Volatile August stock markets led by Japan and AI tech mini krach, now benefitting from a likely to be FED easing cycle

WEEKLY TRENDS

WEEKLY TRENDS

- Given that the US and euro zone inflations are almost out of the way (latest data confirmed the trend lower) markets are now looking at central banks easing cycles (except BOJ) among a resilient US economy (FED is now focusing on the US labour market, not inflation) and a resilient AI market

- With the Nov US presidential elections and the French government temporary standby, markets could soon be looking at government debt outstandings as a percentage of GDP (122% and 98% respectively) together with their individual debts servicing capacity

- September is statistically well known for its drawdown stock markets beat, the first FED rate cut in 4 years could well support those when it is most seasonally needed

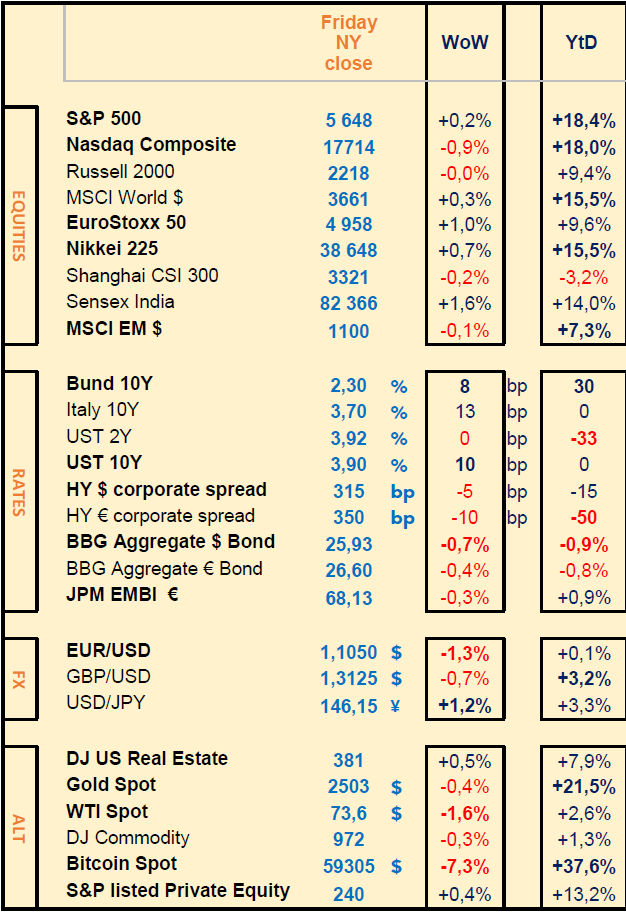

MARKETS

Equities

Volatile August led by a mini Krach and a likely FED easing cycle

August: S&P (+2%), Nasdaq (+1%), Nikkei (-1%), Consumer staples +5% vs Consumer discretionary -3%, Real Estate +5% and Energy -2%

Q2 earnings releases last week (stock WoW performance):

+++ BestBuy (+14%), Crowdstrike (+2%), UK Bunzl (+10%), German Schott Pharma (+18%)

- - - NVIDIA (-8%), Salesforce (-4%), Birkenstock (-23%), PDD Holdings (-13%), Swiss TX (-9%), Danish Ambu (-13%), French Teleperformance (-6%), ID logistics (-8%)

IPO: Delivery Hero (+15%) IPO set to be in Dubaï

Analysts: Super Micro Computer (-29%) on Hindenburg Research paper

Rates

August: UST 10 years yields increased by 10bps

US curve (2-10 years) is now flat (NB 30 years yield at 4.20%)

US

July PCE Deflator lower (+2.6% vs +2.7% expected)

Q2 GDP revised up +3% QoQ vs +2.8% expected and +1.4% prior

EU

August euro zone CPI (+2.2% YoY vs +2.6% prior) lowest level in 3 years

China

August PMI Manufacturing (6 month low at 49.1 vs 49.4 prior)

August Non Manufacturing PMI at 50.3 vs 50.2 prior

China considering refinancing $5.4trn in mortgages

Evergrande warns of $2.85bn loss on provisions

Nota Bene

VIX index ends the month at 15 after having hit 55 in early August

Buyback window opens back up on Sep 13 when 50% of blackouts end

CALENDAR

WHAT ANALYSTS SAY

UBS, 26 August 2024 - Top 10 questions answered

Authors: Vincent Heaney, Strategist

• What is next for the US dollar?

• What’s next for equities?

• How should I position for lower interest rates?

What is next for the US dollar?

