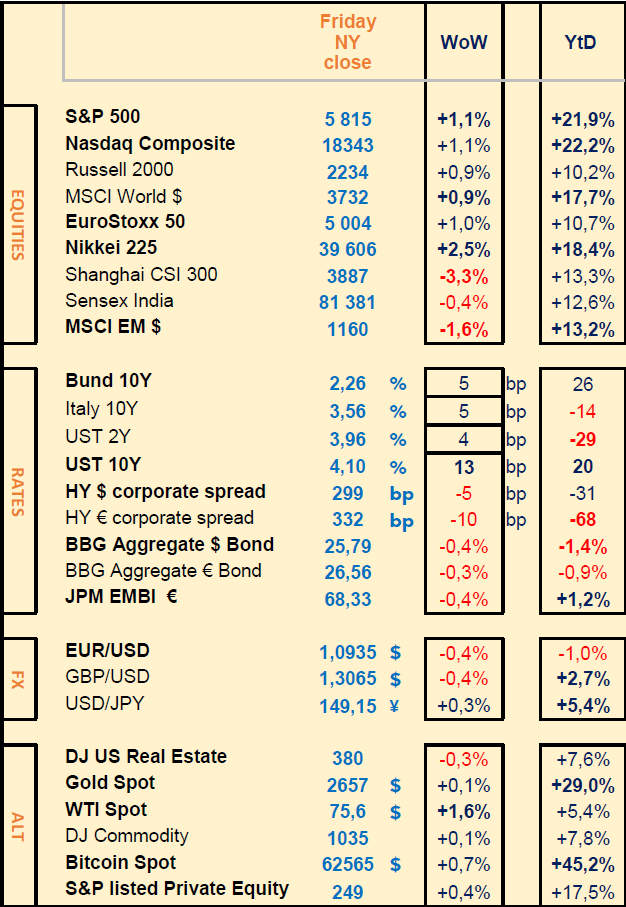

New Chinese $325bn stimulus, new ATH for theSP500 (45th this year), yields higher (US CPI higher), Q3 earnings started

WEEKLY TRENDS

WEEKLY TRENDS

- A lot happened last week but the coming week should be equally active. It started with the US CPI released slightly higher last Thursday, followed by good Q3 earnings from Wells Fargo and JP Morgan on Friday, to end with new economic package announced in China on Saturday morning. Not to forget the Milton hurricane affecting the Oil price among Middle east tensions too

- Next week, shall have new Q3 corporate earnings releases with 26 companies having more than $100bn market capitalisation (GS, LVMH, ASML, Netflix to name just a few). On Thursday, the ECB will most likely decide to cut its repo rate by 25bps

- Note that on Monday, Japan and Canada will be closed, while the US will celebrate Columbus day, yet Wall Street will remain open

MARKETS

Equities

New stimulus package in China, Q3 earnings releases

Q3 earnings releases last week (stock WoW performance):

+++ JPM (+5%), Wells Fargo (+7%), PepsiCo (+4%), Imperial Brands (+5%) good Q3 results and perspectives (earnings growth expected at +4.6% on average)

- - - Repsol (-2%), Porsche (-1%), UK pharma Indivior (-26%)

M&A: French Varta (+255%) Porsche is to finance $65m; Arcadium Lithium (+80%) to be bought by Rio Tinto with a 90% premium

NB: Tesla shares dropped by 13% (Robotaxi disappoints); Super Micro Computer (+16%) on cooling system for data centres; Bayer (-12%) on US Supreme court case; Nvidia (+8%) on new chip designed Blackwell being sold out for the next 12 months

Rates

US curve (2-10 years) steepening, (15bps) 2yr Treasuries yield increased by 5bps while 10yr rose by 15bps.

US

CPI for September was released at +2.4% vs 2.3% expected (Core at +3.3%); PPI at 1.8% vs 1.6% expected (Core at 2.8%). Note that the last FOMC minutes revealed a robust debate about the size of the Sep cut

Commodities

Crude Oil (WTI +1.5%) on Milton possibly affecting US production deliveries, added to possibly Israel targeting Iran oil production sites

China

New $325bn stimulus package announced on Saturday with special sovereign bonds to boost bank Tier 1 capital; bigger deficit key to revival; PBOC will finance $70bn for listed companies to invest in shares

EU zone

France credit rating cut by Fitch to negative on wider deficits (rating maintained at AA– next agencies announcements: Moody’s on 25 Oct, S&P on 29 Nov); Belgium cut to negative by Moody’s; ECB Villeroy said rate cut next week was very probable (market expects a 25bps cut)

Nota Bene

This year so far: BTC +47%, Silver & Gold 32% & 28%, SP500 +22%

South Africa, Peru Chile, North Asia have the highest sensitivity to China

CALENDAR

WHAT ANALYSTS SAY

Goldman Sachs, 11 October 2024 - Briefings

Author: GS Wealth Management

· Why US recession risk has declined

· Oil prices may climb amid Middle East conflict

· A forecast change for S&P 500 earnings

· European telecoms are poised for growth and consolidation

The probability of a US recession has fallen:

The likelihood of a US recession in the coming year has declined amid signs of a still-solid job market, according to Goldman Sachs Research.

