Last week: Tariffs led to lower USD, US stocks - EU defense plan led to higher Bund yields, among a new ECB rate cut

WEEKLY TRENDS

WEEKLY TRENDS

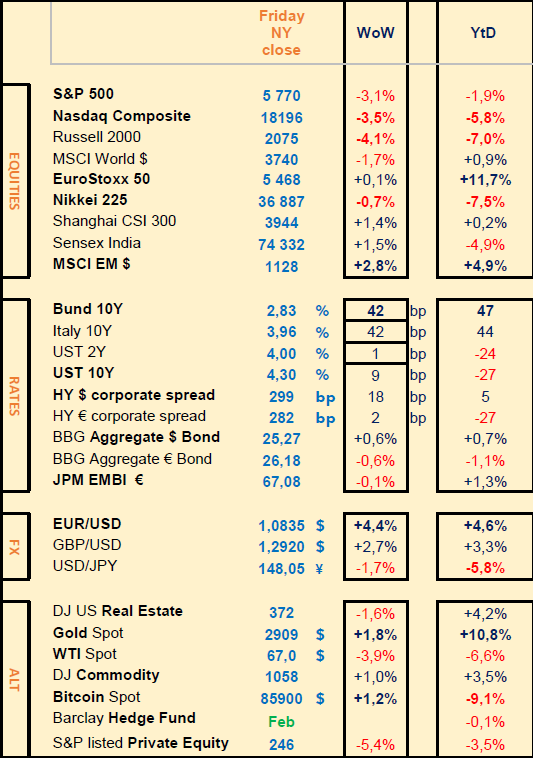

- The eighth week of Q4 earnings releases, was disrupted by numerous worldwide tariffs either implemented or postponed (Canada, Mexico, EU, China with reciprocity). Among this uncertainty, investors preferred to take further profits in US stocks and reinvested somewhat into EM stocks that benefitted from a much lower USD

- EU Defense stocks were uplifted by a major spending plan from the EC (off-balance sheet)

- US stocks suffered their worst week in 6 months but the SP500 and the Nasdaq managed to stay above their 200 day moving averages on Friday (crucial support levels)

- Meanwhile J. Powell declared uncertainty around Trump’s administration policies economic effects that remains high and sees no need to be in a hurry to adjust interest rates. Furthermore, FED’s Williams said that tariffs will likely boost US inflation

- This coming week, we shall have the US Feb inflation data released

MARKETS

Equities

Q4 earnings released (weekly stock performance):

Thales (+6%), Merck (+3%), Bayer (+2%), Reckitt (+2%)

Costco (-8%), Broadcom (-4%), Bunzl (-7%), Dassault Aviation (-2%)

Analysts:

Akzo Nobel (GS ‘buy’ target €75); AXA (MS ’o/w’ target €44); Eiffage (GS ‘buy’ target €140); Lloyds Bank (MS ‘o/w’ target £90); Safran (Barclays ’o/w’ target €300); Thales (JPM ’o/w’ target €220)

Rates

US curve (2-10 years) steepening rose to 30bps. Long Bond yields higher especially in the EU. The ECB cut by 25bps for the sixth time since last Summer, as expected, bringing the depo rate at 2.5%

HY corporate spreads slightly higher across the board

Commodities

Oil price much lower (-4%) on OPEC+ decision to rise production in April

Gold price higher (+2%) on tariffs uncertainty and lower USD (-4%)

US

Feb NFP job report released at +151k jobs created and a rising unemployment at 4.1% vs 4% prior

Cryptos

Trump’s executive order disappointed (created US BTC reserves, funded by BTC seized in criminal and civil forfeitures only).

