Last week: Tariffs negotiations continue - Powell should be safe - possible FED rate cut in June - poor earnings outlook

WEEKLY TRENDS

WEEKLY TRENDS

- Tariffs negotiations continued with India, Japan and South Korea last week

- Bessent’s intervention saved Powell’s seat and lobbied towards lower tariffs with China, in order to calm financial markets after Trump declared his wish to fire the FED President, ‘loser’ Powell. Focus will remain on tariffs negotiations until Trump decides to fire a new series of chaos generating bullets

- Q1 corporate earnings have been good, bar some exceptions, while outlook remains fragile and uncertain for most. Tesla reported lower than expected results last week while Alphabet (Google) reported higher results

- This coming week, we shall have the releases of important data: March US PCE inflation and NFP job report; Q1 earnings from Meta, Apple and Microsoft to name just a few

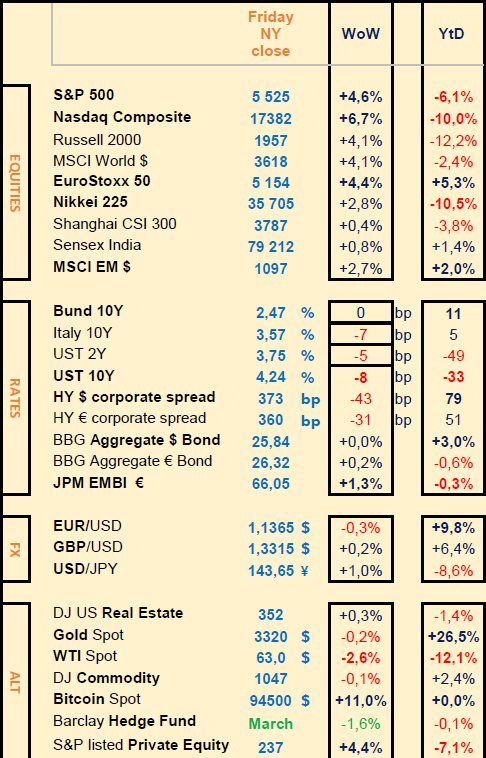

- The USD remained sidelined so did Bond yields, the previous slightly higher and the latter slightly lower. BTC benefitted from a risk-on mood.

MARKETS

Equities

Q1 corporate earnings released (WoW stock performances):

Tesla (+23%), Alphabet (+8%), SAP (+6%), Galderma (+18%), Safran (+7%), Bayer (+9%), Accor (+11%), Intel (+6%)

Worst performers: Thales (-9%), Reckitt Benckiser (-5%)

Analysts:

Airbus (JPM ‘o/w’ target €180)

Michelin (Barclays ‘u/w target €28), OVH (MS ’u/w’ target €10), STMicro (JPM ’neutral’ target €26)

Rates

US curve (2-10 years) steepening stable at 50bps. (Bond yields slightly lower across the board). According CME Fedwatch tool, 3 rate cuts are expected by the Fed this year (-25bps in June-July, -25bps in Sep and possibly another -25bps in Dec)

HY corporate spreads lower at 360/375 bps (EU/US)

Commodities

Oil price down (-2.5%) OPEC+ lower demand expectation and larger production from Kazakhstan

Gold price stable (-0.2%) with a slightly stronger USD. China has bought an amazing 10m troy ounces of Gold over the last 30 months hitting an ATH (All Time High) of 7.1% of its reserves. 5 tonnes were officially added in March and 50 tonnes in February (according to GS, so 10 times official figures).

Crypto

FED gives more support towards Cryptos, while the SNB refused categorically to add BTC to its reserves but added MicroStrategy shares that own a large amount of BTCs.

Under the watch

Stocks rebounded to the 50% retracement from 7 April lows and record highs on 19 Feb (SP500 at 5500 and EU600 at 520)

Nota Bene

Nasdaq 100 is now in positive territory in April after being down as much as 12%

CALENDAR

Macro Data releases:

US March PCE (30), April ISM (1 May), April NFP (2)

Q1 corporate earnings :

US Coca-Cola (29), Microsoft, Meta, Qualcomm (30), Apple, Amazon, Eli Lilly (1 May), Exxon, Chevron (2)

EU Schneider Elec (28), Astra Zeneca, Novartis (29), TotalEnergies, Airbus (30), Shell (2 May)

WHAT ANALYSTS SAY

GOLDMAN SACHS, 25 April 2025

Author: Jan Hatzius, GS Research chief economist

Will tariffs lead to a recession?

