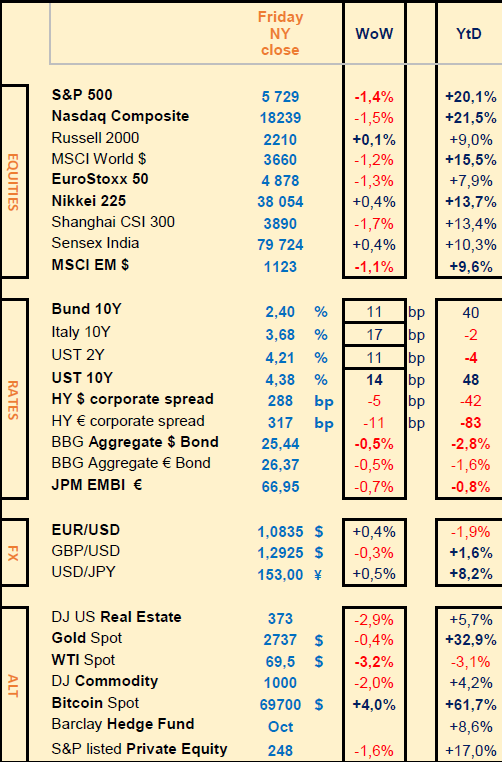

Growth stocks lagged vs Value and Small caps stocks, bond yields rose by 10 to 15bps on slightly higher US/EU inflation

WEEKLY TRENDS

WEEKLY TRENDS

- Ahead of the Nov 5 US presidential election and the Nov 7 FED decision, 170 companies included in the SP500 reported their Q3 earnings last week, with investors remaining focused on the Mag5 quarterly results (Google/Alphabet, Amazon, Microsoft, Meta and Apple). Their earnings beat expectations but the combination of capex spent on AI and reserved outlook caused most shares to decline with the exception of Google and Amazon

- Over last week, the Growth shares lagged Value shares and small caps

- On the macro economic front, BOJ did not change its rates last week amid political uncertainty, the US and EU inflation came slightly higher than expected

- Note that Oil declined after Israel purposely avoided to strike Iran’s oil infrastructures

MARKETS

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Google/Alphabet (+1%), Amazon (+4%), Intel (+2%), Shell (+3%), French SG (+15%), Airbus (+0.5%), Glencore (+0.5%), while Reddit (+39%) and Paycom (+28%)

- - - Meta (-2%), Apple (-4%), Microsoft (-5%), AMD (-10%), Eli Lilly (-8%), Philips (-6%), BP (-5%), Total (-3%), Linde (-4%), UBS (-3%), VW (-5%), Novartis (-3%), Estée Lauder (-24%), Crocs (-20%), Robinhood (-11%)

NB: Super Micro Computer (-45%) on E&Y’s refusal to audit the firm going forward due to ethical issues with the Management; HSBC announced a $3bn share buyback programme

Rates

US curve (2-10 years) steepening, remained at 15bps or so. US 10yr yield ended the week at 4.38%, the highest level since early July (after poor US Treasuries auctions last week). Markets expect a 25bps FED cut on Nov 7 (-40bps by yearend and -70bps cuts in 2025)

Commodities

Oil is down after Israel avoided to strike Iran’s oil infrastructures (NB: US weekly inventories declined by 0.5m barrels vs +1.5m expected)

US

PCE inflation in Sep (+0.3% vs +0.2% prior, revised from +0.1%)

NFP job creation in Oct at +12k vs +100k expected, vs +223k prior (due to strikes and storms) Sep was revised down by 31k and August by 81k

EU

Inflation rose to 2% in Oct from 1.7% prior and 1.9% expected (Core CPI at 2.7% vs 2.6% expected)

EM

BRICS new partners: Algeria, Belarus, Bolivia, Cuba, Kazakhstan, Nigeria, Turkey, Uganda, Uzbekistan, Malaysia, Indonesia, Vietnam, Thailand

