FED first rate move in 4 years, 50bps cut, boosted stock markets hitting new ATH All Time Highs, together with Gold

WEEKLY TRENDS

WEEKLY TRENDS

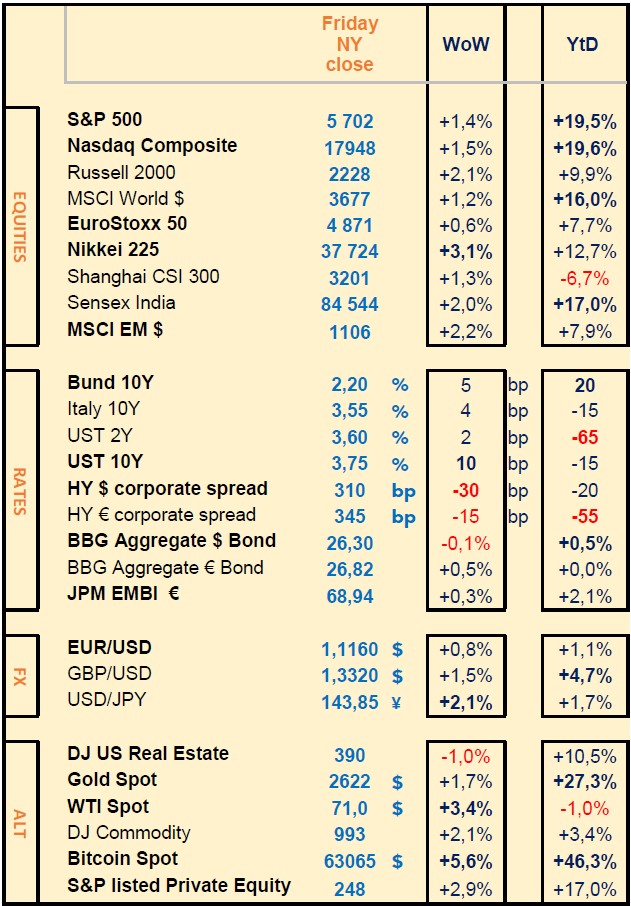

- Last week was all about central banks’ decisions (FED, BOE, BOJ) the latter two decided to stay put and the previous rather unexpectedly decided to start its easing cycle by a 50 bps cut (FED pivot has officially begun). The FED sees 2 more 25bps cuts by yearend, 100bps cuts in 2025 and 50bps in 2026. The S&P500 hit a new ATH on soft landing hopes and on a larger than expected FED rate cut. BOE and BOJ paused on rate moves (easing for the BOE and hiking for the BOJ)

- $5trn quarterly expiration of stock options and futures last Friday (triple witching) did not move much the markets

- Crude oil rose significantly due to US inventories reaching 1 year lows and BTC rose by 6% on a BlackRock paper showing concerns on $35trn US debt pile, pushing institutionals towards BTC.

MARKETS

Equities

Energy, Financials sectors outperformed last week while Real Estate, Consumer Staples underperformed

Q2 earnings releases last week (stock WoW performance) :

+++ Charles Schwab (+4%) H&M (+9%) Vinci (+1%)

- - - Fedex (-12%)

M&A: US Bausch + Lomb (+28%) rumoured to be taken over by Blackstone, Advent, TPG; French Rexel (+15%) is a target for US QXO, proposing $8bn; German Deutsche Wohnen (+12%) could be a target for Vonovia; UK TI Fluids Systems (+14%) is a target for ABC Tech (Apollo Management); French Esker (+8%) is under a takeover bid from Bridgepoint, General Atlantic

NB: Microsoft (+1%) announced a $60bn buyback programme and rose its quarterly dividend by 10% to 83 cents per share; Trump Media & Tech (-24%) was lower due to the expiry on insider selling restrictions

Rates

US curve (2-10 years) continued to steepen last week (+15bps) with long end US Treasuries (10 years) rising by 10bps

Credit

Corporate risk-on mood with HY spreads lower by 15 to 30 bps, investors chasing higher returns by taking more credit risk

Commodities

Crude Oil rallied last week, off a 3 year low (best week since Oct 2023) due to US crude inventories (Cushing) reaching their lowest level in a year

