Last week: After ’Liberation Day’ global markets hurricane, time for retaliations and negotiations, expect high volatility

WEEKLY TRENDS

WEEKLY TRENDS

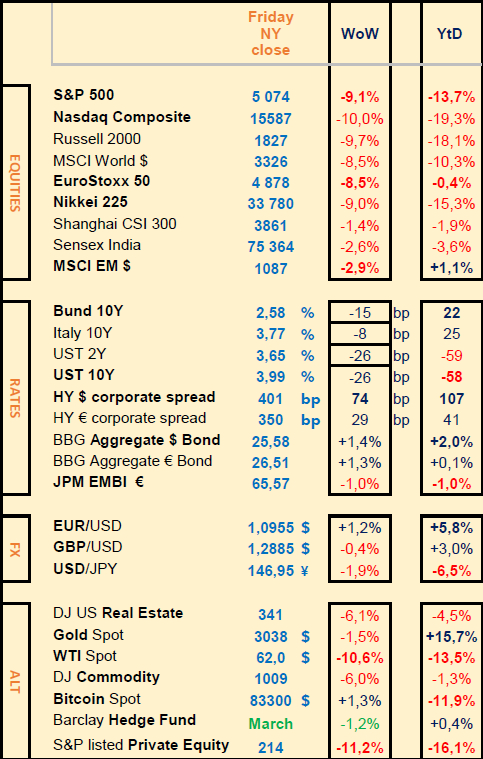

- Rapid corrections and liquidations (amplified by margin calls payments) created last week, the worst week performance for US stocks since March 2020 Covid lockdown

- On Saturday 5th, new US tariffs of 10% were implemented and on the 9th, additional tariffs will come into play for those countries with a US ‘negative’ trade balance (China +54%, EU +20%, Vietnam +46%, Japan +24%) items not included (steel, aluminium, copper, pharma, semiconductors, lumber, bullion, energy, minerals)

- HY credit spreads finally adjusted up ($ +70bps), Copper crashed, so did Oil (OPEC+ more production decision), UST yields dropped by 25bps (curve remained with a 35bp steepening)

- FED is now expected to cut rates 4 times this year (CME FedWatch) despite Powell confirming on Friday he is in no hurry to cut rates

- Now expect negotiations, retaliations for some, and for sure high volatility in global markets

MARKETS

Equities

Best performers: Defensive stocks (Utilities like Engie +2%, Iberdrola), Telecoms (Verizon, AT&T, Orange +3%), Food (Danone +2%, Nestlé)

Worst performers: Asia dependent manufacturers (Adidas -10%, Nike, Lululemon, Deckers, Pandora), Automobile (Stellantis -16%, Tesla -4%), Banks (JPM -12%, GS -11%), Semiconductors (Nvidia -10%, AMD -14%)

Analysts:

Saint Gobain (HSBC ‘buy’ target €124); Vicat (HSBC ’buy’ target €63); Holcim (HSBC ’hold’ target CHF92); Roche (MS ’m/w’ target CHF312); Bunzl (Barclays ’o/w’ target £36); Eiffage (Jefferies ‘buy’ target €128)

Pernod Ricard (Barclays ’u/w’ target €98)

Rates

US curve (2-10 years) steepening remained at 35bps. Bond yields lower.

HY corporate spreads higher at 350/400 bps

Commodities

Oil price down (-10%) after OPEC decision to increase production in May (+411k barrels a day vs +138k)

Copper price down (after China 34% tariffs retaliation on US imports)

US

March ISM Manufacturing 49 vs 50.3 prior, Services 50.8 vs 53.5 prior

March NFP +228k vs +140k expected (+117k prior, revised from +151k), unemployment rose to 4.2% from 4.1% prior

Margin Calls

FX carry trades and Gold were impacted last week by margin calls payments on stocks related trades

Under the watch

Recession fears (GS lifted its US recession probability in the next 12 months to 35%)

Nota Bene

Lack of space for physical Gold (the 3 big vaults at Brinks, JP Morgan and HSBC are now running out of space, 35m ounces altogether)

CALENDAR

Macro economic data :

US March CPI (10 April), March PPI (11 April), March 18-19 FOMC minutes (9 April)

WHAT ANALYSTS SAY

Interview, 31 March 2025

Author : Michel Girardin, economist

Does the increase in auto tariffs signal that these taxes are an end in themselves, or are they still a means of exerting pressure?

