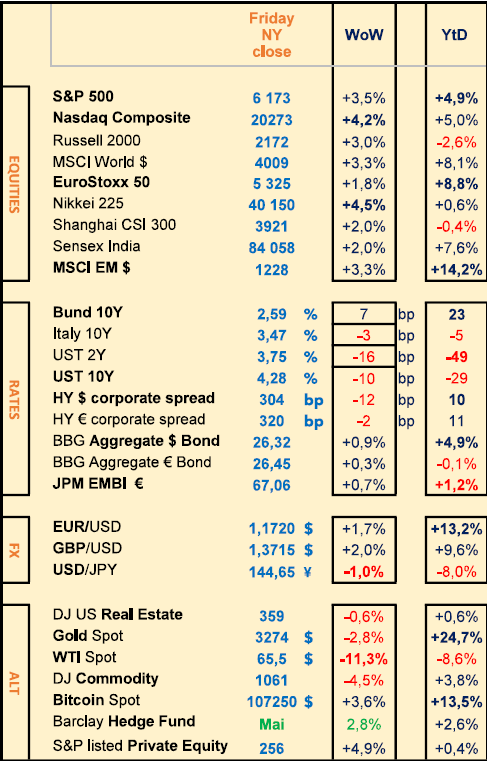

Last week: Risk-On (Nasdaq +4%, Bond yields & spreads lower) US-China trade talks, Middle East ceasefire, Oil price lower

WEEKLY TRENDS

WEEKLY TRENDS

- FED officials dovish comments, added to a Middle East cease fire, plus an almost US-China trade done deal, together with a no more US ‘revenge tax’ section 899 for foreign investors, made Bonds rally across the curve last week with the shorter end outperforming the longer end

- On stocks, the Mag7 dominated the price action (WoW +4% vs +2% for the SP500 excl. Mag7). EM stocks are outperforming too, standing at a 3yr high (+14% YTD vs +5% for the Nasdaq and EU50 at +9%). Note that the SP500 bounced back from April lows (7th April) with an amazing +24%.

- Oil price tumbled last Monday as US avoided attacking Iran energy infrastructures (WoW -11% for the WTI)

- The USD is weaker following some FED officials dovish comments last week (Bowman and Goolsbee) and also due to Trump’s declaring once more that he wants to replace J. Powell as soon as possible, and earlier than planned.

MARKETS

Equities

Important weekly performances:

Nike (+20%, restructuring), Air France (+14%, Middle-East cease fire)

Worldline (-28%, ’dirty payments’ enquiry), OVH (-20%, poor earnings)

Analysts:

Essilor-Luxottica (JPM ‘o/w’ target €267), Holcim (MS ‘o/w’ target CHF55)

Airbus (DB ‘buy’ target €185), UBS (MS ‘u/w’ target CHF26)

Rates

US curve (2-10 years) steepening slightly higher at 53bps (Bond yields lower across the board)

HY corporate spreads stable at 305-320 bps (US/EU)

Commodities

Oil price much lower (-11%) due to Middle East cease fire

Gold price lower (-3%) despite a weaker USD

US

May PCE at 2.3% (Core PCE at 2.7% vs 2.6% expected and 2.5% prior)

Crypto

Risk-On benefitted all Cryptos (BTC +3.5%, ETH +10%, SOL +7.5%, BNB +4.5% and XRP +3.5%)

Under the watch

Platinum price continued to perform (40% this month only, at 2015 highs )

Nota Bene

SP500 rebound, since April 7th, the 24% rebound of the SP500 is mostly due to the IT sector (+41%) Communication services (28%) Industrials (+26%) Consumer Discretionary (+25%) while the Consumer staples sector returned 6% and Health care +1% during the period

CALENDAR

Macro Data releases:

US June job report NFP (3rd July)

Upcoming CB meetings:

ECB 24 July

FOMC/FED 30 July

BOJ 31 July

BOE 7 Aug

WHAT ANALYSTS SAY

Goldman Sachs Asset Management, 27 June 2025

Author: GS Global Investment Research - GIR

Key takeaways:

As the US Congress struggles to pass a legislative package on taxation and spending, many investors are once again expressing concerns about the sustainability of US fiscal policy.

Our colleagues in the GIR division predict that the deficit will continue to grow, reaching 7% of GDP in 2034.

Given that neither political party has clearly stated its commitment to fiscal consolidation, concerns about the US fiscal trajectory are likely to persist.

This could translate into higher risk premiums and bond yields.

Nevertheless, we see potential opportunities in active duration management and safe-haven assets outside the United States, which can serve as a hedge against debt sustainability risks.