Paul Krugman, the Nobel-winning economist, explains that the size and speed of the rise in tariff rates makes this “the biggest trade shock in history.” But he's more concerned about the uncertainty created by the trade policy shift than the scale of the shift itself when it comes to US recession risk. Even high tariffs don't normally cause recessions, he says, but unpredictable tariffs that leave businesses hesitant to make long-term investment decisions very well might. As a result, Krugman says “a recession seems likely,” and argues that policy reversals may actually hurt rather than help, given that the reversals themselves may be reversed at a moment's notice, which only increases uncertainty.

Jan Hatzius, Goldman Sachs Research's chief economist, also expects a sizable tariff-induced hit to US GDP growth owing to reduced business investment, the tax-like effect of tariff increases on real income and consumer spending, and tighter financial conditions as markets price a dimmer outlook. He forecasts low US growth and a 45% chance of recession within the next year, assuming the full slate of the “Liberation Day” tariffs won't take effect. Goldman Sachs Research would probably shift to a recession call, he says, if they do take effect. That said, Hatzius is more optimistic than Krugman that a policy reversal could stabilize near-term conditions.

Oren Cass, founder of American Compass, argues that although the Trump administration's goal of reordering the global trade system will entail some short-term costs, “there is no reason the trade policies the administration is pursuing would need to cause a recession.” In his view, while the abruptness and lack of communication around the implementation of the shifts in tariff policy were understandably frustrating, the administration has already taken helpful steps to course correct, which should continue to resolve any uncertainty. And, Cass says, companies already have enough information about the administration's tariff goals to work out the right strategy: Invest significantly more in US-based production.

Are US Treasuries past the point of peak concern?

William Marshall, head of US rates strategy in Goldman Sachs Research, points to three main factors that could help explain the weakness in the price of Treasuries:

· Concerns about the path of the US economy. Growing trade tensions complicate the case for owning Treasuries as a hedge against volatility, given the possibility that tariffs could drive down growth while boosting inflation, Marshall points out. “Growth and inflation moving in opposite directions erodes some of that hedging property, which makes things a little bit more complicated. So if you're a multi-asset investor thinking about Treasuries in a portfolio context, their value is perhaps a little bit less clear cut,” Marshall says.

· A reassessment of the implications of tariffs for US debt. At the same time, the market's focus on the implications of tariffs for US borrowing has shifted in recent weeks from an emphasis on how much money tariffs could raise in revenue to concerns about the prospect of a downturn, which could lead to higher government borrowing due to lower tax receipts and increased spending needs.

· Are investors re-allocating away from dollar assets? It's not evident to Marshall that the recent price action reflects that dynamic. “We would not rule out a diversification away from dollar assets over time, but the near-term behavior appears more consistent with some anticipatory concern about that possibility in conjunction with unwinds of levered longs,” he notes, referring to trades using borrowed money that are positioned for assets to climb.

Marshall says the Treasury market may be past the local point of greatest concern, and the 90-day delay in tariff implementation allays concerns of a more severe tariff scenario in the near term. But he adds that all three factors could remain drivers of uncertainty in the market for some time to come.

ALLIANZ GLOBAL INVESTORS, 24 April 2025

Author: Ingo Mainert, AGI

American exceptionalism - the idea, indeed the ideology, of a special historical role for the United States - has been debated in the socio-political arena for decades. In economic terms, it can certainly be said that the United States has enjoyed a certain exceptional position in recent years. It has been the only major economy to record above-trend growth. At the same time, the US stock market has outperformed many of its peers, driven by major technology stocks. As a result, at the end of 2024, the United States accounted for more than 70% of the highly regarded MSCI World Equity index, in which the weighting of stocks depends on their market capitalisation. In the S&P500, the ‘Magnificent Seven’ technology giants alone account for almost 30% of the market. This concentration and asymmetry has made many investors uneasy for some time. It is high time to think about alternative weighting systems.

