US economy is holding up (soft landing), the Fed is to cut less (25bps io 100bps), stocks rallied and the USD lowered

WEEKLY TRENDS

WEEKLY TRENDS

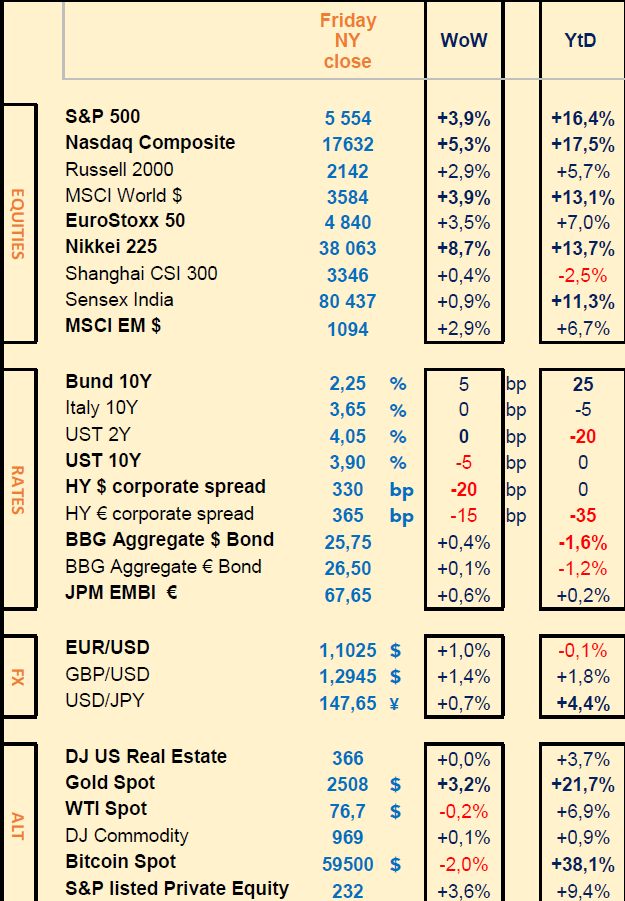

- After significant falls the previous weeks led by the Nikkei and a US stocks rotation at the end of July, stock markets globally corrected (S&P up 4%, Nasdaq +5%, Russell +3% and the Nikkei +9%)

- US July retail sales figures supported the move up and US July CPI / PPI data confirmed the soft landing of the US economy, leading to less Fed rate cuts expected this year (75bps instead of 100bps previously)

- US rate curve maintained its inversion 2-10 years at 15bps, Corporate high yield spreads reduced by 20bps and the USD weakened across the board to a 5 month low

- Gold benefited from lower US 10yr yield and a weaker USD, reaching yet another All Time High (ATH)

- Markets are now waiting for Powell’s speech at Jackson Hole (25 Aug) and Nvidia’s earnings (28 Aug)

MARKETS

Equities

Nikkei up +8.7%, Nasdaq +5.3%, MSCI World +3.9% and EM +2.9%

Q2 earnings releases (stock WoW performance):

+++ Starbucks (+26%), Wallmart (+7%), Cisco (+8%), Alibaba (+2%)

- - - Airbnb (-7%), Tencent Music (-19%), Dillard’s (-9%), Orsted (-9%)

M&A: Mars is to buy Pringles’ Kellanova for $36bn, Bharti Airtel is to buy BT’s 24.5% participation in Altice UK (GBP 3bn)

Analysts: GTT (+8% on Berenberg’s upgrade) JetBlue (-22% on S&P/Moody’s downgrades)

Mpox: Bavarian Nordic (+48%), Semi-conductors: Nvidia +19% (UBS maintained its target at $150), AMD +8%, Broadcom +14%

Rates

10 year US Treasury yield decreased slightly by 5bps WoW

Fed rate cuts expected (-25bps in Sep, -25bps in Nov, -25bps in Dec)

