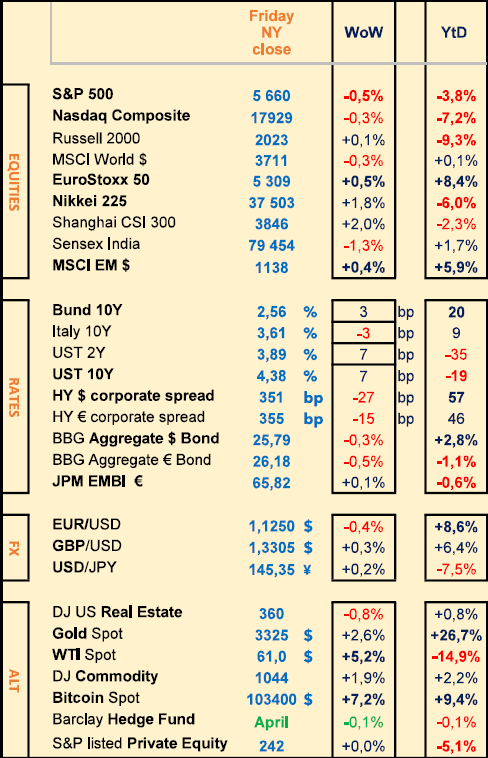

Last week: Calmer markets with first US-UK tariffs accord, Oil and BTC corrected up ; BOE cut by -25bps, FED unchanged

WEEKLY TRENDS

WEEKLY TRENDS

- 90% of the SP500 firms have now released their Q1 earnings, lifting some uncertainty, together with the first US tariff accord found last week with the UK, and with hopes to find an agreement with China soon (Trump claiming ‘80% tariff seems right’)

- Uncertainty remains though on the Ukraine front with Europe (France, Germany, Poland, UK) pushing an ultimatum to Russia for a 30 day ceasefire starting May 12th, else, sanctions will be applied

- Oil was boosted by the UK-US accord but also unfortunately by a renewed India-Pakistan conflict

- Note that the Healthcare sector was hit by the nomination of Vinay Prasad as head of the CBER-FDA (Sanofi, Novo Nordisk, Astra Zeneca, all showed a -5% WoW return). Alphabet (-7%) was impacted by the potential decision of Apple to add AI to its Safari engine

- China’s PBOC cut its 7 day reverse repo rate by 10bps at 1.4% (RRR was cut by 50bps to 6.2%).

MARKETS

Equities

Q1 corporate earnings released (WoW stock performances):

Rheinmetall (+7%), AMD (+4%), Ferrari (+6%)

Palantir (-5%), ARM Holdings (-4%), Novo Nordisk (-5%)

Analysts:

Be Semiconductor (JPM ‘o/w’ target €121), Haleon (MS ‘o/w’ target £425), Airbus (MS ‘o/w’ target €195), Swiss Life (Barclays ‘o/w’ target CHF809)

ABB (GS ‘neutral’ target CHF48), Amundi (JPM ’neutral’ target €72)

Rates

US curve (2-10 years) steepening stable at 50bps. (Bond yields slightly higher across the board). First FED rate cut is now pushed back to September, instead of July. BOE cut its base rate by 25bps to 4.25%.

HY corporate spreads lower at 350 bps (EU/US)

Commodities

Oil price higher (+5%) correction after the 8% drop the previous week, mostly due to the UK-US deal and the ongoing promising talks with China

Gold price higher (+2.5%) boosted by the India-Pakistan conflict

US

Trade deficit at record high (March at -$140.5bn vs -$137.5bn expected and -$123.2bn prior, revised from -$122.7bn)

Services PMI (April 50.8 vs 51.2 expected and 54.4 prior)

ISM Services (April 51.6 vs 50.2 expected and 50.8 prior)

Under the watch

SP500 200 day Moving Average at 5748

‘The US debt limit measures could run out in August’, Bessent.

Nota Bene

$37bn are the trading profits generated in Q1 by the major US banks, a record since 2015.

Bessent declared US growth next year will be 3%, resulting from new tariffs, deregulation and tax reduction.

