Last week : Best May for stocks in 35 years (SP at +6%), two US courts decisions on trade policy - ECB 25bps likely cut

WEEKLY TRENDS

WEEKLY TRENDS

- May was the best month in 35 years for US stocks, the SP500 ended the month at +6% (so much for the ‘sell in May and go away’) mostly due to the IT sector that returned +10% and itself mostly due to Tesla’s and Nvidia’s performances (+24% and +19%)

- Earlier last week, the US court of International trade ruled that the Trump administration did not have the authority to impose global tariffs but on Thursday evening, a Federal appeal court put a temporary hold on the ruling which led stocks to give back some of the gains made on the earlier announcement

- This coming Thursday, the ECB is expected to cut its deposit rate by 25bps to 2% while on the same day Broadcom will release its Q1 earnings. The following day, on Friday, markets will focus on the May US NFP job report, expected to show a Non Farm Payroll creation of +130k jobs vs +177k prior

MARKETS

Equities

Q1 corporate earnings released (WoW stock performances):

Nvidia (+4%), Salesforce (-5%), Dell (+1%)

NB weekly performances:

Dottikon (Swiss pharma, +33%), Grenergy (Spanish solar energy, +24%), Veeva Sys (US cloud, +20%), Ulta Beauty (US beauty products, +16%), Air France (+14%), Alstom (+8%)

Rates

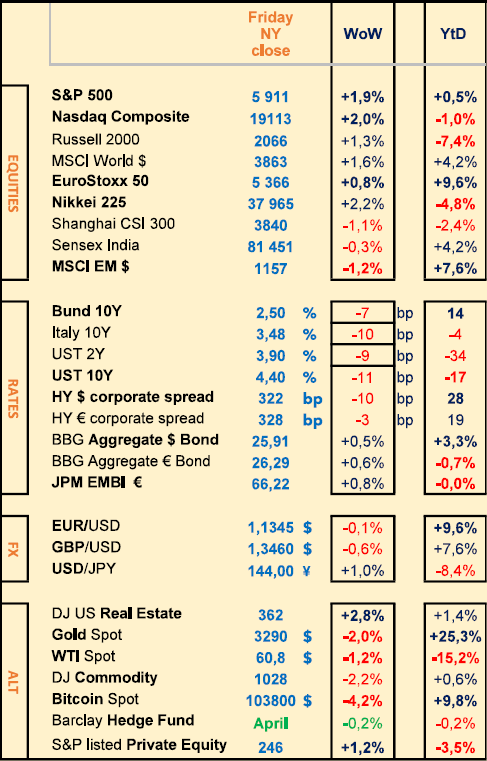

US curve (2-10 years) steepening stable at 50bps (Bond yields lower across the board)

HY corporate spreads slightly lower at 320-330 bps (US/EU)

Commodities

Oil price lower (-1%) among speculation the OPEC+ will increase its production, starting July 1st (+411k barrels/day of additional production)

Gold price lower (-2%) month end correction, despite lower Bond yields

US

April PCE core at 2.5% vs 2.5% expected and 2.7% prior

China

May PMI composite at 50.4 vs 50.2 prior (manufacturing at 49.5 vs 49 and services at 50.3 vs 50.04)

Under the watch

$7243bn current US Money Market funds total assets

US mutual funds are underweight IT sector vs benchmark (GS research) despite showing the highest earnings growth (+17%) after Communication and Healthcare sectors (both at +15%) while the SP500 shows +9%

Nota Bene

May Mag7 stock performances (Tesla +24%, Nvidia +19%, Meta +9%, Microsoft +7%, Amazon +7%, Alphabet / Google +6%, Apple -4%) while the SP500 returned +6% (after -6% in the first 4 months) the IT sector returned +10% in May so did the Consumer Discretionary, while the Healthcare sector returned -6% (the only negative sector return in May)

CALENDAR

Macro Data releases:

US May PMI (2 June); May ISM (3 June); May NFP job report (6 June)

EU ECB rate decision (5 June) -25bps expected

Q1 corporate earnings: US MongoDB (4 June); Broadcom , DocuSign (5 June)

WHAT ANALYSTS SAY

UBS Global Wealth Management, 26 May 2025

Author: James Mazeau, Economist, Chief Investment Office

The US government loses its last ‘triple A’ rating from a major agency (S&P downgraded the United States' rating in 2011, and Fitch followed suit in 2023). The federal government has a budget deficit of more than $2 trillion per year, even after a period of strong economic growth and low unemployment. In addition, net interest expenses now absorb 18% of tax revenues.

