Amazon, Alphabet earnings disappoint - Jan US job report lifted 2yr US Bond yield - BOE 25bps cut - Gold hit new ATH

WEEKLY TRENDS

WEEKLY TRENDS

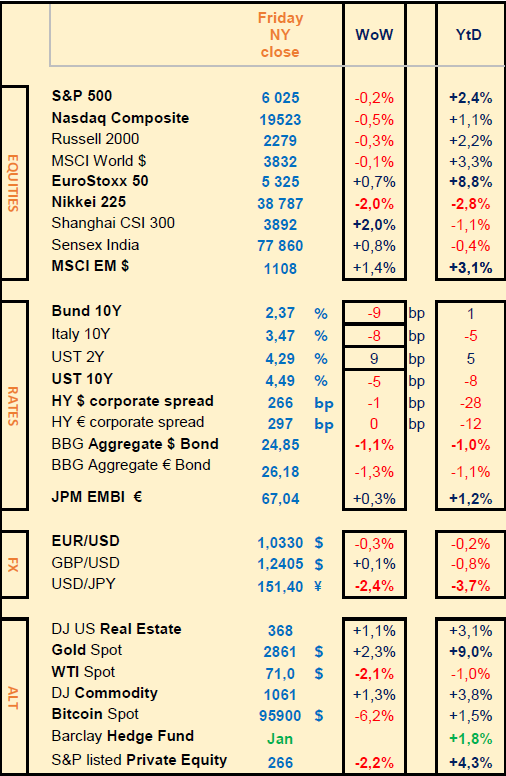

- Fourth week of Q4 earnings releases showed a variety of results (Alphabet, Merck and Amazon disappointed while Palantir, Eli Lilly and Novo Nordisk cheered up the mood). European stocks in general did better than their US counterparts, especially SG, Arcelor, Dassault Systems, Total, ARM Holdings, Infineon and Vinci

- The US NFP for Dec was released lower than expected at +143k jobs created vs 175k, but with a lower unemployment rate at 4% vs 4.1% prior and rising monthly salaries at +0.5%

- Gold reached new highs last week while BTC broke the $100k mark once more and ended the week lower at $96k (new US tariffs impact still concern investors who prefer safer havens). Oil price was not exempt from the new trade war (China imposing 10% tariffs on US oil) also pressured by increased US inventories

- This coming week will see the releases of additional Q4 earnings and Jan US inflation data

MARKETS

Equities

Q4 earnings released (weekly stock performance):

Palantir (+31%), Eli Lilly (+9%), Vinci (+7%), TotalEnergies (+6%), ARM holdings (+6%), Novo Nordisk (+5%), AstraZeneca (+3%), Linde (+2%)

Merck (-11%), Alphabet (-7%), AMD (-5%), Pepsico (-3%), Pfizer (-2%), Amazon (-2%), L’Oreal (-2%)

Analysts:

SocGen (MS ’o/w’ target €44); Universal Music (JPM ‘o/w’ target €42); ArcelorMittal (Barclays ‘o/w’ target €28); BNP (GS ‘buy’ target €82); SG (Barclays ‘o/w’ target €243)

Rates

US curve (2-10 years) steepening lowered by -15bps at 20bps. Long Bond yields lowered across the board, while US 2yr yield higher by 10bps

HY corporate spreads were unchanged

Commodities

Oil price down (-2%) on increased weekly US inventories (+8.6m barrels vs +2.4m expected) mainly due to increased imports from Canada

Gold price up (+2%) on renewed uncertainty over a new trade war (1m oz. of Gold were added to Comex Gold vaults on Friday)

China

Jan Caixin PMI released at 51.0 vs 52.2 prior (global services) 51.1 vs 51.4 prior (composite)

Cryptos

BlackRock plans to launch a BTC ETP in Europe. Ether is now at its weakest relative to BTC since Jan 2021

Under the watch

Private Equity ‘carried interest’ tax perk regime (new target for Trump)

FED reverse repo facility is collapsing, could lead to more money printing

Nota Bene

China has opened antitrust investigations into Nvidia and Google hours after imposing 10-15% new tariffs on some US imports

CALENDAR

Macro data releases:

US: CPI for January (12 Feb), PPI for January (13)

Q4 Corporate earnings:

US: McDonald’s (10 Feb), Coca-Cola, Shopify (11), Cisco (12)

EU: BP (11), EssilorLuxotica (12), Nestlé, Siemens, Unilever (13), Hermès, Safran (14)

WHAT ANALYSTS SAY

World Gold Council, 7 Feb 2025 - Central Bank Gold statistics December 2024

Authors: Krishan Gopaul, Senior Analyst, EMEA; Marissa Salim, Senior Research Lead, APAC

· Central banks reported 3t of net selling in December via the IMF and other public data sources

· Demand tapered during the month: gross purchases of 13t were offset by gross sales of 16t, with Kazakhstan reporting net sales of 11t

· Notably, People’s Bank of China was the largest reported net buyer (10t), followed by Czech National Bank and Bank of Ghana with a tonne net purchases each.