Gold, new ATH (All Time High) at $2640 during the day on Friday, helped by a lower USD and by a stronger demand out of India (due to tariffs cut)

Crypto

BlackRock warned last week of growing concerns around the spiralling $35trn US debt pile that is driving institutional interest in BTC. This dynamic also taking hold in other countries with significant debt accumulations

Nota Bene

Hedge Funds piled into shorts last week against stocks for the 5th week in a row (Goldman Sachs)

Mag7 levelled their previous record high but were unable to break it

CALENDAR

WHAT ANALYSTS SAY

LOMBARD ODIER, 19 September 2024 - CIO Viewpoint

Author: Bill Papadakis, Senior Macro Strategist

Key takeaways

· The Fed’s rate-cutting cycle has begun, and we now see it making 25 bps cuts in each of the remaining meetings this year. If recession risks were to materialise, it has scope to ease policy more substantially

· While this was certainly a key policy meeting, the overall path of policy matters more than individual cuts. We estimate the neutral level of interest rates in the US is around 3.5%, higher than current investor projections

· With markets anticipating deeper Fed cuts compared with other central banks, the US dollar’s interest rate advantage is narrowing and we shift to a more neutral USD stance

· We see scope for the Swiss franc and Japanese yen to gain against the dollar, on limited monetary easing and limited tightening ahead respectively. We retain a cautious outlook on the euro and sterling

The Federal Reserve has made its first interest rate cut since the pandemic, reducing rates by 50 basis points (bps). We believe the Fed’s policy path is converging towards market expectations, and that means less support for the US dollar (USD) going forward. We have turned neutral on the dollar overall and the Swiss franc and Japanese yen are now our most preferred currencies.

The Fed's decision to bring rates down to 4.75-5.00% is in line with our argument that this was an ‘insurance cut’ designed to stave off further labour market weakening and frontload some policy easing. Market expectations before the meeting fluctuated between 25 bps and 50 bps. We do not see this first large rate cut as a cause for alarm, rather as a message that the Fed does not want to be behind the curve.

Fed outlook – cutting towards ‘neutral’ rates

For much of 2022 and 2023, the Fed focused on the inflation side of its dual mandate of price and job market stability. Then a series of weaker-than-expected labour reports, beginning with July payrolls, culminated in August with Chair Jerome Powell signalling a pivot from fighting inflation to focus on the Fed’s job market mandate. The Fed’s policy flexibility is in contrast to the European Central Bank (ECB) and Bank of England (BoE), which as we noted recently, lack the Fed’s flexible dual mandate of price and job market stability, and where services inflation is still elevated. In the US, 10-year breakeven inflation (a measure of long-term inflation expectations) in contrast is now back at 2%.

The September meeting delivered the 50 bps rate cut that we expected. In addition, in their updated set of projections, Fed policymakers pointed to two additional 25 bps cuts in the remainder of this year, followed by a total of 100 bps of cuts in 2025 and 50 bps in 2026. Together with the language used by Chair Powell in the post-meeting press conference, we see these as a sign of the Fed’s growing confidence on the path of disinflation and its increasing focus on preserving full employment following recent data that indicated softer conditions in the US labour market. The large cut at the start of the easing cycle, along with the strong guidance for cuts at future meetings, should contribute substantially to ensuring a soft landing and limit the risk that conditions in the labour market deteriorate going forward.

Fed outlook – cutting towards ‘neutral’ rates

At the same time, we believe market expectations of a terminal rate at 2.8% in 12 months’ time are too low, barring a US recession. In our core scenario of a successful soft landing for the economy, we would expect the neutral interest rate – which neither stimulates nor curbs growth – to be closer to 3.5%. In the event of a second Trump presidency following November’s elections, the terminal rate in this rate cutting cycle may not even reach that level, if inflation were to pick up again on fresh tariffs, tax cuts and/or tighter immigration policy.