We understand Donald Trump's tactics better and better. It's a bit like a madman's strategy, which consists of observing, launching a shocking initiative and, faced with the reactions, starting to negotiate. His partners have already got used to this tactic of blowing hot and cold. As a sign of this interpretation and of the continuation of discussions, the Europeans have postponed the presentation of their retaliatory measures until mid-April. Tariffs therefore remain the core of Trump's policy.

Do the successive increases in customs duties mark the end of multilateralism?

I wouldn't be so categorical. Donald Trump is a difficult negotiator, but he will not jeopardise multilateralism, which remains a fundamental principle of the United Nations. Multilateralism enables us to tackle the major challenges of our time, such as peace, sustainable development, climate change and human rights. Apart from the first issue, it is true that the others are no longer high on the American agenda. We'll see on 24 April, World Multilateralism Day. But it's true that multilateralism has taken a hit with Trumponomics, but it's not dead. We will continue to be buffeted by the pace of trade negotiations.

When will the impact of the tariff increases be felt in the results of European and American companies?

Analysts present the effects of the tariffs as catastrophic for companies, but they concern products imported into the United States by foreign manufacturers, not those produced in the United States. The European automotive sector already has a strong presence with production sites in the United States, such as BMW and Mercedes.

Aren't a large percentage of cars produced in Mexico and then imported into the United States?

No doubt, but the headlines sometimes seem to exaggerate this impact. BMW will continue to sell cars that will not be affected by these tariffs. On a global level, I think the trend will be to manufacture more and more directly in the United States, which will limit transport costs and make it possible to avoid customs barriers. Estimating the effects of tariffs is a rather perilous exercise. Not only do you have to calculate the products imported into the United States, but also the components of those products.

The impact on earnings will become apparent when companies pass on these duties in their prices. But the effect on prices will come before the effect on volumes. By increasing the price of imports, customs barriers initially worsen the balance of trade. It is only when this price increase leads to a reduction in the volume of imports that the situation can improve, provided that the quantity effect dominates the price effect. Calculating these effects is difficult to model, especially as we will have to wait for the reactions of our trading partners. And we will have to wait until we know the final levels of customs duties. There is too little visibility today.

Will the United States go into recession?

I think so, but the characteristics of this recession will be very particular. It won't be linked to a rise in unemployment, but to a fall in consumption induced by a rise in inflation. Consumer behaviour is generally a function of the labour market, in particular the ability to change jobs easily and to negotiate good salaries. Today, the steepening of the yield curve highlights the emerging risk of stagflation. Consumer confidence is in free fall. It has fallen by 27% in 12 months. This is a very good leading indicator of a risk of recession, not in terms of its level but in terms of its variation. According to my estimates, a 20% fall in the consumer confidence index indicates a marked danger of recession.

Historically, consumer confidence peaked in 2000, during the internet bubble. The transition from a situation of consumer euphoria to one of great satisfaction was enough to trigger a recession in 2002. The same applies to the unemployment rate. It's the change in the unemployment rate that matters: if it rises by 0.5 percentage points, a recession is likely. Today, consumers are worried about inflation.

The ‘MAGA’ policy is inflationary through customs barriers and an end to illegal immigration. If 15 million immigrants are illegal and 9 million have jobs, their departure will force employers to call on domestic labour, which will lead to a sharp rise in wages and then prices.

Donald Trump is asking the Fed to lower interest rates to avoid the effect of tariffs. But this undermines the central bank's independence. And that is something the financial markets are not happy about.

Is this the end of the idea that Donald Trump judges the quality of his decisions by the S&P index?

Donald Trump may be able to ignore the fall in the stock markets and the rise in long-term interest rates for a while, but if the situation worsens, the pressure on the President will increase dangerously. The signal offered by the steepening yield curve is clear (4.7% at 30 years and 4.01% at 2 years).

Could Donald Trump's fiscal policy lead to a recession?

Donald Trump is making the same mistakes as Donald Reagan in his day, relying on Arthur Laffer's theories. Trump wants to lower taxes in the hope that tax revenues will increase. But this only works if taxes are confiscatory. If taxes are moderate, as they were in Ronald Reagan's time, it doesn't work. Lower taxes lead to lower tax revenues and higher deficits.

The source of the US problem can be found in the early 1980s.

Public debt stood at around 30% of GDP. At the time, Arthur Laffer advised President Reagan to cut taxes in order to trigger an increase in tax revenues, which would result from an acceleration in growth. His hopes were dashed. Public debt doubled during Reagan's presidency. Reducing taxes boosted growth, but this in turn led to an increase in imports and the trade deficit. As a result, the United States found itself in the mid-1980s with a double deficit - government and trade. Donald Trump's reasoning has not moved away from this logic.