Under the watch

EU defense stocks (the new Magnificents: BAE, Thales, Safran, Dassault aviation, Rolls-Royce, Airbus, SAAB, Rheinmetall, Leonardo, Hensoldt)

US Q1 GDP expected to be contracting at -2.4% (Fed Atlanta March 6th)

Nota Bene

EU Defense stocks YTD performances: BAE +36%, Thales +72%, Safran +16%, Dassault Aviation +46%, Rolls Royce Holdings +36%, Airbus +6%, SAAB +54%, Rheinmetall +84%, Leonardo +65%, Hensoldt +87%

CALENDAR

Q4 Corporate earnings:

US: Oracle (10 March), Adobe (12), Charles Schwab (14)

EU: VW, PG Partners (11), Rheinmetall (12), Enel, Generali (13), BMW, Swiss Life (14)

Macro data releases:

US: Feb CPI (12 March), PPI (13)

WHAT ANALYSTS SAY

Goldman Sachs, 7 March 2025

Authors: David Kostin, Chief US equity strategist, GS Research; Alex Phillips, Chief US political economist, GS Research

· The Impact of new tariffs on the US economy and stock market

US President Donald Trump made a series of changes this week to tariffs on imports from three of the US's largest trade partners.

The 10-percentage-point hike in the China-focused tariff (which is in addition to the 10% levy imposed last month) is estimated to raise the US effective tariff rate by 1.2 percentage points, and increase core prices by around 0.1%, Alec Phillips, Goldman Sachs Research's chief US political economist, writes in a report. Meanwhile, a 25% tariff on Canada and Mexico (10% on Canadian energy) would, according to projections, raise the effective tariff rate by 5.7 percentage points, and increase core prices by around 0.6%. Some trade announcements have been reversed or paused.

The eventual overall level of tariffs will have repercussions for the US stock market: Every five-percentage-point increase in the US tariff rate is estimated to reduce S&P 500 earnings per share by roughly 1-2%, says David Kostin, chief US equity strategist in Goldman Sachs Research.

· How much will rising Defense spending boost Europe ’s economy

Defense spending by European Union member states is expected to rise significantly over the next two years, with a projected increase of around €80 billion ($84 billion) by 2027, equivalent to roughly 0.5% of GDP, according to a Goldman Sachs Research report dated February 27. Economists Niklas Garnadt and Filippo Taddei forecast the increase in defense expenditures will have a positive, but limited, impact on GDP growth in the region.

The incoming German government said this week that it intends to exempt defense spending from budget control measures and to allot €500 billion to an infrastructure fund. If implemented, the policies could result in faster-than-expected GDP growth from Europe's largest economy. Accelerated growth from Germany could somewhat boost euro area GDP expansion, according to Goldman Sachs Research. EU leaders also this week endorsed a new funding initiative for defense.

The team estimates that the anticipated higher spending would have a fiscal multiplier of 0.5 over two years, meaning every €100 spent on defense would boost GDP by €50.

Europe's share of global arms production declined between 2008-2016, although it has since started to pick up again. EU manufacturers have joined the global surge in arms production and are now poised to expand at a faster rate than their US counterparts, according to market pricing. Europe bought a substantial amount of military equipment from non-EU suppliers immediately after Ukraine was invaded by Russia. However, a large portion of European defense supplies has historically been purchased from domestic companies, particularly in larger EU member states.

The average domestic sourcing share was around 90% in France, 80% in Germany, and 70% in Italy between 2005 and 2022.

· The space satellite market is forecast to become seven times bigger

As many as 70,000 low earth orbit (LEO) satellites are expected to be launched over the next five years, according to Goldman Sachs Research. Installed at altitudes of 100-1,200 miles, and circling the Earth every 90 minutes, these satellites could supplement cell phone, broadband, maritime, and aviation data requirements.

Our analysts' base-case forecast is for the satellite market to grow to $108 billion by 2035, up from the current $15 billion. In the most optimistic scenario, the market could grow to be worth as much as $457 billion in that same period. Roughly 53,000 of the estimated 70,000 launches over the next half-decade are likely to be from China, writes Allen Chang, head of the Greater China Technology Research team.

Satellites avoid “some of the difficulties faced by traditional ground-based infrastructure — such as difficult terrain or national boundaries,” Chang writes. But for LEO satellites to challenge traditional telecommunications services, some hurdles – such as high launch costs and latency issues – still need to be overcome.

