Last week: US-China trade talks, ceasefire in ME, US-RU talks; Q3 earnings, France’s debt downgrade, US regional banks

WEEKLY TRENDS

WEEKLY TRENDS

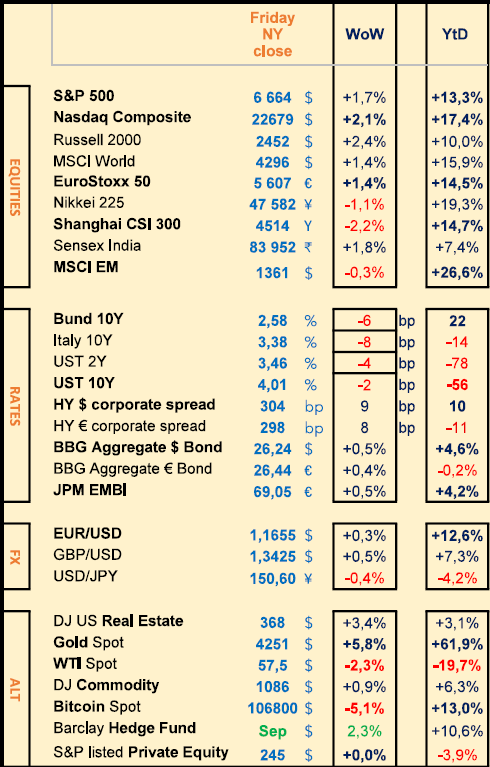

- A lot of happenings are affecting the financial markets right now. First, we had the ceasefire in the Middle East, together with the refreshed talks between the US and RU over UA, pushing down Defense stocks like Rheinmetall (-12%) and Leonardo (-10%). Oil price was lower too (-2%) at $57 (Citi now forecasting $50)

- China and US seem to regain the will to talk over trade which favoured US stocks late on Friday

- Q3 earnings showed pretty strong results so far (Essilor +14% WoW, Ericsson +13%, LVMH +11%, Nestlé +12%) while US banks suffered from the Regional banks credit fragile situation (Tricolor, Zions and Western Alliance) but BofA managed to end the week at +4%, Wells Fargo at +6% and Citi, MS at +2% while GS, JPM ended at -3%

- Vix index had a wild move on Friday, opening at 25% (level not seen since April’s Trump new tariffs) closing at 20%

- Obesity drug manufacturers had a rough time (Novo Nordisk at -7% and Eli Lilly at -3%) on Trump’s new decision

- Gold continues to benefit from debasement trades (+6%) while Cryptos suffered (BTC -5%)

- S&P downgraded France to single A+ after closing on Friday.

MARKETS

Equities

Weekly performances after earnings:

Essilor Luxottica (+14%), Ericsson (+13%), LVMH (+11%), Nestlé (+12%)

Michelin (-8%), JPM (-3%), GS (-3%), State Street (-1%)

Analysts: St Gobain (BNPP ‘o/w’ target €129), Technip (JPM ‘o/w’ target €50), Essilor Luxottica (BNPP ‘o/w’ target €320 while GS is at €315 and JPM at €300)

Rates

US curve (2-10 years) steepening unchanged at 55bps

HY corporate spreads higher +10bps (US at 305bps); EU at 300bps

Commodities

Oil price lower (-2.5%) on ME ceasefire and Trump’s talks with RU on UA

Gold price higher (+6%) or +65% YTD - Silver +80% YTD - Copper is lower on less China consumption, despite LT demand from Data centers

EU

Sep CPI for the Euro zone released at +2.2% vs +2% in Aug (Core at +2.4% vs +2.3% prior)

UK

Aug GDP released at +0.1% vs -0.1% in July

Crypto

BTC lower (-5%) after -8% previous week (ETH -9%; XRP, SOL at -11%)

Under the watch

SRF (FED’s Standing Repo Facility) used by banks io the usual interbank market lending ($15bn in two days) - sign of liquidity pressure

Nota Bene

US shutdown costs 0.2% US growth or $15bn each week

US seized $15bn worth of BTC from Prince group in Cambodia, Washington now has accumulated 325000 BTC ($35bn)