But while the US debt crisis has worsened and explains Moody's downgrade, investors are already well aware of this.

While yields may rise by 10 to 15 basis points in the short term, as was the case after Fitch's downgrade in 2023, Moody's decision is unlikely to trigger massive sell-offs or changes in credit spreads. Most investment mandates do not require a AAA rating for US Treasury bonds, and central banks still consider the Treasury bond market to be exceptionally liquid.

According to UBS Research, the credit quality of the United States is very high and, apart from cash, US Treasury bonds remain the least risky and least remunerative US dollar asset. The strength of US capital markets, the dollar's status as a reserve currency and the wealth held by US households mean that the US's ability to repay its debt should not be called into question.

The first downgrade of the United States' credit rating in 2011 was unexpected and caused widespread consternation. However, in the end, it had little lasting financial or political impact. Policymakers largely ignored Fitch's downgrade in 2023.

While Moody's downgrade in 2025 could be used as a political tool in short-term budget negotiations, it is unlikely to alter the overall trajectory of US fiscal policy.

With Moody's being the third rating agency to downgrade the United States' credit rating, the shock effect on investors is likely to have subsided, and UBS Research anticipates a more moderate reaction from the equity markets.

In recent weeks, global investors have been more concerned about effective US tariffs, which are expected to be around 15%, which will weigh on growth but will not be enough to cause a recession.

While budget negotiations and their impact on the deficit could begin to have a growing impact on markets in the coming weeks, the credit rating downgrade should not in itself be a major concern for equity markets.

Pictet Asset Management, 26 May 2025

Author: Patrick Zweifel, Chief Economist

During his first term, Trump started with what works: fiscal stimulus in a context of recovery, targeted deregulation and moderate tariffs. The already dynamic economy accelerated, allowing the Fed to normalise its monetary policy. The dollar strengthened, containing inflationary pressures linked to tariffs. In 2025, everything is reversed: stagflationary policies (trade and migration) precede measures to support growth. The tariff shock, ten times more aggressive, has severely affected household and business confidence, heralding a potentially sharp slowdown in activity.

In this context, the budget passed by the House last week – which still needs to be approved by the Senate before 4 July – should have been an opportunity to correct the trajectory. This is not the case. The significant tax cuts introduced in 2017 – due to expire at the end of the year – have been extended. This is good news for business competitiveness, of course, but the addition of new exemptions on tips and overtime further increases the bill. Added to this are increases in defence and security spending. On the savings side, the cuts mainly target social safety nets, notably Medicaid. The result is a net increase in the deficit of around $300 billion, or 1 percentage point of GDP, which at first glance appears to support growth.

However, this budget does not include revenue from customs tariffs – estimated at $250-300 billion, but too uncertain – or the projected savings from the DOGE, which range from $50 to $150 billion according to very optimistic assumptions. Once these factors are taken into account, the deficit remains roughly stable, between 6.5% and 7% of GDP, and becomes neutral for growth. This level of deficit, far from being temporary, is now expected to persist throughout the coming decade.

The risk of a sharp adjustment in long-term rates is very real. Bessent himself, after criticising Yellen's excessive issuance of T-Bills, is now proposing the same approach – concentrating borrowing on short maturities – to avoid panic on the yield curve.

The problem is that time is running out. The climate of mistrust is growing : more than a third of US securitised debt is held by foreign investors, who are as crucial as they are volatile. Their confidence has been seriously shaken by the instability of the Trump presidency and the questioning of international commitments. Even the safe-haven status of US Treasuries is no longer guaranteed.