World Gold Council, 6 March 2025

Authors: Jean Boivin, Head of the BII; Wei Li, Global Chief Investment Strategist, BII

February review - Looking forward

· Dollar weakness and ETF flows fuel Gold

Gold continued its uptrend in February, hitting multiple new highs before pulling back to end the month at US$2,835/oz – up 0.8% m/m.1 This performance was echoed across major currencies, all of which also registered new record high . General interest in gold was bolstered by continued flows of gold into COMEX inventories, driven by continued tariff uncertainty.

According to our Gold Return Attribution Model (GRAM), US dollar weakness during the month was one of the primary drivers of gold’s performance, alongside an increase in geopolitical risk and a drop in interest rates. And while gold’s strong price performance in January created a small drag, it was counterbalanced by positive support from flight-to-quality flows. This was best illustrated by gold ETF activity, which saw massive net inflows of US$9.4bn (100t) – the strongest month since March 2022 – led by US- and Asian-listed funds.

· Reassessing risk and reward

The “Trump trade” – stronger dollar and US stocks – has taken a back seat amidst concerns about tariffs and hawkish foreign policies, conditions that will likely remain. As governments look to increase military spending, budgets deficits are likely to increase and credit ratings to fall. At the same time, despite inflationary pressures, markets expect a more dovish Fed, pricing in at least two full rate cuts by the end of the year. These factors combined are creating a particularly supportive environment for gold.

· Risk-off in, risk-on out

The “Trump trade” – which hinged on the pro-US growth agenda of the new administration and fuelled a dollar and stock rally post US election – appears to have faded. While European stocks continue to do well, the major beneficiaries have been risk-off assets such as Treasuries and gold.

· Inflation is bubbling up

Trump‘s campaign agenda hinged on a few key items, including: tariffs, immigration and tax cuts – all of which have the potential to flare up inflation.

· Uncertainty, uncertainty, uncertainty

Investor nervousness has pushed bond prices higher and yields lower. Market participants now expect two full rate cuts by the end of the year…a far more dovish read from mid-January, pre-Trump inauguration. And the probability of a Fed hike appears to have peaked.

· New world (dis)order?

Negotiations to end the Russia-Ukraine war have led to much handwringing and consternation, particularly across Europe during February. This has compounded already elevated geopolitical uncertainty as positive outcomes are by no means guaranteed and existing political alliances are being questioned. Speculation that Europe will need to ramp up defence spending going forward – resulting in larger deficits – has already pushed up borrowing costs. Yield curves on European sovereign debt have become increasingly steep; short-term rates are falling while long-term rates remain high as expectations grow for an increased supply of long-dated debt.

· Perfect conditions for gold?

There are several factors that could reinstate the thorny problem of higher inflation, especially at a time when deteriorating economic conditions may necessitate interest rates staying low. The US economy is likely in ‘stagflation’ and consumers appear to see it that way.

Historically, each of these drivers has individually been positive for gold.

A move up in the GPR index of 100 points is typically linked to a 2.5% increase in the price of gold, all else equal. Similarly, a rise in 10-year break-even inflation expectations of 50bps is typically associated with an approx. 4% rise in gold prices. And a 50bps fall in 10-year Treasury rates over the long-run has been associated with a 2.5% rise in gold.

Although these drivers seldom occur simultaneously, their combined effect can create an environment in which gold can continue to perform positively. It is worth noting that a solid fundamental case for gold still has to scale the hurdle of a temporary technical stretched price.

Equities

Q4 earnings released (weekly stock performance):

Thales (+6%), Merck (+3%), Bayer (+2%), Reckitt (+2%)

Costco (-8%), Broadcom (-4%), Bunzl (-7%), Dassault Aviation (-2%)

Analysts:

Akzo Nobel (GS ‘buy’ target €75); AXA (MS ’o/w’ target €44); Eiffage (GS ‘buy’ target €140); Lloyds Bank (MS ‘o/w’ target £90); Safran (Barclays ’o/w’ target €300); Thales (JPM ’o/w’ target €220)

Rates

US curve (2-10 years) steepening rose to 30bps. Long Bond yields higher especially in the EU. The ECB cut by 25bps for the sixth time since last Summer, as expected, bringing the depo rate at 2.5%

HY corporate spreads slightly higher across the board

Commodities

Oil price much lower (-4%) on OPEC+ decision to rise production in April

Gold price higher (+2%) on tariffs uncertainty and lower USD (-4%)

US

Feb NFP job report released at +151k jobs created and a rising unemployment at 4.1% vs 4% prior

Cryptos

Trump’s executive order disappointed (created US BTC reserves, funded by BTC seized in criminal and civil forfeitures only).