Nota Bene

Nvidia will replace Intel in the DJ index on Nov 8; US Federal debt hit another record of $35.8trn ($23bn a day); US net interest payments are to reach a record 4.6% of GDP in 2025

CALENDAR

WHAT ANALYSTS SAY

World Gold Council, 30 October 2024 - Gold demand trends Q3 2024

Value of gold demand rockets with price

ETF and OTC investment flows buoy total demand

Total gold demand (inclusive of OTC investment) gained 5% y/y to 1,313t – a record for a third quarter. This strength was reflected in the gold price, which reached a series of new record highs during the quarter. The value of demand jumped 35% y/y to exceed US$100bn for the first time ever.

Global gold ETF inflows (95t) were a major driver of growth; Q3 was the first positive quarter since Q1’22, with a y/y swing from hefty (-139t) Q3’23 outflows.

Bar and coin investment (269t) was down 9% y/y, from a relatively strong Q3’23. Much of the decline was specific to two or three key markets, counterbalanced by a very strong quarter in India.

Gold jewellery consumption (459t) sank 12% y/y despite strong growth in India. Although consumers bought reduced quantities, their spend on gold jewellery increased: the value of demand jumped 13% y/y to more than US$36bn.

The pace of central bank buying (186t) slowed in Q3, but y-t-d buying is in line with 2022 and remains widespread.

AI continued to support the use of gold in technology (83t); it grew 7% y/y albeit from a fairly low base and the outlook remains cautious.

Highlights:

The LBMA (PM) gold price continued to breach successive record highs during Q3. The average price for the quarter was 28% higher y/y at a record US$2,474/oz.

OTC investment almost doubled y/y to 137t. This was the seventh consecutive quarter in which OTC investment has been positive for gold demand and remains a notable component of the market.

Total gold supply grew by 5% y/y to a record 1,313t. Mine production grew 6% y/y to another quarterly record and y-t-d output has eclipsed the 2018 prior high. Recycled gold volumes rose 11% y/y, but widespread distress selling is not yet in evidence.

Investment flows were key to gold’s performance in Q3.

Falling interest rates, geopolitical uncertainty, portfolio diversification and momentum buying were among the key drivers.

2024 full year outlook:

resurgent professional flows combined with solid bar and coin investment will offset weaker consumer demand and slower central bank buying.

UBS, 28 October 2024 - Are semis a good way to gain AI exposure?

Authors: Sundeep Gantori, Equity Strategist ; Jon Gordon, Strategist

After a sell-off in early August, tech shares have bounced back and volatility has eased. We view the US IT sector as Attractive given its still-promising fundamentals. But there are near-term risks around cyclical tech revenues and US-China tech curbs. The next steps for investors depend on their relative technology and AI exposure within individual portfolios.

Semiconductor stocks came under pressure as part of a broader tech correction in early August:

• From its 10 July high to its 5 August intra-session low, the Philadelphia Semiconductor Index fell as much as 21% in a rapid unwinding of long semi positions.

• Other global tech stocks were sold too, with the MSCI AC World Technology Index falling as much as 16% over this period.

• An unwinding of crowded carry trades, mixed second quarter earnings, and systematic selling weighed on popular semiconductor companies, in particular.

Although AI beneficiaries have rebounded, risks remain:

• The Nasdaq, NYSE FANG+ and Philadelphia Semi indices have seen choppy trade since their 7 August lows, but are up 14.3%, 16.9%, and 17.7% respectively, as of 25 October.

• Mixed signals on consumer tech demand and rumors over delayed 2nm adoption have chipped into broader tech sentiment.

• Incoming news on capex demand, AI monetization, or export controls could stir up renewed volatility.

Investors should therefore prepare for tech volatility and craft a portfolio-specific plan:

• Any undue correction in quality tech stocks should be a good buying opportunity, as we still expect mid-teen earnings growth for global tech in 2025.