The relatively weak performance of US equities since the new government took office could be just the prelude to more serious changes in the financial markets. A new era, initially proclaimed following the Russian invasion of Ukraine and more recently in connection with the change of government in the United States, could also be imminent for the international financial system. The government programme known as ‘Trumponomics’, combined with a confrontational US negotiating policy focused on agreements with all countries, is leading to a return to a bygone era in trade policy: instead of cooperation and partnership - we are back to American isolationism and G-Zero. The problem is that, given that trade is not a zero-sum game, but is globally positive for all parties involved, this policy harms everyone. And the one who spoils things is probably the one who cuts himself the deepest. These are not good omens for the US stock market.

As if that wasn't enough, the Trump administration is also tinkering with the dollar's ‘safe haven’ status as the world's reserve currency. The president's economic advisers are reportedly considering a ‘Mar-a-Lago deal’ - an approach that combines aspects of monetary policy and security, including partial restrictions on capital movements. Unlike the Plaza Accord of 1985, which is supposed to have served as an inspiration, the willingness of the other major economies to participate is likely to be limited. All these considerations are not favourable to the current financial system, from which the United States derives many advantages: for example, the favourable yields on Treasury bills, which make public debt cheaper.

A strategic re-examination of the appropriateness of the excessive weighting of US equities in standard international indices is therefore necessary. But what are the alternatives? The advantage of a GDP-based weighting is that it is easy to calculate, an index weighting based on ‘market capitalisation’, leads to an overweighting of the largest debtors. This problem is minimised by a weighting based on GDP. If we apply this scheme to the MSCI World equity index, the US share is reduced from over 70% to around 50%.

However, this approach also has its drawbacks. The most obvious is that a country's economic development in a globalised world is linked only to a limited extent to that of the largest companies. This is particularly evident in Germany, where many DAX companies operate worldwide and have been able to weather the national economic downturn in recent years.

It therefore seems more appropriate to choose a direction which, like market capitalisation, is based on the company's key figures. These could be profits, for example. The advantage of this is that it reflects the company's real success and does not include an element of expectation. In fact, the share prices on which market capitalisation is based also anticipate the valuation of future profits - they therefore contain a ‘speculative’ element. According to Allianz GI's rough calculations, the US share of the global equity index would fall from 70% to around 40% with an earnings-based weighting. At this level, real diversification and significant deviations from conviction-based benchmarks would again be possible in global portfolios.

All this suggests that investors would do well to question traditional index weighting systems in order to avoid being caught out by the increasing number of market reversals and to reduce their dependence on the US when investing in global equities.

An earnings-based weighting could be a first step. In any case, we are currently experiencing a climate of optimism in Europe, which has led to a phenomenon not seen for a long time: the outperformance of European equity markets relative to the US. So for the time being, the fantasy is more along the lines of ‘Make European Markets Great (Again)!’ than ‘MAGA’.

Equities

Q1 corporate earnings released (WoW stock performances):

Tesla (+23%), Alphabet (+8%), SAP (+6%), Galderma (+18%), Safran (+7%), Bayer (+9%), Accor (+11%), Intel (+6%)

Worst performers: Thales (-9%), Reckitt Benckiser (-5%)

Analysts:

Airbus (JPM ‘o/w’ target €180)

Michelin (Barclays ‘u/w target €28), OVH (MS ’u/w’ target €10), STMicro (JPM ’neutral’ target €26)

Rates

US curve (2-10 years) steepening stable at 50bps. (Bond yields slightly lower across the board). According CME Fedwatch tool, 3 rate cuts are expected by the Fed this year (-25bps in June-July, -25bps in Sep and possibly another -25bps in Dec)

HY corporate spreads lower at 360/375 bps (EU/US)

Commodities

Oil price down (-2.5%) OPEC+ lower demand expectation and larger production from Kazakhstan

Gold price stable (-0.2%) with a slightly stronger USD. China has bought an amazing 10m troy ounces of Gold over the last 30 months hitting an ATH (All Time High) of 7.1% of its reserves. 5 tonnes were officially added in March and 50 tonnes in February (according to GS, so 10 times official figures).

