Weak US economic data renew expectations of a 50bps FED rate cut in Sep - Corporate earnings growth under question

WEEKLY TRENDS

WEEKLY TRENDS

- A series of weaker than expected US economic data releases (ISM, PMI and weaker August job report) led to faster and larger FED rate cuts expectations and had a direct impact on corporate earnings growth expectations

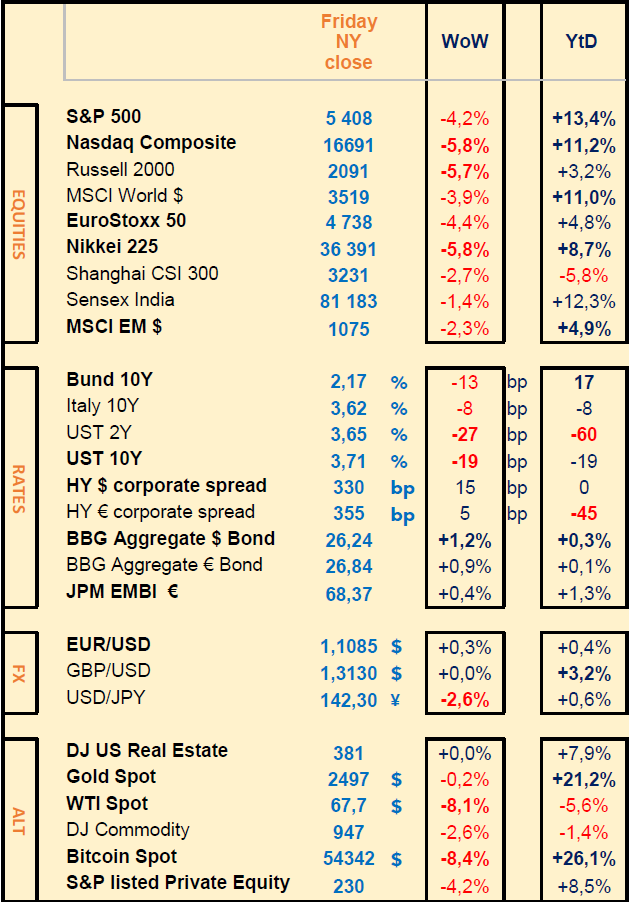

- The stock markets lowered globally with a more profound effect for the Nikkei, the Russell 2000 and the Nasdaq, the latter showing now an 11.2% YTD return vs the SP500 at +13.4%

- US treasuries rallied, 10 year reaching the lowest yield since June 2023. The US 2-10 year yield curve inversion has turned into a modest 5bps steepening curve

- Texas crude oil is down 8% over the week under the global risk off mood, a weak economic turn and despite OPEC+ members agreeing to extend production cuts to November

MARKETS

Equities

Early August mini Krach renewed in early September

Q2 earnings releases last week (stock WoW performance):

+++ US Vaxcyte (+38%), China Nio (+24%), Swiss Dormakaba (+9%)

- - - Partners Group (-11%), Broadcom (-15%), Volvo Car (-15%)

M&A: UK Rightmove (+18%), Australian REA is to launch an offer by 30 Sep; US Frontier Communications (+23%) to be bought by Verizon for $20bn (+40% over 3rd Sep stock price), Elis is to buy Vestis for $3.3bn

NB: Nvidia (-14%) possibly under DoJ investigation over anti-trust concerns; Hermes (-12%), LVMH (-9%) on weaker Chinese consumption data

Rates

US curve (2-10 years) is now steepening (+5bps)

FED rate cuts in 2024 are now at -125bps vs -100bps prior (CME FedWatch still points to a -25bps Sep rate cut despite a few looking at -50bps)

US

August NFP (+142 000 jobs created vs +165k expected and July revised down to 89k vs 114k prior) unemployment stays at 4.2% as expected

August Manufacturing PMI at 47.9 vs 48 expected and 49.6 prior

August Manufacturing ISM at 47.2 vs 47.5 expected and 46.8 prior

EU

Q2 euro zone GDP (+0.2% QoQ vs +0.3% prior and expected)