Annual US federal deficit as a percentage of GDP:

Equities

Important weekly performances:

Nike (+20%, restructuring), Air France (+14%, Middle-East cease fire)

Worldline (-28%, ’dirty payments’ enquiry), OVH (-20%, poor earnings)

Analysts:

Essilor-Luxottica (JPM ‘o/w’ target €267), Holcim (MS ‘o/w’ target CHF55)

Airbus (DB ‘buy’ target €185), UBS (MS ‘u/w’ target CHF26)

Rates

US curve (2-10 years) steepening slightly higher at 53bps (Bond yields lower across the board)

HY corporate spreads stable at 305-320 bps (US/EU)

Commodities

Oil price much lower (-11%) due to Middle East cease fire

Gold price lower (-3%) despite a weaker USD

US

May PCE at 2.3% (Core PCE at 2.7% vs 2.6% expected and 2.5% prior)

Crypto

Risk-On benefitted all Cryptos (BTC +3.5%, ETH +10%, SOL +7.5%, BNB +4.5% and XRP +3.5%)

Under the watch

Platinum price continued to perform (40% this month only, at 2015 highs )

Nota Bene

SP500 rebound, since April 7th, the 24% rebound of the SP500 is mostly due to the IT sector (+41%) Communication services (28%) Industrials (+26%) Consumer Discretionary (+25%) while the Consumer staples sector returned 6% and Health care +1% during the period

CALENDAR

Macro Data releases:

US June job report NFP (3rd July)

Upcoming CB meetings:

ECB 24 July

FOMC/FED 30 July

BOJ 31 July

BOE 7 Aug

WHAT ANALYSTS SAY

- Goldman Sachs: The growing weight of US debt: risk or opportunity?

- JP Morgan: The market is too complacent about the risk of US inflation

- Vontobel: Rising debt relative to GDP, declining confidence, erratic trade policy point to a prolonged decline in the USD

Goldman Sachs Asset Management, 27 June 2025

Author: GS Global Investment Research - GIR

Key takeaways:

As the US Congress struggles to pass a legislative package on taxation and spending, many investors are once again expressing concerns about the sustainability of US fiscal policy.

Our colleagues in the GIR division predict that the deficit will continue to grow, reaching 7% of GDP in 2034.

Given that neither political party has clearly stated its commitment to fiscal consolidation, concerns about the US fiscal trajectory are likely to persist.

This could translate into higher risk premiums and bond yields.

Nevertheless, we see potential opportunities in active duration management and safe-haven assets outside the United States, which can serve as a hedge against debt sustainability risks.

Annual US federal deficit as a percentage of GDP:

JP Morgan, 25 June 2025

Author: Karen Ward, JP Morgan Asset Management, Chief Market Strategist

We believe that the market is too complacent about the risk of inflation. It seems to me that the best reference point for this environment is the year 2022. We are witnessing a supply shock and potential disruptions to supply chains in a context of fiscal stimulus. The events of 2022 showed us that lower supply combined with higher demand leads to higher prices. The market believes that inflation will decline, but I am not convinced, especially when we also take into account tariffs, fiscal policy and immigration restrictions. The rise in inflation will be slower and less pronounced than in 2022, but it is likely to occur. This is the current risk for the market, both for equities and bonds.

The rebound shows us that the market believes that the Trump administration's most disruptive economic policies are a thing of the past and that future decisions will have more limited effects. The markets may be right, but perhaps not. We recommend remaining cautious and taking into account the risks that will weigh on the US economy between now and the end of the year, particularly inflation but also a slowdown. We recommend a very different portfolio today. Investors need to make different management decisions.

A portfolio should always include some protection. Today, a resilient portfolio that can weather a storm is different from what it was before the pandemic, for example. Back then, when there was no inflation, investors could rely on equities and bonds. In any case, they could only win. In a scenario of strong economic growth, equities appreciated. In a brief recession, bonds rose. Today, a new shock is emerging: the return of inflation. This is likely to lead to a decline in both equities and bonds. We can learn from the events of 2022 and invest in real assets such as infrastructure, transport-related assets and timber. Investors may also want to consider gold and commodities, as well as macro hedge funds. It is more difficult to build a resilient portfolio today because the risk of inflation is higher than in the past and it is difficult to protect against it.

Value stocks in Europe have been one of our key convictions since last autumn. In fact, markets fluctuate in response to new information and insights. Expectations were so high for the United States that it seemed difficult to raise them any further. On the other hand, expectations were so low in Europe that positive surprises seemed logical. The idea of increasing interest in Europe was also based on extremely attractive valuations. European equities are outperforming this year and should continue to do so. The discount relative to US equities remains significant.

