5 words from Nvidia last week: “demand for chips is great” led to Nasdaq’s best week this year / ECB cut by 25bps

WEEKLY TRENDS

WEEKLY TRENDS

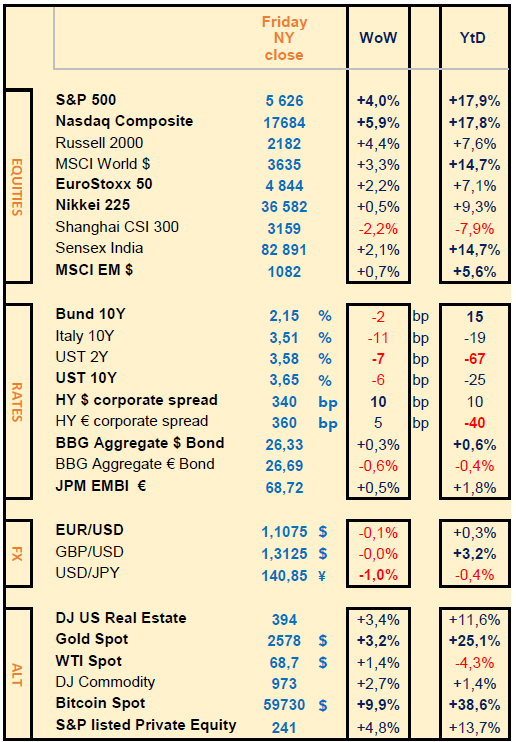

- Growth stocks posted solid gains last week mainly due to Nvidia’s CEO remark that demand for chips was great, also helped by lower annualised August headline US CPI at +2.5% vs July’s +2.9%

- Government bonds yields dropped by 5 to 10bps, however HY Corporate spreads rose by similar amplitude

- USD came lower especially against the Yen and USD denominated commodities benefitted from it: Silver, Crude Oil while Gold hit an ATH

- After the ECB’s 2nd rate cut last week, it is now the turn of the FED, BOE and BOJ to decide this week. The market is now pricing the FED (FOMC) Sep 18th decision at 50/50 between -25bps and -50bps, joining the global easing cycle started by the BOC (3 cuts already), the SNB and the ECB with 2 cuts and the BOE with one cut so far

MARKETS

Equities

Equity risk-on mood, except for China (CSI300 ended the week at -2%)

Q2 earnings releases last week (stock WoW performance) :

+++ Broadcom (+22%), Oracle (+14%), Inditex (+8%)

- - - Adobe (-5%), GameStop (-5%), Worldline (-15%)

M&A: South Africa AngloGold Ashanti (+31%) is to buy Centamin for £2bn; Commerzbank (+23%) could soon be the property of UniCredit that acquired 9% last week; Denmark DSV (+12%) is to buy Schenker for €14bn

NB: Palentir (+17%) to enter the SP500 on Sep 23rd; Ubisoft (-20%)

Rates

US curve (2-10 years) steepening (+7bps) the most since June 2022

FED rate cuts in 2024 are now priced at -125bps vs -100bps prior

US

August CPI (+0.2% in August, at +2.5% over the last 12 months)

August PPI (+0.2% in August, at +1.7% over the last 12 months)

Commodities

Crude Oil benefitted from a weaker USD and from Hurricane Francine in the Gulf of Mexico, and despite lower 2025 demand expectations from the IEA and from OPEC, respectively at +0.9m barrels a day vs +2m

New ATH (All Time High) for Gold at $2570

EU

Lagarde signalled the ECB was open to an Oct cut but Dec is more likely

Nota Bene

US government to spend more this year in interest payments ($1.2trn) than on military

US money markets saw for the 6th consecutive week a net inflow, total Money Market fund AuM at record high ($6.32trn)

Mag7 stocks were up 5 days in a row, best week since March 2023

CALENDAR

WHAT ANALYSTS SAY

GOLDMAN SACHS, 13 September 2024 - Briefings

Author: Investment strategy group, Asset Wealth Management

· The US economy is still poised for a soft landing

There's a 20% chance of a US recession over the next 12 months. That figure is unchanged from our economists' estimate before last week's US jobs report for employment in August, writes GS Research Chief Economist Jan Hatzius. The recession probability is now halfway between the 15% our economists estimated just before the weaker-than-expected July jobs report and the 25% they estimated right after.