Hedge Funds are shorting US equities (over last 2 weeks HF sold $4bn) Retail and Financial Institutions are buyers (ref. BofA)

CALENDAR

Q3 earnings releases:

US Coca-Cola (21 Oct), Tesla (22), Intel (23)

EU L’Oreal (21), Hermès/SAP (22), Roche/Thales (23)

Macro releases:

UK Sep Inflation (22 Oct)

US CPI, PPI, NFP (all pending while US shutdown)

Central Banks meetings:

US FED/FOMC (29 Oct), EU ECB (30), UK BOE/MPC (6 Nov)

WHAT ANALYSTS SAY

Edmond de Rothschild, 17 October 2025

Author: Michael Nizard, Multi-Assets and Overlay Director

The absence of US statistics due to the shutdown is forcing the Fed to rely on activity reports from regional Fed banks, which reveal economic stagnation and a deterioration in employment.

The resurgence of trade tensions between the United States and China marked this week. Following China's announcement that it would increase controls on exports containing more than 0.1% of Chinese rare earths, with stricter export licence requirements targeting the US defence and semiconductor sectors in particular, and impose new port taxes on their ships, Donald Trump threatened to apply new 100% tariffs on Chinese products in November. Despite this escalation, the market remains confident that a compromise will be reached as the truce on the application of tariffs ends on 10 November.

For its part, the EU is considering forcing Chinese companies operating in Europe to transfer their technology to local companies and tightening its requirements on the use of European products, particularly in the automotive sector.

In France, the new appointment of Sébastien Lecornu as Prime Minister, accompanied by the announcement of the suspension of the pension reform and the abandonment of the use of Article 49.3 granted to the Socialist Party, made it possible to avoid censure by 18 votes. A new government is in place, with a budget that aims to keep the deficit below 5% of GDP, which has reassured the French markets by removing the prospect of a new election.

In Japan, on the other hand, the withdrawal of the Komeito party from its historic coalition with the LDP has opened up the possibility of the appointment of a prime minister from the opposition, namely Y. Tamaki of the PDP party, with an agreement currently being negotiated between three parties. This could lead to a more expansionary fiscal policy and a reduction in central bank rate hikes.

The oil market continued to decline, despite a temporary rise due to unconfirmed rumours that India could reduce its exports of Russian oil under pressure from the US.

The lack of US statistics due to the government shutdown has forced the Fed to turn to regional Fed activity reports, which point to economic stagnation and a deterioration in employment.

This week, Jerome Powell opened the door to further cuts in key interest rates and monetary easing by halting the Fed's balance sheet reduction (quantitative tightening). Inflation measured by the University of Michigan fell slightly over one year, from 4.7% to 4.6%, while remaining stable at 3.7% over 5-10 years. Small business optimism and the Philadelphia Fed's business outlook fell from 100.8 to 98.8 and from 23.2 to -12.8, respectively.

In Europe, activity indicators are also slowing, with the ZEW index expectations for the eurozone down from 26.1 to 22.7 and industrial production at +1.1% versus 2% previously.

The anticipated positive effect of the Fed's monetary easing and strong corporate earnings has been tempered by concerns about regional US banks. Two of them recently reported that they had been victims of fraud, with the embezzled funds being invested in distressed commercial mortgages.

Uncertainty is prompting us to maintain a cautious approach to risky assets, primarily US equities. We remain positive on duration, particularly on emerging market bonds, and favour the highest-rated corporate bonds.

ING, 10 October 2025

Author: René Willekes, Head of TMT (Technology, Media, Telecommunications) and Health

More than half of Swiss pharma exports go to the US, which is a major challenge for the industry and the national economy. Hence, Roche and Novartis have announced investments of $50 billion and $23 billion, respectively, in manufacturing and R&D facilities in the United States and to expand their presence in the country. Pfizer, Roche, Novartis and Lonza are currently negotiating mini-agreements with the US government. Eventhough these agreements will not be accessible to all Swiss players in the sector, they do set a precedent.

Swiss companies are diversifying their supply chains, for example by relocating API production to other regions and leveraging strategic partnerships to ensure resilience in the face of potential future disruptions.