CALENDAR

Macro Data releases:

US April CPI (13 May), UK Q1 GDP (14 May)

Q1 corporate earnings:

US Cisco (14 May), Walmart (15)

EU Munich Re (13), Siemens, Allianz (15), Richemont (16)

WHAT ANALYSTS SAY

Rothschild & Co, 9 May 2025

Author: Chiara Gay, Bond Portfolio Manager at Rothschild & Co

Markets are giving a good account of themselves, but the fundamentals are cracking: the time has come to rethink your portfolios. Caution pays, quality reassures.

In the current climate of persistent macroeconomic uncertainty and higher-than-expected inflation, we are adopting a more cautious stance on our bond exposure. While our positioning in the high-yield segment was buoyant last year, we no longer believe that the risk/reward ratio justifies an overweighting of lower-quality securities. We now favour higher-quality bonds that are more resilient and offer a more balanced return on risk.

Market behaviour in April highlighted some underlying fragilities. Technical factors, such as the fall in new issues and the growing importance of passive flows from ETFs and similar funds, have helped to keep credit spreads at historically low levels. However, fundamentals are starting to send different signals. More and more market professionals are warning of a possible return of credit-related problems. The combination of stubborn inflation, persistently high interest rates and the first signs of widening spreads suggests a gradual deterioration in conditions for corporate bonds.

Furthermore, the fact that the economy has not experienced a real recession for over a decade, apart from the brief and atypical Covid-related contraction, reinforces our belief that markets are underpricing risk. In our view, tighter financial conditions and slower growth will put increasing pressure on the most vulnerable segments of the credit spectrum.

Nevertheless, spreads in the high yield segment remain well below the levels seen during the recession, even after the correction seen in April. Yet March was the worst monthly performance for this segment for several months. Despite this, spreads remain far from the 600-800 basis point levels typically seen during a recession. Against this backdrop of heightened uncertainty, we have revised our credit spread forecasts upwards, anticipating a more persistent rise in credit risk. The expected rise in corporate defaults and pressure on ratings, particularly in sectors exposed to pricing constraints, reinforces our belief that lower quality debt remains vulnerable to macro-economic risks.

In an environment where market prices seem increasingly disconnected from fundamentals, we see more value in high quality debt. These instruments offer an attractive combination of stability, liquidity and regular income. In the face of accumulating risks, we believe that a defensive approach is no longer a matter of prudence, but is imperative if portfolios are to remain resilient.

Vanguard, 7 May 2025

Author: Viktor Nossek, Head of Investment and Product analytics, Vanguard Europe

While major Chinese banks are expected to adopt a half-yearly payment schedule, investors' attention is turning to Europe.

In Q1 2025, the volume of global dividends amounted to $398bn, an increase of 9.4% compared to the same period the previous year. While this remains a robust increase, it is well below the 15.3% rise recorded in the fourth quarter of 2024 - an early sign that growing global uncertainty is beginning to weigh on business confidence. On a rolling 12-month basis, global dividend payouts remain stable at $2200bn.

Dividend payouts in 2024 had reached record levels. And although dividends continued to rise in the first quarter of 2025, the first effects of potential tariffs are beginning to be felt. Declines were seen particularly in Asia-Pacific and emerging markets (excluding China), as well as in the consumer goods sectors in the US (-$5.8bn year-on-year) and China (-$2.3bn). However, these losses were offset this quarter by gains in North American financial stocks and the technology sector.

A stagnation in global dividends has been avoided thanks to an exceptional distribution of interim dividends in China. China's ‘Big Four’ - the four main state-owned banks (ICBC, Bank of China, Agricultural Bank of China, Bank of Communications) - alone paid out $24.3bn in the first quarter, almost half of their total payouts for 2024. While these banks traditionally paid their dividends annually, mainly in the third quarter, regulatory requirements are now leading them to distribute them more evenly over the year. This development could set a precedent and encourage other Chinese companies to adopt half-yearly or even quarterly distributions.

On a global scale, dividends paint a mixed picture. Japan recorded an 18% rise, North America 4%, the UK 1%, while Europe stagnated. Emerging markets (excluding China) were down by almost 7%, and the Asia-Pacific region (excluding Japan) saw its dividends fall by 14%.

Despite the exceptional interim payout in China, North America remains the leading payout region, with $191bn paid out in the first quarter, ahead of the emerging markets ($74bn), Europe ($51bn) and China ($38bn).