Added to this is a more insidious and perhaps more dangerous attack: the undermining of one of the structural pillars of American strength – innovation. By cutting research budgets and attacking major universities head-on, Trump is weakening a long-term growth engine that has always enabled the United States to overcome its crises and look to the future. Ironically, this ‘Big Beautiful Bill’ intended to restore ‘American greatness’ could become its fiscal Achilles heel. By betting everything on hypothetical growth, it exposes the United States to an implacable reality: fiscal credibility cannot be bought on credit.

JP Morgan Asset Management, 26 May 2025

Author: Tilmann Galler, Global Market Strategist

Since 2011, the US dollar has shown considerable strength, giving Americans a huge boost in purchasing power in recent years. Markets are now wondering whether this emerging weakness could be the beginning of the end of the 14-year bull cycle for the US dollar. Three factors have contributed significantly to the dollar's strength since 2011 : economic growth, interest rate policy and its status as a global reserve currency. Are these factors still valid today?

After the financial crisis, the US economy managed to achieve strong real GDP growth and massively reduce unemployment, outperforming other G7 economies. Global leadership in information technology and digitalisation, energy independence and the successful consolidation of the financial sector contributed to the economic momentum. This made the US dollar attractive to global capital and investment. The Fed also played an important role in the dollar's appreciation. In the mid-2010s, it began a series of interest rate hikes, signalling confidence in the sustainability of the US recovery. These rate hikes made US fixed-income assets more attractive to global investors than other currencies, further fuelling demand for the dollar. The US dollar's reputation as a safe haven and the world's main reserve currency was another factor in its continued strength. The political stability of the United States and its robust institutional frameworks led to strong demand from international investors during events such as the European debt crisis, Brexit and the war in Ukraine.

However, the long years of dollar strength also have their downsides. First, the US manufacturing industry has lost international competitiveness, cementing the trade deficit. Second, the easy availability of financing capital has led to a relaxation of fiscal discipline. Tax cuts and active economic policy have caused public debt to balloon over the past 10 years from 95% of GDP to 120% of GDP, while increasing domestic demand. This in turn has increased demand for imports, further exacerbating the trade deficit.

The new US administration now wants to take action with tariffs. Their widespread and massive use is aimed at reducing demand for imports and bringing production back to the United States. The trading partners concerned are in turn increasing public spending to mitigate the negative effects. In line with the government's wishes, the US central bank should now, despite the inflationary effect of the tariff policy, cut interest rates to support growth – and reduce the attractiveness of the US dollar.

If other measures also damage the institutional framework of the United States, the US dollar risks losing its status as a safe haven. If the ‘most expensive dollar’ since 1986 loses its demand, a fall is to be feared. The booming price of gold and the success of cryptocurrencies are already clear warning signs. It is extremely uncertain whether President Trump will consistently pursue this risky trade policy path. For investment portfolios, however, this means that the US dollar position needs to be reviewed. In global equities, the share has risen from 40% to 66% over the past 14 years. Increased use of euro-hedged strategies can help reduce dollar risk.

Equities

Q1 corporate earnings released (WoW stock performances):

Nvidia (+4%), Salesforce (-5%), Dell (+1%)

NB weekly performances:

Dottikon (Swiss pharma, +33%), Grenergy (Spanish solar energy, +24%), Veeva Sys (US cloud, +20%), Ulta Beauty (US beauty products, +16%), Air France (+14%), Alstom (+8%)

Rates

US curve (2-10 years) steepening stable at 50bps (Bond yields lower across the board)

HY corporate spreads slightly lower at 320-330 bps (US/EU)

Commodities

Oil price lower (-1%) among speculation the OPEC+ will increase its production, starting July 1st (+411k barrels/day of additional production)

Gold price lower (-2%) month end correction, despite lower Bond yields

US

April PCE core at 2.5% vs 2.5% expected and 2.7% prior

China

May PMI composite at 50.4 vs 50.2 prior (manufacturing at 49.5 vs 49 and services at 50.3 vs 50.04)