China

JPM, UBS, Nomura, all downgraded their China stocks exposure recommendations recently, over expected Tariff war 2.0 around US elections

Nota Bene

Palantir, Dell and Erie will join the SP500 on Sep 23rd replacing American Airlines, Etsy and Bio-Rad Lab

Global net Gold purchases by central banks reached 483 tonnes in H1 2024, the most on record (5% higher than the previous record in H1 2023 at 460 tonnes) the largest buyers were Poland, India and Turkey

CALENDAR

WHAT ANALYSTS SAY

UBS, 3rd September 2024 - Weak data and tech concerns drive equity selloff

Author: Mark Haefele, Global Wealth Management, CIO

What happened?

US equities fell and bonds rallied on Tuesday as the ISM manufacturing index signalled ongoing weakness in the industrial sector, while NVIDIA and other mega-cap stocks came under pressure, contributing to the market’s slide.

The S&P 500 fell 2.1%, its steepest decline since 5 August, as markets resumed activity following the Labor Day break. The tech-heavy Nasdaq Composite dropped 3.3%, with mega-cap tech stocks lower across the board, as Apple, Meta, Amazon, Alphabet, and Microsoft all lost ground. NVIDIA led the decline, falling 9.5%. The AI chipmaker’s shares have been volatile since the company reported earnings last week.

The ISM manufacturing report added to investor concerns about the health of the US economy. The headline index edged up slightly to 47.2 in August from July’s eight-month low of 46.8, but it remained in contractionary territory and missed consensus estimates. The new orders component fell further into contraction, dropping sharply to 44.6 from 47.4 in the previous month, marking its lowest reading since May 2023. Bonds rallied amid the risk-off sentiment, with yield on 10-year Treasuries dropping by 7 basis points.

Futures markets now price that the Fed will cut policy rates by roughly 100 bps in the remainder of this year

What do we expect?

We expect stocks to trade higher over the coming 6-12 months but would not rule out renewed volatility in stocks in the near term.

September has historically been a poor month for returns, suggesting that some seasonality may be playing a role in negative sentiment. The S&P 500 has declined in September in each of the last four years and seven of the last ten. This historical context may help explain why today's move could be signalling a broader risk-off sentiment as investors brace for potential volatility.

Additionally, uncertainty about the economic growth outlook may affect expectations for companies with cyclical revenue streams, including those at many technology companies.

In the lead up to the US presidential election, fears of increased restrictions on technology trade between the US and China could also weigh on the outlook. Additionally, we note that some leveraged and carry-fund positioning has already returned, though it is not at the extreme levels seen in early August.

Attention will now turn to the labor market, and Friday’s nonfarm payrolls report for August. Another disappointing jobs report could heighten recession fears and prompt the Fed to take more aggressive action.

UBS, 3rd September 2024 - Crude oil: trading at a 9 month low

Author: Giovanni Staunovo, Strategist

· Oil prices are trading at their lowest level since December 2023, following news of potential supply additions from OPEC+ and Libya.

· We still believe the oil market is undersupplied despite weak Chinese oil demand, as demand remains strong in other countries and supply growth has disappointed in some non-OPEC+ states.

· While prices are likely to stay volatile in the near term, we retain a positive outlook and expect prices to recover from current levels over the coming months

Crude oil prices have come under renewed pressure in recent days. In our previous report, we indicated that weak Chinese crude imports, refinery activity, and economic data in July were weighing on prices. The latest sell-off has been driven by two supply stories. Last week, news agencies reported OPEC+ will likely stick to their plan to increase monthly production by a modest amount of 180,000 barrels per day starting in October (the eight OPEC+ member states have yet to announce any changes to their voluntary production cuts).

On Tuesday, media reports of a potential deal in Libya that would allow the country to bring back disrupted supply triggered a further drop in prices. Previously, disagreement over control of the central bank and how oil revenues are distributed among Libyan stakeholders triggered a shutdown in oil production.