A more neutral dollar stance

We recently suggested that market pricing for Fed easing had reached excessive levels compared with that for other central banks, and that the US dollar could recover in the short-term. Yet the long-anticipated start of a looser monetary cycle in the US with a 50 bps cut narrows yield differentials between developed economies. As a result, we have adopted a neutral stance on the US dollar against cyclical currencies like the euro and sterling, which face headwinds from a global growth slowdown, and we now prefer the Swiss franc and Japanese yen. The Swiss National Bank (SNB) was the first to initiate interest rate cuts this year and seems largely finished with its cycle, even as the Fed is just starting. The Bank of Japan is hiking interest rates, and so on an entirely different monetary track. Our assumptions for major currencies are shown in the table in the pdf (see top-right hand side of page to download).

Over a three-month time horizon, the risks for the US dollar may be to the downside, particularly if the labour market data shows a faster pace of cooling. In this instance, markets would watch the Fed’s focus on maintaining strong employment and further policy easing, while the ECB and BoE concentrate on getting sticky services inflation under control.

That said, over a 12-month time horizon, and assuming our base case of a US soft landing, risks to the dollar could be to the upside. This is because the prevailing market view of a Fed terminal rate below 3% could shift higher in 2025, just as policy easing by both the ECB and BoE progresses.

We continue to carefully monitor US politics in relation to our dollar view. A Kamala Harris win could further weaken the currency. The corporate tax hike from 21% to 28% proposed by her campaign would likely slow foreign investors’ flows into US equities. Conversely, a Donald Trump win may trigger rising inflation expectations if we were to see higher and broader import tariffs, and/or an increase in low-income wages as a result of tighter immigration policies. This could slow the Fed’s rate cutting cycle and lead to a stronger US dollar.

UBS, 20 September - Monthly Investment Letter: Get ready

Author: Mark Haefele, CIO UBS Global Wealth Management

Looking toward the fourth quarter, investors need to get ready. The Federal Reserve has begun to reduce interest rates. The US election race is close. And amid uncertainty about the path for economic growth, market volatility appears likely to persist.

How should investors prepare?

· First, deploy cash, money-market fund assets, and expiring fixed-term deposits. We believe interest rates are likely to fall further, and potentially much further if economic data deteriorates. Investors can find more durable sources of portfolio income in medium-duration quality bonds, diversified fixed income portfolios, and equity income strategies, which combine dividend income with option-selling.

· Second, consider capital preservation strategies and diversification into alternative assets. The US election and economic uncertainty could lead to higher volatility. While we do not recommend making major portfolio shifts based on hopes and fears about election outcomes, capital preservation strategies can be a way to manage risks. Diversification into alternative assets, including private equity and credit, hedge funds, or gold, can also help investors reduce portfolio volatility.

· Finally, get ready to seize the artificial intelligence (AI) opportunity. Underinvested portfolios should prepare to use periods of volatility to buy AI beneficiaries, including megacap stocks and semiconductor stocks. Beyond technology, we also believe investors should build exposure to “quality growth” companies, including those in the health care and consumer sectors and select firms that are likely to benefit from the energy transition. Companies with strong balance sheets and a track record of earnings growth have historically outperformed in weaker economic environments.

In our asset allocation, we see comparable risk-reward for equities and bonds.

In our base case, we expect high single-digit upside over the next year in listed equities and mid-single-digit returns for quality bonds.

We prefer technology stocks, investment grade credit, and gold. We are also positioning for US dollar weakness, as we expect the Fed to cut rates more quickly than its global counterparts.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Energy, Financials sectors outperformed last week while Real Estate, Consumer Staples underperformed

Q2 earnings releases last week (stock WoW performance) :

+++ Charles Schwab (+4%) H&M (+9%) Vinci (+1%)

- - - Fedex (-12%)

M&A: US Bausch + Lomb (+28%) rumoured to be taken over by Blackstone, Advent, TPG; French Rexel (+15%) is a target for US QXO, proposing $8bn; German Deutsche Wohnen (+12%) could be a target for Vonovia; UK TI Fluids Systems (+14%) is a target for ABC Tech (Apollo Management); French Esker (+8%) is under a takeover bid from Bridgepoint, General Atlantic

NB: Microsoft (+1%) announced a $60bn buyback programme and rose its quarterly dividend by 10% to 83 cents per share; Trump Media & Tech (-24%) was lower due to the expiry on insider selling restrictions