While last week's jobs data fell modestly short of expectations, it showed a rebound from the previous month and a small dip in the unemployment rate to 4.2%. Most other recent economic indicators — including the nonmanufacturing ISM, initial jobless claims, and personal consumption - have been solid. Goldman Sachs Research's US GDP tracking estimate for the third quarter remains at 2.5%.

Goldman Sachs Research continues to expect three Federal Reserve rate cuts of 25 basis points each at the remaining Federal Open Market Committee meetings this year. “Our confidence that the upcoming cut on September 18 will be modest in size has grown following the latest data, as well as Fed commentary just before the start of the blackout period emphasizing that ‘cuts will be done carefully,'” Hatzius writes.

· The bullish outlook for UK stocks

UK stocks have outperformed several major asset classes and equity markets around the world this year. To investors looking for diversification, UK equities may present an opportunity. “Valuations are low, dividend yields are good, and there is less concern around concentrations risk,” says Lindsay Matcham, who works in futures sales trading in Goldman Sachs Global Banking & Markets.

Goldman Sachs Research forecasts the FTSE 100 to rise to 8,800 over the next 12 months, up from its present level of 8,256, as of Sep. 4. The index began the year at 7,721 and has registered a year-to-date rise of close to 7%. UK equities “proved resilient in the early August correction,” our analysts note. The robust year comes after over a decade of persistent underperformance: the UK weight in MSCI World has fallen to 2.2% from 5.3% in 2010.

Over the last 10 years, the FTSE 100 has delivered a 6% per annum total return, versus 8% for Stoxx 50, and 13% for the S&P 500. Some of this underperformance is due to weak earnings, domestic political upheavals, and the lack of a large listed technology sector, but much of it owes to a sharp decline in valuation as investors have shunned UK stocks. “The issue is not that foreign investors are refusing to ‘buy British'” our analysts write. Foreign investors own around two-thirds of the UK market cap. Rather, the issue is “a dearth of home-grown equity investing.”

As a result, companies without buyers for their stock trade at a large discount to non-UK equity, and often look to buy back shares; in fact, the only net buyers of UK equities in recent years have been corporates via buybacks, and the total shareholder yield for the FTSE 100 is twice that of the S&P 500. Cash-generative companies in telecoms, energy, and financials, where valuations tend to be low, have been particularly active in buying back stocks.

· Why September is the weakest month for equities

Since 1950, the second half of September has delivered the worst S&P 500 returns of any two-week trading period in the calendar year. The last 11 days of the month are historically even more dire; since 1928, the median S&P 500 return is negative for 10 out of those 11 days, says Scott Rubner, on the Emerging Markets Ex-Asia Derivative Sales and Macro Execution team. “The annual September weakness can traditionally be explained by the flow of funds into and out of the equity markets,” Rubner says.

US companies have been the largest buyers on equity markets. But as a number of companies enter a “blackout period” — a phase when they're unable to buy and sell shares ahead of the release of their earnings reports — Rubner expects corporate demand for shares to drop by 35% for around two weeks beginning Sep. 13.

Other institutional investors tend to rebalance their portfolios towards the end of every quarter, which in this case is the last half of September. Pension funds are 103% funded at the moment, according to the Milliman Top 100 Pension Funding Index, a measure of assets and future liabilities. “We have consistently seen them reduce equity risk and immunize liabilities (against the risk of interest-rate fluctuations) while moving into investment-grade credit around this time of the year,” Rubner says

Another factor this year is the upcoming US presidential election in November, and the prospect of policy uncertainty in its wake. “If I backtest this year against the previous six elections, it's exponentially more levered,” Rubner says. A potential risk is to go long on equities heading into the election, and “then something out of the blue happens, like say a capital gains tax on realized gains.”

· Gold prices forecast to climb to record high

The price of gold has increased more than 20% this year, peaking at a record of more than $2,500 per troy ounce. Goldman Sachs Research forecasts the price of gold will reach $2,700 by early next year, buoyed by interest rate cuts by the Federal Reserve and gold purchases by emerging market central banks. Gold could get an additional boost if the US imposes new financial sanctions or if concerns mount about the US debt burden.