We move the US dollar to least Preferred. We expect the trend toward a weaker dollar to continue over the medium term as US economic growth moderates, inflation cools further, and the Fed cuts rates. The currency’s high valuation and the US fiscal and current-account deficits reinforce the longer term case for a weaker greenback. We therefore recommend that investors reduce their USD holdings as the currency is likely to stay weak over the medium term. The Fed looks set to start cutting rates at its September meeting, and we expect it to cut rates at each of its three remaining meetings in 2024. Fears about the growing size of US fiscal deficit would be a headwind for the US dollar over the longer term.

Investors for whom the greenback is not their base currency should consider hedging their existing USD exposure. We like the Swiss franc, the euro, the British pound, and the Australian dollar. The Swiss National Bank is likely near the end of its rate-cutting cycle, and we believe the franc's defensive qualities are appealing amid political uncertainty. The Bank of England is likely to cut interest rates less aggressively than the Fed, and the Reserve Bank of Australia might not cut at all until next year. We expect the euro to benefit from a strong recovery in the Eurozone's trade balance, which suffered during the energy crisis.

What’s next for equities?

Equity markets have rebounded from their early-August pullback. While various economic and geopolitical risks remain—and market volatility may resurface in the coming months—we believe robust earnings growth, the prospect of lower interest rates, and rising investment in AI continue to create a constructive backdrop for equities. We recommend focusing on quality growth stocks as we believe they are well placed to deliver resilient earnings growth, especially if cyclical concerns mount.

US economic and earnings growth is solid, and inflation continues to cool. We expect the Federal Reserve to cut interest rates at all three of its remaining meetings in 2024, with the potential for a 50-basis-point cut if economic data weakens. Companies remain committed to their AI investment plans.

In our base case, we forecast the S&P 500 rising to around 6,200 by June 2025. We recommend that investors ensure they hold sufficient long-term exposure to AI. We also favor quality growth stocks more broadly, including those exposed to the energy transition and select quality companies in Europe and Japan.

How should I position for lower interest rates?

With economic growth and inflation slowing, central banks may accelerate interest rate cuts. Cash yields could drop sharply from here, so we believe investors should act to invest excess cash and money market holdings. Fixed income yields have fallen in recent weeks, but relative to cash, we think the risk-return profile is attractive for investment grade bonds, diversified fixed income portfolios, and "quality" equities with high and sustainable dividends. In fixed income, we like durations between one year and 10 years and target an average portfolio duration of around five years.

In his speech at the Federal Reserve’s annual Jackson Hole Symposium, Chair Jerome Powell said the “time has come for policy to adjust.” He added “confidence has grown that inflation is on a sustainable path” back to the central bank’s 2% target.

Minutes of the Fed’s July meeting showed that most officials were strongly inclined toward a rate cut in September, with several even open to an immediate reduction last month.

Historically, cash has only outperformed bonds early in the hiking cycle, with global bonds starting to outperform even before rates peaked. We see the 10-year US Treasury yield falling to 3.50% by March 2025, as rate cuts gain traction. Switzerland, Sweden, Canada, the UK, and the European Central Bank have all started their rate-cutting cycles. We expect more to join in the coming months.

Quality bond ladders and structured investments can help investors manage their liquidity. We recommend investors shift excess cash into quality fixed income, including investment grade corporate bonds. Diversified fixed income strategies can also help enhance portfolio yield.

Equity income strategies, including dividends and volatility-selling strategies, are increasingly attractive alternatives to cash.

We believe investors should act to invest excess cash and money market holdings as cash yields could fall quickly. Quality bond ladders and structured investment strategies can offer investors some of the certainty provided by cash, but with higher return potential as rates fall. Investors should also consider investment grade bonds, diversified fixed income strategies, and equity income strategies to deploy cash.

BLACKROCK, August 2024 - Midyear Global Outlook

Authors: Philipp Hildebrand, Vice-Chairman, Jean Boivin, Head of BlackRock Investment Institute

We think companies may need to revamp business models and invest to stay competitive. For investors, it means company fundamentals will matter even more. The gap between winners and losers could be wider than ever, in our view.

That dispersion creates opportunities and is why our second theme is Leaning into risk. The answer to a highly uncertain outlook is not simply reducing risk. We look for investments that can do well across scenarios and lean into the current most likely one. For us, that’s a concentrated AI scenario where a handful of AI winners can keep driving stocks. We stand ready to adapt as and when another scenario – potentially suddenly – becomes more likely as the transformation unfolds. So our third theme is Spotting the next wave. This is about being dynamic and ready to overhaul asset allocations when outcomes – and investment opportunities - can be vastly different.

