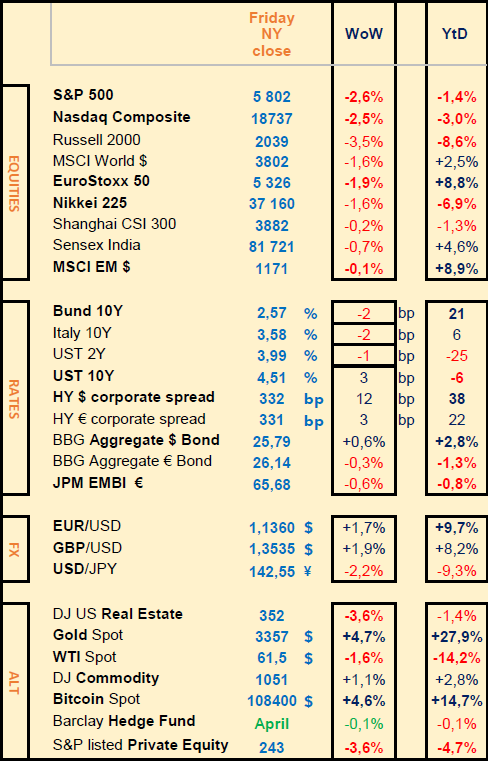

Last week: Trump’s latest tariff threat on EU - Higher than expected April UK CPI - poor US Treasury Bond auction

WEEKLY TRENDS

WEEKLY TRENDS

- While Trump threatened on Friday the EU with new 50% tariffs and Apple with new tariffs on its own, Bessent the US Treasury Secretary, declared he expected several trade deals within the next few weeks

- The poor $16bn 20yr US Treasury Bond auction results last Wednesday pushed the 30yr UST yield above 5% (at 5.15%, a level not seen since 2007)

- Trump tax bill went through Congress and is now at the Senate

- OPEC+ super sized output hike intention has pushed the Oil price lower last week and the PBOC together with the RBA, cut their rates by 10 and 25bps respectively

- UK CPI remained high or at least higher than expected in April which caused the UK rates futures to now discount only one more 25bps cut this year

- Last but not least, the Senate presented last Monday a bill to regulate Stablecoins (cryptos indexed to the USD).

- Focus will remain on tariffs, PCE data and Nvidia earnings releases

MARKETS

Equities

Q1 corporate earnings released (WoW stock performances):

BAT (+4%), Vodafone (+8%), Home Depot (-3%), Diageo (-9%)

Analysts:

Julius Baer (GS ‘buy’ target CHF69), Barclays (MS ‘o/w’ target £385), Vallourec (Barclays ‘o/w’ target €22), Alstom (JPM ‘o/w’ target €25)

Allianz (GS ‘neutral’ target €374)

Rates

US curve (2-10 years) steepening stable at 50bps. (US 30yr Bond yield higher at 5.05%).

HY corporate spreads slightly higher at 330 bps (EU/US)

Commodities

Oil price lower (-1.5%) among new threats from Israel to attack Iranian nuclear stations and the OPEC+ intending to increase its production, starting July 1st (+400k barrels/day additional production).

Gold price higher (+4.5%) following a weaker USD and in front of the US budget deficit issue

Cryptos

BTC almost up 5% and +15% YTD , 2nd best return after Gold so far this year (+28% YTD) fronting new regulations to come and due to global uncertainty surrounding US debt, tariffs, potential armed conflicts (India, Iran)

UK

April CPI at +3.5% (yoy) vs 3.3% expected, futures market now discounts only 1 more cut this year (-25bps)

Under the watch

US importers paid a record $16.5bn as April tariff bill lands

Nota Bene

Moody’s improved Italy’s rating outlook (to positive) maintained its rating at Baa3, due to better than expected fiscal performance last year

Jamie Dimon (JPM CEO) said that the full effects of tariffs have yet to be felt and that markets show an extraordinary amount of complacency

CALENDAR

Macro Data releases:

US April Core PCE price index (30 May), China May PMI (31 May)

Q1 corporate earnings:

US Nvidia, Salesforce (28 May), Dell (29)

WHAT ANALYSTS SAY

Coinhouse, 23 May 2025

Author: Manuel Valente, Coinhouse co-founder

Stablecoins, cryptocurrencies backed by currencies such as the dollar, have outgrown their initial role as a refuge from the volatility of crypto-assets. Originally designed to simplify trading on dedicated platforms, they are now emerging as an essential infrastructure for global payments, buoyed by massive institutional adoption and structuring regulatory frameworks.