Under the watch

EU defense stocks (the new Magnificents: BAE, Thales, Safran, Dassault aviation, Rolls-Royce, Airbus, SAAB, Rheinmetall, Leonardo, Hensoldt)

US Q1 GDP expected to be contracting at -2.4% (Fed Atlanta March 6th)

Nota Bene

EU Defense stocks YTD performances: BAE +36%, Thales +72%, Safran +16%, Dassault Aviation +46%, Rolls Royce Holdings +36%, Airbus +6%, SAAB +54%, Rheinmetall +84%, Leonardo +65%, Hensoldt +87%

CALENDAR

Q4 Corporate earnings:

US: Oracle (10 March), Adobe (12), Charles Schwab (14)

EU: VW, PG Partners (11), Rheinmetall (12), Enel, Generali (13), BMW, Swiss Life (14)

Macro data releases:

US: Feb CPI (12 March), PPI (13)

WHAT ANALYSTS SAY

- Goldman Sachs - Briefings

- World Gold Council - Riding a wave of uncertainty

Goldman Sachs, 7 March 2025

Authors: David Kostin, Chief US equity strategist, GS Research; Alex Phillips, Chief US political economist, GS Research

· The Impact of new tariffs on the US economy and stock market

US President Donald Trump made a series of changes this week to tariffs on imports from three of the US's largest trade partners.

The 10-percentage-point hike in the China-focused tariff (which is in addition to the 10% levy imposed last month) is estimated to raise the US effective tariff rate by 1.2 percentage points, and increase core prices by around 0.1%, Alec Phillips, Goldman Sachs Research's chief US political economist, writes in a report. Meanwhile, a 25% tariff on Canada and Mexico (10% on Canadian energy) would, according to projections, raise the effective tariff rate by 5.7 percentage points, and increase core prices by around 0.6%. Some trade announcements have been reversed or paused.

The eventual overall level of tariffs will have repercussions for the US stock market: Every five-percentage-point increase in the US tariff rate is estimated to reduce S&P 500 earnings per share by roughly 1-2%, says David Kostin, chief US equity strategist in Goldman Sachs Research.

· How much will rising Defense spending boost Europe ’s economy

Defense spending by European Union member states is expected to rise significantly over the next two years, with a projected increase of around €80 billion ($84 billion) by 2027, equivalent to roughly 0.5% of GDP, according to a Goldman Sachs Research report dated February 27. Economists Niklas Garnadt and Filippo Taddei forecast the increase in defense expenditures will have a positive, but limited, impact on GDP growth in the region.

The incoming German government said this week that it intends to exempt defense spending from budget control measures and to allot €500 billion to an infrastructure fund. If implemented, the policies could result in faster-than-expected GDP growth from Europe's largest economy. Accelerated growth from Germany could somewhat boost euro area GDP expansion, according to Goldman Sachs Research. EU leaders also this week endorsed a new funding initiative for defense.

The team estimates that the anticipated higher spending would have a fiscal multiplier of 0.5 over two years, meaning every €100 spent on defense would boost GDP by €50.

Europe's share of global arms production declined between 2008-2016, although it has since started to pick up again. EU manufacturers have joined the global surge in arms production and are now poised to expand at a faster rate than their US counterparts, according to market pricing. Europe bought a substantial amount of military equipment from non-EU suppliers immediately after Ukraine was invaded by Russia. However, a large portion of European defense supplies has historically been purchased from domestic companies, particularly in larger EU member states.

The average domestic sourcing share was around 90% in France, 80% in Germany, and 70% in Italy between 2005 and 2022.

· The space satellite market is forecast to become seven times bigger

As many as 70,000 low earth orbit (LEO) satellites are expected to be launched over the next five years, according to Goldman Sachs Research. Installed at altitudes of 100-1,200 miles, and circling the Earth every 90 minutes, these satellites could supplement cell phone, broadband, maritime, and aviation data requirements.