· Both gross purchases and sales in 2024 are lower compared to the same period in 2023.

· Poland is the largest reported net buyer in 2024 (90t) followed by Turkey (75t) and India (73t) over the same period.

Highlights

· The LBMA (PM) gold price reached 40 new record highs during 2024

· The combination of record gold prices and volumes produced a Q4 value of US$111bn. This took 2024 over the line to reach the highest-ever annual value of US$382bn.

· Growth in both mine production and recycling contributed to the increase in total supply of gold.

· Demand from high net worth investors remained healthy, but contrasted with profit-taking in some areas of OTC investment.

· 2025 full year outlook: central banks and ETF investors likely to drive demand with economic uncertainty supporting gold’s role as a risk hedge, but on the flipside, keeping pressure on jewellery.

Goldman Sachs, 7 Feb 2025 - Briefings

Authors: Kim Posnett, Global co-Head of Investment Banking; George Lee, CIO and co-Head Goldman Sachs Institute

What cheaper AI could mean for tech investment

The introduction of low-cost generative Artificial Intelligence models is raising questions about whether the high spending on AI by the world's largest technology companies is justified.

"This is unambiguously good news," says Kim Posnett, global co-head of investment banking in Goldman Sachs' Global Banking & Markets business. "The cost of compute is coming down dramatically. The price per token is coming down dramatically. That means these models are becoming more cost efficient. It is great for the world that this will be cheaper for all of us."

The emergence of lower-cost AI models also promises more efficient ways to train AI on large datasets, says George Lee, co-head of the Goldman Sachs Global Institute and the firm's former CIO. These models may "promise much more efficient ways of pre-training," Lee says, and "reduce the amount of capital we have to allocate to at least part of this ecosystem." While the decline in potential capital and token costs appears sudden, "this is part of a repeated history of the way that technology happens," Lee says. "It's a measurable but small blip in a steeply declining overall curve."

The biggest risk to the US exceptionalism theme

Financial markets were buffeted this week amid trade tensions between the US and its largest trade partners. However, sticky inflation was seen as a bigger risk to the US exceptionalism theme than tariffs, according to the latest Marquee QuickPoll, which surveyed nearly 800 respondents in early February (the poll closed on February 5). Key highlights include:

US economic data (43%) and geopolitics (42%) are the two biggest risks on investors' minds this month. "The focus on geopolitics reached levels not seen since April 2022 - the onset of the Russia-Ukraine war - as markets navigate policy-driven volatility," says Goldman Sachs' Oscar Ostlund, global head of Content Strategy, Market Analytics, and Data Science.

Investors are particularly focused on sticky inflation, singling it out as the biggest threat to the US exceptionalism theme. And some may be concerned that tariffs could keep prices elevated, according to the results. Notably, only 13% picked AI-related concerns as a risk here.

And despite the recent selloff in the tech sector sparked by the introduction of DeepSeek's low-cost AI model, 51% of respondents didn't change their tech or Magnificent 7 allocations. About a third moved towards defensives, while 21% moved towards non-US stocks. "Lack of ROI is the biggest concern for AI investors, even more so in the post-DeepSeek era, where focus for the first time turned towards AI names outside of the US," Ostlund says.

In terms of favorite long trades, developed-market equities took the lead by a large margin, followed by Gold. And while investors were still bullish on risk assets (on net), the bearish tone continued rising on the margin.

NB The S&P 500 fell by a cumulative total of 5% across all the days on which the US announced tariffs in 2018 and 2019, according to Goldman Sachs Research. It fell by slightly more - a cumulative total of 7% - across the days when other countries announced retaliatory tariffs.

IPO activity in Europe is expected to rise in 2025

IPO volumes rose strongly in Europe in 2024, signaling a gradual rebound after two years of subdued issuance. There are signs that public offerings will climb again this year, according to Richard Cormack in Goldman Sachs Global Banking & Markets.

Cormack points out that the region's IPO volume last year, while up about 80% from 2024, was still about a third below the longer-term average. "We should be getting closer to normalized volumes this year," says Cormack, the head of Equity Capital Markets in EMEA. He says the calendar for potential public offerings is busier than it was a year ago, and there are more conversations in particular with private equity sponsors.

He notes that the discount that investors sought for investing in an IPO narrowed over 2024. As that discount continues to shrink, issuers have become more comfortable embarking on public offerings. Some companies have attracted attention by changing their listings from London to New York. Cormack says there are companies from the UK and the rest of Europe that are particularly predisposed to listing in the US - businesses that are geographically exposed to the US and high-growth companies that won't see profitability until further into the future. He points out that there's more willingness to value the latter among US investors, and a deeper pool of capital to fund them.

