Last week: Resilient US job report, FED expected to stay put on Wednesday but cut in the Summer - Risk back on for now

WEEKLY TRENDS

WEEKLY TRENDS

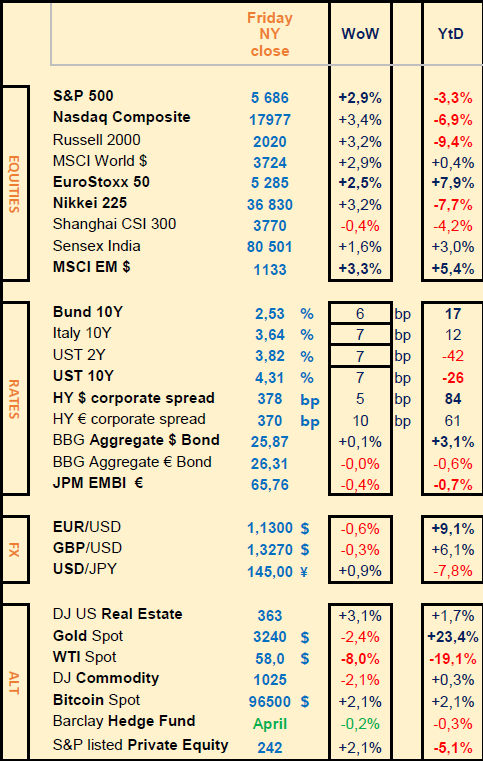

- Robust US job report in April, added to continued negotiations with China on trade barriers, together with strong Q1 earnings from Microsoft and Meta, pushed stocks higher and renewed the Risk-On mood (SP500 +3%, BTC +2%) despite a disappointing US Q1 GDP released at -0.3%

- Long Bond yields are slightly up, so are corporate high yield spreads. USD is also up slightly

- Focus will remain on Q1 earnings (Palantir, Berkshire, AMD, NovoNordisk, all releasing their Q1 earnings and outlooks this coming week) and on the FED FOMC meeting (no change to be expected) together with Powell’s speech on Wednesday, and on the BOE MPC meeting the following day (-25bps expected)

- Nota Bene, the US/UA rare minerals deal closed last week (Ukraine has 5% of the World’s critical raw materials) via a US/UA reconstruction investment fund with a 50-50 revenue split agreement

MARKETS

Equities

Q1 corporate earnings released (WoW stock performances):

Microsoft (+11%), Meta (+7%), Amazon (+0.1%)

Apple (-2%), Eli Lilly (-5%), Qualcomm (-5%), Exxon (-2%)

Analysts:

ASM (HSBC ‘buy’ target €560), Orange (JPM ‘o/w’ target €16.2), Porsche (JPM ‘o/w’ target €64)

Richemont (GS ‘neutral’ target CHF165), Roche (DB ’sell’ target CHF250)

Rates

US curve (2-10 years) steepening stable at 50bps. (Bond yields slightly higher across the board). According CME Fedwatch tool, 3 rate cuts are expected by the Fed this year (-25bps in June-July, -25bps in Sep and possibly another -25bps in Dec).

HY corporate spreads higher at 370/380 bps (EU/US)

Commodities

Oil price largely lower (-8%) OPEC+ (lower demand expectation and larger production expected)

Gold price lower (-2%) due to a stronger USD and a rumoured sale from China

US

NFP in April showed +177k jobs created vs 185k prior (revised from 228k)

Q1 GDP contracted for the first time since early 2022 (a one-off due to large imports ahead of Trump’s Liberation Day, thus avoiding tariffs)

PCE inflation in April showed +2.3% vs 2.7% prior (+2.6% Core vs 3%)

Under the watch

SP500 200 day Moving Average at 5747

Nota Bene

‘Sell in May and go away’ the SP500 showed May positive returns 9 times in the last 10 years, 2019 returned a negative figure (-6.6%).

