Last week : Hell of a week, the US Bond market called the final shot and put pressure on Trump to have a 90 day pause

WEEKLY TRENDS

WEEKLY TRENDS

- Like Liz Truss in Oct 2022, Donald Trump capitulated on Bond market furry last Wednesday, providing a 90 day reprieve for most countries to negotiate before the new tariffs become effective, with the exception of China that remains on a tit for tat trade war with the US. Trump’s peculiar fiscal policies managed to rattle the ultimate ‘risk free’ US Treasury bond market of which 30% are held by foreigners who collectively allow the US to run its large fiscal deficit and fuel a consumption driven economy

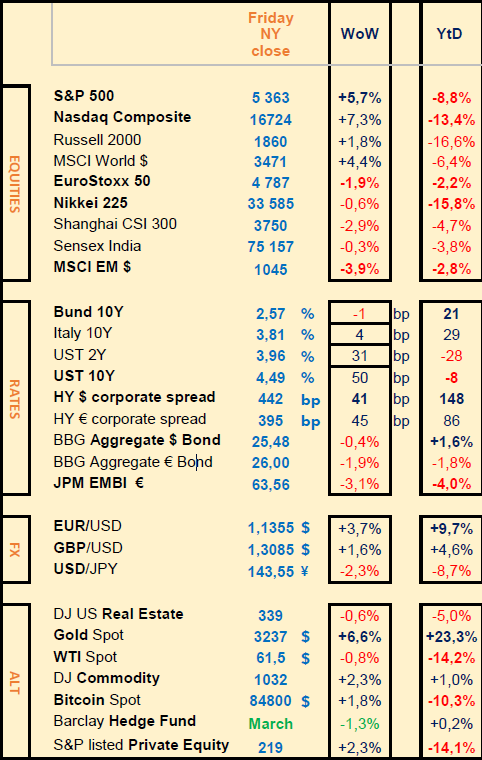

- The 10yr UST yield rose by 50bps and the 2yr yield rose by 30bps (the US bond market literally delivered a vote of no confidence in Trump)

- The stock market relief rally that followed Trump’s decision on Wednesday was unprecedented (SP500 rose by 9.5%, the 3rd biggest 1 day gain since 1950). Gold continued to benefit from a stagflation outlook and a weaker USD

- Focus remains on the fragile Bond market

MARKETS

Equities

Jamie Dimon (JP Morgan’s CEO): the economy is facing considerable turbulence (incl. geopolitics) with potential positives (tax reform and deregulation) potential negative (tariffs, sticky inflation, high fiscal deficit, still rather high asset prices and volatility) summarises well the situation

Worst performers: Energy (Eni -7%, BP -5%, TotalEnergies -2%), European Pharma (Sanofi -3%, Novartis -1%, Roche -2%)

Best performers: Semiconductors (AMD +17%, Broadcom +25%)

Analysts:

Cap Gemini (GS ‘buy’ target €175); Dassault Sys (GS ’buy’ target €43); SGS (JPM ’o/w’ target CHF102); UBS (GS ’buy’ target CHF35); LSE (MS ’o/w’ target £130); LVMH (HSBC ‘buy’ target €700)

Stellantis (HSBC ’hold’ target €9); Zurich Ins (GS ’neutral’ target CHF581); Kering (DB ’hold’ target €205)

Rates

US curve (2-10 years) steepening rose by18bps to 53bps. (2yr vs 30yr rose to 109bps, the widest gap since 2020).

HY corporate spreads rose by 45bps to 400/445 bps

Commodities

Oil price down (-1%) OPEC may now look into postponing its decision to increase production (originally scheduled in May)

Gold price up (+6%) helped by a weaker USD and stagflation prospects

US

March CPI +2.4% vs 2.8% prior, PPI +2.7% vs 3.2% prior

Under the watch

FED Boston Susan Collins ‘FED is absolutely prepared to intervene to address chaotic liquidity conditions’ (FT on Friday )

Nota Bene

Italy was upgraded on Friday by S&P (from BBB to BBB+)

Trump administration exempted smartphones, computers from reciprocal tariffs (possibly under a temporary reprieve, Saturday 12 April)

CALENDAR

Monetary policy:

EU: ECB rate decision (17 April) a -25bps rate cut is expected

Q1 corporate earnings:

US GS (14 April); BofA, Citi, J&J (15); Netflix (17)

EU LVMH, Vinci (15); ASML, Rio Tinto (16), L’Oreal (17)

WHAT ANALYSTS SAY

BNPP AM, 9 April 2025

Author: Daniel Morris, Chief Market Strategist, BNP Paribas AM

If we take a step back to the end of last year and recall the expectations that were formulated at the time for the year 2025, we can see that the current evolution of growth and inflation in the United States is not so different from what was anticipated a few months ago.