The Swiss government is actively involved in bilateral negotiations to obtain exemptions and maintain the sector's competitiveness. While these measures enable the largest players to weather the tariff storm, small companies, particularly those focusing on generics, face greater challenges. Smaller Swiss pharmaceutical companies do not have access to their own production facilities in the US and are unable to purchase or develop production capacity in the US in the short term. They will therefore have to find other ways to mitigate the impact of tariffs.

The sector is preparing for potential GDP losses if tariffs persist, although current strategies should protect the Swiss pharmaceutical industry from the worst effects in the medium term.

While the outlook for the sector appears rather bleak, one category should benefit. We note that CDMOs (Contract Development Manufacturing Organisations) appear to be the big winners in the current climate of uncertainty. As many pharmaceutical companies seek to rapidly expand their industrial presence, CDMOs offer flexible, ready-to-use capabilities. Their well-established facilities enable pharmaceutical companies to rapidly increase production in the United States without the long lead times and capital expenditure required to build new plants. As a result, the sector is experiencing a sharp increase in mergers and acquisitions, investment and growth. ING forecasts a compound annual growth rate of 8.5% for CDMOs through 2030 as they become an increasingly essential link in the supply chain.

Swiss pharmaceutical companies need banking solutions that enable them to assess their debt capacity and quantify their financial potential for strategic investments and acquisitions. This approach promotes informed investment decisions, whether to develop international activities, expand their presence, or identify merger and acquisition opportunities that could mitigate risks related to the regulatory or commercial environment.

An important aspect of these strategic changes is scenario planning. Analysing scenarios for various financing solutions helps companies in the sector understand the potential impact on their business models, cash flows and investment plans. They need access to concrete financing solutions, which may include acquisition financing, access to capital markets, investment loans and working capital facilities, ensuring they have the resources and financing diversification necessary to navigate uncertainty and seize growth opportunities.

In addition, interest rate and currency hedging solutions will enable them to stabilise costs, secure selling prices and take advantage of a favourable monetary environment by setting appropriate target levels. As Swiss pharmaceutical companies adapt to the new global business landscape, the ability to act decisively, whether through investments or strategic mergers and acquisitions, will be essential to maintaining Switzerland's leading position in the life sciences sector.

DPAM Indosuez Wealth Management, 17 October 2025

Author: Raffaele Prencipe, Fixed Income portfolio manager

Following the decline in inflation, key interest rates were lowered. However, long-term yields remained unchanged or even rose. The decline in demand from pension funds and life insurers for 30-yr bonds caused their yields to jump to levels not seen in decades in various countries. Overall, the trend is towards defined contribution pension plans rather than defined benefit plans. As a result, the allocation to long-term government bonds is losing importance and funds are being spread more diversely across other assets such as corporate bonds and equities.

The higher interest rates are, the more difficult it is to balance budgets, and in OECD member countries, the amounts allocated to debt interest payments exceed those allocated to defence. In an extreme case, Brazil, whose primary deficit has been contained in recent years, is nevertheless seeing its debt increase because it has to devote nearly 8% of its GDP annually to debt interest payments. Governments are taking measures to reduce the supply of long-term bonds. The UK, for example, which generally covered 30% of its annual needs by issuing bonds with maturities of more than 15 years, has reduced this proportion to 20% and then to 10%, with the Bank of England deciding to issue more short- and medium-term bonds as part of its quantitative tightening programme. Japan has also limited its long-term bond issues twice in recent months. However, the Bank of Japan has decided to maintain its purchases of bonds with maturities of more than 15 years unchanged. India reduced its issuance of bonds with maturities ranging from 30 to 50 years from 35% to 30%, with this reduction in the supply of long-term securities being offset by an increase in the supply of securities with maturities ranging from one to ten years.

In the United States, the proportion of short-term debt rose to 25% of total negotiable debt, while purchases of bonds with maturities of more than 10 years doubled. According to Stephen Miran, chairman of the White House Council of Economic Advisers and governor of the Federal Reserve, capping rate hikes would be part of the Fed's ‘triple mandate’ of maximising employment, maintaining price stability and keeping long-term rates moderate. If the yield curve were to be controlled, the dollar would continue to depreciate.