Latest markets created acronym ‘TACO’ (Trump Always Chickens Out)

CALENDAR

Macro Data releases:

US FED (7 May), UK BOE (8 May)

Q1 corporate earnings:

US Berkshire Hathaway, Palantir (5 May), AMD (6), Costco, Uber (7)

EU AXA, Intesa, Ferrari (6), Novo Nordisk, ARM Hold., Zurich Ins (7)

WHAT ANALYSTS SAY

UBP, 2 May 2025

Author: Michaël Lok, UBP CIO and Co-CEO AM

On 9 July, Donald Trump's suspension will come to an end. What implications will this have for investment?

The US economy on the brink of a decisive ‘pivot

Trade threats have already slowed growth and rekindled inflation expectations. However, the third quarter is shaping up to be a pivotal moment in macroeconomic terms. If the tariffs were actually implemented in July, the shock would be clear: a reversal in the growth profile, and the first inflationary surges could be seen between now and September.

On the household front, morale, purchasing power and the wealth effect continue to deteriorate, while the unemployment rate is expected to rise in the second half of the year - factors likely to dampen consumption, which is currently resilient, without causing it to plummet. Businesses, for their part, are suffering from a lack of visibility, which is weighing on their investments and their efforts to relocate to the United States.

Full implementation of the tariff hikes, accompanied by retaliatory measures, would push inflation - both headline and underlying - above 4% year-on-year. But the prices of energy and non-energy goods have continued their year-on-year downward trend over the past month. A return of oil prices to between $55 and $40 a barrel would be necessary to keep headline inflation below 4%, despite trade tensions.

Overall, the outlook for 2025 remains uncertain, with growth expected to be between 1% and 1.5%, marked by a dip in activity in the third quarter. Moreover, the Federal Reserve's room for manoeuvre, faced with its dual mandate on inflation and growth, is proving to be more limited than the markets had envisaged. However, a slight rebound in activity could occur in the fourth quarter, stimulated by tax cuts. Despite a generally uncertain economic outlook, there are a few glimmers of hope. The US administration is sending out positive signals, notably through the easing of tensions with China. In addition, ongoing negotiations with certain trading partners, including India and Japan, could mitigate the negative effects of trade tensions. This dynamic could influence Europe and Switzerland, paving the way for lower tariff increases, which would ease the burden on companies in the countries concerned.

How do you position yourself in such an uncertain environment?

At the time of writing, US companies are reporting fairly good results for the first quarter, although the outlook is being treated with the requisite caution. The weaker dollar and the ‘front-loading’ phenomenon, i.e. the rush to buy imports before the new taxes come into force, explain the better-than-expected performance. But the exceptional nature of this second factor points to a slowdown in the second quarter. The rotation of financial flows out of the US, including by US investors, boosted the relative performance of Europe and the emerging markets. The results of the US technology giants, the driving force behind US stock market dominance in recent years, will play a decisive role in determining the direction of this trend.

Against this wait-and-see backdrop, we remain strongly convinced in gold, which we believe offers a good hedge against dollar weakness. Our target price is $4,000 an ounce by 2026.

JP Morgan Asset Management, 2 May 2025

Author: Nicholas Weindling, JP Morgan AM, Japan equity specialist

What other factors influence performance?

Faster wage growth is also prompting domestic investors to reconsider Japanese equities, supported by a more favourable economic outlook, reasonable valuations, higher yields and convincing corporate reforms. The Nippon Individual Savings Account (NISA), which offers tax exemptions on capital gains and dividends, has seen a surge in investment in Japanese equities. The government's changes at the start of the year, which increased the amounts invested and confirmed the tax exemption for an indefinite period, are likely to support future demand.

The end of deflation is boosting consumer confidence and increasing demand for domestic investment. The corporate sector is responding to these expectations, with a steady rise in capital expenditure by domestic companies. This is driven by the need to improve productivity and by offshoring efforts, such as the construction of semiconductor manufacturing plants in Japan by Taiwanese company TSMC.

What challenges or risks lie ahead?

The Japanese market is closely linked to the global economy, so any concerns about global growth can have an impact. A strong yen can be detrimental to the profits of Japanese companies, given that a significant proportion of those profits come from abroad. The reciprocal tariffs announced by President Trump on 2 April are in line with his 2024 policy. At first sight, however, they appear to be stricter than expected. We are assessing the potential impact to incorporate the latest developments, as a significant rise in tariffs could have a secondary effect on the business climate in the rest of the world, including Japan. We expect more uncertainty as we await international reactions.