Under the watch

$7243bn current US Money Market funds total assets

US mutual funds are underweight IT sector vs benchmark (GS research) despite showing the highest earnings growth (+17%) after Communication and Healthcare sectors (both at +15%) while the SP500 shows +9%

Nota Bene

May Mag7 stock performances (Tesla +24%, Nvidia +19%, Meta +9%, Microsoft +7%, Amazon +7%, Alphabet / Google +6%, Apple -4%) while the SP500 returned +6% (after -6% in the first 4 months) the IT sector returned +10% in May so did the Consumer Discretionary, while the Healthcare sector returned -6% (the only negative sector return in May)

CALENDAR

Macro Data releases:

US May PMI (2 June); May ISM (3 June); May NFP job report (6 June)

EU ECB rate decision (5 June) -25bps expected

Q1 corporate earnings: US MongoDB (4 June); Broadcom , DocuSign (5 June)

WHAT ANALYSTS SAY

- UBS: US lost their last AAA rating

- Pictet Asset Management: Make the Debt great again

- JP Morgan: Does US trade policy lead to a weak US dollar?

UBS Global Wealth Management, 26 May 2025

Author: James Mazeau, Economist, Chief Investment Office

The US government loses its last ‘triple A’ rating from a major agency (S&P downgraded the United States' rating in 2011, and Fitch followed suit in 2023). The federal government has a budget deficit of more than $2 trillion per year, even after a period of strong economic growth and low unemployment. In addition, net interest expenses now absorb 18% of tax revenues.

But while the US debt crisis has worsened and explains Moody's downgrade, investors are already well aware of this.

While yields may rise by 10 to 15 basis points in the short term, as was the case after Fitch's downgrade in 2023, Moody's decision is unlikely to trigger massive sell-offs or changes in credit spreads. Most investment mandates do not require a AAA rating for US Treasury bonds, and central banks still consider the Treasury bond market to be exceptionally liquid.

According to UBS Research, the credit quality of the United States is very high and, apart from cash, US Treasury bonds remain the least risky and least remunerative US dollar asset. The strength of US capital markets, the dollar's status as a reserve currency and the wealth held by US households mean that the US's ability to repay its debt should not be called into question.

The first downgrade of the United States' credit rating in 2011 was unexpected and caused widespread consternation. However, in the end, it had little lasting financial or political impact. Policymakers largely ignored Fitch's downgrade in 2023.

While Moody's downgrade in 2025 could be used as a political tool in short-term budget negotiations, it is unlikely to alter the overall trajectory of US fiscal policy.

With Moody's being the third rating agency to downgrade the United States' credit rating, the shock effect on investors is likely to have subsided, and UBS Research anticipates a more moderate reaction from the equity markets.

In recent weeks, global investors have been more concerned about effective US tariffs, which are expected to be around 15%, which will weigh on growth but will not be enough to cause a recession.

While budget negotiations and their impact on the deficit could begin to have a growing impact on markets in the coming weeks, the credit rating downgrade should not in itself be a major concern for equity markets.

Pictet Asset Management, 26 May 2025

Author: Patrick Zweifel, Chief Economist

During his first term, Trump started with what works: fiscal stimulus in a context of recovery, targeted deregulation and moderate tariffs. The already dynamic economy accelerated, allowing the Fed to normalise its monetary policy. The dollar strengthened, containing inflationary pressures linked to tariffs. In 2025, everything is reversed: stagflationary policies (trade and migration) precede measures to support growth. The tariff shock, ten times more aggressive, has severely affected household and business confidence, heralding a potentially sharp slowdown in activity.

In this context, the budget passed by the House last week – which still needs to be approved by the Senate before 4 July – should have been an opportunity to correct the trajectory. This is not the case. The significant tax cuts introduced in 2017 – due to expire at the end of the year – have been extended. This is good news for business competitiveness, of course, but the addition of new exemptions on tips and overtime further increases the bill. Added to this are increases in defence and security spending. On the savings side, the cuts mainly target social safety nets, notably Medicaid. The result is a net increase in the deficit of around $300 billion, or 1 percentage point of GDP, which at first glance appears to support growth.