A meteoric rise in adoption: 90% of the 295 executives of traditional banks, fintechs and payment gateways surveyed are exploring or using stablecoins. Nearly half of these institutions are actively using them for payments and 23% are running pilot projects, while only 10% are undecided.

Adoption varies by region. In Latin America, 71% of institutions are using stablecoins for cross-border payments, in Asia, 49% of players are targeting market expansion, while Europe and North America are capitalising on regulatory clarity to accelerate adoption.

The rise of stablecoins has not been without obstacles. The collapse of Terra/Luna in 2022, an algorithmic stablecoin, and questions about Tether's reserves highlighted the need for robust guarantees. These crises encouraged the growth of stablecoins with audited reserves, such as USDC and PYUSD, and catalysed the emergence of strict regulatory frameworks.

In Europe, MiCA regulations impose audited liquid reserves, European licences and strict consumer protection and anti-money laundering rules. In the US, the GENIUS Act, currently being debated in the Senate, aims to establish a federal framework for issuers, with similar reserve and licensing requirements.

The adoption of stablecoins is being boosted by the weaknesses of the SWIFT system, which has been the backbone of international interbank payments for over 60 years. SWIFT transactions often take between one and five days, whereas stablecoins enable settlements to be made in a matter of seconds. SWIFT fees, ranging from $20 to $50 per transaction, contrast with the minimal costs of blockchains. What's more, SWIFT lacks transparency, whereas blockchain offers complete traceability. Finally, SWIFT is reserved for institutions, whereas stablecoins democratise access, particularly for the self-employed and emerging markets.

Despite their rapid growth, stablecoins face a number of obstacles. Integration with traditional banking systems remains complex, particularly in Europe, where 42% of businesses fear the risks associated with their use.

Major players are filling these gaps. PayPal, with its PYUSD stablecoin, and Visa, with its VTAP platform, are linking stablecoins to traditional finance. In Latin America, Bancolombia Group is making it easier for individuals to invest using stablecoins.

La Financière de l’Echiquier, 23 May 2025

Author : Kevin Net, LFDE, Head of Asia investments

Since the end of 2024, China has once again been attracting international investors. Could Trump's announcement of additional tariffs on Chinese products and the escalation of trade disputes between China and the United States derail this renewed momentum?

China's potential has been seen in a different light since the revelation of DeepSeek, a generative AI offering performance comparable to that of Open AI's ChatGPT at a lower cost. Other major innovations have been unveiled, such as the ultra-fast recharging system developed by BYD for electric cars and the launch of an ambitious space exploration programme. These successes are the result of relentless investment in research and development: spending, which has tripled between 2011 and 2022, will reach nearly $811bn. Today, nearly half the world's patent applications come from China. These strengths have enabled the country to establish itself as a world leader in a number of strategic sectors.

A strategy of adaptation and autonomy

While the market was benefiting from the DeepSeek effect and in March returned to levels not seen since 2022, the return of the trade war led to a correction. The United States has imposed tariffs of 54% on China, to which China has responded with tariffs of 34% on American products, triggering an escalation that has so far reached 145% on Chinese imports and 125% on American imports, creating a de facto embargo between the two countries. China nevertheless has the means to resist these customs barriers. Several years ago, the country embarked on a strategy aimed at developing its self-sufficiency, particularly in the technology and energy sectors, and at relocating its production facilities, with production sites close to the end markets. China can also pivot towards its domestic economy. Following on from 2024, it is deploying targeted stimulus measures for consumption, to improve consumer sentiment, which remains at half-mast, and to release the very substantial savings accumulated during the pandemic. It is also worth noting the outstretched hand towards the private sector, which is still China's main employer.

Finally, Trump's approach, which until now has seen tariffs as a negotiating tool, could offer Beijing some diplomatic room for manoeuvre. The two countries are due to meet soon. The possibility of a major trade agreement cannot be ruled out.

Equity markets: geopolitical risks taken into account

In terms of valuation, the Chinese equity market is currently trading at around 10.7 times earnings, below its historical average. Some are talking about the need for a ‘geopolitical discount’. Despite this risk, we are convinced of the strength of Chinese innovation. What's more, the ability of companies to win market share on a global scale remains intact, which justifies a re-rating of the market. Unlike last September's rally, which was driven by expectations of stimulus, the rally at the start of the year was driven by positive concrete news from companies, and by Xi Jinping's reassuring turnaround towards the private sector. The market is now more interested in Chinese companies' capacity for innovation than in macroeconomic issues, which we believe have already been priced in.

