With 2 days left in the year, risky assets are certain to end 2024 with spectacular gains (BTC +120%, Nasdaq +30%)

WEEKLY TRENDS

WEEKLY TRENDS

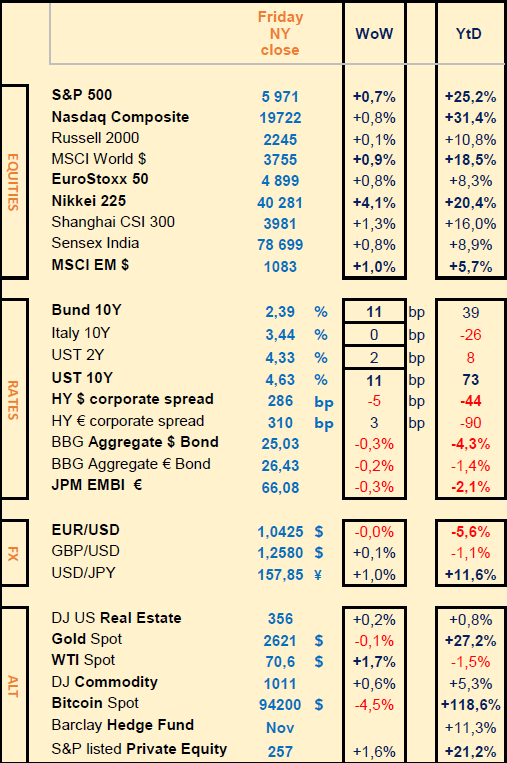

- US Large cap stocks (especially BATMMAAN) have clearly outperformed the rest of the stock markets in 2024 with S&P +25% and Nasdaq +31% so far, versus Europe +8%, India +9% and China +16%. Japan +20% performed well but its currency lost 11% against the USD

- US Mid Caps struggled with a ‘mere’ +11% despite US rate cuts (-100bps)

- Bonds did not perform well despite across the board Central Banks rate cuts and despite slightly improving corporate credit spreads

- The usually sought inflation hedge Gold was highly bought by Central Banks (YTD at +27%) despite disinflation, investors looking to diversify away from the USD reserves, hence a stunning performance from the BTC too at +119% YTD

- Despite FED rate cuts but thanks to a stonking US large caps stocks performance, the USD managed well to keep in positive territory this year

MARKETS

Equities

Major indices weekly performances:

US Large Caps at +0.8%, US Mid Caps at +0.1%

World +0.9%, EU at +0.8%, Japan at +4.1%, China at +1.3%, EM at +1%

NB

Warren Buffet spent a very small portion of his cash ($325bn) last week with $400m worth of Occidental shares bought, $100m of Sirius and $45m of Verisign

Rates

US curve (2-10 years) steepening increased by 10bps to 30bps. Bond yields increased across the board, HY corporate spread remained stable (US -5bps while EU +5bps).

Commodities

Oil price increased (+1.7% due to renewed tensions in the Middle East)

Gold price stable (despite higher UST yields)

Note Uranium has fallen to a 13 month low ($70.35 or -22% YTD)

US

Durable good orders fell by 1.1% in November vs +0.2% expected

EU

Bundestag dissolution and new elections called for the 23rd Feb 2025

Crypto

BTC much lower, broke the $100k mark, but remained with a stunning YTD performance of +119% (helped by the SEC approval in January, its Halving in April and by Trump’s election in November, with an additional performance of +40% since the 5th of November)

Nota Bene

Stonking YTD performances from a few US Large caps (BATMMAAN) with Nvidia +180%, Meta at +70%, Tesla +70% and Amazon +50%.

Central Banks rate cuts in 2024: FED 3 cuts (-100bps) to 4.5%; ECB 4 cuts (-100bps) to 3%; BOE 2 cuts (-50bps) to 4.75%; SNB 5 cuts (-125bps) to 0.5%

CALENDAR

WHAT ANALYSTS SAY

UBS Wealth Management, 24 Dec 2024 - Japanese economy is in upward trend

Authors: Kazumasa Ishii, Strategist SuMi TRUST Wealth Management; Chisa Kobayashi, Analyst, UBS SuMi TRUST Wealth Management

In brief

• We expect Japan's GDP to show 3% nominal growth and 1% real growth in 2025 after three consecutive years of over 2% inflation and two consecutive years of high wage growth.