Inversion of the US curve, 2-10yr inversion slightly moved up at 15bps

US

July Retail sales (+1%, best reading for 18 months), July PPI +0.1% (YoY 2.2%, expected +2.3%), July CPI +0.2% (YoY +2.9%, expected +3%)

USD

USD index at a 5 month low (-0.7% WoW, -1.7% MoM, +1.1% YtD)

Japan

Q2 GDP at +0.8% QoQ, +3.1% YoY (Q1 at -0.6% QoQ)

Commodities

Gold up 3.2% and reaching another record high breaking $2500, Copper inventories are at their highest level in 4 years due to weak demand from Asia. China reported record levels of Silver imports in H1 2024

Nota Bene

Norway’s $1700bn fund reduced its holdings in Meta, NovoNord, ASML

US regional banks Q2 earnings dropped by 67% YoY

US banks face $500bn unrealised losses on ‘held to maturity’ securities

US Money Markets funds hit another record high at $61900bn (Aug 7th)

CALENDAR

WHAT ANALYSTS SAY

Goldman Sachs, 16 August 2024 - Briefings

Authors: Sam Morgan, global head of FICC sales

· How markets are reacting to Middle East tensions

As geopolitical tensions in the Middle East continue to spike, threatening to spill over into a broader war, markets have reacted — but not as sharply as might have been expected. Sam Morgan, co-head of One Goldman Sachs and global head of FICC sales, says regional assets, such as US dollar-Israeli shekel exchange rates, have been impacted and gyrated in recent months.

“But the impact on commodities has been fairly limited. The oil price is currently down on the month, and global equity and bond markets have been focused elsewhere,” Morgan says. The primary drivers of recent moves in the equity market have been changing perceptions around the timing and magnitude of Fed cuts, US employment and inflation data, tech earnings and AI developments, rather than the Middle East conflict.

Usually, tensions in the Middle East impact global growth through the price of oil. To date, the oil market has largely shrugged off geopolitical concerns and focused on the impact on demand of US and China growth slowdowns (and the potential impact of the US election on oil supply). To be sure, a further escalation of the conflict could push up oil prices if critical oil infrastructure were endangered. But the broader lesson remains that the markets focus first and foremost on the economy and policy, Morgan says. “Geopolitical tensions have major impacts on specific companies, sectors (such as defense), and countries. But for global impacts, there needs to be a direct knock-on to growth, inflation (via oil prices, say), or monetary and fiscal policy.”

UBS, 9 August 2024 - House view

Authors: Chief Investment Office GWM, Investment Research

· Global asset allocation

In our global strategy, we keep our preference for bonds over equities.

Within equities, we retain our preference for quality. Our most preferred region is the United Kingdom.

Within bonds, we prefer high grade and investment grade over emerging market credit and high yield.

Within commodities, we hold a preference for both oil and gold.

Within foreign exchange, the CHF is our most preferred currency. We stay neutral on the other major currencies.

· Equities

Global equities kept grinding higher over the last few months. Leadership was concentrated in the tech sector in June but has broadened in July as US inflation softened.

Inflation is normalizing, while economic growth is slowing modestly from elevated levels. This leaves room for central banks to cut rates, which should support both corporate earnings and valuations.

We expect earnings to keep recovering in the coming quarters. Tech should lead, but other sectors should contribute positively as well.

The equity outlook is constructive but well priced in, in our view, which limits the risk-reward of chasing the rally. We recommend keeping equity allocations at strategic weights. Regionally, we prefer the UK.

· Bonds

We are most preferred on fixed income given the all-in yields on offer and as central banks across parts of the developed world start reducing the level of official policy rates. Specifically, we maintain a preference for high grade and investment grade bonds and remain neutral on emerging market credit and high yield.

Despite the stalling in the disinflationary progress earlier in the year, recent data suggest that the stickiness in core service items is rolling over. This, combined with weak goods prices and some loosening of the tightness in labor markets, has allowed central banks in Switzerland, Sweden, Canada, and Europe to reduce the level of monetary policy restrictiveness. Others, such as the Federal Reserve, remain in data-watch mode but have signalled that the next policy rate move will be lower later this year.