Goldman Sachs Asset Management, 23 May 2025

Author: GS Global Investment Research

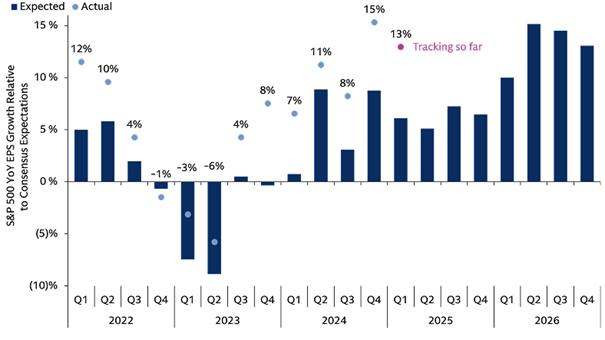

Once again, US companies have defied expectations, with first-quarter earnings growth of 13% year-on-year, 7 percentage points above consensus forecasts at the start of the season. However, many US companies are increasingly sensitive to the effects of tariffs on their business.

Mentions of the word “recession” on earnings conference calls have increased tenfold, reaching 23% in the first quarter, while references to redundancies remain low, appearing in just 2% of calls. This suggests that many companies prefer to wait for clarification on economic policy and macroeconomic data before making concrete decisions.

Equities

Q1 corporate earnings released (WoW stock performances):

BAT (+4%), Vodafone (+8%), Home Depot (-3%), Diageo (-9%)

Analysts:

Julius Baer (GS ‘buy’ target CHF69), Barclays (MS ‘o/w’ target £385), Vallourec (Barclays ‘o/w’ target €22), Alstom (JPM ‘o/w’ target €25)

Allianz (GS ‘neutral’ target €374)

Rates

US curve (2-10 years) steepening stable at 50bps. (US 30yr Bond yield higher at 5.05%).

HY corporate spreads slightly higher at 330 bps (EU/US)

Commodities

Oil price lower (-1.5%) among new threats from Israel to attack Iranian nuclear stations and the OPEC+ intending to increase its production, starting July 1st (+400k barrels/day additional production).

Gold price higher (+4.5%) following a weaker USD and in front of the US budget deficit issue

Cryptos

BTC almost up 5% and +15% YTD , 2nd best return after Gold so far this year (+28% YTD) fronting new regulations to come and due to global uncertainty surrounding US debt, tariffs, potential armed conflicts (India, Iran)

UK

April CPI at +3.5% (yoy) vs 3.3% expected, futures market now discounts only 1 more cut this year (-25bps)

Under the watch

US importers paid a record $16.5bn as April tariff bill lands

Nota Bene

Moody’s improved Italy’s rating outlook (to positive) maintained its rating at Baa3, due to better than expected fiscal performance last year

Jamie Dimon (JPM CEO) said that the full effects of tariffs have yet to be felt and that markets show an extraordinary amount of complacency

CALENDAR

Macro Data releases:

US April Core PCE price index (30 May), China May PMI (31 May)

Q1 corporate earnings:

US Nvidia, Salesforce (28 May), Dell (29)

WHAT ANALYSTS SAY

- Coinhouse: Stablecoins - the payment revolution

- Financière de l’Echiquier: what are the strengths and opportunities of the chinese market?

- Goldman Sachs: Earnings growth comes as a surprise despite economic uncertainties

Coinhouse, 23 May 2025

Author: Manuel Valente, Coinhouse co-founder

Stablecoins, cryptocurrencies backed by currencies such as the dollar, have outgrown their initial role as a refuge from the volatility of crypto-assets. Originally designed to simplify trading on dedicated platforms, they are now emerging as an essential infrastructure for global payments, buoyed by massive institutional adoption and structuring regulatory frameworks.

A meteoric rise in adoption: 90% of the 295 executives of traditional banks, fintechs and payment gateways surveyed are exploring or using stablecoins. Nearly half of these institutions are actively using them for payments and 23% are running pilot projects, while only 10% are undecided.

Adoption varies by region. In Latin America, 71% of institutions are using stablecoins for cross-border payments, in Asia, 49% of players are targeting market expansion, while Europe and North America are capitalising on regulatory clarity to accelerate adoption.