Gold is our strategists' preferred near-term long (the commodity they most expect to go up in the short term), and it's also their preferred hedge against geopolitical and financial risks. Overall, Goldman Sachs Research forecasts a total return of 5% for the GSCI Commodity Index in 2025, down from the 12% total return it expects for this year.

“In this softer cyclical environment, gold stands out as the commodity where we have the highest confidence in near-term upside,” Goldman Sachs Research strategists Samantha Dart and Lina Thomas write.

BLACKROCK, 9 September 2024 - Weekly Commentary

Authors: Jean Boivin, Head of BlackRock Investment Institute

· Why U.S. equity gains can broaden

We get selective in artificial intelligence names, moving toward beneficiaries outside the tech sector. We look for quality in bonds after a sharp yield drop. We think the jobs data show market expectations for Fed rate cuts are overdone. U.S. recession fears and other factors have jolted markets. We could see more volatility flare-ups ahead of the U.S. presidential election. We move from a U.S. tech focus within our equity overweight, leaning further into a wider set of winners from the artificial intelligence (AI) buildout. We don’t see the Federal Reserve cutting policy rates as sharply as markets expect and go underweight U.S. short dated Treasuries. We prefer medium-term Treasuries and quality credit.

We see multiple factors driving market volatility: resurgent recession fears due to some softer economic data, pre-U.S. election jitters and profit-taking as investors make room for new stock issues. Yet U.S. corporate earnings have proved resilient. All sectors beat expectations for Q2 earnings, driving broad improvement in profit margins. Overall S&P 500 earnings growth was 13% in Q2, beating the 10% consensus expectation, LSEG data shows. Analysts are forecasting broad-based earnings growth over the next 12 months – especially for sectors tied to the AI theme. We see a narrowing gap in earnings growth between U.S. tech companies and the rest of the market – even if tech still leads the way – suggesting U.S. equity returns can broaden. We favor high-quality companies delivering consistent earnings growth and free cash flow in case volatility persists.

Even as inflation is falling toward the Fed’s target in the near term, higher inflation over the medium term will limit how far the Fed can cut rates, we think. Growth jitters and cooling inflation have driven 10-year yields to 15-month lows as investors have priced in more than 100 basis points of cuts by year-end and about 240 basis points of cuts over the next 12 months – implying a Fed response to a recession. That would take policy rates below our view of the neutral interest rate – the rate at which policy neither stimulates nor holds back growth.

We go underweight short-dated U.S. Treasuries, looking for income elsewhere in developed markets such as short-dated euro area bonds and credit.

Bottom line: We expand from a U.S. tech focus, leaning into a wider set of winners from the AI buildout. We trim our Japanese equity overweight. We go underweight U.S. short-dated Treasuries, preferring medium-term maturities and quality credit.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Equity risk-on mood, except for China (CSI300 ended the week at -2%)

Q2 earnings releases last week (stock WoW performance) :

+++ Broadcom (+22%), Oracle (+14%), Inditex (+8%)

- - - Adobe (-5%), GameStop (-5%), Worldline (-15%)

M&A: South Africa AngloGold Ashanti (+31%) is to buy Centamin for £2bn; Commerzbank (+23%) could soon be the property of UniCredit that acquired 9% last week; Denmark DSV (+12%) is to buy Schenker for €14bn

NB: Palentir (+17%) to enter the SP500 on Sep 23rd; Ubisoft (-20%)

Rates

US curve (2-10 years) steepening (+7bps) the most since June 2022

FED rate cuts in 2024 are now priced at -125bps vs -100bps prior

US

August CPI (+0.2% in August, at +2.5% over the last 12 months)

August PPI (+0.2% in August, at +1.7% over the last 12 months)

Commodities

Crude Oil benefitted from a weaker USD and from Hurricane Francine in the Gulf of Mexico, and despite lower 2025 demand expectations from the IEA and from OPEC, respectively at +0.9m barrels a day vs +2m

