)

Opportunity cost (making gold more or less attractive relative to bond yields)

Momentum (which can boost trends or, equally, mean-revert them)

2025: a tale of two halves?

Our analysis suggests that, if the economy were to perform according to consensus in 2025, gold may continue to trade in a similar range to that seen in the last part of the year, with the potential for some upside.

Risk-on/risk-off

A more business-friendly fiscal policy combined with an America-first agenda is likely to improve sentiment among domestic investors and consumers. This will likely favour risk-on trades in the first few months of the year. The question, however, is whether these policies will also result in inflationary pressures and disruptions to supply chains. In addition, concerns about European sovereign debt are once again mounting, not to mention continued geopolitical instability, particularly in light of the events in South Korea and Syria in early December. In all, this could prompt investors to look for hedges, such as gold, to counter risk.

The Fed on a tightrope

There are many reasons why inflation can rebound, but the economy is still not strong and a reversal in policy could deteriorate credit conditions. If the Global Financial Crisis taught us anything, it is that when issues in the system start to unravel, they unravel fast! Historically, gold has risen by an average of 6% in the first six months of a rate cut cycle. Its subsequent performance has been influenced by the length and depth of that cycle. Overall, a more dovish Fed will be beneficial for gold, but a prolonged pause or policy reversal would likely put further pressure on investment demand.

Can Asia demand continue?

This year, Asian investors added to gold’s performance, particularly during the first half, and Indian demand benefitted from the reduction in import duty in the second half. However, the risk of trade wars looms large. Chinese consumer demand will likely depend on the health of economic growth – whether through normal means or government stimuli. And while the same factors that influenced investment demand in 2024 are still present, gold may face competition from stocks and real estate. India seems to stand on a better footing. Economic growth remains above 6.5%, and any tariff increase will affect it less than other US trading partners given a much smaller trade deficit. This, in turn, could support gold consumer demand. At the same time, gold financial investment products have seen remarkable growth and while they make up a small portion of the overall market, they have been a welcome addition to gold’s ecosystem.

Central banks as buyers

Central bank buying is policy driven and thus difficult to forecast, but our surveys and analysis suggest that the current trend will remain in place. In our view, demand in excess of 500 tonnes (the approximate long-term trend) should still have a net positive effect on performance. And we believe central bank demand in 2025 will surpass that. But a deceleration below that level could bring additional pressures to gold.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Q3 earnings releases last week (stock WoW performance) :

+++ Broadcom (+25%), German Ciena (+22%), UK Currys (+15%)

- - - Oracle (-11%), Adobe (-15%), Costco (-1%), Charles Schwab (-4%)

M&A:

CompuGroup (+30%) CVC bids 22 € per share; FirstGroup (+8%) acquired RATP Dev Trans London; Corp Fin Alba (+74%) the March family buys back all shares at an 80% premium

Rates

US curve (2-10 years) steepening increased by 5bps to 10bps. Bond yields increased across the board, HY corporate spread remained flat in USD. All eyes on the FED decision next week, expectations at large are for a -25bp cut.

CB rate decisions

Bank of Canada and SNB reduced their rates by -50bps, the ECB reduced its rate by -25bps and the Reserve Bank of Australia stayed put

Commodities

Oil price largely increased (due to potential new US sanctions against Russia while China eases monetary policy stance, first time since 2011)

Gold price slightly higher (+0.5%) despite higher US Treasuries yields

US

CPI in Nov slightly increased to 2.7% vs 2.6% prior (Core is at 3.3%) reminding the markets that the 2% target will remain tough to reach

Crypto

BTC stays well above the $100k mark. Trump confirmed reserve plans (acquiring 1m BTC over 5 years). Microsoft shareholders rejected a proposal to invest in BTC while MicroStrategy continued its large purchases

Nota Bene

Moody’s downgraded France credit rating unexpectedly in its timing on Friday just after new PM was named. Downgraded by one notch from Aa2 to Aa3 and outlook reduced from stable to negative, the agency is anticipating a debt to gdp ratio at 120% in 2027.