· Foreign Exchange

The USD has been running out of steam lately. The risks are skewed toward additional USD weakness, as more macro disappointments are likely. This could lead to a test of existing ranges in key pairings such as EURUSD or GBPUSD.

The Swiss franc stays most preferred, as rate differentials should narrow and as uncertainty is likely to rise in 2H. Bouts of uncertainty in the months ahead should be used to engage in yield-pickup strategies.

Emerging market currencies have stabilized. And although we believe the outlook should improve once the Fed begins to cut rates, not all currencies are expected to perform well. We expect the CNY to remain under pressure, while the BRL could lag.

· Commodities

Commodities have given up some gains of late, outside of precious metals where gold has made new record highs. Indeed, weaker Chinese and US macro data have hurt sentiment across industrial metals and crude oil markets. But we expect key sectors to bottom over the coming months. We therefore maintain a positive outlook on the asset class into 2025. Over six to 12 months, we forecast total returns of around 10% for the UBS CMCI.

While gold remains a good hedge, we also see opportunities to engage in selling downside in crude oil, silver, sugar, and platinum.

· Position for lower rates

With economic growth and inflation slowing, and central banks starting to cut interest rates, we see significant opportunities in the fixed income market. We think investors should invest cash and money market holdings into high-quality corporate and government bonds, where we expect to see price appreciation as markets start to anticipate a deeper rate-cutting cycle. We also expect broadly diversified fixed income strategies to perform well in the months ahead. In addition, we have identified select ideas within Europe that can benefit from lower rates.

· Seize the AI opportunity

The market potential of AI is vast, and we expect AI to be a key driver of equity market returns over the coming years. We think it is important that investors hold sufficient long-term exposure to AI. For now, we see the best opportunities in the enabling layer of the AI value chain—which is benefiting from significant investment in AI capabilities—and in vertically integrated megacaps, which are well positioned across the value chain. We also think investors should look beyond the US for ways to capture AI growth, including in China’s tech monoliths.

· Opportunities in currencies and commodities

We see a variety of opportunities to enhance and diversify portfolio returns via the currency and commodity spaces. First, although the US dollar could remain well-bid in the near term, we expect it to weaken over the medium term as US interest rates are cut and fears rise about the US fiscal deficit. As a result, we recommend selling dollar rallies. Second, with the SNB unlikely to cut rates much further from here, we expect the Swiss franc to appreciate. Finally, we see opportunities in a broad range of commodities, including oil, copper, gold and silver.

· Seek quality growth

We think the idea of seeking quality growth should apply broadly to investors’ equity holdings. Recent earnings growth has been largely driven by firms with competitive advantages and exposure to structural drivers that have enabled them to grow and reinvest earnings consistently over time. We think that trend will continue, and investors should tilt toward quality growth to benefit.

· Prepare for the US election

The US election can trigger bouts of volatility, and we think investors should manage risks accordingly. In equities, the US consumer discretionary and renewables sectors would be at risk in a “red sweep” scenario. We see more potential upside in financials in that scenario. Investors should consider strategies to help hedge risks in sensitive stocks and sectors that we have identified, as well as currencies such as the Chinese yuan. We also think that gold can act as an effective hedge against fears of geopolitical polarization, inflation, or excessive deficits.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Nikkei up +8.7%, Nasdaq +5.3%, MSCI World +3.9% and EM +2.9%

Q2 earnings releases (stock WoW performance):

+++ Starbucks (+26%), Wallmart (+7%), Cisco (+8%), Alibaba (+2%)

- - - Airbnb (-7%), Tencent Music (-19%), Dillard’s (-9%), Orsted (-9%)

M&A: Mars is to buy Pringles’ Kellanova for $36bn, Bharti Airtel is to buy BT’s 24.5% participation in Altice UK (GBP 3bn)

Analysts: GTT (+8% on Berenberg’s upgrade) JetBlue (-22% on S&P/Moody’s downgrades)

Mpox: Bavarian Nordic (+48%), Semi-conductors: Nvidia +19% (UBS maintained its target at $150), AMD +8%, Broadcom +14%