We are still expecting a ‘soft landing’ scenario for this year. Even in the absence of the tariff announcements, economic growth in the US could be expected to slow in 2025.

Stagflation' is always a risk. As far as inflation is concerned, we need to make a clear distinction between, on the one hand, the momentary impact on prices caused by the imposition of customs duties, which is of the “one-off” type, i.e. a one-off increase, and, on the other hand, a long-term inflationary trend. For example, the Covid pandemic had a real inflationary impact over several quarters, due to disruptions in supply chains, staff shortages caused by the “big quit”, etc. The application of customs duties, on the other hand, would not have such an impact - it implies a rise in inflation at a given point in time, but not necessarily continuously over time.

We can no longer just talk about uncertainty regarding the application of customs duties. This is now a fact to be taken into account, with certain adjustments. Nevertheless, once again, this does not fundamentally change the inflation trajectory that we have been observing for several months. As far as the ECB is concerned, the markets are still expecting its main key rate to be cut to 2% over the course of the year.

Markets often move a little excessively when such announcements are made, but then correct themselves. In terms of substance, the investment plan announced in Germany is nonetheless very significant. It increases the long-term growth prospects for the German economy. Now, we shouldn't expect too much from this type of investment in terms of its impact on the economy. In infrastructure, for example, modernising and improving transport links is good for the economy. However, the impact of these investments is not comparable to what we might expect in emerging countries. Germany is not India, nor is it similar to countries whose economies are growing very fast. Germany already has a functioning rail network - it's all very well to modernise it, but that doesn't change the situation in the slightest. So we shouldn't expect a spectacular multiplier effect on growth in Germany and Europe.

The performance gap contrasts, of course, with the prevailing view last December that US equities would continue to perform well, or that American exceptionalism would prevail. Few would have dared to bet on Chinese and European equities at the end of last year. But that's exactly what happened - and the rebound in European equity markets is set to continue.

We are currently neutral on equities, but remain constructive over the medium term. Overall, we should bear in mind that the outlook for earnings growth remains positive for 2025. In the United States, corporate profits should grow by an average of 16% in 2025 compared with 2024. In Europe, earnings growth is expected to be around 14% this year compared with last year. In the United States, expectations for corporate profits have been revised downwards slightly - from a high level. In Europe, on the other hand, they have been revised slightly upwards - albeit from a lower level.

A growth rate in the low single digits is not bad from a historical perspective.

ODDO BHF, 8 April 2025

Author : Arthur Jurus, Head of Investment Office PWM, ODDO BHF

A ‘Mar-a-Lago Agreement’ could be the successor to Bretton Woods (1944) and the Plaza (1985). In this context, the Swiss franc and gold could benefit greatly. The tariff increases decided by the United States appear to inaugurate a monetary realignment strategy aimed at depreciating the dollar, reducing federal debt and strengthening competitiveness.

Access to the dollar and the US market will become more restricted. Bond yields have logically fallen, while equity markets have reacted strongly, reflecting the uncertainty surrounding the ability of the global system to adapt to these new rules.

Tariffs are used to negotiate the opening up of foreign markets to American products and to encourage companies to produce in the United States. Their level varies according to the trade deficit with each partner, revealing a hierarchy: strategic partners (Canada, Mexico, United Kingdom), neutral partners (EU), or opposed partners (China). Those who adjust their preferences in favour of the United States could retain access to the dollar and to American military security, for example through NATO, via a possible European rearmament in American equipment.

Another objective is to reduce the federal debt. The slowdown induced by the tariffs allows long rates to fall, reducing the cost of refinancing. A drop of 100 basis points on the US 10-year bond saves $90 billion, whereas $7,200 billion needs to be refinanced. The administration can then extend maturities, propose new forms of debt (perpetual, zero coupon), or push the Fed and foreign creditors to absorb more public debt.

