Take profits on stocks, earnings pushed AliBaba, lower PMI services in US and EU, new bank analysts recommendations

WEEKLY TRENDS

WEEKLY TRENDS

- After the sixth week of Q4 earnings releases, 80% of the S&P listed companies have published their results, globally better than expected and much better in the case of Financials

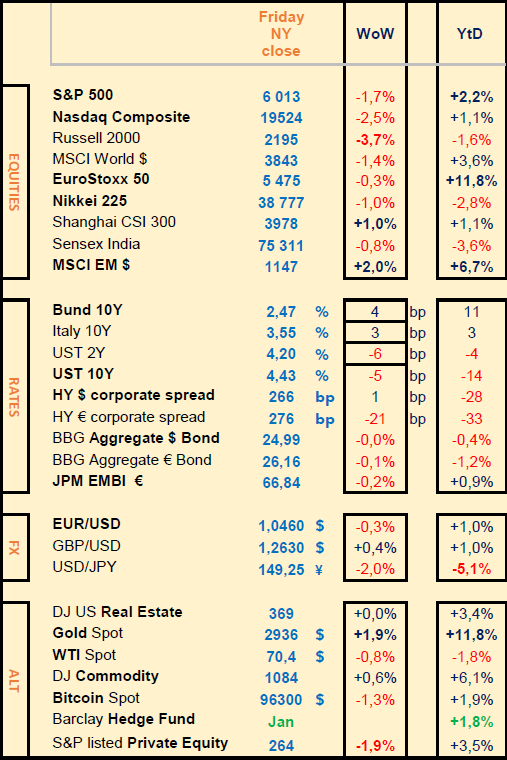

- Last week saw a series of take profits, mostly in the mid caps, Rates stayed fairly stable, Gold continued to progress towards the $3000 mark and Oil price ended lower after a surge during the week

- Advanced Feb PMI data showed a surprising weakness in the US Services PMI and a less surprising weakness in the euro zone, with a regain in the UK

- Important coming week with the German Federal elections this weekend, with the US inflation PCE data release and with the Nvidia’s earnings release too

- Important to note the less concentration of performance so far this year (in 2024, the S&P benchmark returned 23%, MAG7 representing 34% of this index, vs the equal weighted S&P returned 11%) now standing at 2.2 % vs 2.4%

MARKETS

Equities

Q4 earnings released (weekly stock performance):

Alibaba (+11%), Analog Devices (+13%), StandChart (+5%), Schneider Elec (+4%), Rio Tinto (+3%), Air Liquide (+3%)

Walmart (-10%), Glencore (-9%), Airbus (-5%), CapGemini (-11%)

Analysts:

STMicro (Jefferies ‘buy’ target €34); Legrand (MS ’o/w’ target €115); Orange (Barclays ‘o/w’ target €13); Euronext (Citi ‘buy’ target €134); Glencore (MS ‘o/w’ target £470); Fincantieri (Intesa ‘buy’ target €10.20); Eramet (Oddo ‘o/w’ target €87); Vinci (GS ‘buy’ target €132); SG (Intesa‘buy’ target €46) - NB ThyssenKrupp (+28% after BofA’s note on a split)

Rates

US curve (2-10 years) steepening stable (+3) at 23bps. Bond yields fairly stable with US yields down 5bps and EU up 5bps.

HY corporate spreads unchanged for US but lower by 20bps for EU

Commodities

Oil price lower on the uncertainty between Trump wishing to lower the price and the OPEC members wanting to maintain their level of production

Gold price up on global economic uncertainty over the trade war impacts

US

Feb PMI Manufacturing released at 51.6 vs 51.2 prior and Services at 49.7vs 52.9 prior

Cryptos

Another outgoing flows for the BTC ETFs last week (-$500m net exits). Note that SOL lost 30% over a month ($252 to $178)

Under the watch

Equal weighted S&P at par with the index (+2.4% vs 2.2% YTD perform)

Nota Bene

First time unemployment claims in Washington DC skyrocketed (3x 2024 average) when DOGE layoffs began.

US credit card debt has reached an ATH at $1.2trn ($800bn in 2021)

CALENDAR

Q4 Corporate earnings:

US: Home Depot (25 Feb), Nvidia (26), Dell (27)

EU: AXA (27 Feb), Allianz, Holcim, BASF (28)

Macro data releases:

US: PCE Price index for Jan (28 Feb) expected at 2.5% previous 2.6%

German Federal elections: 23 Feb (pro-business social conservative CDU Friedrich Merz expected to win, polls give 30% vs AfD at 21%)

WHAT ANALYSTS SAY

Goldman Sachs, 21 Feb 2025 - Briefings

Authors: Jan Hatzius, Chief economist, Head of GS Research; Dominic Wilson, Senior Advisor in Global Markets Research

The impact of tariffs on US stocks

· Will the US economy's tailwinds still trump tariffs?