CALENDAR

- Corporate earnings: US Micron , Lennar (18 Dec), Accenture, Fedex, Nike (19 Dec) Others: H&M (16 Dec)

- Rate decisions: FOMC/FED (18 Dec), Bank of Japan and RPC/Bank of England (19 Dec)

WHAT ANALYSTS SAY

- CA Indosuez Wealth Management - Global Outlook 2025, five key investment strategy messages

- BlackRock - 2025 Global Outlook, Building the transformation

- World Gold Council - Gold Outlook 2025

CA Indosuez Wealth Management, 10 Dec 2024 - Gold market structure & trends

Authors: Jerome Van der Bruggen, CIO PB, Degroof Petercam

RATE CUTS COULD BE DELAYED BUT ARE UNLIKELY TO BE STOPPED

Given that the Fed continues to aim for a 2% inflation rate, it means that a terminal rate of 3.5% would neither be accommodative nor restrictive. Meanwhile, the US is projected to achieve a soft landing, with growth normalising around 2%. With growth that is still robust and further loosening in sight, the backdrop for equities remains positive. The bond market, which was again affected by inflation and global growth upward repricing in 2024, may regain interest in 2025 but benefiting more shorter to intermediate bonds as opposed to long-dated bonds, which remain vulnerable to concerns about term premia and public debt sustainability.

US EXCEPTIONALISM PREVAILS

while the dollar’s dominance is being challenged by the emerging countries' desire to reduce their reliance on the currency, fears of “de-dollarisation” appear overstated. A final element helping to explain US exceptionalism is the strategic policymaking of US institutions that have implemented bold measures such as the 2017 Tax Cuts and Jobs Act (TCJA) or the 2022 CHIPS and Science Act. All this has helped US companies to show superior earnings growth compared to their global counterparts and underpinned the performance of the US stock market and the rising weight of US equites in global portfolios.

AI AND ELECTRIFICATION: TWO LONG LASTING THEMES

AI, despite high developing costs and increasing demand for energy, is set to drive productivity growth like past technological revolutions did in the past. Areas like generative AI, which creates new content from existing data, hold vast economic potential. By 2050, electricity output is expected to more than double and become greener, with 70% from non-fossil sources, up from 11% today. The sectors that will likely benefit from investments include renewable energy, energy storage, grid transformation, and electric vehicles.

AS CHINA REFORMS, ASEAN EMERGES

The shift in supply chains, spurred by US-China trade tensions, benefits ASEAN, which is also experiencing robust demographic growth, increased foreign direct investment (FDI), and market-friendly reforms. ASEAN’s dynamic economies are poised to continue driving global growth. We remain positive on a selection of EM equities, especially in Asia where growth potential is supported by an ongoing monetary easing cycle and the prospect of a Chinese stimulus that could act as a regional catalyst.

MULTI-ASSET PORTFOLIOS: THE BEST OF BOTH WORLDS

The goal of this approach is to provide capital appreciation by investing in a broad range of financial instruments, relying on the risk premium inherent to all asset classes. So, these portfolios are constructed to provide several attractive features that enable investors to see through the volatility of financial markets. They are balanced and designed to optimise returns relative to the risk taken. They are highly diversified both geographically and by sector, and include foreign currencies and commodities, like gold.

BlackRock, 10 Dec 2024 - Global Outlook 2025, building the transformation

Authors: Jean Boivin, Head of BlackRock Investment Institute ; Wei Lin, Global Chief of the BlackRock Investment Institute

· Financing the future

Sizeable capital will be needed as the transformation unfolds and that investment is happening now. We think private markets will play a vital rôle in financing the waves of transformation

· Rethinking investing

We think investors should focus more on themes and less on broad asset classes. Greater volatility points to a need to be more dynamic with portfolio allocations.

· Staying pro-risk

We have more conviction in U.S. equities outperforming their international peers. We recognize valuations are rich in U.S. equities but don’t see them as a near-term market driver.