• Investors with low AI exposure currently may use structured strategies to build up long-term exposure, while investors with high exposure may consider capital preservation strategies.

BlackRock, 28 October 2024 - Seizing on fixed income swings

Authors: Wel Li, Global Chief Investment Strategist; Simon Blundell, Head of European Fundamental Fixed Income

Recent swings in fixed income markets reinforce our preference for quality and income. U.S. high yield spreads narrowed to near their tightest in 17 years as short-dated U.S. Treasury yields surged on markets pricing out Federal Reserve rate cuts. We prefer taking risk in equities from a whole portfolio perspective, yet we see investment opportunities in fixed income – like UK gilts over U.S. Treasuries. In credit, we favor short over long maturities and Europe over the U.S.

Inflation will keep the Fed from cutting as much as markets expect, in our view. Services inflation has proved sticky, with wage growth running hot enough that core inflation is unlikely to cool to the Fed’s 2% target. U.S. budget deficits look set to stay large regardless of who wins the U.S. presidential election, with neither candidate prioritizing a reduction. Longer term, we see mega forces – structural shifts impacting returns now and in the future – keeping inflation persistent. Higher inflation is why we’ve been expecting investors to demand significantly more term premium, or additional compensation for the risk of holding longer-dated bonds. We’re seeing early signs of this: Term premium on U.S. 10-year Treasury yields now sits near 20 basis points, having jumped around 45 basis points in the past month alone.

Over the long term, we think term premium can rise further. Near term, shifting narratives can cause bouts of volatility and sharp yield swings in either direction, as seen recently. We favor international long-dated government bondsover U.S. long Treasuries, where we stay neutral.In the U.S., we prefer intermediate maturities that offer attractive income with less interest rate risk. We stay underweight short-dated U.S. Treasuries on a near-term tactical horizon. We prefer UK gilts and recently went overweight. UK bond markets await this week’s UK budget announcement, the first since Labour’s victory in the July election. Markets are pricing in some chance of a repeat of the 2022 mini-budget disaster – an outcome we see as unlikely.

Our preference for European over U.S. fixed income extends to credit. U.S. high yield spreads are rich relative to the euro area, especially given a weaker ratings profile in the U.S. Adjusting for ratings quality, European high yield is about 60 basis points cheaper than U.S. high yield. We think euro area high yield and investment grade credit better compensate investors for risk than their U.S. counterparts. Tight U.S. credit spreads are largely due to strong investor demand for new issues outstripping supply, resilient corporate balance sheets and strong macro data snuffing out lingering recession fears.

Bottom line:

Macro uncertainty is driving sharp interest rate swings, making long-dated government bonds less reliable portfolio diversifiers. Yet such swings and the return of total income in bonds creates investment opportunities we seize on.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Google/Alphabet (+1%), Amazon (+4%), Intel (+2%), Shell (+3%), French SG (+15%), Airbus (+0.5%), Glencore (+0.5%), while Reddit (+39%) and Paycom (+28%)

- - - Meta (-2%), Apple (-4%), Microsoft (-5%), AMD (-10%), Eli Lilly (-8%), Philips (-6%), BP (-5%), Total (-3%), Linde (-4%), UBS (-3%), VW (-5%), Novartis (-3%), Estée Lauder (-24%), Crocs (-20%), Robinhood (-11%)

NB: Super Micro Computer (-45%) on E&Y’s refusal to audit the firm going forward due to ethical issues with the Management; HSBC announced a $3bn share buyback programme

Rates

US curve (2-10 years) steepening, remained at 15bps or so. US 10yr yield ended the week at 4.38%, the highest level since early July (after poor US Treasuries auctions last week). Markets expect a 25bps FED cut on Nov 7 (-40bps by yearend and -70bps cuts in 2025)

Commodities

Oil is down after Israel avoided to strike Iran’s oil infrastructures (NB: US weekly inventories declined by 0.5m barrels vs +1.5m expected)

US

PCE inflation in Sep (+0.3% vs +0.2% prior, revised from +0.1%)