Crypto

FED gives more support towards Cryptos, while the SNB refused categorically to add BTC to its reserves but added MicroStrategy shares that own a large amount of BTCs.

Under the watch

Stocks rebounded to the 50% retracement from 7 April lows and record highs on 19 Feb (SP500 at 5500 and EU600 at 520)

Nota Bene

Nasdaq 100 is now in positive territory in April after being down as much as 12%

CALENDAR

Macro Data releases:

US March PCE (30), April ISM (1 May), April NFP (2)

Q1 corporate earnings :

US Coca-Cola (29), Microsoft, Meta, Qualcomm (30), Apple, Amazon, Eli Lilly (1 May), Exxon, Chevron (2)

EU Schneider Elec (28), Astra Zeneca, Novartis (29), TotalEnergies, Airbus (30), Shell (2 May)

WHAT ANALYSTS SAY

- GOLDMAN SACHS: Will tariffs lead to a recession? Are US Treasuries past the point of peak concern?

- ALLIANZ GLOBAL INVESTORS: Diversification and risk reduction: US index weightings questioned.

GOLDMAN SACHS, 25 April 2025

Author: Jan Hatzius, GS Research chief economist

Will tariffs lead to a recession?

Paul Krugman, the Nobel-winning economist, explains that the size and speed of the rise in tariff rates makes this “the biggest trade shock in history.” But he's more concerned about the uncertainty created by the trade policy shift than the scale of the shift itself when it comes to US recession risk. Even high tariffs don't normally cause recessions, he says, but unpredictable tariffs that leave businesses hesitant to make long-term investment decisions very well might. As a result, Krugman says “a recession seems likely,” and argues that policy reversals may actually hurt rather than help, given that the reversals themselves may be reversed at a moment's notice, which only increases uncertainty.

Jan Hatzius, Goldman Sachs Research's chief economist, also expects a sizable tariff-induced hit to US GDP growth owing to reduced business investment, the tax-like effect of tariff increases on real income and consumer spending, and tighter financial conditions as markets price a dimmer outlook. He forecasts low US growth and a 45% chance of recession within the next year, assuming the full slate of the “Liberation Day” tariffs won't take effect. Goldman Sachs Research would probably shift to a recession call, he says, if they do take effect. That said, Hatzius is more optimistic than Krugman that a policy reversal could stabilize near-term conditions.

Oren Cass, founder of American Compass, argues that although the Trump administration's goal of reordering the global trade system will entail some short-term costs, “there is no reason the trade policies the administration is pursuing would need to cause a recession.” In his view, while the abruptness and lack of communication around the implementation of the shifts in tariff policy were understandably frustrating, the administration has already taken helpful steps to course correct, which should continue to resolve any uncertainty. And, Cass says, companies already have enough information about the administration's tariff goals to work out the right strategy: Invest significantly more in US-based production.

Are US Treasuries past the point of peak concern?

William Marshall, head of US rates strategy in Goldman Sachs Research, points to three main factors that could help explain the weakness in the price of Treasuries:

· Concerns about the path of the US economy. Growing trade tensions complicate the case for owning Treasuries as a hedge against volatility, given the possibility that tariffs could drive down growth while boosting inflation, Marshall points out. “Growth and inflation moving in opposite directions erodes some of that hedging property, which makes things a little bit more complicated. So if you're a multi-asset investor thinking about Treasuries in a portfolio context, their value is perhaps a little bit less clear cut,” Marshall says.

· A reassessment of the implications of tariffs for US debt. At the same time, the market's focus on the implications of tariffs for US borrowing has shifted in recent weeks from an emphasis on how much money tariffs could raise in revenue to concerns about the prospect of a downturn, which could lead to higher government borrowing due to lower tax receipts and increased spending needs.