The financial sector maintains its leading position with $101 billion in dividends paid out, followed by energy ($56 billion), healthcare ($46 billion), technology ($39 billion) and consumer staples ($32 billion).

With the major Chinese banks set to adopt a half-yearly payout rythm from the third quarter, investors' attention is now turning to Europe. Traditionally, the second quarter is the key disbursement period in the region. However, against a backdrop of rising trade tensions, it may be more difficult to achieve new dividend records in US dollars, not least because of the sensitivity of European economies to exports.

Dividends remain a key driver of long-term stock market performance. Since 1993, the FTSE All-World index has gained almost 1.150%, of which 586 percentage points has come from reinvested dividends. This trend is likely to become even more important in an environment marked by persistent uncertainty and the risk of stagflation.

Pictet Asset Management, 5 May 2025

Author: Arun Sai, Senior Multi Asset Strategist, Pictet AM

US government bonds and the dollar rarely fall at the same time. Yet that is exactly what happened last month, marking the fourth most severe simultaneous correction in 40 years. In our view, it signals a rejection of President Trump's policies and calls into question the safe-haven status of Treasuries and the dollar, representing a crucial turning point for investors.

Tariffs aimed at reducing the dollar surpluses of trading partners are dampening demand for the dollar and Treasury bonds. At the same time, the militarisation of the US financial system and political reversals are reducing the attractiveness of investing in the country.

The United States has long wielded global influence, pushing back the boundaries of economic orthodoxy through its exceptionalism. It has maintained a double deficit, budget and current account, allowing its economy to prosper. However, current policies have transformed the United States from a source of global stability into an epicentre of uncertainty. National credibility is an essential asset, and its loss makes it difficult for foreign capital to continue to flow in at a sustained rate.

The UK offers some valuable lessons. In 2022, former Prime Minister Liz Truss's unfunded tax cuts caused panic in the gilt markets, with lingering effects. The US situation is made all the more fragile by its exceptionally high public borrowing requirements. The Treasury plans to issue USD2,000bn of new debt and refinance USD8,000bn of maturing bonds to finance the budget deficit. However, net issuance of Treasury bills has not kept pace with the budget deterioration. This will require around $500bn of new borrowing, at a time when financing costs are rising. In addition, tax cuts and the economic slowdown are expected to worsen the budget balance.

Recent Treasury bond auctions have been tepid, signalling a warning to investors. If increased supply leads to higher yields, US debt dynamics could deteriorate further. According to the Congressional Budget Office, a 0.1 percentage point rise in annual yields could increase the deficit by $350bn between 2026 and 2035. While the US will not lose its safe-haven status overnight, diversifying portfolios into other assets is becoming sensible.

German Bunds and gold should benefit from this reallocation. German government bond yields have remained stable despite the volatility of the US market, recording their strongest relative outperformance to Treasuries since 1989. Gold hit a new record high of $3,100 an ounce, supported by emerging market central banks increasing their precious metal reserves. Emerging market sovereign bonds in local currency and high quality credit should also see inflows, driven by growing economies and tame inflation.

Trump's trade policies may change, but the damage to the economy is already being felt. Bond investors have many reasons to look for alternatives to Treasuries and the dollar. This move towards portfolio diversification is inevitable. In the medium to long term, investors may seek a variety of global assets to better manage risk in an uncertain economic landscape.

Equities

Q1 corporate earnings released (WoW stock performances):

Rheinmetall (+7%), AMD (+4%), Ferrari (+6%)

Palantir (-5%), ARM Holdings (-4%), Novo Nordisk (-5%)

Analysts:

Be Semiconductor (JPM ‘o/w’ target €121), Haleon (MS ‘o/w’ target £425), Airbus (MS ‘o/w’ target €195), Swiss Life (Barclays ‘o/w’ target CHF809)

ABB (GS ‘neutral’ target CHF48), Amundi (JPM ’neutral’ target €72)

Rates

US curve (2-10 years) steepening stable at 50bps. (Bond yields slightly higher across the board). First FED rate cut is now pushed back to September, instead of July. BOE cut its base rate by 25bps to 4.25%.