The depreciation of the dollar is also at the heart of this strategy. As the world's reserve currency, the dollar is overvalued, which hurts US exporters. A monetary realignment, similar to those of 1934 or 1971, seems likely. A ‘Mar-a-Lago agreement’ could succeed Bretton Woods (1944) and the Plaza (1985), with mechanisms to force countries to reduce their dollar reserves or peg their currencies to the greenback in order to limit its fall. Against this backdrop, the Swiss franc and gold could benefit strongly. The franc would benefit from a US slowdown, inflation above 3% and an expected cut in the Fed's key interest rates. Gold would be supported by higher inflation, lower real interest rates and a change in monetary regime similar to that of 1971-1980, when its price increased 23-fold.

The Fed will be faced with a dilemma: cutting rates in the short term to support the economy, but potentially raising them in the medium term if inflation picks up again. Its credibility could be called into question, especially if it is forced to buy public debt on a massive scale, at the risk of seeing the real value of its balance sheet eroded and participating in a monetisation of the debt.

In the short term, these measures will weaken the US economy. Imported inflation will weigh on purchasing power and retailers' margins. In the run-up to the elections, the administration could counterbalance these effects by lowering energy prices, reducing standards or cutting taxes on households and businesses.

BLACKROCK, 11 April 2025

Author : BlackRock Investment Institute

The U.S. has paused newly announced tariffs for most countries for 90 days, just hours after they took effect and unleashed volatility almost on par with the biggest market shocks of the past few decades. President Donald Trump suspended the extra “reciprocal” tariffs on all countries except China, now facing tariffs of at least 145%. The 10% universal tariff remains. Trade tensions with China are deepening, and significant uncertainty remains. Yet the pause suggests that the U.S. administration is taking some account of financial risks and costs as well as a country’s willingness to engage, putting a check on a maximal stance during the negotiations.

As a result, we extend our tactical horizon back to 6 to 12 months from 3 months to dial up risk.

This is a major development, particularly in easing the near-term risk of a financial accident. Yet we need to brace for unpredictable negotiations, and the U.S. is still likely to end up with much higher tariffs than we expected a few weeks ago. We estimate the average effective tariff rate is now around 20%, even with the pause. We see three primary types of U.S. tariffs.

First, tariffs on strategic sectors to support reshoring of activity — so far, 25% levies on autos and parts, and on steel and aluminum, with sectors like lumber, semiconductors, pharmaceuticals and copper likely next.

Second, a universal 10% tariff on most imports to generate revenue and aid domestic production.

Third, country-specific tariffs on roughly 60 nations with goods trade surpluses with the U.S., intended to provide negotiating leverage to reduce imbalances.

U.S. tariffs add to inflation, and ongoing uncertainty is raising the risk of a recession.

Prolonged policy uncertainty may weigh on corporate capital spending and delay longer-term commitments. Consumer spending could be hurt by any erosion of wealth and real incomes. The dented confidence of foreign investors in the U.S. could curb their appetite for U.S. assets.

For China, we see tariffs lowering growth – and potential policy stimulus only partly offsetting that drag.

We cautiously lean into risk and shift our tactical horizon back to six to 12 months from three months.

We up equity exposure, including to U.S. and Japanese stocks.

Yet we expect ongoing volatility and potentially sharp reversals. Selectivity across sectors and securities will be key, and we are wary of chasing momentum.

We see opportunities in U.S. technology and global banks, especially European, hurt by the broad-based selloff.

Long-term U.S. Treasuries have failed to offer ballast during the stock selloff against a backdrop of persistent budget deficits and sticky inflation.

We favor gold as a portfolio diversifier.

Equities

Jamie Dimon (JP Morgan’s CEO): the economy is facing considerable turbulence (incl. geopolitics) with potential positives (tax reform and deregulation) potential negative (tariffs, sticky inflation, high fiscal deficit, still rather high asset prices and volatility) summarises well the situation

Worst performers: Energy (Eni -7%, BP -5%, TotalEnergies -2%), European Pharma (Sanofi -3%, Novartis -1%, Roche -2%)

Best performers: Semiconductors (AMD +17%, Broadcom +25%)

Analysts:

Cap Gemini (GS ‘buy’ target €175); Dassault Sys (GS ’buy’ target €43); SGS (JPM ’o/w’ target CHF102); UBS (GS ’buy’ target CHF35); LSE (MS ’o/w’ target £130); LVMH (HSBC ‘buy’ target €700)

Stellantis (HSBC ’hold’ target €9); Zurich Ins (GS ’neutral’ target CHF581); Kering (DB ’hold’ target €205)

Rates

US curve (2-10 years) steepening rose by18bps to 53bps. (2yr vs 30yr rose to 109bps, the widest gap since 2020).