"Outside of those two conditions, I don't think you'll see a flood of indigenous UK or indigenous European non-tech, non-biopharma companies list outside of their home markets," Cormack says.

AI to drive 165% increase in data center power demand

The explosion in interest in Generative Artificial Intelligence has resulted in an arms race to develop the technology, which will require vast numbers of high-density data centers as well as the electricity to power them.

Goldman Sachs Research forecasts global power demand from data centers to increase 50% by 2027 and by as much as 165% by the end of the decade (compared with 2023), writes James Schneider, a senior equity research analyst covering US telecom, digital infrastructure, and IT services, in the team's report.

The balance between data center supply and demand is forecast by Goldman Sachs Research to tighten in the coming years. The occupancy rate for this infrastructure is projected to increase from around 85% in 2023 to a potential peak of more than 95% in late 2026. That will likely be followed by a moderation starting in 2027, as more data centers come online and AI-driven demand growth slows.

These trends will open up new opportunities for investors, particularly in hyperscale cloud providers, power utilities, asset managers, and data center operators, according to Schneider.

Equities

Q4 earnings released (weekly stock performance):

Palantir (+31%), Eli Lilly (+9%), Vinci (+7%), TotalEnergies (+6%), ARM holdings (+6%), Novo Nordisk (+5%), AstraZeneca (+3%), Linde (+2%)

Merck (-11%), Alphabet (-7%), AMD (-5%), Pepsico (-3%), Pfizer (-2%), Amazon (-2%), L’Oreal (-2%)

Analysts:

SocGen (MS ’o/w’ target €44); Universal Music (JPM ‘o/w’ target €42); ArcelorMittal (Barclays ‘o/w’ target €28); BNP (GS ‘buy’ target €82); SG (Barclays ‘o/w’ target €243)

Rates

US curve (2-10 years) steepening lowered by -15bps at 20bps. Long Bond yields lowered across the board, while US 2yr yield higher by 10bps

HY corporate spreads were unchanged

Commodities

Oil price down (-2%) on increased weekly US inventories (+8.6m barrels vs +2.4m expected) mainly due to increased imports from Canada

Gold price up (+2%) on renewed uncertainty over a new trade war (1m oz. of Gold were added to Comex Gold vaults on Friday)

China

Jan Caixin PMI released at 51.0 vs 52.2 prior (global services) 51.1 vs 51.4 prior (composite)

Cryptos

BlackRock plans to launch a BTC ETP in Europe. Ether is now at its weakest relative to BTC since Jan 2021

Under the watch

Private Equity ‘carried interest’ tax perk regime (new target for Trump)

FED reverse repo facility is collapsing, could lead to more money printing

Nota Bene

China has opened antitrust investigations into Nvidia and Google hours after imposing 10-15% new tariffs on some US imports

CALENDAR

Macro data releases:

US: CPI for January (12 Feb), PPI for January (13)

Q4 Corporate earnings:

US: McDonald’s (10 Feb), Coca-Cola, Shopify (11), Cisco (12)

EU: BP (11), EssilorLuxotica (12), Nestlé, Siemens, Unilever (13), Hermès, Safran (14)

WHAT ANALYSTS SAY

- World Gold Council - Central Bank Gold statistics December 2024

- Goldman Sachs - Briefings

World Gold Council, 7 Feb 2025 - Central Bank Gold statistics December 2024

Authors: Krishan Gopaul, Senior Analyst, EMEA; Marissa Salim, Senior Research Lead, APAC

· Central banks reported 3t of net selling in December via the IMF and other public data sources

· Demand tapered during the month: gross purchases of 13t were offset by gross sales of 16t, with Kazakhstan reporting net sales of 11t

· Notably, People’s Bank of China was the largest reported net buyer (10t), followed by Czech National Bank and Bank of Ghana with a tonne net purchases each.

· Both gross purchases and sales in 2024 are lower compared to the same period in 2023.

· Poland is the largest reported net buyer in 2024 (90t) followed by Turkey (75t) and India (73t) over the same period.

Highlights

· The LBMA (PM) gold price reached 40 new record highs during 2024

· The combination of record gold prices and volumes produced a Q4 value of US$111bn. This took 2024 over the line to reach the highest-ever annual value of US$382bn.

· Growth in both mine production and recycling contributed to the increase in total supply of gold.

· Demand from high net worth investors remained healthy, but contrasted with profit-taking in some areas of OTC investment.

· 2025 full year outlook: central banks and ETF investors likely to drive demand with economic uncertainty supporting gold’s role as a risk hedge, but on the flipside, keeping pressure on jewellery.