Other factors also likely exacerbated the price drop on Tuesday, like algorithm trading or negative gamma via the option market with Brent falling below USD 75/bbl.

From a fundamental point of view, based on falling observed oil inventories globally since May, the oil market remains undersupplied despite weak Chinese demand. Oil demand growth is healthy overall, though it’s a mixed story: It’s been weak in China this year, following a robust 2023, and strong in India as well as in European countries like Italy and Spain after a muted 2023. And notably, market players have largely ignored the production side. Production growth in Guyana remains strong, and supply from some other key non-OPEC+ countries has been rather disappointing.

Lastly, speculative positioning remains extremely low at present and considering that the oil market is still undersupplied, we think market participants are currently too pessimistic. We still expect prices to recover, with Brent moving back up above USD 80/bbl over the coming months. Hence, we continue to recommend risk-seeking investors to sell the downside price risks in crude oil.

WORLD GOLD COUNCIL, 6 September 2024 - Weekly Gold market wrap-up

Authors: WGC

· Flying high in August

Following a strong monthly increase in July, gold posted another healthy gain in August to finish 3.6% higher at US$2,513/oz. It also reached a new all-time on 20 August before a very marginal decline into month end.

According to our Gold Return Attribution Model (GRAM), gold was pulled higher by a material drop in the US dollar and, to a lesser extent, lower 10-year Treasury yields as the Fed signalled the time had come for rate cuts. The main identifiable negative contribution came from a momentum factor, the gold return in the previous month, i.e. when high, the following month typically sees a lower return and vice versa.

Also of note in August, the significant cut in import duty on gold in India, which took place in late July, has been a shot in the arm for gold demand in the country. Anecdotal reports suggest the duty reduction was followed by strong buying interest from jewellery retailers as well as consumers. Meanwhile, global physically-backed gold ETFs extended their inflow streak to four months. Western funds once again contributed the lion’s share of flows.

· Looking ahead

The current macro environment is tough to read due to the swirl of contradictory economic data releases. Arguably the pivotal US election is adding to the uncertainty and has likely fostered an increase in investors expressing their view through options markets. Gold ‘spreading’ positions in options, a normally quieter corner of the gold market, are at a multi-year high, suggesting that investors are either hedging or speculating on both a rate-cutting cycle and the outcome of the US election.

Globally, top line data still looks quite good. GDP growth is ticking along at 2.5% and composite PMIs remain positive. But services, which account for the lion’s share of output, are supporting those numbers and disguising the fact that manufacturing remains in a bit of a slump, particularly in Europe and China. Short-term rate markets, for their part, were little changed after Powell’s remarks, having priced in nearly 100 basis points in cuts before the end of the year, suggesting they anticipate further weakening in the labour market.

· In summary

We can only speculate on how broader macro data might influence market reactions, but it seems likely that both election dynamics and expectations of rate cuts have increased activity in gold, as seen in options ‘spreading’ positioning. Under these circumstances it is reasonable that investors are more focused on the near-term outlook. Their behaviour suggests that they view gold as a hedge against immediate event risks while also positioning it as a beneficiary of lower interest rates.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Early August mini Krach renewed in early September

Q2 earnings releases last week (stock WoW performance):

+++ US Vaxcyte (+38%), China Nio (+24%), Swiss Dormakaba (+9%)

- - - Partners Group (-11%), Broadcom (-15%), Volvo Car (-15%)

M&A: UK Rightmove (+18%), Australian REA is to launch an offer by 30 Sep; US Frontier Communications (+23%) to be bought by Verizon for $20bn (+40% over 3rd Sep stock price), Elis is to buy Vestis for $3.3bn

NB: Nvidia (-14%) possibly under DoJ investigation over anti-trust concerns; Hermes (-12%), LVMH (-9%) on weaker Chinese consumption data

Rates

US curve (2-10 years) is now steepening (+5bps)

FED rate cuts in 2024 are now at -125bps vs -100bps prior (CME FedWatch still points to a -25bps Sep rate cut despite a few looking at -50bps)