New ATH (All Time High) for Gold at $2570

EU

Lagarde signalled the ECB was open to an Oct cut but Dec is more likely

Nota Bene

US government to spend more this year in interest payments ($1.2trn) than on military

US money markets saw for the 6th consecutive week a net inflow, total Money Market fund AuM at record high ($6.32trn)

Mag7 stocks were up 5 days in a row, best week since March 2023

CALENDAR

- Corporate earnings: US Charles Schwab (16 Sep), Fedex (19 Sep); Europe H&M (11 Sep), Vinci (17 Sep)

- Macro: US August retail sales and Industrial Production (17 Sep)

- Central Bank rate decisions: FED (18 Sep, -25bps expected), BOE (19 Sep, no change expected), BOJ (20 Sep, no change expected)

WHAT ANALYSTS SAY

- GOLDMAN SACHS - the US economy is still poised for a soft landing ; the bullish outlook for British stocks; why September is the weakest month for equities; Gold is set to soar to a record high

- BLACKROCK - Weekly Commentary: why US equity gains can broaden

GOLDMAN SACHS, 13 September 2024 - Briefings

Author: Investment strategy group, Asset Wealth Management

· The US economy is still poised for a soft landing

There's a 20% chance of a US recession over the next 12 months. That figure is unchanged from our economists' estimate before last week's US jobs report for employment in August, writes GS Research Chief Economist Jan Hatzius. The recession probability is now halfway between the 15% our economists estimated just before the weaker-than-expected July jobs report and the 25% they estimated right after.

While last week's jobs data fell modestly short of expectations, it showed a rebound from the previous month and a small dip in the unemployment rate to 4.2%. Most other recent economic indicators — including the nonmanufacturing ISM, initial jobless claims, and personal consumption - have been solid. Goldman Sachs Research's US GDP tracking estimate for the third quarter remains at 2.5%.

Goldman Sachs Research continues to expect three Federal Reserve rate cuts of 25 basis points each at the remaining Federal Open Market Committee meetings this year. “Our confidence that the upcoming cut on September 18 will be modest in size has grown following the latest data, as well as Fed commentary just before the start of the blackout period emphasizing that ‘cuts will be done carefully,'” Hatzius writes.

· The bullish outlook for UK stocks

UK stocks have outperformed several major asset classes and equity markets around the world this year. To investors looking for diversification, UK equities may present an opportunity. “Valuations are low, dividend yields are good, and there is less concern around concentrations risk,” says Lindsay Matcham, who works in futures sales trading in Goldman Sachs Global Banking & Markets.

Goldman Sachs Research forecasts the FTSE 100 to rise to 8,800 over the next 12 months, up from its present level of 8,256, as of Sep. 4. The index began the year at 7,721 and has registered a year-to-date rise of close to 7%. UK equities “proved resilient in the early August correction,” our analysts note. The robust year comes after over a decade of persistent underperformance: the UK weight in MSCI World has fallen to 2.2% from 5.3% in 2010.

Over the last 10 years, the FTSE 100 has delivered a 6% per annum total return, versus 8% for Stoxx 50, and 13% for the S&P 500. Some of this underperformance is due to weak earnings, domestic political upheavals, and the lack of a large listed technology sector, but much of it owes to a sharp decline in valuation as investors have shunned UK stocks. “The issue is not that foreign investors are refusing to ‘buy British'” our analysts write. Foreign investors own around two-thirds of the UK market cap. Rather, the issue is “a dearth of home-grown equity investing.”

As a result, companies without buyers for their stock trade at a large discount to non-UK equity, and often look to buy back shares; in fact, the only net buyers of UK equities in recent years have been corporates via buybacks, and the total shareholder yield for the FTSE 100 is twice that of the S&P 500. Cash-generative companies in telecoms, energy, and financials, where valuations tend to be low, have been particularly active in buying back stocks.

· Why September is the weakest month for equities

Since 1950, the second half of September has delivered the worst S&P 500 returns of any two-week trading period in the calendar year. The last 11 days of the month are historically even more dire; since 1928, the median S&P 500 return is negative for 10 out of those 11 days, says Scott Rubner, on the Emerging Markets Ex-Asia Derivative Sales and Macro Execution team. “The annual September weakness can traditionally be explained by the flow of funds into and out of the equity markets,” Rubner says.