Rates

10 year US Treasury yield decreased slightly by 5bps WoW

Fed rate cuts expected (-25bps in Sep, -25bps in Nov, -25bps in Dec)

Inversion of the US curve, 2-10yr inversion slightly moved up at 15bps

US

July Retail sales (+1%, best reading for 18 months), July PPI +0.1% (YoY 2.2%, expected +2.3%), July CPI +0.2% (YoY +2.9%, expected +3%)

USD

USD index at a 5 month low (-0.7% WoW, -1.7% MoM, +1.1% YtD)

Japan

Q2 GDP at +0.8% QoQ, +3.1% YoY (Q1 at -0.6% QoQ)

Commodities

Gold up 3.2% and reaching another record high breaking $2500, Copper inventories are at their highest level in 4 years due to weak demand from Asia. China reported record levels of Silver imports in H1 2024

Nota Bene

Norway’s $1700bn fund reduced its holdings in Meta, NovoNord, ASML

US regional banks Q2 earnings dropped by 67% YoY

US banks face $500bn unrealised losses on ‘held to maturity’ securities

US Money Markets funds hit another record high at $61900bn (Aug 7th)

CALENDAR

- Corporate Q2 earnings: in the US Lowe’s, Medtronic (20 Aug), Analog Devices (21 Aug), Intuit (22 Aug) ; in Europe Alcon (CH), Coloplast (DK), UK Antofagasta (20 Aug) Swiss Re (22 Aug)

- Data releases: EU July CPI (20 Aug)

WHAT ANALYSTS SAY

- Goldman Sachs - How markets have reacted to tensions in the Middle East

- UBS - Global asset allocation update

Goldman Sachs, 16 August 2024 - Briefings

Authors: Sam Morgan, global head of FICC sales

· How markets are reacting to Middle East tensions

As geopolitical tensions in the Middle East continue to spike, threatening to spill over into a broader war, markets have reacted — but not as sharply as might have been expected. Sam Morgan, co-head of One Goldman Sachs and global head of FICC sales, says regional assets, such as US dollar-Israeli shekel exchange rates, have been impacted and gyrated in recent months.

“But the impact on commodities has been fairly limited. The oil price is currently down on the month, and global equity and bond markets have been focused elsewhere,” Morgan says. The primary drivers of recent moves in the equity market have been changing perceptions around the timing and magnitude of Fed cuts, US employment and inflation data, tech earnings and AI developments, rather than the Middle East conflict.

Usually, tensions in the Middle East impact global growth through the price of oil. To date, the oil market has largely shrugged off geopolitical concerns and focused on the impact on demand of US and China growth slowdowns (and the potential impact of the US election on oil supply). To be sure, a further escalation of the conflict could push up oil prices if critical oil infrastructure were endangered. But the broader lesson remains that the markets focus first and foremost on the economy and policy, Morgan says. “Geopolitical tensions have major impacts on specific companies, sectors (such as defense), and countries. But for global impacts, there needs to be a direct knock-on to growth, inflation (via oil prices, say), or monetary and fiscal policy.”

UBS, 9 August 2024 - House view

Authors: Chief Investment Office GWM, Investment Research

· Global asset allocation

In our global strategy, we keep our preference for bonds over equities.

Within equities, we retain our preference for quality. Our most preferred region is the United Kingdom.

Within bonds, we prefer high grade and investment grade over emerging market credit and high yield.

Within commodities, we hold a preference for both oil and gold.

Within foreign exchange, the CHF is our most preferred currency. We stay neutral on the other major currencies.

· Equities

Global equities kept grinding higher over the last few months. Leadership was concentrated in the tech sector in June but has broadened in July as US inflation softened.

Inflation is normalizing, while economic growth is slowing modestly from elevated levels. This leaves room for central banks to cut rates, which should support both corporate earnings and valuations.

We expect earnings to keep recovering in the coming quarters. Tech should lead, but other sectors should contribute positively as well.