Despite a slew of tariff announcements, policy uncertainty, and concerns in recent weeks about rising inflation, the outlook for US economic growth still looks to be on track, says Jan Hatzius, chief economist and head of Goldman Sachs Research.

“I think the tailwinds are probably going to trump the tariffs,” Hatzius says, referring to the title of the team's 2025 outlook. "We're still looking for about 2.5% growth in the US.

We still think that core PCE inflation is going to come down to something like 2.5% by the end of the year. And in that environment, we still think that the Federal Reserve might deliver some additional rate cuts, although we have pushed that out to some degree.” But in terms of the overall economic backdrop, Hatzius adds, it's remarkable how little has changed since the team published its outlook in November 2024.

But what has changed in recent months is the market's conviction that the economy can maintain its strength, says Dominic Wilson, senior advisor in the Global Markets Research Group.

“The challenge is not that the outlook has changed in a dramatic way, but that…the market has moved closer to a view that growth is going to be good, that recession risks are a relatively low,” Wilson says. “That felt like a debate we were having with the market for a lot of the last couple of years. And it's just less of a debate at this point.”

German stocks have had their best start to a year since reunification

· German stocks rally as election nears

Despite Germany's lackluster economic growth and its recession in 2023 and 2024, its index of large-cap stocks (DAX) has shown remarkable resilience. It rallied 20% in 2023, 19% in 2024, and has gained 14% year-to-date (as of February 18). The DAX is off to its best yearly start since German reunification.

Seven of Germany's largest companies have significant international footprints, generating around 80% of their sales abroad, making them relatively immune to the country's economic slowdown, according to Goldman Sachs Research strategist Guillaume Jaisson. By contrast, the mid-cap index (MDAX) and small-cap index (SDAX) have higher exposure to the domestic economy (33% and 45%, respectively) and have struggled as the economy continues to face difficulties.

Germany holds federal elections on February 23, and the outcome may have a major impact on Europe's largest economy.

The most-awaited reform by financial markets is the constitutional debt brake, which limits central government structural deficits to 0.35% of GDP. Our economists predict a high likelihood of some reform to the debt brake, which could provide a boost to medium- and smaller-sized German companies.

They also expect a significant increase in defense spending amid pressure from the US administration for European governments to play a greater role in the continent's security. A basket of EU defense stocks has rallied more than 30% this year (as of February 18).

The impact of reduced US immigration on GDP growth

· How will declining immigration impact the US economy?

Immigration to the US is expected to fall from the elevated levels of the past three years, declining to a pace slightly below the pre-pandemic average, according to Goldman Sachs Research.

If that occurs, the impact on the economy is likely to be limited, though more significant restrictions on immigration by the Trump administration could have larger repercussions.

Net immigration is expected to slow to 750,000 per year, well below the pace of the last three years but only moderately below the normal pre-pandemic pace, Goldman Sachs Research economists Elsie Peng, David Mericle, and Alec Phillips write in the team's report.

In their baseline estimate, the GDP impact from changes in immigration is likely to be limited: The slower pace of immigration would contribute 30-40 basis points less to potential US GDP growth than the 2023-2024 pace, but it would be just 5 basis points less than the pre-pandemic pace.

The impact from reduced immigration on wage growth and inflation should be modest now that the US labor market is back in balance, according to Goldman Sachs Research. At its peak, the boost to labor force growth from immigration was 100,000 per month above the normal pre-pandemic pace. It has since fallen to 40,000 above the typical level and is predicted to return to normal by early 2026.

How the AI trade is changing

As US tech giants underperform, a new crop of AI-exposed stocks is earning investors' attention.

“The Magnificent Seven tech giants — which powered the market higher through 2024 — have underperformed significantly this year,” observes John Marshall, head of Derivatives Research in Goldman Sachs Research. “This makes it look like investors are losing their taste for the AI trade.”

But Marshall says that, on the contrary, buying activity from retail investors has recently risen to a two-year high, with much of the activity focused on stocks in the tech-heavy Nasdaq 100 index.

“Retail investors are buying tech stocks which could benefit from integrating AI into their businesses.” Marshall says. “These companies aren't building AI or streamlining their businesses; they're finding new revenue opportunities.”

“The AI trade is still on,” Marshall concludes. “It's just different.”

Barclays Private Bank, 3 Feb 2025 - Markets perspectives February 2025; Multi-asset portfolio allocation

Authors: Julien Lafargue, London UK, Chief Market Strategist

Multi-asset portfolio allocation

Equities

Following a tactical increase to developed market equities in the summer, we see opportunity in maintaining a larger overweight to the asset class. In line with our long-term investment philosophy, portfolios remain geared towards high-quality, cash-generative and conservatively capitalised businesses. As a function of bottom-up selection, more opportunities are found in developed market equities, compared to those in emerging markets.