Investment implications: We stay overweight U.S. stocks and the AI theme on a six- to 12- month view. Our overweight to Japanese stocks is one of our highest-conviction views. We like income in short-term bonds and credit. And we see private markets as a way to tap into the early winners and the infrastructure needed for the investment boom ahead.

We lean into an above-benchmark exposure to the AI theme. We also like sectors such as tech, industrials, energy and materials. We like infrastructure and industrial companies exposed to the investment boom. High-for-longer policy rates prompts us to favor quality in both fixed income and equities.

AI’s buildout could initially be inflationary as demand for energy and commodities surges. Early winners could include large tech firms, chip makers and energy and utility firms – before benefits expand to other sectors.

We turn overweight UK stocks. The potential for relative political stability and attractive valuations may pull in foreign investors. We like inflation-linked bonds on a strategic horizon, partly due to elevated debt levels.

Different demand patterns in aging populations create opportunities in sectors like healthcare. We favor countries like India and Saudi Arabia benefitting from younger populations and infrastructure investment.

We like Japanese stocks on both tactical and strategic horizons, one of our highest-conviction views. We think sectors like healthcare can benefit from aging populations.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Volatile August led by a mini Krach and a likely FED easing cycle

August: S&P (+2%), Nasdaq (+1%), Nikkei (-1%), Consumer staples +5% vs Consumer discretionary -3%, Real Estate +5% and Energy -2%

Q2 earnings releases last week (stock WoW performance):

+++ BestBuy (+14%), Crowdstrike (+2%), UK Bunzl (+10%), German Schott Pharma (+18%)

- - - NVIDIA (-8%), Salesforce (-4%), Birkenstock (-23%), PDD Holdings (-13%), Swiss TX (-9%), Danish Ambu (-13%), French Teleperformance (-6%), ID logistics (-8%)

IPO: Delivery Hero (+15%) IPO set to be in Dubaï

Analysts: Super Micro Computer (-29%) on Hindenburg Research paper

Rates

August: UST 10 years yields increased by 10bps

US curve (2-10 years) is now flat (NB 30 years yield at 4.20%)

US

July PCE Deflator lower (+2.6% vs +2.7% expected)

Q2 GDP revised up +3% QoQ vs +2.8% expected and +1.4% prior

EU

August euro zone CPI (+2.2% YoY vs +2.6% prior) lowest level in 3 years

China

August PMI Manufacturing (6 month low at 49.1 vs 49.4 prior)

August Non Manufacturing PMI at 50.3 vs 50.2 prior

China considering refinancing $5.4trn in mortgages

Evergrande warns of $2.85bn loss on provisions

Nota Bene

VIX index ends the month at 15 after having hit 55 in early August

Buyback window opens back up on Sep 13 when 50% of blackouts end

CALENDAR

- Corporate earnings: US Broadcom and Costco (5 Sep); Europe Swiss Life, Partners Group (3 Sep), French Biomérieux (4 Sep)

- Macro: China August Caixin Manufacturing (2 Sep), US August ISM Manufacturing (3 Sep), BOC rate decision (4 Sep -25bps likely), US August ISM Services (5 Sep), US August Non Farm Payrolls (6 Sep)

- Markets closed: Monday (US and Canada)

WHAT ANALYSTS SAY

- UBS - Top 10 questions answered

- BLACKROCK - Midyear Global Outlook

UBS, 26 August 2024 - Top 10 questions answered

Authors: Vincent Heaney, Strategist

• What is next for the US dollar?

• What’s next for equities?

• How should I position for lower interest rates?

What is next for the US dollar?

We move the US dollar to least Preferred. We expect the trend toward a weaker dollar to continue over the medium term as US economic growth moderates, inflation cools further, and the Fed cuts rates. The currency’s high valuation and the US fiscal and current-account deficits reinforce the longer term case for a weaker greenback. We therefore recommend that investors reduce their USD holdings as the currency is likely to stay weak over the medium term. The Fed looks set to start cutting rates at its September meeting, and we expect it to cut rates at each of its three remaining meetings in 2024. Fears about the growing size of US fiscal deficit would be a headwind for the US dollar over the longer term.

Investors for whom the greenback is not their base currency should consider hedging their existing USD exposure. We like the Swiss franc, the euro, the British pound, and the Australian dollar. The Swiss National Bank is likely near the end of its rate-cutting cycle, and we believe the franc's defensive qualities are appealing amid political uncertainty. The Bank of England is likely to cut interest rates less aggressively than the Fed, and the Reserve Bank of Australia might not cut at all until next year. We expect the euro to benefit from a strong recovery in the Eurozone's trade balance, which suffered during the energy crisis.

What’s next for equities?