NFP job creation in Oct at +12k vs +100k expected, vs +223k prior (due to strikes and storms) Sep was revised down by 31k and August by 81k

EU

Inflation rose to 2% in Oct from 1.7% prior and 1.9% expected (Core CPI at 2.7% vs 2.6% expected)

EM

BRICS new partners: Algeria, Belarus, Bolivia, Cuba, Kazakhstan, Nigeria, Turkey, Uganda, Uzbekistan, Malaysia, Indonesia, Vietnam, Thailand

Nota Bene

Nvidia will replace Intel in the DJ index on Nov 8; US Federal debt hit another record of $35.8trn ($23bn a day); US net interest payments are to reach a record 4.6% of GDP in 2025

CALENDAR

- Corporate earnings: US Berkshire Hathaway, Palantir (4 Nov), Qualcomm (6), Airbnb (7); Europe Bayer (5 Nov), Novo Nordisk, ARM, Enel, Unicredit, BMW (6), Zurich Ins, Engie (7), Richemont (8)

- Macro: China Caixin Oct PMI (5 Nov); US Oct ISM Services (5 Nov) and PMI (6 Nov)

- Monetary policy decisions 7 Nov: MPC / BOE (-25bps expected); FOMC / FED (-25bps expected)

WHAT ANALYSTS SAY

- World Gold Council - Gold demand trends, Q3 2024

- UBS - Are semis a good way to gain AI exposure?

- BlackRock - Seizing on fixed income swings

World Gold Council, 30 October 2024 - Gold demand trends Q3 2024

Value of gold demand rockets with price

ETF and OTC investment flows buoy total demand

Total gold demand (inclusive of OTC investment) gained 5% y/y to 1,313t – a record for a third quarter. This strength was reflected in the gold price, which reached a series of new record highs during the quarter. The value of demand jumped 35% y/y to exceed US$100bn for the first time ever.

Global gold ETF inflows (95t) were a major driver of growth; Q3 was the first positive quarter since Q1’22, with a y/y swing from hefty (-139t) Q3’23 outflows.

Bar and coin investment (269t) was down 9% y/y, from a relatively strong Q3’23. Much of the decline was specific to two or three key markets, counterbalanced by a very strong quarter in India.

Gold jewellery consumption (459t) sank 12% y/y despite strong growth in India. Although consumers bought reduced quantities, their spend on gold jewellery increased: the value of demand jumped 13% y/y to more than US$36bn.

The pace of central bank buying (186t) slowed in Q3, but y-t-d buying is in line with 2022 and remains widespread.

AI continued to support the use of gold in technology (83t); it grew 7% y/y albeit from a fairly low base and the outlook remains cautious.

Highlights:

The LBMA (PM) gold price continued to breach successive record highs during Q3. The average price for the quarter was 28% higher y/y at a record US$2,474/oz.

OTC investment almost doubled y/y to 137t. This was the seventh consecutive quarter in which OTC investment has been positive for gold demand and remains a notable component of the market.

Total gold supply grew by 5% y/y to a record 1,313t. Mine production grew 6% y/y to another quarterly record and y-t-d output has eclipsed the 2018 prior high. Recycled gold volumes rose 11% y/y, but widespread distress selling is not yet in evidence.

Investment flows were key to gold’s performance in Q3.

Falling interest rates, geopolitical uncertainty, portfolio diversification and momentum buying were among the key drivers.

2024 full year outlook:

resurgent professional flows combined with solid bar and coin investment will offset weaker consumer demand and slower central bank buying.

UBS, 28 October 2024 - Are semis a good way to gain AI exposure?

Authors: Sundeep Gantori, Equity Strategist ; Jon Gordon, Strategist

After a sell-off in early August, tech shares have bounced back and volatility has eased. We view the US IT sector as Attractive given its still-promising fundamentals. But there are near-term risks around cyclical tech revenues and US-China tech curbs. The next steps for investors depend on their relative technology and AI exposure within individual portfolios.