Our economists say there's a 15% chance of recession in the next 12 months, down from their earlier projection of 20%. That's in line with the unconditional long-term average probability of 15%, writes Jan Hatzius, head of Goldman Sachs Research and the firm's chief economist, in the team's report. The most important reason for the forecast change is that the US unemployment rate fell to 4.05 % in September — below the level in July, when the rate jumped to 4.25%, and marginally below the June level .

The unemployment rate is also below the threshold that activates the “Sahm rule,” which identifies signals that can indicate the start of a recession. The rule is triggered when the three-month average US unemployment rate increases by 0.50% or more from its low during the previous 12 months. Recent employment data brings job market signals into line with broader economic growth signals. Real GDP grew 3% in the second quarter and an estimated 3.2% in the third quarter. The strong economic activity data and the recent rebound in oil prices on fears of escalation from the Middle East conflict haven't changed Goldman Sach Research's conviction that inflation will cool further.

If US Federal Reserve officials had known what was coming, the Federal Open Market Committee might have cut rates by 25 basis points on September 18 instead of 50 basis points, Hatzius writes. But that doesn't mean it was a mistake. “We think the FOMC was late to start cutting, so a catch-up that brings the funds rate closer to the levels of around 4% implied by standard policy rules makes sense even in hindsight,” Hatzius writes.

The latest jobs data strengthens Goldman Sachs Research's conviction that the next few FOMC meetings (including November 6-7) will bring smaller 25 basis point cuts. Our economists expect the Fed to reduce rates to a terminal funds rate of 3.25% - 3.5%.

What the Middle East conflict means for oil prices :

Geopolitical risks are likely to drive oil prices higher, at least in the short term, explains Goldman Sachs' Co-Head of Commodities Research Daan Struyven. “The risks in the short term are skewed somewhat to the upside, not only because of the possibility of supply disruptions in the Middle East, but also because…if you look at speculative positioning, you're in the lowest 1% of history,”

Over the long term — assuming no major escalation in the region — oil prices could fall given spare capacity and the risks from trade tariffs, he notes. “High spare capacity probably limits the upside over longer horizons because if you give OPEC enough time and if they can bring the barrels back, that should limit the tightening effects,” he says.

A strong economy is driving a higher earnings forecast for the S&P in 2025 :

Ahead of the third-quarter earnings season, Goldman Sachs Research raised its S&P 500 earnings-per-share forecast for 2025 to $268, up from a previous estimate of $256. Our analysts also introduced a 2026 estimate of $288 and left their 2024 full-year estimate unchanged at $241.

The upward revision of the 2025 forecast — a 11% year-on-year rise — is driven primarily by greater margin expansion, David Kostin, Goldman Sachs' chief US equity strategist, writes in his team's report. He attributes his expectation of 78 basis points of net margin expansion in 2025 — compared with 24 basis points in a previous estimate — in large part because of a strong economy.

“From a top-down perspective, our economists' forecast for US GDP growth is above consensus,” Kostin writes. Goldman Sachs economists expect real US GDP growth to average 2.3% in 2025 and 2.0% in 2026 (as of October 4).

European telecoms are poised for growth and consolidation :

The outlook is brightening for European telecommunications companies, says Andrew Lee, head of the Technology, Media, and Telecom Group in Goldman Sachs Research. That's in large part because the prospects for greater pricing power and industry consolidation have improved as regulators focus more on Europe's competitiveness. This is bullish news for an industry characterized by slow or no growth for years. The improving outlook isn't yet fully reflected in consensus forecasts or investor expectations, Lee said after Goldman Sachs' European Communacopia Conference.

Lee notes that Mario Draghi, former head of the European Central Bank, was a major conversation topic. Draghi's report on how to improve EU competitiveness suggests that regulators need to allow greater market concentration to incentivize investment and support growth. Draghi highlighted European mobile services as one sector where they can do that. “What we heard from all our company operators is that they think things have definitively changed,” Lee says. “There's a high likelihood that we will see attempts at consolidation to test this apparent new regulatory stance in the coming months and years.”