Alternative trading strategies (ATS)

There are a limited number of opportunities in the ATS universe, as the cost/benefit trade-off can be challenging. Our focus is on strategies that offer low correlations to equity markets, so providing diversification benefits.

Commodities

As a risk-mitigating asset, gold remains the only direct commodity exposure held in portfolios. Elsewhere, we believe that our risk budget is better spent outside of the asset class.

Cash and short duration bonds

Portfolios continue to hold larger allocations to short duration bonds. However, we have started to reduce the allocation, as major central banks start to cut interest rates, prompting bond yields to move lower.

Fixed income

Value is seen in developed market government bonds, which can also hedge against macroeconomic volatility.

In credit, the higher-quality segment is preferred, driven by what is considered to be better relative value.

Exposure is relatively low in high yield, where selection is key, as spreads have room to widen in an adverse scenario.

Equities

Q4 earnings released (weekly stock performance):

Alibaba (+11%), Analog Devices (+13%), StandChart (+5%), Schneider Elec (+4%), Rio Tinto (+3%), Air Liquide (+3%)

Walmart (-10%), Glencore (-9%), Airbus (-5%), CapGemini (-11%)

Analysts:

STMicro (Jefferies ‘buy’ target €34); Legrand (MS ’o/w’ target €115); Orange (Barclays ‘o/w’ target €13); Euronext (Citi ‘buy’ target €134); Glencore (MS ‘o/w’ target £470); Fincantieri (Intesa ‘buy’ target €10.20); Eramet (Oddo ‘o/w’ target €87); Vinci (GS ‘buy’ target €132); SG (Intesa‘buy’ target €46) - NB ThyssenKrupp (+28% after BofA’s note on a split)

Rates

US curve (2-10 years) steepening stable (+3) at 23bps. Bond yields fairly stable with US yields down 5bps and EU up 5bps.

HY corporate spreads unchanged for US but lower by 20bps for EU

Commodities

Oil price lower on the uncertainty between Trump wishing to lower the price and the OPEC members wanting to maintain their level of production

Gold price up on global economic uncertainty over the trade war impacts

US

Feb PMI Manufacturing released at 51.6 vs 51.2 prior and Services at 49.7vs 52.9 prior

Cryptos

Another outgoing flows for the BTC ETFs last week (-$500m net exits). Note that SOL lost 30% over a month ($252 to $178)

Under the watch

Equal weighted S&P at par with the index (+2.4% vs 2.2% YTD perform)

Nota Bene

First time unemployment claims in Washington DC skyrocketed (3x 2024 average) when DOGE layoffs began.

US credit card debt has reached an ATH at $1.2trn ($800bn in 2021)

CALENDAR

Q4 Corporate earnings:

US: Home Depot (25 Feb), Nvidia (26), Dell (27)

EU: AXA (27 Feb), Allianz, Holcim, BASF (28)

Macro data releases:

US: PCE Price index for Jan (28 Feb) expected at 2.5% previous 2.6%

German Federal elections: 23 Feb (pro-business social conservative CDU Friedrich Merz expected to win, polls give 30% vs AfD at 21%)

WHAT ANALYSTS SAY

- Goldman Sachs - Briefings

- Barclays - Market perspectives February 2025, Multi-asset portfolio allocation

Goldman Sachs, 21 Feb 2025 - Briefings

Authors: Jan Hatzius, Chief economist, Head of GS Research; Dominic Wilson, Senior Advisor in Global Markets Research

The impact of tariffs on US stocks

· Will the US economy's tailwinds still trump tariffs?

Despite a slew of tariff announcements, policy uncertainty, and concerns in recent weeks about rising inflation, the outlook for US economic growth still looks to be on track, says Jan Hatzius, chief economist and head of Goldman Sachs Research.

“I think the tailwinds are probably going to trump the tariffs,” Hatzius says, referring to the title of the team's 2025 outlook. "We're still looking for about 2.5% growth in the US.

We still think that core PCE inflation is going to come down to something like 2.5% by the end of the year. And in that environment, we still think that the Federal Reserve might deliver some additional rate cuts, although we have pushed that out to some degree.” But in terms of the overall economic backdrop, Hatzius adds, it's remarkable how little has changed since the team published its outlook in November 2024.

But what has changed in recent months is the market's conviction that the economy can maintain its strength, says Dominic Wilson, senior advisor in the Global Markets Research Group.