It is also worrying to note that not only are we seeing an increase in the level of debt, but also in the servicing of that debt.

If economic growth is good and bond yields low, a country has nothing to worry about. But the example of Greece is a reminder that bond yields can soar if the markets are worried. The debt represented 170% of GDP and bond yields soared to 40%. This meant that 68% of GDP was spent on servicing the debt, and therefore the creditors. Today, the United States is in an unsustainable zone (4.7% yield for 130% debt/GDP). It risks facing a problem similar to that of Greece.

What impact will this have on the markets?

The market is always right; it will force Donald Trump to accept that he is making mistakes. But that will take time.

For many, many years, expectations that European assets would outperform American assets have not been met. Now, with the arrival of Donald Trump, European overweighting is finally justified by the new fundamentals.

Is it different this time?

Yes, I think we can thank Donald Trump. It is rare for Germany to announce a significant stimulus policy, with increased budget spending on infrastructure and defence. Europe will enjoy a fine recovery, thanks to Donald Trump.

Equities

Best performers: Defensive stocks (Utilities like Engie +2%, Iberdrola), Telecoms (Verizon, AT&T, Orange +3%), Food (Danone +2%, Nestlé)

Worst performers: Asia dependent manufacturers (Adidas -10%, Nike, Lululemon, Deckers, Pandora), Automobile (Stellantis -16%, Tesla -4%), Banks (JPM -12%, GS -11%), Semiconductors (Nvidia -10%, AMD -14%)

Analysts:

Saint Gobain (HSBC ‘buy’ target €124); Vicat (HSBC ’buy’ target €63); Holcim (HSBC ’hold’ target CHF92); Roche (MS ’m/w’ target CHF312); Bunzl (Barclays ’o/w’ target £36); Eiffage (Jefferies ‘buy’ target €128)

Pernod Ricard (Barclays ’u/w’ target €98)

Rates

US curve (2-10 years) steepening remained at 35bps. Bond yields lower.

HY corporate spreads higher at 350/400 bps

Commodities

Oil price down (-10%) after OPEC decision to increase production in May (+411k barrels a day vs +138k)

Copper price down (after China 34% tariffs retaliation on US imports)

US

March ISM Manufacturing 49 vs 50.3 prior, Services 50.8 vs 53.5 prior

March NFP +228k vs +140k expected (+117k prior, revised from +151k), unemployment rose to 4.2% from 4.1% prior

Margin Calls

FX carry trades and Gold were impacted last week by margin calls payments on stocks related trades

Under the watch

Recession fears (GS lifted its US recession probability in the next 12 months to 35%)

Nota Bene

Lack of space for physical Gold (the 3 big vaults at Brinks, JP Morgan and HSBC are now running out of space, 35m ounces altogether)

CALENDAR

Macro economic data :

US March CPI (10 April), March PPI (11 April), March 18-19 FOMC minutes (9 April)

WHAT ANALYSTS SAY

- Michel GIRARDIN : interview (31 March 2025)

Interview, 31 March 2025

Author : Michel Girardin, economist

Does the increase in auto tariffs signal that these taxes are an end in themselves, or are they still a means of exerting pressure?

We understand Donald Trump's tactics better and better. It's a bit like a madman's strategy, which consists of observing, launching a shocking initiative and, faced with the reactions, starting to negotiate. His partners have already got used to this tactic of blowing hot and cold. As a sign of this interpretation and of the continuation of discussions, the Europeans have postponed the presentation of their retaliatory measures until mid-April. Tariffs therefore remain the core of Trump's policy.

Do the successive increases in customs duties mark the end of multilateralism?

I wouldn't be so categorical. Donald Trump is a difficult negotiator, but he will not jeopardise multilateralism, which remains a fundamental principle of the United Nations. Multilateralism enables us to tackle the major challenges of our time, such as peace, sustainable development, climate change and human rights. Apart from the first issue, it is true that the others are no longer high on the American agenda. We'll see on 24 April, World Multilateralism Day. But it's true that multilateralism has taken a hit with Trumponomics, but it's not dead. We will continue to be buffeted by the pace of trade negotiations.

When will the impact of the tariff increases be felt in the results of European and American companies?

Analysts present the effects of the tariffs as catastrophic for companies, but they concern products imported into the United States by foreign manufacturers, not those produced in the United States. The European automotive sector already has a strong presence with production sites in the United States, such as BMW and Mercedes.