HY corporate spreads lower at 350 bps (EU/US)

Commodities

Oil price higher (+5%) correction after the 8% drop the previous week, mostly due to the UK-US deal and the ongoing promising talks with China

Gold price higher (+2.5%) boosted by the India-Pakistan conflict

US

Trade deficit at record high (March at -$140.5bn vs -$137.5bn expected and -$123.2bn prior, revised from -$122.7bn)

Services PMI (April 50.8 vs 51.2 expected and 54.4 prior)

ISM Services (April 51.6 vs 50.2 expected and 50.8 prior)

Under the watch

SP500 200 day Moving Average at 5748

‘The US debt limit measures could run out in August’, Bessent.

Nota Bene

$37bn are the trading profits generated in Q1 by the major US banks, a record since 2015.

Bessent declared US growth next year will be 3%, resulting from new tariffs, deregulation and tax reduction.

CALENDAR

Macro Data releases:

US April CPI (13 May), UK Q1 GDP (14 May)

Q1 corporate earnings:

US Cisco (14 May), Walmart (15)

EU Munich Re (13), Siemens, Allianz (15), Richemont (16)

WHAT ANALYSTS SAY

- Rothschild & Co: Bond - stop the risk, go for quality

- Vanguard Europe: Global dividends - growth slows in the first quarter

- Pictet AM: Bond investors have many reasons to look for alternatives to US Treasuries and to the US dollar

Rothschild & Co, 9 May 2025

Author: Chiara Gay, Bond Portfolio Manager at Rothschild & Co

Markets are giving a good account of themselves, but the fundamentals are cracking: the time has come to rethink your portfolios. Caution pays, quality reassures.

In the current climate of persistent macroeconomic uncertainty and higher-than-expected inflation, we are adopting a more cautious stance on our bond exposure. While our positioning in the high-yield segment was buoyant last year, we no longer believe that the risk/reward ratio justifies an overweighting of lower-quality securities. We now favour higher-quality bonds that are more resilient and offer a more balanced return on risk.

Market behaviour in April highlighted some underlying fragilities. Technical factors, such as the fall in new issues and the growing importance of passive flows from ETFs and similar funds, have helped to keep credit spreads at historically low levels. However, fundamentals are starting to send different signals. More and more market professionals are warning of a possible return of credit-related problems. The combination of stubborn inflation, persistently high interest rates and the first signs of widening spreads suggests a gradual deterioration in conditions for corporate bonds.

Furthermore, the fact that the economy has not experienced a real recession for over a decade, apart from the brief and atypical Covid-related contraction, reinforces our belief that markets are underpricing risk. In our view, tighter financial conditions and slower growth will put increasing pressure on the most vulnerable segments of the credit spectrum.

Nevertheless, spreads in the high yield segment remain well below the levels seen during the recession, even after the correction seen in April. Yet March was the worst monthly performance for this segment for several months. Despite this, spreads remain far from the 600-800 basis point levels typically seen during a recession. Against this backdrop of heightened uncertainty, we have revised our credit spread forecasts upwards, anticipating a more persistent rise in credit risk. The expected rise in corporate defaults and pressure on ratings, particularly in sectors exposed to pricing constraints, reinforces our belief that lower quality debt remains vulnerable to macro-economic risks.

In an environment where market prices seem increasingly disconnected from fundamentals, we see more value in high quality debt. These instruments offer an attractive combination of stability, liquidity and regular income. In the face of accumulating risks, we believe that a defensive approach is no longer a matter of prudence, but is imperative if portfolios are to remain resilient.

Vanguard, 7 May 2025

Author: Viktor Nossek, Head of Investment and Product analytics, Vanguard Europe

While major Chinese banks are expected to adopt a half-yearly payment schedule, investors' attention is turning to Europe.

In Q1 2025, the volume of global dividends amounted to $398bn, an increase of 9.4% compared to the same period the previous year. While this remains a robust increase, it is well below the 15.3% rise recorded in the fourth quarter of 2024 - an early sign that growing global uncertainty is beginning to weigh on business confidence. On a rolling 12-month basis, global dividend payouts remain stable at $2200bn.

Dividend payouts in 2024 had reached record levels. And although dividends continued to rise in the first quarter of 2025, the first effects of potential tariffs are beginning to be felt. Declines were seen particularly in Asia-Pacific and emerging markets (excluding China), as well as in the consumer goods sectors in the US (-$5.8bn year-on-year) and China (-$2.3bn). However, these losses were offset this quarter by gains in North American financial stocks and the technology sector.