Equity markets have rebounded from their early-August pullback. While various economic and geopolitical risks remain—and market volatility may resurface in the coming months—we believe robust earnings growth, the prospect of lower interest rates, and rising investment in AI continue to create a constructive backdrop for equities. We recommend focusing on quality growth stocks as we believe they are well placed to deliver resilient earnings growth, especially if cyclical concerns mount.

US economic and earnings growth is solid, and inflation continues to cool. We expect the Federal Reserve to cut interest rates at all three of its remaining meetings in 2024, with the potential for a 50-basis-point cut if economic data weakens. Companies remain committed to their AI investment plans.

In our base case, we forecast the S&P 500 rising to around 6,200 by June 2025. We recommend that investors ensure they hold sufficient long-term exposure to AI. We also favor quality growth stocks more broadly, including those exposed to the energy transition and select quality companies in Europe and Japan.

How should I position for lower interest rates?

With economic growth and inflation slowing, central banks may accelerate interest rate cuts. Cash yields could drop sharply from here, so we believe investors should act to invest excess cash and money market holdings. Fixed income yields have fallen in recent weeks, but relative to cash, we think the risk-return profile is attractive for investment grade bonds, diversified fixed income portfolios, and "quality" equities with high and sustainable dividends. In fixed income, we like durations between one year and 10 years and target an average portfolio duration of around five years.

In his speech at the Federal Reserve’s annual Jackson Hole Symposium, Chair Jerome Powell said the “time has come for policy to adjust.” He added “confidence has grown that inflation is on a sustainable path” back to the central bank’s 2% target.

Minutes of the Fed’s July meeting showed that most officials were strongly inclined toward a rate cut in September, with several even open to an immediate reduction last month.

Historically, cash has only outperformed bonds early in the hiking cycle, with global bonds starting to outperform even before rates peaked. We see the 10-year US Treasury yield falling to 3.50% by March 2025, as rate cuts gain traction. Switzerland, Sweden, Canada, the UK, and the European Central Bank have all started their rate-cutting cycles. We expect more to join in the coming months.

Quality bond ladders and structured investments can help investors manage their liquidity. We recommend investors shift excess cash into quality fixed income, including investment grade corporate bonds. Diversified fixed income strategies can also help enhance portfolio yield.

Equity income strategies, including dividends and volatility-selling strategies, are increasingly attractive alternatives to cash.

We believe investors should act to invest excess cash and money market holdings as cash yields could fall quickly. Quality bond ladders and structured investment strategies can offer investors some of the certainty provided by cash, but with higher return potential as rates fall. Investors should also consider investment grade bonds, diversified fixed income strategies, and equity income strategies to deploy cash.

BLACKROCK, August 2024 - Midyear Global Outlook

Authors: Philipp Hildebrand, Vice-Chairman, Jean Boivin, Head of BlackRock Investment Institute

We think companies may need to revamp business models and invest to stay competitive. For investors, it means company fundamentals will matter even more. The gap between winners and losers could be wider than ever, in our view.

That dispersion creates opportunities and is why our second theme is Leaning into risk. The answer to a highly uncertain outlook is not simply reducing risk. We look for investments that can do well across scenarios and lean into the current most likely one. For us, that’s a concentrated AI scenario where a handful of AI winners can keep driving stocks. We stand ready to adapt as and when another scenario – potentially suddenly – becomes more likely as the transformation unfolds. So our third theme is Spotting the next wave. This is about being dynamic and ready to overhaul asset allocations when outcomes – and investment opportunities - can be vastly different.

Investment implications: We stay overweight U.S. stocks and the AI theme on a six- to 12- month view. Our overweight to Japanese stocks is one of our highest-conviction views. We like income in short-term bonds and credit. And we see private markets as a way to tap into the early winners and the infrastructure needed for the investment boom ahead.

We lean into an above-benchmark exposure to the AI theme. We also like sectors such as tech, industrials, energy and materials. We like infrastructure and industrial companies exposed to the investment boom. High-for-longer policy rates prompts us to favor quality in both fixed income and equities.

AI’s buildout could initially be inflationary as demand for energy and commodities surges. Early winners could include large tech firms, chip makers and energy and utility firms – before benefits expand to other sectors.

We turn overweight UK stocks. The potential for relative political stability and attractive valuations may pull in foreign investors. We like inflation-linked bonds on a strategic horizon, partly due to elevated debt levels.

Different demand patterns in aging populations create opportunities in sectors like healthcare. We favor countries like India and Saudi Arabia benefitting from younger populations and infrastructure investment.

We like Japanese stocks on both tactical and strategic horizons, one of our highest-conviction views. We think sectors like healthcare can benefit from aging populations.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.