US

August NFP (+142 000 jobs created vs +165k expected and July revised down to 89k vs 114k prior) unemployment stays at 4.2% as expected

August Manufacturing PMI at 47.9 vs 48 expected and 49.6 prior

August Manufacturing ISM at 47.2 vs 47.5 expected and 46.8 prior

EU

Q2 euro zone GDP (+0.2% QoQ vs +0.3% prior and expected)

China

JPM, UBS, Nomura, all downgraded their China stocks exposure recommendations recently, over expected Tariff war 2.0 around US elections

Nota Bene

Palantir, Dell and Erie will join the SP500 on Sep 23rd replacing American Airlines, Etsy and Bio-Rad Lab

Global net Gold purchases by central banks reached 483 tonnes in H1 2024, the most on record (5% higher than the previous record in H1 2023 at 460 tonnes) the largest buyers were Poland, India and Turkey

CALENDAR

- Corporate earnings: US Oracle (9 Sep), Adobe (12); Europe Inditex (11 Sep)

- Macro: US August CPI (11 Sep), PPI (12 Sep); ECB rate decision (12 Sep, with a 25bps rate cut likely)

- Apple event (9 Sep) market will be looking for AI related announcements

WHAT ANALYSTS SAY

- UBS - Weak data and tech concerns drive equity selloff ; Crude oil trading at a 9 month low

- WORLD GOLD COUNCIL - Weekly Gold market wrap-up

UBS, 3rd September 2024 - Weak data and tech concerns drive equity selloff

Author: Mark Haefele, Global Wealth Management, CIO

What happened?

US equities fell and bonds rallied on Tuesday as the ISM manufacturing index signalled ongoing weakness in the industrial sector, while NVIDIA and other mega-cap stocks came under pressure, contributing to the market’s slide.

The S&P 500 fell 2.1%, its steepest decline since 5 August, as markets resumed activity following the Labor Day break. The tech-heavy Nasdaq Composite dropped 3.3%, with mega-cap tech stocks lower across the board, as Apple, Meta, Amazon, Alphabet, and Microsoft all lost ground. NVIDIA led the decline, falling 9.5%. The AI chipmaker’s shares have been volatile since the company reported earnings last week.

The ISM manufacturing report added to investor concerns about the health of the US economy. The headline index edged up slightly to 47.2 in August from July’s eight-month low of 46.8, but it remained in contractionary territory and missed consensus estimates. The new orders component fell further into contraction, dropping sharply to 44.6 from 47.4 in the previous month, marking its lowest reading since May 2023. Bonds rallied amid the risk-off sentiment, with yield on 10-year Treasuries dropping by 7 basis points.

Futures markets now price that the Fed will cut policy rates by roughly 100 bps in the remainder of this year

What do we expect?

We expect stocks to trade higher over the coming 6-12 months but would not rule out renewed volatility in stocks in the near term.

September has historically been a poor month for returns, suggesting that some seasonality may be playing a role in negative sentiment. The S&P 500 has declined in September in each of the last four years and seven of the last ten. This historical context may help explain why today's move could be signalling a broader risk-off sentiment as investors brace for potential volatility.

Additionally, uncertainty about the economic growth outlook may affect expectations for companies with cyclical revenue streams, including those at many technology companies.

In the lead up to the US presidential election, fears of increased restrictions on technology trade between the US and China could also weigh on the outlook. Additionally, we note that some leveraged and carry-fund positioning has already returned, though it is not at the extreme levels seen in early August.

Attention will now turn to the labor market, and Friday’s nonfarm payrolls report for August. Another disappointing jobs report could heighten recession fears and prompt the Fed to take more aggressive action.

UBS, 3rd September 2024 - Crude oil: trading at a 9 month low

Author: Giovanni Staunovo, Strategist

· Oil prices are trading at their lowest level since December 2023, following news of potential supply additions from OPEC+ and Libya.