Aren't a large percentage of cars produced in Mexico and then imported into the United States?

No doubt, but the headlines sometimes seem to exaggerate this impact. BMW will continue to sell cars that will not be affected by these tariffs. On a global level, I think the trend will be to manufacture more and more directly in the United States, which will limit transport costs and make it possible to avoid customs barriers. Estimating the effects of tariffs is a rather perilous exercise. Not only do you have to calculate the products imported into the United States, but also the components of those products.

The impact on earnings will become apparent when companies pass on these duties in their prices. But the effect on prices will come before the effect on volumes. By increasing the price of imports, customs barriers initially worsen the balance of trade. It is only when this price increase leads to a reduction in the volume of imports that the situation can improve, provided that the quantity effect dominates the price effect. Calculating these effects is difficult to model, especially as we will have to wait for the reactions of our trading partners. And we will have to wait until we know the final levels of customs duties. There is too little visibility today.

Will the United States go into recession?

I think so, but the characteristics of this recession will be very particular. It won't be linked to a rise in unemployment, but to a fall in consumption induced by a rise in inflation. Consumer behaviour is generally a function of the labour market, in particular the ability to change jobs easily and to negotiate good salaries. Today, the steepening of the yield curve highlights the emerging risk of stagflation. Consumer confidence is in free fall. It has fallen by 27% in 12 months. This is a very good leading indicator of a risk of recession, not in terms of its level but in terms of its variation. According to my estimates, a 20% fall in the consumer confidence index indicates a marked danger of recession.

Historically, consumer confidence peaked in 2000, during the internet bubble. The transition from a situation of consumer euphoria to one of great satisfaction was enough to trigger a recession in 2002. The same applies to the unemployment rate. It's the change in the unemployment rate that matters: if it rises by 0.5 percentage points, a recession is likely. Today, consumers are worried about inflation.

The ‘MAGA’ policy is inflationary through customs barriers and an end to illegal immigration. If 15 million immigrants are illegal and 9 million have jobs, their departure will force employers to call on domestic labour, which will lead to a sharp rise in wages and then prices.

Donald Trump is asking the Fed to lower interest rates to avoid the effect of tariffs. But this undermines the central bank's independence. And that is something the financial markets are not happy about.

Is this the end of the idea that Donald Trump judges the quality of his decisions by the S&P index?

Donald Trump may be able to ignore the fall in the stock markets and the rise in long-term interest rates for a while, but if the situation worsens, the pressure on the President will increase dangerously. The signal offered by the steepening yield curve is clear (4.7% at 30 years and 4.01% at 2 years).

Could Donald Trump's fiscal policy lead to a recession?

Donald Trump is making the same mistakes as Donald Reagan in his day, relying on Arthur Laffer's theories. Trump wants to lower taxes in the hope that tax revenues will increase. But this only works if taxes are confiscatory. If taxes are moderate, as they were in Ronald Reagan's time, it doesn't work. Lower taxes lead to lower tax revenues and higher deficits.

The source of the US problem can be found in the early 1980s.

Public debt stood at around 30% of GDP. At the time, Arthur Laffer advised President Reagan to cut taxes in order to trigger an increase in tax revenues, which would result from an acceleration in growth. His hopes were dashed. Public debt doubled during Reagan's presidency. Reducing taxes boosted growth, but this in turn led to an increase in imports and the trade deficit. As a result, the United States found itself in the mid-1980s with a double deficit - government and trade. Donald Trump's reasoning has not moved away from this logic.

It is also worrying to note that not only are we seeing an increase in the level of debt, but also in the servicing of that debt.

If economic growth is good and bond yields low, a country has nothing to worry about. But the example of Greece is a reminder that bond yields can soar if the markets are worried. The debt represented 170% of GDP and bond yields soared to 40%. This meant that 68% of GDP was spent on servicing the debt, and therefore the creditors. Today, the United States is in an unsustainable zone (4.7% yield for 130% debt/GDP). It risks facing a problem similar to that of Greece.

What impact will this have on the markets?

The market is always right; it will force Donald Trump to accept that he is making mistakes. But that will take time.

For many, many years, expectations that European assets would outperform American assets have not been met. Now, with the arrival of Donald Trump, European overweighting is finally justified by the new fundamentals.

Is it different this time?

Yes, I think we can thank Donald Trump. It is rare for Germany to announce a significant stimulus policy, with increased budget spending on infrastructure and defence. Europe will enjoy a fine recovery, thanks to Donald Trump.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.