• The main drivers of the growth will likely be private consumption and investment. Slowing inflation and wage hikes resulting real wage growth should lift consumption, while strong financial conditions and lower input prices should boost investment.

• Backed by robust domestic demand, the BoJ is likely to gradually raise the policy rate while monitoring the impact of US policies. A supplementary budget of a similar scale to that of last year should support the economy.

• Our asset class views for 2025 are the following :

Interest rates: We expect two hikes in 2025 (in March and in October), with the policy rate rising to 0.75%, and the 10-year JGB yield to rise to 1.2%.

Exchange rates: The USDJPY is expected to fluctuate in a 155-160 range in 1Q25, but will likely decline gradually as the interest rate differential between Japan and the US narrows.

Stocks: We remain Neutral. While the fundamentals are supportive, higher US tariffs are a risk. We continue to favor high-quality stocks with high margins, preferring domestically-oriented stocks in sectors such as financials, IT services, real estate, and retail.

Goldman Sachs, 20 Dec 2024 - Briefings

Authors: Jari Stehn, Goldman Sachs Research’s Chief European economist ; Sung Cho, co-head of US Fundamental Equity at GS AM

When will the German economy bounce back?

Germany's economy faces a series of headwinds in 2025, including trade uncertainty with the US and still-high energy prices that are a drag on the industrial sector, according to Goldman Sachs Research.

Europe's largest economy is forecast to expand 0.3% in 2025, which is slower than the estimate for the euro area of 0.8% and 1.2% for the UK. The country's real (inflation-adjusted) GDP is unchanged since the fourth quarter of 2019.

Germany's economy is also beset by a higher degree of regulation than its peers, says Jari Stehn, Goldman Sachs Research's chief European economist.

China is a key export market, but the Asian giant's economic growth has slowed, and China has also become a major competitor in manufacturing.

For all the challenges, there are signs that Germany is finding ways to adapt. “Even though industrial production is down significantly over the last few years, the amount of value added has actually been much more stable,” Stehn says.

“German companies have been able to respond by moving out of relatively low-margin production in chemicals or paper, and so on, into higher value production. I think the way forward essentially is for German companies to continue to do that.”

How the tech trade may change in 2025

The largest US stocks, known as the “Magnificent 7,” have enjoyed a phenomenal run over the past two years, in part thanks to the buildout of AI infrastructure. But Sung Cho, co-head of US Fundamental Equity in Goldman Sachs Asset Management, believes the tech trade will broaden out in 2025.

Cho says the buildout of AI might significantly benefit data and security companies, as well as software companies that successfully integrate AI into their existing product set.

He adds that as the Federal Reserve likely continues cutting rates, smaller tech companies — which saw their multiples contract significantly as rates rose — might find the macro backdrop much more favorable.

Will European stocks rally in 2025 ?

Goldman Sachs Research expects European stocks to gain in 2025 even as the region faces headwinds from political and trade uncertainty and slow economic growth. The STOXX 600 index, made up of European and UK companies, is forecast to generate a total return of about 9% next year (as of November 19) — which is modestly lower than Goldman Sachs Research's projections for the index's US and Asian counterparts.

While there are a number of challenges, European stocks may also benefit from cooling inflation, a larger-than-expected European policy response, or concerns about the prospect for returns from mega-cap US stocks.

Sharon Bell, senior strategist on the European Portfolio Strategy team, points out that US equities have performed exceptionally well, and there are concerns that valuations could be vulnerable. Major tech companies are also investing heavily in AI. “The biggest American technology companies used to be capital-light businesses, but now they're spending a lot of money on capital investment,” she says. “If people start questioning the returns on that investment, then valuations could come down, which could benefit European stocks on a relative basis.”

The outlook for M&A

“The next 12 months will be a better environment for, particularly, large dealmaking activity than the previous 12 months because of [the] risk appetite, financing environment, regulatory conditions, geopolitical conditions.” Mark Sorrell, Global Banking & Markets, Goldman Sachs.

Exploring AI use cases and scalability

With the world's biggest companies still racing to build the most sophisticated artificial intelligence, questions about how far and how fast the technology can be scaled are coming into focus. Although corporate spending on AI is at record levels, and use cases are starting to emerge — especially at the largest tech companies — the size of future economic benefits is still the subject of debate, says Alexander Duval, head of Europe Tech Hardware & Semiconductors in Goldman Sachs Research.