· We still believe the oil market is undersupplied despite weak Chinese oil demand, as demand remains strong in other countries and supply growth has disappointed in some non-OPEC+ states.

· While prices are likely to stay volatile in the near term, we retain a positive outlook and expect prices to recover from current levels over the coming months

Crude oil prices have come under renewed pressure in recent days. In our previous report, we indicated that weak Chinese crude imports, refinery activity, and economic data in July were weighing on prices. The latest sell-off has been driven by two supply stories. Last week, news agencies reported OPEC+ will likely stick to their plan to increase monthly production by a modest amount of 180,000 barrels per day starting in October (the eight OPEC+ member states have yet to announce any changes to their voluntary production cuts).

On Tuesday, media reports of a potential deal in Libya that would allow the country to bring back disrupted supply triggered a further drop in prices. Previously, disagreement over control of the central bank and how oil revenues are distributed among Libyan stakeholders triggered a shutdown in oil production.

Other factors also likely exacerbated the price drop on Tuesday, like algorithm trading or negative gamma via the option market with Brent falling below USD 75/bbl.

From a fundamental point of view, based on falling observed oil inventories globally since May, the oil market remains undersupplied despite weak Chinese demand. Oil demand growth is healthy overall, though it’s a mixed story: It’s been weak in China this year, following a robust 2023, and strong in India as well as in European countries like Italy and Spain after a muted 2023. And notably, market players have largely ignored the production side. Production growth in Guyana remains strong, and supply from some other key non-OPEC+ countries has been rather disappointing.

Lastly, speculative positioning remains extremely low at present and considering that the oil market is still undersupplied, we think market participants are currently too pessimistic. We still expect prices to recover, with Brent moving back up above USD 80/bbl over the coming months. Hence, we continue to recommend risk-seeking investors to sell the downside price risks in crude oil.

WORLD GOLD COUNCIL, 6 September 2024 - Weekly Gold market wrap-up

Authors: WGC

· Flying high in August

Following a strong monthly increase in July, gold posted another healthy gain in August to finish 3.6% higher at US$2,513/oz. It also reached a new all-time on 20 August before a very marginal decline into month end.

According to our Gold Return Attribution Model (GRAM), gold was pulled higher by a material drop in the US dollar and, to a lesser extent, lower 10-year Treasury yields as the Fed signalled the time had come for rate cuts. The main identifiable negative contribution came from a momentum factor, the gold return in the previous month, i.e. when high, the following month typically sees a lower return and vice versa.

Also of note in August, the significant cut in import duty on gold in India, which took place in late July, has been a shot in the arm for gold demand in the country. Anecdotal reports suggest the duty reduction was followed by strong buying interest from jewellery retailers as well as consumers. Meanwhile, global physically-backed gold ETFs extended their inflow streak to four months. Western funds once again contributed the lion’s share of flows.

· Looking ahead

The current macro environment is tough to read due to the swirl of contradictory economic data releases. Arguably the pivotal US election is adding to the uncertainty and has likely fostered an increase in investors expressing their view through options markets. Gold ‘spreading’ positions in options, a normally quieter corner of the gold market, are at a multi-year high, suggesting that investors are either hedging or speculating on both a rate-cutting cycle and the outcome of the US election.

Globally, top line data still looks quite good. GDP growth is ticking along at 2.5% and composite PMIs remain positive. But services, which account for the lion’s share of output, are supporting those numbers and disguising the fact that manufacturing remains in a bit of a slump, particularly in Europe and China. Short-term rate markets, for their part, were little changed after Powell’s remarks, having priced in nearly 100 basis points in cuts before the end of the year, suggesting they anticipate further weakening in the labour market.

· In summary

We can only speculate on how broader macro data might influence market reactions, but it seems likely that both election dynamics and expectations of rate cuts have increased activity in gold, as seen in options ‘spreading’ positioning. Under these circumstances it is reasonable that investors are more focused on the near-term outlook. Their behaviour suggests that they view gold as a hedge against immediate event risks while also positioning it as a beneficiary of lower interest rates.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.