“The challenge is not that the outlook has changed in a dramatic way, but that…the market has moved closer to a view that growth is going to be good, that recession risks are a relatively low,” Wilson says. “That felt like a debate we were having with the market for a lot of the last couple of years. And it's just less of a debate at this point.”

German stocks have had their best start to a year since reunification

· German stocks rally as election nears

Despite Germany's lackluster economic growth and its recession in 2023 and 2024, its index of large-cap stocks (DAX) has shown remarkable resilience. It rallied 20% in 2023, 19% in 2024, and has gained 14% year-to-date (as of February 18). The DAX is off to its best yearly start since German reunification.

Seven of Germany's largest companies have significant international footprints, generating around 80% of their sales abroad, making them relatively immune to the country's economic slowdown, according to Goldman Sachs Research strategist Guillaume Jaisson. By contrast, the mid-cap index (MDAX) and small-cap index (SDAX) have higher exposure to the domestic economy (33% and 45%, respectively) and have struggled as the economy continues to face difficulties.

Germany holds federal elections on February 23, and the outcome may have a major impact on Europe's largest economy.

The most-awaited reform by financial markets is the constitutional debt brake, which limits central government structural deficits to 0.35% of GDP. Our economists predict a high likelihood of some reform to the debt brake, which could provide a boost to medium- and smaller-sized German companies.

They also expect a significant increase in defense spending amid pressure from the US administration for European governments to play a greater role in the continent's security. A basket of EU defense stocks has rallied more than 30% this year (as of February 18).

The impact of reduced US immigration on GDP growth

· How will declining immigration impact the US economy?

Immigration to the US is expected to fall from the elevated levels of the past three years, declining to a pace slightly below the pre-pandemic average, according to Goldman Sachs Research.

If that occurs, the impact on the economy is likely to be limited, though more significant restrictions on immigration by the Trump administration could have larger repercussions.

Net immigration is expected to slow to 750,000 per year, well below the pace of the last three years but only moderately below the normal pre-pandemic pace, Goldman Sachs Research economists Elsie Peng, David Mericle, and Alec Phillips write in the team's report.

In their baseline estimate, the GDP impact from changes in immigration is likely to be limited: The slower pace of immigration would contribute 30-40 basis points less to potential US GDP growth than the 2023-2024 pace, but it would be just 5 basis points less than the pre-pandemic pace.

The impact from reduced immigration on wage growth and inflation should be modest now that the US labor market is back in balance, according to Goldman Sachs Research. At its peak, the boost to labor force growth from immigration was 100,000 per month above the normal pre-pandemic pace. It has since fallen to 40,000 above the typical level and is predicted to return to normal by early 2026.

How the AI trade is changing

As US tech giants underperform, a new crop of AI-exposed stocks is earning investors' attention.

“The Magnificent Seven tech giants — which powered the market higher through 2024 — have underperformed significantly this year,” observes John Marshall, head of Derivatives Research in Goldman Sachs Research. “This makes it look like investors are losing their taste for the AI trade.”

But Marshall says that, on the contrary, buying activity from retail investors has recently risen to a two-year high, with much of the activity focused on stocks in the tech-heavy Nasdaq 100 index.

“Retail investors are buying tech stocks which could benefit from integrating AI into their businesses.” Marshall says. “These companies aren't building AI or streamlining their businesses; they're finding new revenue opportunities.”

“The AI trade is still on,” Marshall concludes. “It's just different.”

Barclays Private Bank, 3 Feb 2025 - Markets perspectives February 2025; Multi-asset portfolio allocation

Authors: Julien Lafargue, London UK, Chief Market Strategist

Multi-asset portfolio allocation

Equities

Following a tactical increase to developed market equities in the summer, we see opportunity in maintaining a larger overweight to the asset class. In line with our long-term investment philosophy, portfolios remain geared towards high-quality, cash-generative and conservatively capitalised businesses. As a function of bottom-up selection, more opportunities are found in developed market equities, compared to those in emerging markets.

Alternative trading strategies (ATS)

There are a limited number of opportunities in the ATS universe, as the cost/benefit trade-off can be challenging. Our focus is on strategies that offer low correlations to equity markets, so providing diversification benefits.

Commodities

As a risk-mitigating asset, gold remains the only direct commodity exposure held in portfolios. Elsewhere, we believe that our risk budget is better spent outside of the asset class.

Cash and short duration bonds

Portfolios continue to hold larger allocations to short duration bonds. However, we have started to reduce the allocation, as major central banks start to cut interest rates, prompting bond yields to move lower.

Fixed income

Value is seen in developed market government bonds, which can also hedge against macroeconomic volatility.

In credit, the higher-quality segment is preferred, driven by what is considered to be better relative value.

Exposure is relatively low in high yield, where selection is key, as spreads have room to widen in an adverse scenario.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.