European equities top the list of unreasonably cheap stocks. While some assets are cheap for good reasons, European stocks are trading at a record and unjustified discount to their US counterparts in the context of Europe's recovery. Emerging markets are also attractive, but to a lesser extent than European stocks, because they face headwinds in the short term.

Some stocks can perform well with both a six-month and a 24-month horizon. I am thinking of geographical diversification and the resilience of European stocks. Investing in high-dividend stocks is also an appropriate response. Looking ahead 24 months, I am constructive on equities. Despite political uncertainties, there are a number of positive developments in Europe, with greater fiscal integration and progress towards capital markets union. It is always very difficult to be negative two years out.

Vontobel, 25 June 2025

Author: Stefan Eppenberger, Head of Multi Asset Strategy

Once again, a Republican president is in the White House, and he has openly expressed a preference for a weaker dollar.

From a purchasing power parity (PPP) perspective, the dollar appears to be overvalued, which has historically often preceded episodes of devaluation.

The US economy is facing significant trade imbalances: the goods and services deficit stands at $140.5 billion. Although this deficit is not as large as it was during the previous dollar bear market in 2006 (when it represented 5.4% of gross domestic product (GDP)), it still amounted to 3.1% of GDP in 2024 and widened to 3.4% in the first quarter of 2025. A weaker dollar could help rebalance the United States' foreign trade by making American exports cheaper for foreign buyers and imports more expensive for American consumers.

The federal budget deficit is estimated at $1.1 trillion for the first seven months of fiscal year 2025, which is $196 billion more than for the same period last year. This fiscal deficit represented 6.9% of GDP in 2024 and is expected to widen further with Donald Trump's proposed tax cuts, putting public debt on a clearly unsustainable path. Combined with high nominal interest rates, this means that the United States now spends more on servicing its debt than on defence – a situation that is difficult to sustain.

There are growing signs that the era of exceptional US growth, to which we have become accustomed, particularly since the Covid-19 pandemic, may be coming to an end. This is partly due to President Trump's political approach, which has disrupted consumer and business confidence in the US, and partly to other country-specific factors (such as the unexpected reform of the debt brake in Germany). According to a Bloomberg survey, economists have significantly lowered their forecasts for US GDP growth. A relative slowdown in US growth could prompt the Fed to cut interest rates further than other central banks, thereby reducing the dollar's yield advantage.

Trump's ‘maximum pressure’ policy on trade and foreign affairs has dampened investor sentiment towards the United States, leading to capital outflows from dollar-denominated assets and contributing to the weakening of the dollar.

The strength of American institutions has underpinned the dollar's role as the global reserve currency for decades. But recent unpredictability in trade policy and President Trump's questioning of the Fed's monetary policy independence have eroded this long-standing confidence. And this at the worst possible moment: the trajectory of US public debt appears to be unsustainable, while a bipartisan consensus seems to be ignoring this risk. The markets did not need to doubt, on top of that, the Fed's ability and willingness to maintain price stability without yielding to the Treasury (fiscal dominance) by monetising public debt through inflation. In other words, although the Fed can still maintain higher nominal interest rates than most other developed central banks, its real policy rate (adjusted for expected inflation) seems much less attractive. Indeed, the tariff shock is inflationary for the United States, but disinflationary for the rest of the world. And not just via the exchange rate: the decline in US imports will likely lead to an oversupply of durable goods in the rest of the world and thus a decline in the prices of certain tradable goods. Although we believe that a bear market for the dollar is likely, certain factors could temporarily call this scenario into question. Even though the dollar's safe-haven appeal has lost some of its lustre, the USD could regain its appeal, if the Fed adopts an overly restrictive stance or in the event of a deep recession.

Author: Karen Ward, JP Morgan Asset Management, Chief Market Strategist

We believe that the market is too complacent about the risk of inflation. It seems to me that the best reference point for this environment is the year 2022. We are witnessing a supply shock and potential disruptions to supply chains in a context of fiscal stimulus. The events of 2022 showed us that lower supply combined with higher demand leads to higher prices. The market believes that inflation will decline, but I am not convinced, especially when we also take into account tariffs, fiscal policy and immigration restrictions. The rise in inflation will be slower and less pronounced than in 2022, but it is likely to occur. This is the current risk for the market, both for equities and bonds.

The rebound shows us that the market believes that the Trump administration's most disruptive economic policies are a thing of the past and that future decisions will have more limited effects. The markets may be right, but perhaps not. We recommend remaining cautious and taking into account the risks that will weigh on the US economy between now and the end of the year, particularly inflation but also a slowdown. We recommend a very different portfolio today. Investors need to make different management decisions.