The rise of stablecoins has not been without obstacles. The collapse of Terra/Luna in 2022, an algorithmic stablecoin, and questions about Tether's reserves highlighted the need for robust guarantees. These crises encouraged the growth of stablecoins with audited reserves, such as USDC and PYUSD, and catalysed the emergence of strict regulatory frameworks.

In Europe, MiCA regulations impose audited liquid reserves, European licences and strict consumer protection and anti-money laundering rules. In the US, the GENIUS Act, currently being debated in the Senate, aims to establish a federal framework for issuers, with similar reserve and licensing requirements.

The adoption of stablecoins is being boosted by the weaknesses of the SWIFT system, which has been the backbone of international interbank payments for over 60 years. SWIFT transactions often take between one and five days, whereas stablecoins enable settlements to be made in a matter of seconds. SWIFT fees, ranging from $20 to $50 per transaction, contrast with the minimal costs of blockchains. What's more, SWIFT lacks transparency, whereas blockchain offers complete traceability. Finally, SWIFT is reserved for institutions, whereas stablecoins democratise access, particularly for the self-employed and emerging markets.

Despite their rapid growth, stablecoins face a number of obstacles. Integration with traditional banking systems remains complex, particularly in Europe, where 42% of businesses fear the risks associated with their use.

Major players are filling these gaps. PayPal, with its PYUSD stablecoin, and Visa, with its VTAP platform, are linking stablecoins to traditional finance. In Latin America, Bancolombia Group is making it easier for individuals to invest using stablecoins.

La Financière de l’Echiquier, 23 May 2025

Author : Kevin Net, LFDE, Head of Asia investments

Since the end of 2024, China has once again been attracting international investors. Could Trump's announcement of additional tariffs on Chinese products and the escalation of trade disputes between China and the United States derail this renewed momentum?

China's potential has been seen in a different light since the revelation of DeepSeek, a generative AI offering performance comparable to that of Open AI's ChatGPT at a lower cost. Other major innovations have been unveiled, such as the ultra-fast recharging system developed by BYD for electric cars and the launch of an ambitious space exploration programme. These successes are the result of relentless investment in research and development: spending, which has tripled between 2011 and 2022, will reach nearly $811bn. Today, nearly half the world's patent applications come from China. These strengths have enabled the country to establish itself as a world leader in a number of strategic sectors.

A strategy of adaptation and autonomy

While the market was benefiting from the DeepSeek effect and in March returned to levels not seen since 2022, the return of the trade war led to a correction. The United States has imposed tariffs of 54% on China, to which China has responded with tariffs of 34% on American products, triggering an escalation that has so far reached 145% on Chinese imports and 125% on American imports, creating a de facto embargo between the two countries. China nevertheless has the means to resist these customs barriers. Several years ago, the country embarked on a strategy aimed at developing its self-sufficiency, particularly in the technology and energy sectors, and at relocating its production facilities, with production sites close to the end markets. China can also pivot towards its domestic economy. Following on from 2024, it is deploying targeted stimulus measures for consumption, to improve consumer sentiment, which remains at half-mast, and to release the very substantial savings accumulated during the pandemic. It is also worth noting the outstretched hand towards the private sector, which is still China's main employer.

Finally, Trump's approach, which until now has seen tariffs as a negotiating tool, could offer Beijing some diplomatic room for manoeuvre. The two countries are due to meet soon. The possibility of a major trade agreement cannot be ruled out.

Equity markets: geopolitical risks taken into account

In terms of valuation, the Chinese equity market is currently trading at around 10.7 times earnings, below its historical average. Some are talking about the need for a ‘geopolitical discount’. Despite this risk, we are convinced of the strength of Chinese innovation. What's more, the ability of companies to win market share on a global scale remains intact, which justifies a re-rating of the market. Unlike last September's rally, which was driven by expectations of stimulus, the rally at the start of the year was driven by positive concrete news from companies, and by Xi Jinping's reassuring turnaround towards the private sector. The market is now more interested in Chinese companies' capacity for innovation than in macroeconomic issues, which we believe have already been priced in.

Goldman Sachs Asset Management, 23 May 2025

Author: GS Global Investment Research

Once again, US companies have defied expectations, with first-quarter earnings growth of 13% year-on-year, 7 percentage points above consensus forecasts at the start of the season. However, many US companies are increasingly sensitive to the effects of tariffs on their business.

Mentions of the word “recession” on earnings conference calls have increased tenfold, reaching 23% in the first quarter, while references to redundancies remain low, appearing in just 2% of calls. This suggests that many companies prefer to wait for clarification on economic policy and macroeconomic data before making concrete decisions.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.