However, this budget does not include revenue from customs tariffs – estimated at $250-300 billion, but too uncertain – or the projected savings from the DOGE, which range from $50 to $150 billion according to very optimistic assumptions. Once these factors are taken into account, the deficit remains roughly stable, between 6.5% and 7% of GDP, and becomes neutral for growth. This level of deficit, far from being temporary, is now expected to persist throughout the coming decade.

The risk of a sharp adjustment in long-term rates is very real. Bessent himself, after criticising Yellen's excessive issuance of T-Bills, is now proposing the same approach – concentrating borrowing on short maturities – to avoid panic on the yield curve.

The problem is that time is running out. The climate of mistrust is growing : more than a third of US securitised debt is held by foreign investors, who are as crucial as they are volatile. Their confidence has been seriously shaken by the instability of the Trump presidency and the questioning of international commitments. Even the safe-haven status of US Treasuries is no longer guaranteed.

Added to this is a more insidious and perhaps more dangerous attack: the undermining of one of the structural pillars of American strength – innovation. By cutting research budgets and attacking major universities head-on, Trump is weakening a long-term growth engine that has always enabled the United States to overcome its crises and look to the future. Ironically, this ‘Big Beautiful Bill’ intended to restore ‘American greatness’ could become its fiscal Achilles heel. By betting everything on hypothetical growth, it exposes the United States to an implacable reality: fiscal credibility cannot be bought on credit.

JP Morgan Asset Management, 26 May 2025

Author: Tilmann Galler, Global Market Strategist

Since 2011, the US dollar has shown considerable strength, giving Americans a huge boost in purchasing power in recent years. Markets are now wondering whether this emerging weakness could be the beginning of the end of the 14-year bull cycle for the US dollar. Three factors have contributed significantly to the dollar's strength since 2011 : economic growth, interest rate policy and its status as a global reserve currency. Are these factors still valid today?

After the financial crisis, the US economy managed to achieve strong real GDP growth and massively reduce unemployment, outperforming other G7 economies. Global leadership in information technology and digitalisation, energy independence and the successful consolidation of the financial sector contributed to the economic momentum. This made the US dollar attractive to global capital and investment. The Fed also played an important role in the dollar's appreciation. In the mid-2010s, it began a series of interest rate hikes, signalling confidence in the sustainability of the US recovery. These rate hikes made US fixed-income assets more attractive to global investors than other currencies, further fuelling demand for the dollar. The US dollar's reputation as a safe haven and the world's main reserve currency was another factor in its continued strength. The political stability of the United States and its robust institutional frameworks led to strong demand from international investors during events such as the European debt crisis, Brexit and the war in Ukraine.

However, the long years of dollar strength also have their downsides. First, the US manufacturing industry has lost international competitiveness, cementing the trade deficit. Second, the easy availability of financing capital has led to a relaxation of fiscal discipline. Tax cuts and active economic policy have caused public debt to balloon over the past 10 years from 95% of GDP to 120% of GDP, while increasing domestic demand. This in turn has increased demand for imports, further exacerbating the trade deficit.

The new US administration now wants to take action with tariffs. Their widespread and massive use is aimed at reducing demand for imports and bringing production back to the United States. The trading partners concerned are in turn increasing public spending to mitigate the negative effects. In line with the government's wishes, the US central bank should now, despite the inflationary effect of the tariff policy, cut interest rates to support growth – and reduce the attractiveness of the US dollar.

If other measures also damage the institutional framework of the United States, the US dollar risks losing its status as a safe haven. If the ‘most expensive dollar’ since 1986 loses its demand, a fall is to be feared. The booming price of gold and the success of cryptocurrencies are already clear warning signs. It is extremely uncertain whether President Trump will consistently pursue this risky trade policy path. For investment portfolios, however, this means that the US dollar position needs to be reviewed. In global equities, the share has risen from 40% to 66% over the past 14 years. Increased use of euro-hedged strategies can help reduce dollar risk.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.