US Jan CPI higher pushed next FED rate cut to Sep - Earnings and potential Ukraine/US deal pushed stocks higher

WEEKLY TRENDS

WEEKLY TRENDS

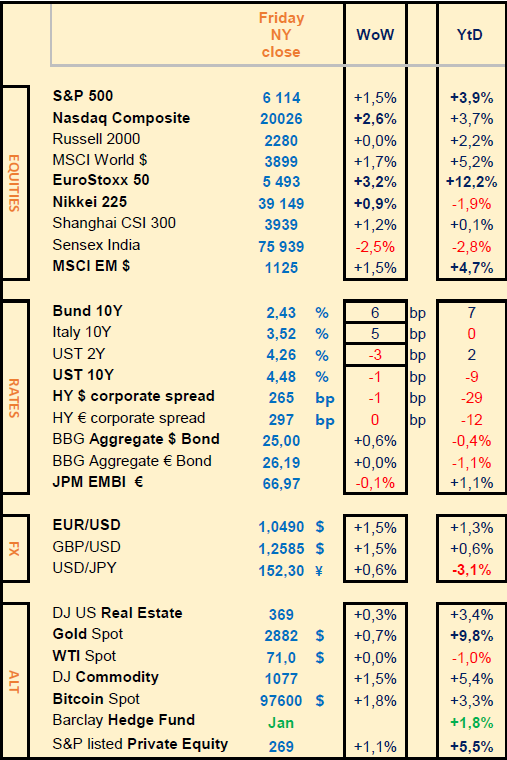

- Fifth week of Q4 earnings releases showed strong results in general, and despite Jan US inflation data released higher than expected at 3% CPI and 3.5% PPI YoY, stocks managed to reach new highs last week, aided by a potential US/UA deal

- European stocks were once again overperforming their US counterparts with strong weekly gains for Kering (+15%), BP (+26% on the activist Elliott hedge fund 5% investment), Essilor (+9%), Heineken (+17%), note that Intel managed to score +23% last week on VP JD Vance intervention in Paris last week

- Gold, Oil and BTC prices remained fairly stable, tilted towards higher prices though. So did rates, Bond yields and HY corporate spreads

- Trump announced new tariffs expected to be in put in place in April only, causing even more uncertainty around their impacts onto the World economy and dragging the USD somewhat lower

MARKETS

Equities

Q4 earnings released (weekly stock performance):

BP (+26%), Siemens (+8%), EssilorLuxitica (+9%), Coca-Cola (+7%), Nestlé (+6%), Shopify (+5%), Hermès (+5%), McDonald’s (+2%)

Unilever (-6%)

Analysts:

VW (HSBC ’buy’ target €125); LVMH (Citi ‘buy’ target €810); CapGemini (BNP ‘o/w’ target €210); Essilor (Jefferies ‘buy’ target €310); Porsche (HSBC downgraded to ‘hold’ target €60)

Rates

US curve (2-10 years) steepening stable at 20bps. Bond yields stable too across the board. ECB Nagel said ECB should not cut hastily as rates are near a neutral level. FED Powell said that the new inflation data showed the FED had more work to do (Futures show a 25bps Sep cut next).

HY corporate spreads were unchanged

Commodities

Oil price stable with OPEC members expecting the same demand growth in 2025 and 2026 (respectively at +1.45m barrels per day and +1.43m)

Gold price up (+1%) on economic uncertainty over the new trade war

US

Jan CPI released at +0.5% (+3% YoY), Core (ex. Food & Energy) at +0.4% and +3.3% YoY; Jan PPI at +0.4% (+3.5% YoY), Core at +3.6%

Cryptos

New outgoing flows for the BTC ETFs last week (-$600m net exits). Note ETH rebounded (+3% vs -19% over the previous 2 weeks)

Under the watch

UA reconstruction led stocks vs defense stocks

Nota Bene

Over the last 12 months, US debt interest payments hit a record $1trn, surpassing Defense spending at $900bn and second to social security spending at $1.6bn, planned for 2025.