We are monitoring the situation closely and assessing the potential impact on our portfolio positioning. In a worst-case scenario, if the global economy were to fall into recession, the currently proposed tariffs could have an impact on a number of cyclical companies in Japan, which could lead to profit cuts. This could lead to a shift from cyclical to growth-oriented companies in Japan, especially if the yen starts to strengthen. This environment may offer opportunities for companies, such as a number of world-renowned consumer brands, which should prove more resilient. It is worth noting that a number of Japanese companies have already relocated their production sites to the US, helping to mitigate some of the negative effects of tariffs.

Despite these challenges, Japan offers long-term investment opportunities. The Japanese stock market is one of the least covered of the developed markets, allowing active managers to explore lesser-known companies. The gap between yield and growth stocks has narrowed, making stock selection more important than style in delivering returns. The key is to focus on finding good companies with strong fundamentals at reasonable valuations.

The gap between yield and growth stocks has narrowed, making stock selection more important than style in delivering returns.

Changes in Japanese corporate governance make Japanese equities a potentially more attractive asset class. These changes include tighter listing criteria by the Tokyo Stock Exchange and active share buybacks.

Japan is once again the focus of international investors' attention, driven by several key factors that are redefining the investment landscape.

Firstly, regulators such as the Financial Supervision Agency (FSA) and the Tokyo Stock Exchange (TSE) are taking a more critical stance on cross-shareholdings, where companies hold shares in other companies. This practice has traditionally led to tangled relationships between companies and inefficiencies. However, recent regulatory pressure is leading to the abolition of such cross-shareholdings. In particular, Japan's three largest insurance companies have committed to selling their cross-shareholdings in their entirety, marking a transition to more transparent and efficient corporate structures.

Secondly, the TSE has launched initiatives such as ‘Action to Implement Management that is Conscious of Cost of Capital and Stock Price’, which encourages companies to focus on return on capital. This initiative denounces companies with poor practices and rewards those that give priority to shareholder value. In addition, the TSE's new standards for the TOPIX index will lead to the disqualification of 1,000 companies by July 2028, thereby favouring quality over quantity in the market.

Thirdly, shareholders are increasingly putting pressure on companies whose governance and performance leave something to be desired. This trend is leading to improved shareholder returns and greater diversity on boards. Activist investors and private equity funds are gaining influence, supported by institutional investors who are more open to activist campaigns today thanks to governance reforms and market developments. The tightening of listing criteria by the TSE and active share buybacks are also contributing to this dynamic.

Recent developments, particularly the TSE's initiatives, have led to an increase in share buybacks. In 2024, 94 companies were delisted from the Tokyo Stock Exchange, the highest number since 2013, marking the first decline in the total number of listed companies. This quest for quality is encouraging companies to focus on higher revenues and profit margins by concentrating on a smaller number of high-quality business sectors. Private equity firms have played a major role in this transformation, and this trend is set to accelerate.

Equities

Q1 corporate earnings released (WoW stock performances):

Microsoft (+11%), Meta (+7%), Amazon (+0.1%)

Apple (-2%), Eli Lilly (-5%), Qualcomm (-5%), Exxon (-2%)

Analysts:

ASM (HSBC ‘buy’ target €560), Orange (JPM ‘o/w’ target €16.2), Porsche (JPM ‘o/w’ target €64)

Richemont (GS ‘neutral’ target CHF165), Roche (DB ’sell’ target CHF250)

Rates

US curve (2-10 years) steepening stable at 50bps. (Bond yields slightly higher across the board). According CME Fedwatch tool, 3 rate cuts are expected by the Fed this year (-25bps in June-July, -25bps in Sep and possibly another -25bps in Dec).