UBS, 10 October 2024 - US equities

Authors: David Lefkowitz, CFA, CIO Head of US Equities

· 3Q results should confirm that large-cap corporate profit growth remains solid, driven by healthy economic growth and continued investment in AI. We look for 5-7% EPS growth for the S&P 500. Excluding the energy sector, growth should be 8-10%

· Profit growth is broadening out, but Magnificent 7 growth remains solid and should surpass 20%. If the Magnificent 7 stocks were their own sector, their profits would be larger than any other.

· We're not concerned by what seems like a “high bar” for 4Q, with the consensus looking for 14% growth. Excluding one-time items that depressed results in 4Q23, “real” expectations are for a more achievable 8% growth.

Healthy profit growth should drive further gains in the S&P 500. Our S&P 500 EPS estimates are USD 250 (11% growth) and USD 270 (8% growth) in 2024 and 2025. Our S&P 500 price targets are 5,900 and 6,200 for year-end and June 2025, respectively.

Economy on solid footing

Despite somewhat persistent fears and some slowdown in lower-end consumer spending, overall economic activity remains solid. The Atlanta Fed GDPNow model suggests the US economy grew at a 3% annualized rate in 3Q. We think healthy economic growth will persist. Job layoffs

remain low, there is still an encouraging level of unfilled jobs relative to the number of unemployed, and the most cyclical parts of the labor market—construction and manufacturing —are not flashing warning signs. And now that the Fed has started its rate-cutting cycle, the economy should get a further boost from lower interest rates on things like credit card debt and business loans.

Lower energy prices certainly ease the burden on consumers, so we could see positive surprises in some of the consumer discretionary areas. Results from early reporters have also been constructive, with the median company beating estimates by close to 3%.

Profit growth broadening out

Similar to the last quarter, profit growth continues to broaden out beyond the largest growth companies, often referred to as the Magnificent 7—Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. Still, we expect growth rates for the Magnificent 7 companies to remain healthy. Many of these companies are benefiting from continued strong growth in AI investment spending and monetization. In aggregate, the Magnificent 7 will account for 21% of S&P 500 profits in 2024 and closer to 25% in 2025. If this group of companies were their own sector, their profits would be larger than any other.

Guidance risks no higher than normal

As always, management team guidance will be a key driver of share price performance during earnings season. Bottom-up consensus analyst estimates suggest S&P 500 EPS is expected to grow 14% in 4Q, which admittedly looks aggressive. However, the year-over-year growth rate

is skewed by some non-recurring items that depressed results in 4Q last year. The biggest component was FDIC charges on the banks to replenish bailout funds that were used during the regional banking crisis. In addition, a regional bank took a large non-cash write-off. If we

normalize for these items, the expected growth rate for 4Q falls to a more reasonable 8%, which should be much more achievable. So we don’t think the risks of guidance disappointments are any higher than normal.

Environment still constructive

As we have been articulating for many months, the backdrop for US equities remains constructive driven by: 1) healthy economic and profit growth; 2) improving inflation, which has prompted the Fed to start cutting interest rates; 3) strong growth in AI spending and—over time—

monetization. In our view, the best way to illustrate this favorable environment is to look at how the S&P 500 has performed in prior periods when the Fed was cutting but the US economy avoided a recession. In non-recessionary scenarios, the S&P 500 rises 17% on average in the 12 months after the Fed starts to cut rates.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

New stimulus package in China, Q3 earnings releases

Q3 earnings releases last week (stock WoW performance):

+++ JPM (+5%), Wells Fargo (+7%), PepsiCo (+4%), Imperial Brands (+5%) good Q3 results and perspectives (earnings growth expected at +4.6% on average)

- - - Repsol (-2%), Porsche (-1%), UK pharma Indivior (-26%)

M&A: French Varta (+255%) Porsche is to finance $65m; Arcadium Lithium (+80%) to be bought by Rio Tinto with a 90% premium

NB: Tesla shares dropped by 13% (Robotaxi disappoints); Super Micro Computer (+16%) on cooling system for data centres; Bayer (-12%) on US Supreme court case; Nvidia (+8%) on new chip designed Blackwell being sold out for the next 12 months

Rates

US curve (2-10 years) steepening, (15bps) 2yr Treasuries yield increased by 5bps while 10yr rose by 15bps.