CALENDAR

Q4 Corporate earnings:

US: Walmart (20 Feb), Analog Devices (19)

EU: BHP (17 Feb), HSBC, Rio Tinto, Glencore (19), Schneider Elec, Airbus (20), Air Liquide, StandChart (21)

WHAT ANALYSTS SAY

Amundi, 14 Feb 2025 - Markets: a tug of war between inflation fears and optimism

Authors: Vincent Mortier, Group CIO ; Monica Defend, Head of Amundi Investment Institute

The Trump2.0 era is upon us and markets have already become extremely sensitive to inflation data, a trend that will likely last in the coming months. Higher inflation sensitivity has also turned equity/bond correlation back to positive. Markets are currently influenced by two opposing forces: the prospect of Trumponomics reinforces the narrative of US exceptionalism, while the imposition of tariffs introduces uncertainty into global supply chain dynamics and inflation trajectories. As the battle between these two narratives will keep volatility high, investors should focus on:

· Earnings trajectory amid US fiscal policy, tariffs and AI. While fiscal loosening and deregulation may provide a temporary boost to GDP, the negative effects of tariffs and reduced immigration are likely to weigh on economic performance in the last part of the year. Tariffs will also impact corporate earnings, with potential risks of revisions in H2, while short-term focus will be on how the recent announcement of a new low-cost AI model by Chinese DeepSeek could affect global players.

· Asynchrony in central banks' actions. The Fed is on pause, with cuts likely to come later in 2025 if inflation data retains a downward trend. In Europe, we expect both the ECB and the BoE to cut rates sooner, while the Bank of Japan (BoJ) remains in the hiking mode.

· US dollar volatility, rising oil prices and China’s stimulus are key themes for Emerging Markets. Uncertainty remains high amid high geopolitical risks and expectations of Trump’s tariffs.

From an investment perspective, the backdrop remains mildly supportive for risky assets thanks to a resilient growth outlook, accommodative central bank policies and abundant liquidity.

· In Fixed Income, ongoing yield volatility calls for an active and tactical duration approach. Globally, current yield levels are historically appealing, so we have slightly increased our duration stance, particularly in Europe. In the US, while rates are attractive, we expect high rates volatility and favour the intermediate part of the yield curve on a risk-reward basis. We maintain a positive stance on global IG credit, where we have been seeking opportunities in the primary market. Overall, we continue to favour IG over HY and financials over industrials. We also like HY alternatives, such as leveraged loans, due to their more attractive valuations.

· In Equities, we are positive overall with a focus on global diversification to play the broadening rally. In the US, we prefer equal-weighted indices compared to the overvalued cap-weighted indices. We like financials and materials, and focus on companies likely to benefit from Trump policies but that remain unpriced, and defensives that have reasonable valuations. In Europe, with expected rate cuts and inflation moderation, we see potential in defensive consumer staples and healthcare stocks with price leadership, as well as quality banks with strong balance sheets and lower sensitivity to rate changes.

· In Emerging Markets (EM) we continue to be selective. We maintain a neutral stance on global EM equities due to uncertainty surrounding Trump’s policies. In bonds, the outlook for EM Hard Currency debt is constructive. Overall, we favour local rates in nations offering high nominal and real yields, and that are less exposed to the new US administration's policies. We look for selective opportunities in HY credit, expecting no significant spread widening as new issuances are well absorbed.

· In Asset Allocation, the positive backdrop for risk assets leads us to maintain a mildly positive risk stance in global equities. We have also become more positive on Euro Investment Grade (IG) credit , while we moved to a neutral stance on EM debt. We believe investors should maintain a focus on equity hedges in the US market due to tight valuations and diversify with Gold to better cope with the potential volatility arising from geopolitical and inflation risks.

Multi-Asset : Risk on, but with hedges and Gold

We continue to expect a benign overall economic outlook, with Developped Market (DM) countries running at different speeds and China stimulating the economy in an effort to mitigate structural downtrend and tariff risks. In the US, economic growth is normalising, but Trump policies raise uncertainties on various fronts– risks of labour supply shortages due to restrictive immigration policies, tariffs and fiscal policy. In the Eurozone we expect some modest and heterogeneous recovery with downside risks linked to tariffs. All in all, this paints a benign but uncertain outlook, which leads us to remain positive on risky assets, while at the same time we believe investors should increase hedges on equities and favour Gold to enhance diversification.