Semiconductor stocks came under pressure as part of a broader tech correction in early August:

• From its 10 July high to its 5 August intra-session low, the Philadelphia Semiconductor Index fell as much as 21% in a rapid unwinding of long semi positions.

• Other global tech stocks were sold too, with the MSCI AC World Technology Index falling as much as 16% over this period.

• An unwinding of crowded carry trades, mixed second quarter earnings, and systematic selling weighed on popular semiconductor companies, in particular.

Although AI beneficiaries have rebounded, risks remain:

• The Nasdaq, NYSE FANG+ and Philadelphia Semi indices have seen choppy trade since their 7 August lows, but are up 14.3%, 16.9%, and 17.7% respectively, as of 25 October.

• Mixed signals on consumer tech demand and rumors over delayed 2nm adoption have chipped into broader tech sentiment.

• Incoming news on capex demand, AI monetization, or export controls could stir up renewed volatility.

Investors should therefore prepare for tech volatility and craft a portfolio-specific plan:

• Any undue correction in quality tech stocks should be a good buying opportunity, as we still expect mid-teen earnings growth for global tech in 2025.

• Investors with low AI exposure currently may use structured strategies to build up long-term exposure, while investors with high exposure may consider capital preservation strategies.

BlackRock, 28 October 2024 - Seizing on fixed income swings

Authors: Wel Li, Global Chief Investment Strategist; Simon Blundell, Head of European Fundamental Fixed Income

Recent swings in fixed income markets reinforce our preference for quality and income. U.S. high yield spreads narrowed to near their tightest in 17 years as short-dated U.S. Treasury yields surged on markets pricing out Federal Reserve rate cuts. We prefer taking risk in equities from a whole portfolio perspective, yet we see investment opportunities in fixed income – like UK gilts over U.S. Treasuries. In credit, we favor short over long maturities and Europe over the U.S.

Inflation will keep the Fed from cutting as much as markets expect, in our view. Services inflation has proved sticky, with wage growth running hot enough that core inflation is unlikely to cool to the Fed’s 2% target. U.S. budget deficits look set to stay large regardless of who wins the U.S. presidential election, with neither candidate prioritizing a reduction. Longer term, we see mega forces – structural shifts impacting returns now and in the future – keeping inflation persistent. Higher inflation is why we’ve been expecting investors to demand significantly more term premium, or additional compensation for the risk of holding longer-dated bonds. We’re seeing early signs of this: Term premium on U.S. 10-year Treasury yields now sits near 20 basis points, having jumped around 45 basis points in the past month alone.

Over the long term, we think term premium can rise further. Near term, shifting narratives can cause bouts of volatility and sharp yield swings in either direction, as seen recently. We favor international long-dated government bondsover U.S. long Treasuries, where we stay neutral.In the U.S., we prefer intermediate maturities that offer attractive income with less interest rate risk. We stay underweight short-dated U.S. Treasuries on a near-term tactical horizon. We prefer UK gilts and recently went overweight. UK bond markets await this week’s UK budget announcement, the first since Labour’s victory in the July election. Markets are pricing in some chance of a repeat of the 2022 mini-budget disaster – an outcome we see as unlikely.

Our preference for European over U.S. fixed income extends to credit. U.S. high yield spreads are rich relative to the euro area, especially given a weaker ratings profile in the U.S. Adjusting for ratings quality, European high yield is about 60 basis points cheaper than U.S. high yield. We think euro area high yield and investment grade credit better compensate investors for risk than their U.S. counterparts. Tight U.S. credit spreads are largely due to strong investor demand for new issues outstripping supply, resilient corporate balance sheets and strong macro data snuffing out lingering recession fears.

Bottom line:

Macro uncertainty is driving sharp interest rate swings, making long-dated government bonds less reliable portfolio diversifiers. Yet such swings and the return of total income in bonds creates investment opportunities we seize on.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.