A stagnation in global dividends has been avoided thanks to an exceptional distribution of interim dividends in China. China's ‘Big Four’ - the four main state-owned banks (ICBC, Bank of China, Agricultural Bank of China, Bank of Communications) - alone paid out $24.3bn in the first quarter, almost half of their total payouts for 2024. While these banks traditionally paid their dividends annually, mainly in the third quarter, regulatory requirements are now leading them to distribute them more evenly over the year. This development could set a precedent and encourage other Chinese companies to adopt half-yearly or even quarterly distributions.

On a global scale, dividends paint a mixed picture. Japan recorded an 18% rise, North America 4%, the UK 1%, while Europe stagnated. Emerging markets (excluding China) were down by almost 7%, and the Asia-Pacific region (excluding Japan) saw its dividends fall by 14%.

Despite the exceptional interim payout in China, North America remains the leading payout region, with $191bn paid out in the first quarter, ahead of the emerging markets ($74bn), Europe ($51bn) and China ($38bn).

The financial sector maintains its leading position with $101 billion in dividends paid out, followed by energy ($56 billion), healthcare ($46 billion), technology ($39 billion) and consumer staples ($32 billion).

With the major Chinese banks set to adopt a half-yearly payout rythm from the third quarter, investors' attention is now turning to Europe. Traditionally, the second quarter is the key disbursement period in the region. However, against a backdrop of rising trade tensions, it may be more difficult to achieve new dividend records in US dollars, not least because of the sensitivity of European economies to exports.

Dividends remain a key driver of long-term stock market performance. Since 1993, the FTSE All-World index has gained almost 1.150%, of which 586 percentage points has come from reinvested dividends. This trend is likely to become even more important in an environment marked by persistent uncertainty and the risk of stagflation.

Pictet Asset Management, 5 May 2025

Author: Arun Sai, Senior Multi Asset Strategist, Pictet AM

US government bonds and the dollar rarely fall at the same time. Yet that is exactly what happened last month, marking the fourth most severe simultaneous correction in 40 years. In our view, it signals a rejection of President Trump's policies and calls into question the safe-haven status of Treasuries and the dollar, representing a crucial turning point for investors.

Tariffs aimed at reducing the dollar surpluses of trading partners are dampening demand for the dollar and Treasury bonds. At the same time, the militarisation of the US financial system and political reversals are reducing the attractiveness of investing in the country.

The United States has long wielded global influence, pushing back the boundaries of economic orthodoxy through its exceptionalism. It has maintained a double deficit, budget and current account, allowing its economy to prosper. However, current policies have transformed the United States from a source of global stability into an epicentre of uncertainty. National credibility is an essential asset, and its loss makes it difficult for foreign capital to continue to flow in at a sustained rate.

The UK offers some valuable lessons. In 2022, former Prime Minister Liz Truss's unfunded tax cuts caused panic in the gilt markets, with lingering effects. The US situation is made all the more fragile by its exceptionally high public borrowing requirements. The Treasury plans to issue USD2,000bn of new debt and refinance USD8,000bn of maturing bonds to finance the budget deficit. However, net issuance of Treasury bills has not kept pace with the budget deterioration. This will require around $500bn of new borrowing, at a time when financing costs are rising. In addition, tax cuts and the economic slowdown are expected to worsen the budget balance.

Recent Treasury bond auctions have been tepid, signalling a warning to investors. If increased supply leads to higher yields, US debt dynamics could deteriorate further. According to the Congressional Budget Office, a 0.1 percentage point rise in annual yields could increase the deficit by $350bn between 2026 and 2035. While the US will not lose its safe-haven status overnight, diversifying portfolios into other assets is becoming sensible.

German Bunds and gold should benefit from this reallocation. German government bond yields have remained stable despite the volatility of the US market, recording their strongest relative outperformance to Treasuries since 1989. Gold hit a new record high of $3,100 an ounce, supported by emerging market central banks increasing their precious metal reserves. Emerging market sovereign bonds in local currency and high quality credit should also see inflows, driven by growing economies and tame inflation.

Trump's trade policies may change, but the damage to the economy is already being felt. Bond investors have many reasons to look for alternatives to Treasuries and the dollar. This move towards portfolio diversification is inevitable. In the medium to long term, investors may seek a variety of global assets to better manage risk in an uncertain economic landscape.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.