US

CPI for September was released at +2.4% vs 2.3% expected (Core at +3.3%); PPI at 1.8% vs 1.6% expected (Core at 2.8%). Note that the last FOMC minutes revealed a robust debate about the size of the Sep cut

Commodities

Crude Oil (WTI +1.5%) on Milton possibly affecting US production deliveries, added to possibly Israel targeting Iran oil production sites

China

New $325bn stimulus package announced on Saturday with special sovereign bonds to boost bank Tier 1 capital; bigger deficit key to revival; PBOC will finance $70bn for listed companies to invest in shares

EU zone

France credit rating cut by Fitch to negative on wider deficits (rating maintained at AA– next agencies announcements: Moody’s on 25 Oct, S&P on 29 Nov); Belgium cut to negative by Moody’s; ECB Villeroy said rate cut next week was very probable (market expects a 25bps cut)

Nota Bene

This year so far: BTC +47%, Silver & Gold 32% & 28%, SP500 +22%

South Africa, Peru Chile, North Asia have the highest sensitivity to China

CALENDAR

- Corporate earnings: US BofA, GS (15 Oct), MS (16), Netflix (17), P&G (18 Oct); Europe LVMH (15 Oct), ASML (16), Nestlé (17 Oct)

- Macro: China September CPI (13 Oct), GDP YoY (18 Oct); ECB rate decision on 17 Oct (-25bps expected)

WHAT ANALYSTS SAY

- Goldman Sachs - Briefings

- UBS - US equities

Goldman Sachs, 11 October 2024 - Briefings

Author: GS Wealth Management

· Why US recession risk has declined

· Oil prices may climb amid Middle East conflict

· A forecast change for S&P 500 earnings

· European telecoms are poised for growth and consolidation

The probability of a US recession has fallen:

The likelihood of a US recession in the coming year has declined amid signs of a still-solid job market, according to Goldman Sachs Research.

Our economists say there's a 15% chance of recession in the next 12 months, down from their earlier projection of 20%. That's in line with the unconditional long-term average probability of 15%, writes Jan Hatzius, head of Goldman Sachs Research and the firm's chief economist, in the team's report. The most important reason for the forecast change is that the US unemployment rate fell to 4.05 % in September — below the level in July, when the rate jumped to 4.25%, and marginally below the June level .

The unemployment rate is also below the threshold that activates the “Sahm rule,” which identifies signals that can indicate the start of a recession. The rule is triggered when the three-month average US unemployment rate increases by 0.50% or more from its low during the previous 12 months. Recent employment data brings job market signals into line with broader economic growth signals. Real GDP grew 3% in the second quarter and an estimated 3.2% in the third quarter. The strong economic activity data and the recent rebound in oil prices on fears of escalation from the Middle East conflict haven't changed Goldman Sach Research's conviction that inflation will cool further.

If US Federal Reserve officials had known what was coming, the Federal Open Market Committee might have cut rates by 25 basis points on September 18 instead of 50 basis points, Hatzius writes. But that doesn't mean it was a mistake. “We think the FOMC was late to start cutting, so a catch-up that brings the funds rate closer to the levels of around 4% implied by standard policy rules makes sense even in hindsight,” Hatzius writes.

The latest jobs data strengthens Goldman Sachs Research's conviction that the next few FOMC meetings (including November 6-7) will bring smaller 25 basis point cuts. Our economists expect the Fed to reduce rates to a terminal funds rate of 3.25% - 3.5%.

What the Middle East conflict means for oil prices :

Geopolitical risks are likely to drive oil prices higher, at least in the short term, explains Goldman Sachs' Co-Head of Commodities Research Daan Struyven. “The risks in the short term are skewed somewhat to the upside, not only because of the possibility of supply disruptions in the Middle East, but also because…if you look at speculative positioning, you're in the lowest 1% of history,”

Over the long term — assuming no major escalation in the region — oil prices could fall given spare capacity and the risks from trade tariffs, he notes. “High spare capacity probably limits the upside over longer horizons because if you give OPEC enough time and if they can bring the barrels back, that should limit the tightening effects,” he says.

A strong economy is driving a higher earnings forecast for the S&P in 2025 :

Ahead of the third-quarter earnings season, Goldman Sachs Research raised its S&P 500 earnings-per-share forecast for 2025 to $268, up from a previous estimate of $256. Our analysts also introduced a 2026 estimate of $288 and left their 2024 full-year estimate unchanged at $241.

The upward revision of the 2025 forecast — a 11% year-on-year rise — is driven primarily by greater margin expansion, David Kostin, Goldman Sachs' chief US equity strategist, writes in his team's report. He attributes his expectation of 78 basis points of net margin expansion in 2025 — compared with 24 basis points in a previous estimate — in large part because of a strong economy.