US tech giants, known as “hyperscalers,” have spent around $200 billion on AI this year, and that will probably increase to $250 billion next year.

“These hyperscalers have a lot of free cash flow, but at some point we need to see a return on investment across a broader array of use cases for investment to continue at such high levels,” Duval says.

Much of the focus in AI has been on generalist large language models, trained on a vast corpus of data. But as the availability of data, power, and capital create bottlenecks for tech companies, small language models (SLMs) could present an increasingly attractive investment case, Duval adds.

“Some believe smaller models are easier to fine-tune, they may have lower energy consumption, and they can be customized to meet an enterprise's specific requirements in a given domain (such as legal, medicine, or finance)," Duval says. "They're also less expensive, because they use less power. We're hearing more discussion of SLMs, power-efficient semiconductors, use of data from new sources, and the need for guardrails.”

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Major indices weekly performances:

US Large Caps at +0.8%, US Mid Caps at +0.1%

World +0.9%, EU at +0.8%, Japan at +4.1%, China at +1.3%, EM at +1%

NB

Warren Buffet spent a very small portion of his cash ($325bn) last week with $400m worth of Occidental shares bought, $100m of Sirius and $45m of Verisign

Rates

US curve (2-10 years) steepening increased by 10bps to 30bps. Bond yields increased across the board, HY corporate spread remained stable (US -5bps while EU +5bps).

Commodities

Oil price increased (+1.7% due to renewed tensions in the Middle East)

Gold price stable (despite higher UST yields)

Note Uranium has fallen to a 13 month low ($70.35 or -22% YTD)

US

Durable good orders fell by 1.1% in November vs +0.2% expected

EU

Bundestag dissolution and new elections called for the 23rd Feb 2025

Crypto

BTC much lower, broke the $100k mark, but remained with a stunning YTD performance of +119% (helped by the SEC approval in January, its Halving in April and by Trump’s election in November, with an additional performance of +40% since the 5th of November)

Nota Bene

Stonking YTD performances from a few US Large caps (BATMMAAN) with Nvidia +180%, Meta at +70%, Tesla +70% and Amazon +50%.

Central Banks rate cuts in 2024: FED 3 cuts (-100bps) to 4.5%; ECB 4 cuts (-100bps) to 3%; BOE 2 cuts (-50bps) to 4.75%; SNB 5 cuts (-125bps) to 0.5%

CALENDAR

- Stock Markets closings: US NYSE (1st Jan); EU : Euronext (31 Dec early at 14.00, and 1st Jan); UK: LSE (31 Dec and 1st Jan)

WHAT ANALYSTS SAY

- UBS Wealth Management - Japanese economy - Outlook for 2025

- Goldman Sachs - Briefings (the outlook for Germany’s economy in 2025; how AI could change the tech trade; can European stocks overcome economic headwinds? ; the outlook for M&A; Introducing small language models)

UBS Wealth Management, 24 Dec 2024 - Japanese economy is in upward trend

Authors: Kazumasa Ishii, Strategist SuMi TRUST Wealth Management; Chisa Kobayashi, Analyst, UBS SuMi TRUST Wealth Management

In brief

• We expect Japan's GDP to show 3% nominal growth and 1% real growth in 2025 after three consecutive years of over 2% inflation and two consecutive years of high wage growth.

• The main drivers of the growth will likely be private consumption and investment. Slowing inflation and wage hikes resulting real wage growth should lift consumption, while strong financial conditions and lower input prices should boost investment.

• Backed by robust domestic demand, the BoJ is likely to gradually raise the policy rate while monitoring the impact of US policies. A supplementary budget of a similar scale to that of last year should support the economy.

• Our asset class views for 2025 are the following :

Interest rates: We expect two hikes in 2025 (in March and in October), with the policy rate rising to 0.75%, and the 10-year JGB yield to rise to 1.2%.

Exchange rates: The USDJPY is expected to fluctuate in a 155-160 range in 1Q25, but will likely decline gradually as the interest rate differential between Japan and the US narrows.

Stocks: We remain Neutral. While the fundamentals are supportive, higher US tariffs are a risk. We continue to favor high-quality stocks with high margins, preferring domestically-oriented stocks in sectors such as financials, IT services, real estate, and retail.