Colombia and Panama have borrowed from banks in Swiss francs to buy back bonds or limit their issuance, with the aim of capping yields. Finally, in Indonesia, the central bank has implemented a bond buyback programme.

To prevent 10-yr yields from being pushed up by 30-yr yields, the UK and Japan should temporarily reduce their supply of long-term loans to zero or to the minimum necessary to ensure liquidity.

If the US labour market deteriorates (surplus of graduates and shortage of workers), interest rates could fall further, but to a lesser extent due to the deterioration in the fiscal situation.

Furthermore, significant investment in artificial intelligence (which will ultimately lead to increased productivity) is contributing to economic growth, and the stock market is being buoyed by increased profits from very large data centres . Therefore, even if central banks reduce key interest rates, long-term interest rates could remain high.

With bond yields having been relatively more attractive than in recent years, investors have increased their allocation to corporate bonds. Indeed, corporate bond yield spreads are at historically low levels and many companies are able to finance themselves at lower costs than governments. In other words, for the foreseeable future, bond markets will offer investors higher yields than has been the case in recent history.

Equities

Weekly performances after earnings:

Essilor Luxottica (+14%), Ericsson (+13%), LVMH (+11%), Nestlé (+12%)

Michelin (-8%), JPM (-3%), GS (-3%), State Street (-1%)

Analysts: St Gobain (BNPP ‘o/w’ target €129), Technip (JPM ‘o/w’ target €50), Essilor Luxottica (BNPP ‘o/w’ target €320 while GS is at €315 and JPM at €300)

Rates

US curve (2-10 years) steepening unchanged at 55bps

HY corporate spreads higher +10bps (US at 305bps); EU at 300bps

Commodities

Oil price lower (-2.5%) on ME ceasefire and Trump’s talks with RU on UA

Gold price higher (+6%) or +65% YTD - Silver +80% YTD - Copper is lower on less China consumption, despite LT demand from Data centers

EU

Sep CPI for the Euro zone released at +2.2% vs +2% in Aug (Core at +2.4% vs +2.3% prior)

UK

Aug GDP released at +0.1% vs -0.1% in July

Crypto

BTC lower (-5%) after -8% previous week (ETH -9%; XRP, SOL at -11%)

Under the watch

SRF (FED’s Standing Repo Facility) used by banks io the usual interbank market lending ($15bn in two days) - sign of liquidity pressure

Nota Bene

US shutdown costs 0.2% US growth or $15bn each week

US seized $15bn worth of BTC from Prince group in Cambodia, Washington now has accumulated 325000 BTC ($35bn)

Hedge Funds are shorting US equities (over last 2 weeks HF sold $4bn) Retail and Financial Institutions are buyers (ref. BofA)

CALENDAR

Q3 earnings releases:

US Coca-Cola (21 Oct), Tesla (22), Intel (23)

EU L’Oreal (21), Hermès/SAP (22), Roche/Thales (23)

Macro releases:

UK Sep Inflation (22 Oct)

US CPI, PPI, NFP (all pending while US shutdown)

Central Banks meetings:

US FED/FOMC (29 Oct), EU ECB (30), UK BOE/MPC (6 Nov)

WHAT ANALYSTS SAY

- Edmond de Rothschild: Uncertainty remains the watchword

- ING: Swiss pharma faces Trump's tariffs

- DPAM Indosuez Wealth Management: A windfall for Bond investors

Edmond de Rothschild, 17 October 2025

Author: Michael Nizard, Multi-Assets and Overlay Director

The absence of US statistics due to the shutdown is forcing the Fed to rely on activity reports from regional Fed banks, which reveal economic stagnation and a deterioration in employment.

The resurgence of trade tensions between the United States and China marked this week. Following China's announcement that it would increase controls on exports containing more than 0.1% of Chinese rare earths, with stricter export licence requirements targeting the US defence and semiconductor sectors in particular, and impose new port taxes on their ships, Donald Trump threatened to apply new 100% tariffs on Chinese products in November. Despite this escalation, the market remains confident that a compromise will be reached as the truce on the application of tariffs ends on 10 November.