HY corporate spreads higher at 370/380 bps (EU/US)

Commodities

Oil price largely lower (-8%) OPEC+ (lower demand expectation and larger production expected)

Gold price lower (-2%) due to a stronger USD and a rumoured sale from China

US

NFP in April showed +177k jobs created vs 185k prior (revised from 228k)

Q1 GDP contracted for the first time since early 2022 (a one-off due to large imports ahead of Trump’s Liberation Day, thus avoiding tariffs)

PCE inflation in April showed +2.3% vs 2.7% prior (+2.6% Core vs 3%)

Under the watch

SP500 200 day Moving Average at 5747

Nota Bene

‘Sell in May and go away’ the SP500 showed May positive returns 9 times in the last 10 years, 2019 returned a negative figure (-6.6%).

Latest markets created acronym ‘TACO’ (Trump Always Chickens Out)

CALENDAR

Macro Data releases:

US FED (7 May), UK BOE (8 May)

Q1 corporate earnings:

US Berkshire Hathaway, Palantir (5 May), AMD (6), Costco, Uber (7)

EU AXA, Intesa, Ferrari (6), Novo Nordisk, ARM Hold., Zurich Ins (7)

WHAT ANALYSTS SAY

- UBP Asset Management: a 90 day tariff break, and then what?

- JP Morgan Asset Management: Reforms make Japanese equities more attractive

UBP, 2 May 2025

Author: Michaël Lok, UBP CIO and Co-CEO AM

On 9 July, Donald Trump's suspension will come to an end. What implications will this have for investment?

The US economy on the brink of a decisive ‘pivot

Trade threats have already slowed growth and rekindled inflation expectations. However, the third quarter is shaping up to be a pivotal moment in macroeconomic terms. If the tariffs were actually implemented in July, the shock would be clear: a reversal in the growth profile, and the first inflationary surges could be seen between now and September.

On the household front, morale, purchasing power and the wealth effect continue to deteriorate, while the unemployment rate is expected to rise in the second half of the year - factors likely to dampen consumption, which is currently resilient, without causing it to plummet. Businesses, for their part, are suffering from a lack of visibility, which is weighing on their investments and their efforts to relocate to the United States.

Full implementation of the tariff hikes, accompanied by retaliatory measures, would push inflation - both headline and underlying - above 4% year-on-year. But the prices of energy and non-energy goods have continued their year-on-year downward trend over the past month. A return of oil prices to between $55 and $40 a barrel would be necessary to keep headline inflation below 4%, despite trade tensions.

Overall, the outlook for 2025 remains uncertain, with growth expected to be between 1% and 1.5%, marked by a dip in activity in the third quarter. Moreover, the Federal Reserve's room for manoeuvre, faced with its dual mandate on inflation and growth, is proving to be more limited than the markets had envisaged. However, a slight rebound in activity could occur in the fourth quarter, stimulated by tax cuts. Despite a generally uncertain economic outlook, there are a few glimmers of hope. The US administration is sending out positive signals, notably through the easing of tensions with China. In addition, ongoing negotiations with certain trading partners, including India and Japan, could mitigate the negative effects of trade tensions. This dynamic could influence Europe and Switzerland, paving the way for lower tariff increases, which would ease the burden on companies in the countries concerned.

How do you position yourself in such an uncertain environment?

At the time of writing, US companies are reporting fairly good results for the first quarter, although the outlook is being treated with the requisite caution. The weaker dollar and the ‘front-loading’ phenomenon, i.e. the rush to buy imports before the new taxes come into force, explain the better-than-expected performance. But the exceptional nature of this second factor points to a slowdown in the second quarter. The rotation of financial flows out of the US, including by US investors, boosted the relative performance of Europe and the emerging markets. The results of the US technology giants, the driving force behind US stock market dominance in recent years, will play a decisive role in determining the direction of this trend.

Against this wait-and-see backdrop, we remain strongly convinced in gold, which we believe offers a good hedge against dollar weakness. Our target price is $4,000 an ounce by 2026.

JP Morgan Asset Management, 2 May 2025

Author: Nicholas Weindling, JP Morgan AM, Japan equity specialist

What other factors influence performance?