Goldman Sachs, 20 Dec 2024 - Briefings

Authors: Jari Stehn, Goldman Sachs Research’s Chief European economist ; Sung Cho, co-head of US Fundamental Equity at GS AM

When will the German economy bounce back?

Germany's economy faces a series of headwinds in 2025, including trade uncertainty with the US and still-high energy prices that are a drag on the industrial sector, according to Goldman Sachs Research.

Europe's largest economy is forecast to expand 0.3% in 2025, which is slower than the estimate for the euro area of 0.8% and 1.2% for the UK. The country's real (inflation-adjusted) GDP is unchanged since the fourth quarter of 2019.

Germany's economy is also beset by a higher degree of regulation than its peers, says Jari Stehn, Goldman Sachs Research's chief European economist.

China is a key export market, but the Asian giant's economic growth has slowed, and China has also become a major competitor in manufacturing.

For all the challenges, there are signs that Germany is finding ways to adapt. “Even though industrial production is down significantly over the last few years, the amount of value added has actually been much more stable,” Stehn says.

“German companies have been able to respond by moving out of relatively low-margin production in chemicals or paper, and so on, into higher value production. I think the way forward essentially is for German companies to continue to do that.”

How the tech trade may change in 2025

The largest US stocks, known as the “Magnificent 7,” have enjoyed a phenomenal run over the past two years, in part thanks to the buildout of AI infrastructure. But Sung Cho, co-head of US Fundamental Equity in Goldman Sachs Asset Management, believes the tech trade will broaden out in 2025.

Cho says the buildout of AI might significantly benefit data and security companies, as well as software companies that successfully integrate AI into their existing product set.

He adds that as the Federal Reserve likely continues cutting rates, smaller tech companies — which saw their multiples contract significantly as rates rose — might find the macro backdrop much more favorable.

Will European stocks rally in 2025 ?

Goldman Sachs Research expects European stocks to gain in 2025 even as the region faces headwinds from political and trade uncertainty and slow economic growth. The STOXX 600 index, made up of European and UK companies, is forecast to generate a total return of about 9% next year (as of November 19) — which is modestly lower than Goldman Sachs Research's projections for the index's US and Asian counterparts.

While there are a number of challenges, European stocks may also benefit from cooling inflation, a larger-than-expected European policy response, or concerns about the prospect for returns from mega-cap US stocks.

Sharon Bell, senior strategist on the European Portfolio Strategy team, points out that US equities have performed exceptionally well, and there are concerns that valuations could be vulnerable. Major tech companies are also investing heavily in AI. “The biggest American technology companies used to be capital-light businesses, but now they're spending a lot of money on capital investment,” she says. “If people start questioning the returns on that investment, then valuations could come down, which could benefit European stocks on a relative basis.”

The outlook for M&A

“The next 12 months will be a better environment for, particularly, large dealmaking activity than the previous 12 months because of [the] risk appetite, financing environment, regulatory conditions, geopolitical conditions.” Mark Sorrell, Global Banking & Markets, Goldman Sachs.

Exploring AI use cases and scalability

With the world's biggest companies still racing to build the most sophisticated artificial intelligence, questions about how far and how fast the technology can be scaled are coming into focus. Although corporate spending on AI is at record levels, and use cases are starting to emerge — especially at the largest tech companies — the size of future economic benefits is still the subject of debate, says Alexander Duval, head of Europe Tech Hardware & Semiconductors in Goldman Sachs Research.

US tech giants, known as “hyperscalers,” have spent around $200 billion on AI this year, and that will probably increase to $250 billion next year.

“These hyperscalers have a lot of free cash flow, but at some point we need to see a return on investment across a broader array of use cases for investment to continue at such high levels,” Duval says.

Much of the focus in AI has been on generalist large language models, trained on a vast corpus of data. But as the availability of data, power, and capital create bottlenecks for tech companies, small language models (SLMs) could present an increasingly attractive investment case, Duval adds.

“Some believe smaller models are easier to fine-tune, they may have lower energy consumption, and they can be customized to meet an enterprise's specific requirements in a given domain (such as legal, medicine, or finance)," Duval says. "They're also less expensive, because they use less power. We're hearing more discussion of SLMs, power-efficient semiconductors, use of data from new sources, and the need for guardrails.”

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.