Goldman Sachs, 7 Feb 2025 - Briefings

Authors: Kim Posnett, Global co-Head of Investment Banking; George Lee, CIO and co-Head Goldman Sachs Institute

What cheaper AI could mean for tech investment

The introduction of low-cost generative Artificial Intelligence models is raising questions about whether the high spending on AI by the world's largest technology companies is justified.

"This is unambiguously good news," says Kim Posnett, global co-head of investment banking in Goldman Sachs' Global Banking & Markets business. "The cost of compute is coming down dramatically. The price per token is coming down dramatically. That means these models are becoming more cost efficient. It is great for the world that this will be cheaper for all of us."

The emergence of lower-cost AI models also promises more efficient ways to train AI on large datasets, says George Lee, co-head of the Goldman Sachs Global Institute and the firm's former CIO. These models may "promise much more efficient ways of pre-training," Lee says, and "reduce the amount of capital we have to allocate to at least part of this ecosystem." While the decline in potential capital and token costs appears sudden, "this is part of a repeated history of the way that technology happens," Lee says. "It's a measurable but small blip in a steeply declining overall curve."

The biggest risk to the US exceptionalism theme

Financial markets were buffeted this week amid trade tensions between the US and its largest trade partners. However, sticky inflation was seen as a bigger risk to the US exceptionalism theme than tariffs, according to the latest Marquee QuickPoll, which surveyed nearly 800 respondents in early February (the poll closed on February 5). Key highlights include:

US economic data (43%) and geopolitics (42%) are the two biggest risks on investors' minds this month. "The focus on geopolitics reached levels not seen since April 2022 - the onset of the Russia-Ukraine war - as markets navigate policy-driven volatility," says Goldman Sachs' Oscar Ostlund, global head of Content Strategy, Market Analytics, and Data Science.

Investors are particularly focused on sticky inflation, singling it out as the biggest threat to the US exceptionalism theme. And some may be concerned that tariffs could keep prices elevated, according to the results. Notably, only 13% picked AI-related concerns as a risk here.

And despite the recent selloff in the tech sector sparked by the introduction of DeepSeek's low-cost AI model, 51% of respondents didn't change their tech or Magnificent 7 allocations. About a third moved towards defensives, while 21% moved towards non-US stocks. "Lack of ROI is the biggest concern for AI investors, even more so in the post-DeepSeek era, where focus for the first time turned towards AI names outside of the US," Ostlund says.

In terms of favorite long trades, developed-market equities took the lead by a large margin, followed by Gold. And while investors were still bullish on risk assets (on net), the bearish tone continued rising on the margin.

NB The S&P 500 fell by a cumulative total of 5% across all the days on which the US announced tariffs in 2018 and 2019, according to Goldman Sachs Research. It fell by slightly more - a cumulative total of 7% - across the days when other countries announced retaliatory tariffs.

IPO activity in Europe is expected to rise in 2025

IPO volumes rose strongly in Europe in 2024, signaling a gradual rebound after two years of subdued issuance. There are signs that public offerings will climb again this year, according to Richard Cormack in Goldman Sachs Global Banking & Markets.

Cormack points out that the region's IPO volume last year, while up about 80% from 2024, was still about a third below the longer-term average. "We should be getting closer to normalized volumes this year," says Cormack, the head of Equity Capital Markets in EMEA. He says the calendar for potential public offerings is busier than it was a year ago, and there are more conversations in particular with private equity sponsors.

He notes that the discount that investors sought for investing in an IPO narrowed over 2024. As that discount continues to shrink, issuers have become more comfortable embarking on public offerings. Some companies have attracted attention by changing their listings from London to New York. Cormack says there are companies from the UK and the rest of Europe that are particularly predisposed to listing in the US - businesses that are geographically exposed to the US and high-growth companies that won't see profitability until further into the future. He points out that there's more willingness to value the latter among US investors, and a deeper pool of capital to fund them.

"Outside of those two conditions, I don't think you'll see a flood of indigenous UK or indigenous European non-tech, non-biopharma companies list outside of their home markets," Cormack says.

AI to drive 165% increase in data center power demand

The explosion in interest in Generative Artificial Intelligence has resulted in an arms race to develop the technology, which will require vast numbers of high-density data centers as well as the electricity to power them.

Goldman Sachs Research forecasts global power demand from data centers to increase 50% by 2027 and by as much as 165% by the end of the decade (compared with 2023), writes James Schneider, a senior equity research analyst covering US telecom, digital infrastructure, and IT services, in the team's report.

The balance between data center supply and demand is forecast by Goldman Sachs Research to tighten in the coming years. The occupancy rate for this infrastructure is projected to increase from around 85% in 2023 to a potential peak of more than 95% in late 2026. That will likely be followed by a moderation starting in 2027, as more data centers come online and AI-driven demand growth slows.

These trends will open up new opportunities for investors, particularly in hyperscale cloud providers, power utilities, asset managers, and data center operators, according to Schneider.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.