· Are investors re-allocating away from dollar assets? It's not evident to Marshall that the recent price action reflects that dynamic. “We would not rule out a diversification away from dollar assets over time, but the near-term behavior appears more consistent with some anticipatory concern about that possibility in conjunction with unwinds of levered longs,” he notes, referring to trades using borrowed money that are positioned for assets to climb.

Marshall says the Treasury market may be past the local point of greatest concern, and the 90-day delay in tariff implementation allays concerns of a more severe tariff scenario in the near term. But he adds that all three factors could remain drivers of uncertainty in the market for some time to come.

ALLIANZ GLOBAL INVESTORS, 24 April 2025

Author: Ingo Mainert, AGI

American exceptionalism - the idea, indeed the ideology, of a special historical role for the United States - has been debated in the socio-political arena for decades. In economic terms, it can certainly be said that the United States has enjoyed a certain exceptional position in recent years. It has been the only major economy to record above-trend growth. At the same time, the US stock market has outperformed many of its peers, driven by major technology stocks. As a result, at the end of 2024, the United States accounted for more than 70% of the highly regarded MSCI World Equity index, in which the weighting of stocks depends on their market capitalisation. In the S&P500, the ‘Magnificent Seven’ technology giants alone account for almost 30% of the market. This concentration and asymmetry has made many investors uneasy for some time. It is high time to think about alternative weighting systems.

The relatively weak performance of US equities since the new government took office could be just the prelude to more serious changes in the financial markets. A new era, initially proclaimed following the Russian invasion of Ukraine and more recently in connection with the change of government in the United States, could also be imminent for the international financial system. The government programme known as ‘Trumponomics’, combined with a confrontational US negotiating policy focused on agreements with all countries, is leading to a return to a bygone era in trade policy: instead of cooperation and partnership - we are back to American isolationism and G-Zero. The problem is that, given that trade is not a zero-sum game, but is globally positive for all parties involved, this policy harms everyone. And the one who spoils things is probably the one who cuts himself the deepest. These are not good omens for the US stock market.

As if that wasn't enough, the Trump administration is also tinkering with the dollar's ‘safe haven’ status as the world's reserve currency. The president's economic advisers are reportedly considering a ‘Mar-a-Lago deal’ - an approach that combines aspects of monetary policy and security, including partial restrictions on capital movements. Unlike the Plaza Accord of 1985, which is supposed to have served as an inspiration, the willingness of the other major economies to participate is likely to be limited. All these considerations are not favourable to the current financial system, from which the United States derives many advantages: for example, the favourable yields on Treasury bills, which make public debt cheaper.

A strategic re-examination of the appropriateness of the excessive weighting of US equities in standard international indices is therefore necessary. But what are the alternatives? The advantage of a GDP-based weighting is that it is easy to calculate, an index weighting based on ‘market capitalisation’, leads to an overweighting of the largest debtors. This problem is minimised by a weighting based on GDP. If we apply this scheme to the MSCI World equity index, the US share is reduced from over 70% to around 50%.

However, this approach also has its drawbacks. The most obvious is that a country's economic development in a globalised world is linked only to a limited extent to that of the largest companies. This is particularly evident in Germany, where many DAX companies operate worldwide and have been able to weather the national economic downturn in recent years.

It therefore seems more appropriate to choose a direction which, like market capitalisation, is based on the company's key figures. These could be profits, for example. The advantage of this is that it reflects the company's real success and does not include an element of expectation. In fact, the share prices on which market capitalisation is based also anticipate the valuation of future profits - they therefore contain a ‘speculative’ element. According to Allianz GI's rough calculations, the US share of the global equity index would fall from 70% to around 40% with an earnings-based weighting. At this level, real diversification and significant deviations from conviction-based benchmarks would again be possible in global portfolios.

All this suggests that investors would do well to question traditional index weighting systems in order to avoid being caught out by the increasing number of market reversals and to reduce their dependence on the US when investing in global equities.

An earnings-based weighting could be a first step. In any case, we are currently experiencing a climate of optimism in Europe, which has led to a phenomenon not seen for a long time: the outperformance of European equity markets relative to the US. So for the time being, the fantasy is more along the lines of ‘Make European Markets Great (Again)!’ than ‘MAGA’.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.