US companies have been the largest buyers on equity markets. But as a number of companies enter a “blackout period” — a phase when they're unable to buy and sell shares ahead of the release of their earnings reports — Rubner expects corporate demand for shares to drop by 35% for around two weeks beginning Sep. 13.

Other institutional investors tend to rebalance their portfolios towards the end of every quarter, which in this case is the last half of September. Pension funds are 103% funded at the moment, according to the Milliman Top 100 Pension Funding Index, a measure of assets and future liabilities. “We have consistently seen them reduce equity risk and immunize liabilities (against the risk of interest-rate fluctuations) while moving into investment-grade credit around this time of the year,” Rubner says

Another factor this year is the upcoming US presidential election in November, and the prospect of policy uncertainty in its wake. “If I backtest this year against the previous six elections, it's exponentially more levered,” Rubner says. A potential risk is to go long on equities heading into the election, and “then something out of the blue happens, like say a capital gains tax on realized gains.”

· Gold prices forecast to climb to record high

The price of gold has increased more than 20% this year, peaking at a record of more than $2,500 per troy ounce. Goldman Sachs Research forecasts the price of gold will reach $2,700 by early next year, buoyed by interest rate cuts by the Federal Reserve and gold purchases by emerging market central banks. Gold could get an additional boost if the US imposes new financial sanctions or if concerns mount about the US debt burden.

Gold is our strategists' preferred near-term long (the commodity they most expect to go up in the short term), and it's also their preferred hedge against geopolitical and financial risks. Overall, Goldman Sachs Research forecasts a total return of 5% for the GSCI Commodity Index in 2025, down from the 12% total return it expects for this year.

“In this softer cyclical environment, gold stands out as the commodity where we have the highest confidence in near-term upside,” Goldman Sachs Research strategists Samantha Dart and Lina Thomas write.

BLACKROCK, 9 September 2024 - Weekly Commentary

Authors: Jean Boivin, Head of BlackRock Investment Institute

· Why U.S. equity gains can broaden

We get selective in artificial intelligence names, moving toward beneficiaries outside the tech sector. We look for quality in bonds after a sharp yield drop. We think the jobs data show market expectations for Fed rate cuts are overdone. U.S. recession fears and other factors have jolted markets. We could see more volatility flare-ups ahead of the U.S. presidential election. We move from a U.S. tech focus within our equity overweight, leaning further into a wider set of winners from the artificial intelligence (AI) buildout. We don’t see the Federal Reserve cutting policy rates as sharply as markets expect and go underweight U.S. short dated Treasuries. We prefer medium-term Treasuries and quality credit.

We see multiple factors driving market volatility: resurgent recession fears due to some softer economic data, pre-U.S. election jitters and profit-taking as investors make room for new stock issues. Yet U.S. corporate earnings have proved resilient. All sectors beat expectations for Q2 earnings, driving broad improvement in profit margins. Overall S&P 500 earnings growth was 13% in Q2, beating the 10% consensus expectation, LSEG data shows. Analysts are forecasting broad-based earnings growth over the next 12 months – especially for sectors tied to the AI theme. We see a narrowing gap in earnings growth between U.S. tech companies and the rest of the market – even if tech still leads the way – suggesting U.S. equity returns can broaden. We favor high-quality companies delivering consistent earnings growth and free cash flow in case volatility persists.

Even as inflation is falling toward the Fed’s target in the near term, higher inflation over the medium term will limit how far the Fed can cut rates, we think. Growth jitters and cooling inflation have driven 10-year yields to 15-month lows as investors have priced in more than 100 basis points of cuts by year-end and about 240 basis points of cuts over the next 12 months – implying a Fed response to a recession. That would take policy rates below our view of the neutral interest rate – the rate at which policy neither stimulates nor holds back growth.

We go underweight short-dated U.S. Treasuries, looking for income elsewhere in developed markets such as short-dated euro area bonds and credit.

Bottom line: We expand from a U.S. tech focus, leaning into a wider set of winners from the AI buildout. We trim our Japanese equity overweight. We go underweight U.S. short-dated Treasuries, preferring medium-term maturities and quality credit.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.