Rates

US curve (2-10 years) continued to steepen last week (+15bps) with long end US Treasuries (10 years) rising by 10bps

Credit

Corporate risk-on mood with HY spreads lower by 15 to 30 bps, investors chasing higher returns by taking more credit risk

Commodities

Crude Oil rallied last week, off a 3 year low (best week since Oct 2023) due to US crude inventories (Cushing) reaching their lowest level in a year

Gold, new ATH (All Time High) at $2640 during the day on Friday, helped by a lower USD and by a stronger demand out of India (due to tariffs cut)

Crypto

BlackRock warned last week of growing concerns around the spiralling $35trn US debt pile that is driving institutional interest in BTC. This dynamic also taking hold in other countries with significant debt accumulations

Nota Bene

Hedge Funds piled into shorts last week against stocks for the 5th week in a row (Goldman Sachs)

Mag7 levelled their previous record high but were unable to break it

CALENDAR

- Corporate earnings: US Micron, Cintas (25 Sep), Costco, Accenture (26 Sep); Europe H&M (26 Sep)

- Macro: US S&P September preliminary PMI manufacturing and services (23 Sep); August PCE inflation data (27 Sep)

WHAT ANALYSTS SAY

- LOMBARD ODIER - the first cut is the steepest : the Fed, market expectations and the dollar

- UBS - Monthly Investment Letter : Get ready

LOMBARD ODIER, 19 September 2024 - CIO Viewpoint

Author: Bill Papadakis, Senior Macro Strategist

Key takeaways

· The Fed’s rate-cutting cycle has begun, and we now see it making 25 bps cuts in each of the remaining meetings this year. If recession risks were to materialise, it has scope to ease policy more substantially

· While this was certainly a key policy meeting, the overall path of policy matters more than individual cuts. We estimate the neutral level of interest rates in the US is around 3.5%, higher than current investor projections

· With markets anticipating deeper Fed cuts compared with other central banks, the US dollar’s interest rate advantage is narrowing and we shift to a more neutral USD stance

· We see scope for the Swiss franc and Japanese yen to gain against the dollar, on limited monetary easing and limited tightening ahead respectively. We retain a cautious outlook on the euro and sterling

The Federal Reserve has made its first interest rate cut since the pandemic, reducing rates by 50 basis points (bps). We believe the Fed’s policy path is converging towards market expectations, and that means less support for the US dollar (USD) going forward. We have turned neutral on the dollar overall and the Swiss franc and Japanese yen are now our most preferred currencies.

The Fed's decision to bring rates down to 4.75-5.00% is in line with our argument that this was an ‘insurance cut’ designed to stave off further labour market weakening and frontload some policy easing. Market expectations before the meeting fluctuated between 25 bps and 50 bps. We do not see this first large rate cut as a cause for alarm, rather as a message that the Fed does not want to be behind the curve.

Fed outlook – cutting towards ‘neutral’ rates

For much of 2022 and 2023, the Fed focused on the inflation side of its dual mandate of price and job market stability. Then a series of weaker-than-expected labour reports, beginning with July payrolls, culminated in August with Chair Jerome Powell signalling a pivot from fighting inflation to focus on the Fed’s job market mandate. The Fed’s policy flexibility is in contrast to the European Central Bank (ECB) and Bank of England (BoE), which as we noted recently, lack the Fed’s flexible dual mandate of price and job market stability, and where services inflation is still elevated. In the US, 10-year breakeven inflation (a measure of long-term inflation expectations) in contrast is now back at 2%.

The September meeting delivered the 50 bps rate cut that we expected. In addition, in their updated set of projections, Fed policymakers pointed to two additional 25 bps cuts in the remainder of this year, followed by a total of 100 bps of cuts in 2025 and 50 bps in 2026. Together with the language used by Chair Powell in the post-meeting press conference, we see these as a sign of the Fed’s growing confidence on the path of disinflation and its increasing focus on preserving full employment following recent data that indicated softer conditions in the US labour market. The large cut at the start of the easing cycle, along with the strong guidance for cuts at future meetings, should contribute substantially to ensuring a soft landing and limit the risk that conditions in the labour market deteriorate going forward.