The equity outlook is constructive but well priced in, in our view, which limits the risk-reward of chasing the rally. We recommend keeping equity allocations at strategic weights. Regionally, we prefer the UK.

· Bonds

We are most preferred on fixed income given the all-in yields on offer and as central banks across parts of the developed world start reducing the level of official policy rates. Specifically, we maintain a preference for high grade and investment grade bonds and remain neutral on emerging market credit and high yield.

Despite the stalling in the disinflationary progress earlier in the year, recent data suggest that the stickiness in core service items is rolling over. This, combined with weak goods prices and some loosening of the tightness in labor markets, has allowed central banks in Switzerland, Sweden, Canada, and Europe to reduce the level of monetary policy restrictiveness. Others, such as the Federal Reserve, remain in data-watch mode but have signalled that the next policy rate move will be lower later this year.

· Foreign Exchange

The USD has been running out of steam lately. The risks are skewed toward additional USD weakness, as more macro disappointments are likely. This could lead to a test of existing ranges in key pairings such as EURUSD or GBPUSD.

The Swiss franc stays most preferred, as rate differentials should narrow and as uncertainty is likely to rise in 2H. Bouts of uncertainty in the months ahead should be used to engage in yield-pickup strategies.

Emerging market currencies have stabilized. And although we believe the outlook should improve once the Fed begins to cut rates, not all currencies are expected to perform well. We expect the CNY to remain under pressure, while the BRL could lag.

· Commodities

Commodities have given up some gains of late, outside of precious metals where gold has made new record highs. Indeed, weaker Chinese and US macro data have hurt sentiment across industrial metals and crude oil markets. But we expect key sectors to bottom over the coming months. We therefore maintain a positive outlook on the asset class into 2025. Over six to 12 months, we forecast total returns of around 10% for the UBS CMCI.

While gold remains a good hedge, we also see opportunities to engage in selling downside in crude oil, silver, sugar, and platinum.

· Position for lower rates

With economic growth and inflation slowing, and central banks starting to cut interest rates, we see significant opportunities in the fixed income market. We think investors should invest cash and money market holdings into high-quality corporate and government bonds, where we expect to see price appreciation as markets start to anticipate a deeper rate-cutting cycle. We also expect broadly diversified fixed income strategies to perform well in the months ahead. In addition, we have identified select ideas within Europe that can benefit from lower rates.

· Seize the AI opportunity

The market potential of AI is vast, and we expect AI to be a key driver of equity market returns over the coming years. We think it is important that investors hold sufficient long-term exposure to AI. For now, we see the best opportunities in the enabling layer of the AI value chain—which is benefiting from significant investment in AI capabilities—and in vertically integrated megacaps, which are well positioned across the value chain. We also think investors should look beyond the US for ways to capture AI growth, including in China’s tech monoliths.

· Opportunities in currencies and commodities

We see a variety of opportunities to enhance and diversify portfolio returns via the currency and commodity spaces. First, although the US dollar could remain well-bid in the near term, we expect it to weaken over the medium term as US interest rates are cut and fears rise about the US fiscal deficit. As a result, we recommend selling dollar rallies. Second, with the SNB unlikely to cut rates much further from here, we expect the Swiss franc to appreciate. Finally, we see opportunities in a broad range of commodities, including oil, copper, gold and silver.

· Seek quality growth

We think the idea of seeking quality growth should apply broadly to investors’ equity holdings. Recent earnings growth has been largely driven by firms with competitive advantages and exposure to structural drivers that have enabled them to grow and reinvest earnings consistently over time. We think that trend will continue, and investors should tilt toward quality growth to benefit.

· Prepare for the US election

The US election can trigger bouts of volatility, and we think investors should manage risks accordingly. In equities, the US consumer discretionary and renewables sectors would be at risk in a “red sweep” scenario. We see more potential upside in financials in that scenario. Investors should consider strategies to help hedge risks in sensitive stocks and sectors that we have identified, as well as currencies such as the Chinese yuan. We also think that gold can act as an effective hedge against fears of geopolitical polarization, inflation, or excessive deficits.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.