A portfolio should always include some protection. Today, a resilient portfolio that can weather a storm is different from what it was before the pandemic, for example. Back then, when there was no inflation, investors could rely on equities and bonds. In any case, they could only win. In a scenario of strong economic growth, equities appreciated. In a brief recession, bonds rose. Today, a new shock is emerging: the return of inflation. This is likely to lead to a decline in both equities and bonds. We can learn from the events of 2022 and invest in real assets such as infrastructure, transport-related assets and timber. Investors may also want to consider gold and commodities, as well as macro hedge funds. It is more difficult to build a resilient portfolio today because the risk of inflation is higher than in the past and it is difficult to protect against it.

Value stocks in Europe have been one of our key convictions since last autumn. In fact, markets fluctuate in response to new information and insights. Expectations were so high for the United States that it seemed difficult to raise them any further. On the other hand, expectations were so low in Europe that positive surprises seemed logical. The idea of increasing interest in Europe was also based on extremely attractive valuations. European equities are outperforming this year and should continue to do so. The discount relative to US equities remains significant.

European equities top the list of unreasonably cheap stocks. While some assets are cheap for good reasons, European stocks are trading at a record and unjustified discount to their US counterparts in the context of Europe's recovery. Emerging markets are also attractive, but to a lesser extent than European stocks, because they face headwinds in the short term.

Some stocks can perform well with both a six-month and a 24-month horizon. I am thinking of geographical diversification and the resilience of European stocks. Investing in high-dividend stocks is also an appropriate response. Looking ahead 24 months, I am constructive on equities. Despite political uncertainties, there are a number of positive developments in Europe, with greater fiscal integration and progress towards capital markets union. It is always very difficult to be negative two years out.

Vontobel, 25 June 2025

Author: Stefan Eppenberger, Head of Multi Asset Strategy

Once again, a Republican president is in the White House, and he has openly expressed a preference for a weaker dollar.

From a purchasing power parity (PPP) perspective, the dollar appears to be overvalued, which has historically often preceded episodes of devaluation.

The US economy is facing significant trade imbalances: the goods and services deficit stands at $140.5 billion. Although this deficit is not as large as it was during the previous dollar bear market in 2006 (when it represented 5.4% of gross domestic product (GDP)), it still amounted to 3.1% of GDP in 2024 and widened to 3.4% in the first quarter of 2025. A weaker dollar could help rebalance the United States' foreign trade by making American exports cheaper for foreign buyers and imports more expensive for American consumers.

The federal budget deficit is estimated at $1.1 trillion for the first seven months of fiscal year 2025, which is $196 billion more than for the same period last year. This fiscal deficit represented 6.9% of GDP in 2024 and is expected to widen further with Donald Trump's proposed tax cuts, putting public debt on a clearly unsustainable path. Combined with high nominal interest rates, this means that the United States now spends more on servicing its debt than on defence – a situation that is difficult to sustain.

There are growing signs that the era of exceptional US growth, to which we have become accustomed, particularly since the Covid-19 pandemic, may be coming to an end. This is partly due to President Trump's political approach, which has disrupted consumer and business confidence in the US, and partly to other country-specific factors (such as the unexpected reform of the debt brake in Germany). According to a Bloomberg survey, economists have significantly lowered their forecasts for US GDP growth. A relative slowdown in US growth could prompt the Fed to cut interest rates further than other central banks, thereby reducing the dollar's yield advantage.

Trump's ‘maximum pressure’ policy on trade and foreign affairs has dampened investor sentiment towards the United States, leading to capital outflows from dollar-denominated assets and contributing to the weakening of the dollar.

The strength of American institutions has underpinned the dollar's role as the global reserve currency for decades. But recent unpredictability in trade policy and President Trump's questioning of the Fed's monetary policy independence have eroded this long-standing confidence. And this at the worst possible moment: the trajectory of US public debt appears to be unsustainable, while a bipartisan consensus seems to be ignoring this risk. The markets did not need to doubt, on top of that, the Fed's ability and willingness to maintain price stability without yielding to the Treasury (fiscal dominance) by monetising public debt through inflation. In other words, although the Fed can still maintain higher nominal interest rates than most other developed central banks, its real policy rate (adjusted for expected inflation) seems much less attractive. Indeed, the tariff shock is inflationary for the United States, but disinflationary for the rest of the world. And not just via the exchange rate: the decline in US imports will likely lead to an oversupply of durable goods in the rest of the world and thus a decline in the prices of certain tradable goods. Although we believe that a bear market for the dollar is likely, certain factors could temporarily call this scenario into question. Even though the dollar's safe-haven appeal has lost some of its lustre, the USD could regain its appeal, if the Fed adopts an overly restrictive stance or in the event of a deep recession.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.