“From a top-down perspective, our economists' forecast for US GDP growth is above consensus,” Kostin writes. Goldman Sachs economists expect real US GDP growth to average 2.3% in 2025 and 2.0% in 2026 (as of October 4).

European telecoms are poised for growth and consolidation :

The outlook is brightening for European telecommunications companies, says Andrew Lee, head of the Technology, Media, and Telecom Group in Goldman Sachs Research. That's in large part because the prospects for greater pricing power and industry consolidation have improved as regulators focus more on Europe's competitiveness. This is bullish news for an industry characterized by slow or no growth for years. The improving outlook isn't yet fully reflected in consensus forecasts or investor expectations, Lee said after Goldman Sachs' European Communacopia Conference.

Lee notes that Mario Draghi, former head of the European Central Bank, was a major conversation topic. Draghi's report on how to improve EU competitiveness suggests that regulators need to allow greater market concentration to incentivize investment and support growth. Draghi highlighted European mobile services as one sector where they can do that. “What we heard from all our company operators is that they think things have definitively changed,” Lee says. “There's a high likelihood that we will see attempts at consolidation to test this apparent new regulatory stance in the coming months and years.”

UBS, 10 October 2024 - US equities

Authors: David Lefkowitz, CFA, CIO Head of US Equities

· 3Q results should confirm that large-cap corporate profit growth remains solid, driven by healthy economic growth and continued investment in AI. We look for 5-7% EPS growth for the S&P 500. Excluding the energy sector, growth should be 8-10%

· Profit growth is broadening out, but Magnificent 7 growth remains solid and should surpass 20%. If the Magnificent 7 stocks were their own sector, their profits would be larger than any other.

· We're not concerned by what seems like a “high bar” for 4Q, with the consensus looking for 14% growth. Excluding one-time items that depressed results in 4Q23, “real” expectations are for a more achievable 8% growth.

Healthy profit growth should drive further gains in the S&P 500. Our S&P 500 EPS estimates are USD 250 (11% growth) and USD 270 (8% growth) in 2024 and 2025. Our S&P 500 price targets are 5,900 and 6,200 for year-end and June 2025, respectively.

Economy on solid footing

Despite somewhat persistent fears and some slowdown in lower-end consumer spending, overall economic activity remains solid. The Atlanta Fed GDPNow model suggests the US economy grew at a 3% annualized rate in 3Q. We think healthy economic growth will persist. Job layoffs

remain low, there is still an encouraging level of unfilled jobs relative to the number of unemployed, and the most cyclical parts of the labor market—construction and manufacturing —are not flashing warning signs. And now that the Fed has started its rate-cutting cycle, the economy should get a further boost from lower interest rates on things like credit card debt and business loans.

Lower energy prices certainly ease the burden on consumers, so we could see positive surprises in some of the consumer discretionary areas. Results from early reporters have also been constructive, with the median company beating estimates by close to 3%.

Profit growth broadening out

Similar to the last quarter, profit growth continues to broaden out beyond the largest growth companies, often referred to as the Magnificent 7—Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. Still, we expect growth rates for the Magnificent 7 companies to remain healthy. Many of these companies are benefiting from continued strong growth in AI investment spending and monetization. In aggregate, the Magnificent 7 will account for 21% of S&P 500 profits in 2024 and closer to 25% in 2025. If this group of companies were their own sector, their profits would be larger than any other.

Guidance risks no higher than normal

As always, management team guidance will be a key driver of share price performance during earnings season. Bottom-up consensus analyst estimates suggest S&P 500 EPS is expected to grow 14% in 4Q, which admittedly looks aggressive. However, the year-over-year growth rate

is skewed by some non-recurring items that depressed results in 4Q last year. The biggest component was FDIC charges on the banks to replenish bailout funds that were used during the regional banking crisis. In addition, a regional bank took a large non-cash write-off. If we

normalize for these items, the expected growth rate for 4Q falls to a more reasonable 8%, which should be much more achievable. So we don’t think the risks of guidance disappointments are any higher than normal.

Environment still constructive

As we have been articulating for many months, the backdrop for US equities remains constructive driven by: 1) healthy economic and profit growth; 2) improving inflation, which has prompted the Fed to start cutting interest rates; 3) strong growth in AI spending and—over time—

monetization. In our view, the best way to illustrate this favorable environment is to look at how the S&P 500 has performed in prior periods when the Fed was cutting but the US economy avoided a recession. In non-recessionary scenarios, the S&P 500 rises 17% on average in the 12 months after the Fed starts to cut rates.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by OJSC Unibank (registered trademark – Unibank INVEST, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.