For its part, the EU is considering forcing Chinese companies operating in Europe to transfer their technology to local companies and tightening its requirements on the use of European products, particularly in the automotive sector.

In France, the new appointment of Sébastien Lecornu as Prime Minister, accompanied by the announcement of the suspension of the pension reform and the abandonment of the use of Article 49.3 granted to the Socialist Party, made it possible to avoid censure by 18 votes. A new government is in place, with a budget that aims to keep the deficit below 5% of GDP, which has reassured the French markets by removing the prospect of a new election.

In Japan, on the other hand, the withdrawal of the Komeito party from its historic coalition with the LDP has opened up the possibility of the appointment of a prime minister from the opposition, namely Y. Tamaki of the PDP party, with an agreement currently being negotiated between three parties. This could lead to a more expansionary fiscal policy and a reduction in central bank rate hikes.

The oil market continued to decline, despite a temporary rise due to unconfirmed rumours that India could reduce its exports of Russian oil under pressure from the US.

The lack of US statistics due to the government shutdown has forced the Fed to turn to regional Fed activity reports, which point to economic stagnation and a deterioration in employment.

This week, Jerome Powell opened the door to further cuts in key interest rates and monetary easing by halting the Fed's balance sheet reduction (quantitative tightening). Inflation measured by the University of Michigan fell slightly over one year, from 4.7% to 4.6%, while remaining stable at 3.7% over 5-10 years. Small business optimism and the Philadelphia Fed's business outlook fell from 100.8 to 98.8 and from 23.2 to -12.8, respectively.

In Europe, activity indicators are also slowing, with the ZEW index expectations for the eurozone down from 26.1 to 22.7 and industrial production at +1.1% versus 2% previously.

The anticipated positive effect of the Fed's monetary easing and strong corporate earnings has been tempered by concerns about regional US banks. Two of them recently reported that they had been victims of fraud, with the embezzled funds being invested in distressed commercial mortgages.

Uncertainty is prompting us to maintain a cautious approach to risky assets, primarily US equities. We remain positive on duration, particularly on emerging market bonds, and favour the highest-rated corporate bonds.

ING, 10 October 2025

Author: René Willekes, Head of TMT (Technology, Media, Telecommunications) and Health

More than half of Swiss pharma exports go to the US, which is a major challenge for the industry and the national economy. Hence, Roche and Novartis have announced investments of $50 billion and $23 billion, respectively, in manufacturing and R&D facilities in the United States and to expand their presence in the country. Pfizer, Roche, Novartis and Lonza are currently negotiating mini-agreements with the US government. Eventhough these agreements will not be accessible to all Swiss players in the sector, they do set a precedent.

Swiss companies are diversifying their supply chains, for example by relocating API production to other regions and leveraging strategic partnerships to ensure resilience in the face of potential future disruptions.

The Swiss government is actively involved in bilateral negotiations to obtain exemptions and maintain the sector's competitiveness. While these measures enable the largest players to weather the tariff storm, small companies, particularly those focusing on generics, face greater challenges. Smaller Swiss pharmaceutical companies do not have access to their own production facilities in the US and are unable to purchase or develop production capacity in the US in the short term. They will therefore have to find other ways to mitigate the impact of tariffs.

The sector is preparing for potential GDP losses if tariffs persist, although current strategies should protect the Swiss pharmaceutical industry from the worst effects in the medium term.

While the outlook for the sector appears rather bleak, one category should benefit. We note that CDMOs (Contract Development Manufacturing Organisations) appear to be the big winners in the current climate of uncertainty. As many pharmaceutical companies seek to rapidly expand their industrial presence, CDMOs offer flexible, ready-to-use capabilities. Their well-established facilities enable pharmaceutical companies to rapidly increase production in the United States without the long lead times and capital expenditure required to build new plants. As a result, the sector is experiencing a sharp increase in mergers and acquisitions, investment and growth. ING forecasts a compound annual growth rate of 8.5% for CDMOs through 2030 as they become an increasingly essential link in the supply chain.