Our analysts' base-case forecast is for the satellite market to grow to $108 billion by 2035, up from the current $15 billion. In the most optimistic scenario, the market could grow to be worth as much as $457 billion in that same period. Roughly 53,000 of the estimated 70,000 launches over the next half-decade are likely to be from China, writes Allen Chang, head of the Greater China Technology Research team.

Satellites avoid “some of the difficulties faced by traditional ground-based infrastructure — such as difficult terrain or national boundaries,” Chang writes. But for LEO satellites to challenge traditional telecommunications services, some hurdles – such as high launch costs and latency issues – still need to be overcome.

World Gold Council, 6 March 2025

Authors: Jean Boivin, Head of the BII; Wei Li, Global Chief Investment Strategist, BII

February review - Looking forward

· Dollar weakness and ETF flows fuel Gold

Gold continued its uptrend in February, hitting multiple new highs before pulling back to end the month at US$2,835/oz – up 0.8% m/m.1 This performance was echoed across major currencies, all of which also registered new record high . General interest in gold was bolstered by continued flows of gold into COMEX inventories, driven by continued tariff uncertainty.

According to our Gold Return Attribution Model (GRAM), US dollar weakness during the month was one of the primary drivers of gold’s performance, alongside an increase in geopolitical risk and a drop in interest rates. And while gold’s strong price performance in January created a small drag, it was counterbalanced by positive support from flight-to-quality flows. This was best illustrated by gold ETF activity, which saw massive net inflows of US$9.4bn (100t) – the strongest month since March 2022 – led by US- and Asian-listed funds.

· Reassessing risk and reward

The “Trump trade” – stronger dollar and US stocks – has taken a back seat amidst concerns about tariffs and hawkish foreign policies, conditions that will likely remain. As governments look to increase military spending, budgets deficits are likely to increase and credit ratings to fall. At the same time, despite inflationary pressures, markets expect a more dovish Fed, pricing in at least two full rate cuts by the end of the year. These factors combined are creating a particularly supportive environment for gold.

· Risk-off in, risk-on out

The “Trump trade” – which hinged on the pro-US growth agenda of the new administration and fuelled a dollar and stock rally post US election – appears to have faded. While European stocks continue to do well, the major beneficiaries have been risk-off assets such as Treasuries and gold.

· Inflation is bubbling up

Trump‘s campaign agenda hinged on a few key items, including: tariffs, immigration and tax cuts – all of which have the potential to flare up inflation.

· Uncertainty, uncertainty, uncertainty

Investor nervousness has pushed bond prices higher and yields lower. Market participants now expect two full rate cuts by the end of the year…a far more dovish read from mid-January, pre-Trump inauguration. And the probability of a Fed hike appears to have peaked.

· New world (dis)order?

Negotiations to end the Russia-Ukraine war have led to much handwringing and consternation, particularly across Europe during February. This has compounded already elevated geopolitical uncertainty as positive outcomes are by no means guaranteed and existing political alliances are being questioned. Speculation that Europe will need to ramp up defence spending going forward – resulting in larger deficits – has already pushed up borrowing costs. Yield curves on European sovereign debt have become increasingly steep; short-term rates are falling while long-term rates remain high as expectations grow for an increased supply of long-dated debt.

· Perfect conditions for gold?

There are several factors that could reinstate the thorny problem of higher inflation, especially at a time when deteriorating economic conditions may necessitate interest rates staying low. The US economy is likely in ‘stagflation’ and consumers appear to see it that way.

Historically, each of these drivers has individually been positive for gold.

A move up in the GPR index of 100 points is typically linked to a 2.5% increase in the price of gold, all else equal. Similarly, a rise in 10-year break-even inflation expectations of 50bps is typically associated with an approx. 4% rise in gold prices. And a 50bps fall in 10-year Treasury rates over the long-run has been associated with a 2.5% rise in gold.

Although these drivers seldom occur simultaneously, their combined effect can create an environment in which gold can continue to perform positively. It is worth noting that a solid fundamental case for gold still has to scale the hurdle of a temporary technical stretched price.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.