Faster wage growth is also prompting domestic investors to reconsider Japanese equities, supported by a more favourable economic outlook, reasonable valuations, higher yields and convincing corporate reforms. The Nippon Individual Savings Account (NISA), which offers tax exemptions on capital gains and dividends, has seen a surge in investment in Japanese equities. The government's changes at the start of the year, which increased the amounts invested and confirmed the tax exemption for an indefinite period, are likely to support future demand.

The end of deflation is boosting consumer confidence and increasing demand for domestic investment. The corporate sector is responding to these expectations, with a steady rise in capital expenditure by domestic companies. This is driven by the need to improve productivity and by offshoring efforts, such as the construction of semiconductor manufacturing plants in Japan by Taiwanese company TSMC.

What challenges or risks lie ahead?

The Japanese market is closely linked to the global economy, so any concerns about global growth can have an impact. A strong yen can be detrimental to the profits of Japanese companies, given that a significant proportion of those profits come from abroad. The reciprocal tariffs announced by President Trump on 2 April are in line with his 2024 policy. At first sight, however, they appear to be stricter than expected. We are assessing the potential impact to incorporate the latest developments, as a significant rise in tariffs could have a secondary effect on the business climate in the rest of the world, including Japan. We expect more uncertainty as we await international reactions.

We are monitoring the situation closely and assessing the potential impact on our portfolio positioning. In a worst-case scenario, if the global economy were to fall into recession, the currently proposed tariffs could have an impact on a number of cyclical companies in Japan, which could lead to profit cuts. This could lead to a shift from cyclical to growth-oriented companies in Japan, especially if the yen starts to strengthen. This environment may offer opportunities for companies, such as a number of world-renowned consumer brands, which should prove more resilient. It is worth noting that a number of Japanese companies have already relocated their production sites to the US, helping to mitigate some of the negative effects of tariffs.

Despite these challenges, Japan offers long-term investment opportunities. The Japanese stock market is one of the least covered of the developed markets, allowing active managers to explore lesser-known companies. The gap between yield and growth stocks has narrowed, making stock selection more important than style in delivering returns. The key is to focus on finding good companies with strong fundamentals at reasonable valuations.

The gap between yield and growth stocks has narrowed, making stock selection more important than style in delivering returns.

Changes in Japanese corporate governance make Japanese equities a potentially more attractive asset class. These changes include tighter listing criteria by the Tokyo Stock Exchange and active share buybacks.

Japan is once again the focus of international investors' attention, driven by several key factors that are redefining the investment landscape.

Firstly, regulators such as the Financial Supervision Agency (FSA) and the Tokyo Stock Exchange (TSE) are taking a more critical stance on cross-shareholdings, where companies hold shares in other companies. This practice has traditionally led to tangled relationships between companies and inefficiencies. However, recent regulatory pressure is leading to the abolition of such cross-shareholdings. In particular, Japan's three largest insurance companies have committed to selling their cross-shareholdings in their entirety, marking a transition to more transparent and efficient corporate structures.

Secondly, the TSE has launched initiatives such as ‘Action to Implement Management that is Conscious of Cost of Capital and Stock Price’, which encourages companies to focus on return on capital. This initiative denounces companies with poor practices and rewards those that give priority to shareholder value. In addition, the TSE's new standards for the TOPIX index will lead to the disqualification of 1,000 companies by July 2028, thereby favouring quality over quantity in the market.

Thirdly, shareholders are increasingly putting pressure on companies whose governance and performance leave something to be desired. This trend is leading to improved shareholder returns and greater diversity on boards. Activist investors and private equity funds are gaining influence, supported by institutional investors who are more open to activist campaigns today thanks to governance reforms and market developments. The tightening of listing criteria by the TSE and active share buybacks are also contributing to this dynamic.

Recent developments, particularly the TSE's initiatives, have led to an increase in share buybacks. In 2024, 94 companies were delisted from the Tokyo Stock Exchange, the highest number since 2013, marking the first decline in the total number of listed companies. This quest for quality is encouraging companies to focus on higher revenues and profit margins by concentrating on a smaller number of high-quality business sectors. Private equity firms have played a major role in this transformation, and this trend is set to accelerate.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.