Fed outlook – cutting towards ‘neutral’ rates

At the same time, we believe market expectations of a terminal rate at 2.8% in 12 months’ time are too low, barring a US recession. In our core scenario of a successful soft landing for the economy, we would expect the neutral interest rate – which neither stimulates nor curbs growth – to be closer to 3.5%. In the event of a second Trump presidency following November’s elections, the terminal rate in this rate cutting cycle may not even reach that level, if inflation were to pick up again on fresh tariffs, tax cuts and/or tighter immigration policy.

A more neutral dollar stance

We recently suggested that market pricing for Fed easing had reached excessive levels compared with that for other central banks, and that the US dollar could recover in the short-term. Yet the long-anticipated start of a looser monetary cycle in the US with a 50 bps cut narrows yield differentials between developed economies. As a result, we have adopted a neutral stance on the US dollar against cyclical currencies like the euro and sterling, which face headwinds from a global growth slowdown, and we now prefer the Swiss franc and Japanese yen. The Swiss National Bank (SNB) was the first to initiate interest rate cuts this year and seems largely finished with its cycle, even as the Fed is just starting. The Bank of Japan is hiking interest rates, and so on an entirely different monetary track. Our assumptions for major currencies are shown in the table in the pdf (see top-right hand side of page to download).

Over a three-month time horizon, the risks for the US dollar may be to the downside, particularly if the labour market data shows a faster pace of cooling. In this instance, markets would watch the Fed’s focus on maintaining strong employment and further policy easing, while the ECB and BoE concentrate on getting sticky services inflation under control.

That said, over a 12-month time horizon, and assuming our base case of a US soft landing, risks to the dollar could be to the upside. This is because the prevailing market view of a Fed terminal rate below 3% could shift higher in 2025, just as policy easing by both the ECB and BoE progresses.

We continue to carefully monitor US politics in relation to our dollar view. A Kamala Harris win could further weaken the currency. The corporate tax hike from 21% to 28% proposed by her campaign would likely slow foreign investors’ flows into US equities. Conversely, a Donald Trump win may trigger rising inflation expectations if we were to see higher and broader import tariffs, and/or an increase in low-income wages as a result of tighter immigration policies. This could slow the Fed’s rate cutting cycle and lead to a stronger US dollar.

UBS, 20 September - Monthly Investment Letter: Get ready

Author: Mark Haefele, CIO UBS Global Wealth Management

Looking toward the fourth quarter, investors need to get ready. The Federal Reserve has begun to reduce interest rates. The US election race is close. And amid uncertainty about the path for economic growth, market volatility appears likely to persist.

How should investors prepare?

· First, deploy cash, money-market fund assets, and expiring fixed-term deposits. We believe interest rates are likely to fall further, and potentially much further if economic data deteriorates. Investors can find more durable sources of portfolio income in medium-duration quality bonds, diversified fixed income portfolios, and equity income strategies, which combine dividend income with option-selling.

· Second, consider capital preservation strategies and diversification into alternative assets. The US election and economic uncertainty could lead to higher volatility. While we do not recommend making major portfolio shifts based on hopes and fears about election outcomes, capital preservation strategies can be a way to manage risks. Diversification into alternative assets, including private equity and credit, hedge funds, or gold, can also help investors reduce portfolio volatility.

· Finally, get ready to seize the artificial intelligence (AI) opportunity. Underinvested portfolios should prepare to use periods of volatility to buy AI beneficiaries, including megacap stocks and semiconductor stocks. Beyond technology, we also believe investors should build exposure to “quality growth” companies, including those in the health care and consumer sectors and select firms that are likely to benefit from the energy transition. Companies with strong balance sheets and a track record of earnings growth have historically outperformed in weaker economic environments.

In our asset allocation, we see comparable risk-reward for equities and bonds.

In our base case, we expect high single-digit upside over the next year in listed equities and mid-single-digit returns for quality bonds.

We prefer technology stocks, investment grade credit, and gold. We are also positioning for US dollar weakness, as we expect the Fed to cut rates more quickly than its global counterparts.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.