HY corporate spreads rose by 45bps to 400/445 bps

Commodities

Oil price down (-1%) OPEC may now look into postponing its decision to increase production (originally scheduled in May)

Gold price up (+6%) helped by a weaker USD and stagflation prospects

US

March CPI +2.4% vs 2.8% prior, PPI +2.7% vs 3.2% prior

Under the watch

FED Boston Susan Collins ‘FED is absolutely prepared to intervene to address chaotic liquidity conditions’ (FT on Friday )

Nota Bene

Italy was upgraded on Friday by S&P (from BBB to BBB+)

Trump administration exempted smartphones, computers from reciprocal tariffs (possibly under a temporary reprieve, Saturday 12 April)

CALENDAR

Monetary policy:

EU: ECB rate decision (17 April) a -25bps rate cut is expected

Q1 corporate earnings:

US GS (14 April); BofA, Citi, J&J (15); Netflix (17)

EU LVMH, Vinci (15); ASML, Rio Tinto (16), L’Oreal (17)

WHAT ANALYSTS SAY

- BNP Paribas AM: Earnings growth outlook remains positive for 2025

- ODDO BHF: The new US monetary realignment

- BLACKROCK: Taking stock of US tariff pause

BNPP AM, 9 April 2025

Author: Daniel Morris, Chief Market Strategist, BNP Paribas AM

If we take a step back to the end of last year and recall the expectations that were formulated at the time for the year 2025, we can see that the current evolution of growth and inflation in the United States is not so different from what was anticipated a few months ago.

We are still expecting a ‘soft landing’ scenario for this year. Even in the absence of the tariff announcements, economic growth in the US could be expected to slow in 2025.

Stagflation' is always a risk. As far as inflation is concerned, we need to make a clear distinction between, on the one hand, the momentary impact on prices caused by the imposition of customs duties, which is of the “one-off” type, i.e. a one-off increase, and, on the other hand, a long-term inflationary trend. For example, the Covid pandemic had a real inflationary impact over several quarters, due to disruptions in supply chains, staff shortages caused by the “big quit”, etc. The application of customs duties, on the other hand, would not have such an impact - it implies a rise in inflation at a given point in time, but not necessarily continuously over time.

We can no longer just talk about uncertainty regarding the application of customs duties. This is now a fact to be taken into account, with certain adjustments. Nevertheless, once again, this does not fundamentally change the inflation trajectory that we have been observing for several months. As far as the ECB is concerned, the markets are still expecting its main key rate to be cut to 2% over the course of the year.

Markets often move a little excessively when such announcements are made, but then correct themselves. In terms of substance, the investment plan announced in Germany is nonetheless very significant. It increases the long-term growth prospects for the German economy. Now, we shouldn't expect too much from this type of investment in terms of its impact on the economy. In infrastructure, for example, modernising and improving transport links is good for the economy. However, the impact of these investments is not comparable to what we might expect in emerging countries. Germany is not India, nor is it similar to countries whose economies are growing very fast. Germany already has a functioning rail network - it's all very well to modernise it, but that doesn't change the situation in the slightest. So we shouldn't expect a spectacular multiplier effect on growth in Germany and Europe.

The performance gap contrasts, of course, with the prevailing view last December that US equities would continue to perform well, or that American exceptionalism would prevail. Few would have dared to bet on Chinese and European equities at the end of last year. But that's exactly what happened - and the rebound in European equity markets is set to continue.

We are currently neutral on equities, but remain constructive over the medium term. Overall, we should bear in mind that the outlook for earnings growth remains positive for 2025. In the United States, corporate profits should grow by an average of 16% in 2025 compared with 2024. In Europe, earnings growth is expected to be around 14% this year compared with last year. In the United States, expectations for corporate profits have been revised downwards slightly - from a high level. In Europe, on the other hand, they have been revised slightly upwards - albeit from a lower level.

A growth rate in the low single digits is not bad from a historical perspective.

ODDO BHF, 8 April 2025

Author : Arthur Jurus, Head of Investment Office PWM, ODDO BHF

A ‘Mar-a-Lago Agreement’ could be the successor to Bretton Woods (1944) and the Plaza (1985). In this context, the Swiss franc and gold could benefit greatly. The tariff increases decided by the United States appear to inaugurate a monetary realignment strategy aimed at depreciating the dollar, reducing federal debt and strengthening competitiveness.

Access to the dollar and the US market will become more restricted. Bond yields have logically fallen, while equity markets have reacted strongly, reflecting the uncertainty surrounding the ability of the global system to adapt to these new rules.