· Tracking AI’s evolution

The AI theme has broadened out from our original concentrated AI scenario. We see private markets as key — not just in funding infrastructure but also in capturing potential future AI winners.

· Infrastructure for the long term

We favor infrastructure equity on a strategic horizon of five years and longer as a potential beneficiary of mega forces. Private markets can help bridge the gap between needed infrastructure and what governments and banks can finance alone.

· Intensifying fragmentation

We think a second Trump administration could reinforce geopolitical fragmentation and economic competition. Energy and low-carbon technology is now a key front in this competition and is shaking up companies globally.

· New diversifiers needed

We see the potential for assets like bitcoin to provide distinct sources of risk and return. With traditional diversifiers like bonds no longer working as before, investors have more reasons to be dynamic with portfolios.

Big calls

Tactical: US equities (bif tech backed by strong earnings) ; Japanese equities (stronger yen is at risk) ; selective fixed income (underweight long dated US Treasuries, overweight UK Gilts)

Strategic: Infrastructure equity and private credit (as banks retreat); fixed income granularity (short and medium term IG); equity granularity (EM like India and Saudia Arabia; Developed Markets like Japan)

World Gold Council, 13 Dec 2024 - Gold Outlook 2025

Authors: Jeremy De Pessemier, CFA, Asset Allocation Strategist; Johan Palmberg, Senior Quantitative Analyst

Our analysis is based on

Economic expansion (and its direct effect on consumer demand)

Risk and uncertainty (as a trigger for flows from investors looking for effective hedges)

Opportunity cost (making gold more or less attractive relative to bond yields)

Momentum (which can boost trends or, equally, mean-revert them)

2025: a tale of two halves?

Our analysis suggests that, if the economy were to perform according to consensus in 2025, gold may continue to trade in a similar range to that seen in the last part of the year, with the potential for some upside.

Risk-on/risk-off

A more business-friendly fiscal policy combined with an America-first agenda is likely to improve sentiment among domestic investors and consumers. This will likely favour risk-on trades in the first few months of the year. The question, however, is whether these policies will also result in inflationary pressures and disruptions to supply chains. In addition, concerns about European sovereign debt are once again mounting, not to mention continued geopolitical instability, particularly in light of the events in South Korea and Syria in early December. In all, this could prompt investors to look for hedges, such as gold, to counter risk.

The Fed on a tightrope

There are many reasons why inflation can rebound, but the economy is still not strong and a reversal in policy could deteriorate credit conditions. If the Global Financial Crisis taught us anything, it is that when issues in the system start to unravel, they unravel fast! Historically, gold has risen by an average of 6% in the first six months of a rate cut cycle. Its subsequent performance has been influenced by the length and depth of that cycle. Overall, a more dovish Fed will be beneficial for gold, but a prolonged pause or policy reversal would likely put further pressure on investment demand.

Can Asia demand continue?

This year, Asian investors added to gold’s performance, particularly during the first half, and Indian demand benefitted from the reduction in import duty in the second half. However, the risk of trade wars looms large. Chinese consumer demand will likely depend on the health of economic growth – whether through normal means or government stimuli. And while the same factors that influenced investment demand in 2024 are still present, gold may face competition from stocks and real estate. India seems to stand on a better footing. Economic growth remains above 6.5%, and any tariff increase will affect it less than other US trading partners given a much smaller trade deficit. This, in turn, could support gold consumer demand. At the same time, gold financial investment products have seen remarkable growth and while they make up a small portion of the overall market, they have been a welcome addition to gold’s ecosystem.

Central banks as buyers

Central bank buying is policy driven and thus difficult to forecast, but our surveys and analysis suggest that the current trend will remain in place. In our view, demand in excess of 500 tonnes (the approximate long-term trend) should still have a net positive effect on performance. And we believe central bank demand in 2025 will surpass that. But a deceleration below that level could bring additional pressures to gold.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.