Swiss pharmaceutical companies need banking solutions that enable them to assess their debt capacity and quantify their financial potential for strategic investments and acquisitions. This approach promotes informed investment decisions, whether to develop international activities, expand their presence, or identify merger and acquisition opportunities that could mitigate risks related to the regulatory or commercial environment.

An important aspect of these strategic changes is scenario planning. Analysing scenarios for various financing solutions helps companies in the sector understand the potential impact on their business models, cash flows and investment plans. They need access to concrete financing solutions, which may include acquisition financing, access to capital markets, investment loans and working capital facilities, ensuring they have the resources and financing diversification necessary to navigate uncertainty and seize growth opportunities.

In addition, interest rate and currency hedging solutions will enable them to stabilise costs, secure selling prices and take advantage of a favourable monetary environment by setting appropriate target levels. As Swiss pharmaceutical companies adapt to the new global business landscape, the ability to act decisively, whether through investments or strategic mergers and acquisitions, will be essential to maintaining Switzerland's leading position in the life sciences sector.

DPAM Indosuez Wealth Management, 17 October 2025

Author: Raffaele Prencipe, Fixed Income portfolio manager

Following the decline in inflation, key interest rates were lowered. However, long-term yields remained unchanged or even rose. The decline in demand from pension funds and life insurers for 30-yr bonds caused their yields to jump to levels not seen in decades in various countries. Overall, the trend is towards defined contribution pension plans rather than defined benefit plans. As a result, the allocation to long-term government bonds is losing importance and funds are being spread more diversely across other assets such as corporate bonds and equities.

The higher interest rates are, the more difficult it is to balance budgets, and in OECD member countries, the amounts allocated to debt interest payments exceed those allocated to defence. In an extreme case, Brazil, whose primary deficit has been contained in recent years, is nevertheless seeing its debt increase because it has to devote nearly 8% of its GDP annually to debt interest payments. Governments are taking measures to reduce the supply of long-term bonds. The UK, for example, which generally covered 30% of its annual needs by issuing bonds with maturities of more than 15 years, has reduced this proportion to 20% and then to 10%, with the Bank of England deciding to issue more short- and medium-term bonds as part of its quantitative tightening programme. Japan has also limited its long-term bond issues twice in recent months. However, the Bank of Japan has decided to maintain its purchases of bonds with maturities of more than 15 years unchanged. India reduced its issuance of bonds with maturities ranging from 30 to 50 years from 35% to 30%, with this reduction in the supply of long-term securities being offset by an increase in the supply of securities with maturities ranging from one to ten years.

In the United States, the proportion of short-term debt rose to 25% of total negotiable debt, while purchases of bonds with maturities of more than 10 years doubled. According to Stephen Miran, chairman of the White House Council of Economic Advisers and governor of the Federal Reserve, capping rate hikes would be part of the Fed's ‘triple mandate’ of maximising employment, maintaining price stability and keeping long-term rates moderate. If the yield curve were to be controlled, the dollar would continue to depreciate.

Colombia and Panama have borrowed from banks in Swiss francs to buy back bonds or limit their issuance, with the aim of capping yields. Finally, in Indonesia, the central bank has implemented a bond buyback programme.

To prevent 10-yr yields from being pushed up by 30-yr yields, the UK and Japan should temporarily reduce their supply of long-term loans to zero or to the minimum necessary to ensure liquidity.

If the US labour market deteriorates (surplus of graduates and shortage of workers), interest rates could fall further, but to a lesser extent due to the deterioration in the fiscal situation.

Furthermore, significant investment in artificial intelligence (which will ultimately lead to increased productivity) is contributing to economic growth, and the stock market is being buoyed by increased profits from very large data centres . Therefore, even if central banks reduce key interest rates, long-term interest rates could remain high.

With bond yields having been relatively more attractive than in recent years, investors have increased their allocation to corporate bonds. Indeed, corporate bond yield spreads are at historically low levels and many companies are able to finance themselves at lower costs than governments. In other words, for the foreseeable future, bond markets will offer investors higher yields than has been the case in recent history.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.