Tariffs are used to negotiate the opening up of foreign markets to American products and to encourage companies to produce in the United States. Their level varies according to the trade deficit with each partner, revealing a hierarchy: strategic partners (Canada, Mexico, United Kingdom), neutral partners (EU), or opposed partners (China). Those who adjust their preferences in favour of the United States could retain access to the dollar and to American military security, for example through NATO, via a possible European rearmament in American equipment.

Another objective is to reduce the federal debt. The slowdown induced by the tariffs allows long rates to fall, reducing the cost of refinancing. A drop of 100 basis points on the US 10-year bond saves $90 billion, whereas $7,200 billion needs to be refinanced. The administration can then extend maturities, propose new forms of debt (perpetual, zero coupon), or push the Fed and foreign creditors to absorb more public debt.

The depreciation of the dollar is also at the heart of this strategy. As the world's reserve currency, the dollar is overvalued, which hurts US exporters. A monetary realignment, similar to those of 1934 or 1971, seems likely. A ‘Mar-a-Lago agreement’ could succeed Bretton Woods (1944) and the Plaza (1985), with mechanisms to force countries to reduce their dollar reserves or peg their currencies to the greenback in order to limit its fall. Against this backdrop, the Swiss franc and gold could benefit strongly. The franc would benefit from a US slowdown, inflation above 3% and an expected cut in the Fed's key interest rates. Gold would be supported by higher inflation, lower real interest rates and a change in monetary regime similar to that of 1971-1980, when its price increased 23-fold.

The Fed will be faced with a dilemma: cutting rates in the short term to support the economy, but potentially raising them in the medium term if inflation picks up again. Its credibility could be called into question, especially if it is forced to buy public debt on a massive scale, at the risk of seeing the real value of its balance sheet eroded and participating in a monetisation of the debt.

In the short term, these measures will weaken the US economy. Imported inflation will weigh on purchasing power and retailers' margins. In the run-up to the elections, the administration could counterbalance these effects by lowering energy prices, reducing standards or cutting taxes on households and businesses.

BLACKROCK, 11 April 2025

Author : BlackRock Investment Institute

The U.S. has paused newly announced tariffs for most countries for 90 days, just hours after they took effect and unleashed volatility almost on par with the biggest market shocks of the past few decades. President Donald Trump suspended the extra “reciprocal” tariffs on all countries except China, now facing tariffs of at least 145%. The 10% universal tariff remains. Trade tensions with China are deepening, and significant uncertainty remains. Yet the pause suggests that the U.S. administration is taking some account of financial risks and costs as well as a country’s willingness to engage, putting a check on a maximal stance during the negotiations.

As a result, we extend our tactical horizon back to 6 to 12 months from 3 months to dial up risk.

This is a major development, particularly in easing the near-term risk of a financial accident. Yet we need to brace for unpredictable negotiations, and the U.S. is still likely to end up with much higher tariffs than we expected a few weeks ago. We estimate the average effective tariff rate is now around 20%, even with the pause. We see three primary types of U.S. tariffs.

First, tariffs on strategic sectors to support reshoring of activity — so far, 25% levies on autos and parts, and on steel and aluminum, with sectors like lumber, semiconductors, pharmaceuticals and copper likely next.

Second, a universal 10% tariff on most imports to generate revenue and aid domestic production.

Third, country-specific tariffs on roughly 60 nations with goods trade surpluses with the U.S., intended to provide negotiating leverage to reduce imbalances.

U.S. tariffs add to inflation, and ongoing uncertainty is raising the risk of a recession.

Prolonged policy uncertainty may weigh on corporate capital spending and delay longer-term commitments. Consumer spending could be hurt by any erosion of wealth and real incomes. The dented confidence of foreign investors in the U.S. could curb their appetite for U.S. assets.

For China, we see tariffs lowering growth – and potential policy stimulus only partly offsetting that drag.

We cautiously lean into risk and shift our tactical horizon back to six to 12 months from three months.

We up equity exposure, including to U.S. and Japanese stocks.

Yet we expect ongoing volatility and potentially sharp reversals. Selectivity across sectors and securities will be key, and we are wary of chasing momentum.

We see opportunities in U.S. technology and global banks, especially European, hurt by the broad-based selloff.

Long-term U.S. Treasuries have failed to offer ballast during the stock selloff against a backdrop of persistent budget deficits and sticky inflation.

We favor gold as a portfolio diversifier.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.