Therefore, we maintain our positive stance on global equities. We believe it is important to diversify by regions and styles. Growth opportunities are more prominent in the US, while Japan and the UK offer more value-oriented investments. The Eurozone still faces significant challenges, but much of this risk is already priced in to valuations which remain appealing compared to the US. We remain close to neutral in EM equity and are cautiously optimistic on China, due to its appealing valuations and expectations of policy support.

Fixed Income : we remain positive on the 2-year Treasury and maintain our view of a steepening yield curve in 5-30 year maturities. We maintain our positive stance on EU rates and UK rates as well, and we remain cautious on JGBs. We also remain positive on Italian BTPs versus German Bunds. In credit, we have become more constructive on European IG credit due to strong demand and solid fundamentals. In EM debt, we have moved to a neutral stance on EM local debt as disinflation slows and the capacity for EM central banks to cut rates is fading, while we remain neutral on Hard Currency debt.

We actively diversify the overall allocation with currencies by keeping a preference for USD vs CHF and for JPY vs CHF. We keep a cautious view on the trade-weighted EUR as Eurozone is weaker and the ECB is dovish. In EM, we still like BRL but we are no longer positive on INR.

Trump 2.0 policies are likely to diverge from current market expectations as 2025 unfolds.

Inflation will be a key factor in evaluating the Fed's trajectory, with Trump’s policies potentially limiting future Fed easing unless a significant growth shock occurs.

At current levels, global fixed income markets provide attractive yields, serving as a buffer against macro economic and monetary policy uncertainties, which makes them appealing as income generators and portfolio diversifiers.

Global investors should also look at opportunities in Europe, which offer higher visibility on the ECB's direction and in EM hard currency debt. Here the outlook remains positive, supported by attractive absolute yields, although careful country selection is key.

Equities : Market rotation in favour of Europe and US-ex mega caps

Recent volatility, driven first by uncertainty around interest rates and more recently by the DeepSeek announcement, has continued to favour a broadening of the rally, particularly in European equities and sectors outside technology.

High valuations leave little room for disappointment ; however, lower expected taxes for corporates and reduced regulation should benefit US domestic stocks and global companies with significant US operations.

All eyes will now be on the earnings season, which could further support the continuation of the recent rotation.

Against this backdrop, we continue to see opportunities in Europe, in US large caps-ex mega caps and financials, while remaining more cautious on Emerging Markets for the time being.

Equities

Q4 earnings released (weekly stock performance):

BP (+26%), Siemens (+8%), EssilorLuxitica (+9%), Coca-Cola (+7%), Nestlé (+6%), Shopify (+5%), Hermès (+5%), McDonald’s (+2%)

Unilever (-6%)

Analysts:

VW (HSBC ’buy’ target €125); LVMH (Citi ‘buy’ target €810); CapGemini (BNP ‘o/w’ target €210); Essilor (Jefferies ‘buy’ target €310); Porsche (HSBC downgraded to ‘hold’ target €60)

Rates

US curve (2-10 years) steepening stable at 20bps. Bond yields stable too across the board. ECB Nagel said ECB should not cut hastily as rates are near a neutral level. FED Powell said that the new inflation data showed the FED had more work to do (Futures show a 25bps Sep cut next).

HY corporate spreads were unchanged

Commodities

Oil price stable with OPEC members expecting the same demand growth in 2025 and 2026 (respectively at +1.45m barrels per day and +1.43m)

Gold price up (+1%) on economic uncertainty over the new trade war

US

Jan CPI released at +0.5% (+3% YoY), Core (ex. Food & Energy) at +0.4% and +3.3% YoY; Jan PPI at +0.4% (+3.5% YoY), Core at +3.6%

Cryptos

New outgoing flows for the BTC ETFs last week (-$600m net exits). Note ETH rebounded (+3% vs -19% over the previous 2 weeks)

Under the watch

UA reconstruction led stocks vs defense stocks

Nota Bene

Over the last 12 months, US debt interest payments hit a record $1trn, surpassing Defense spending at $900bn and second to social security spending at $1.6bn, planned for 2025.

CALENDAR

Q4 Corporate earnings:

US: Walmart (20 Feb), Analog Devices (19)

EU: BHP (17 Feb), HSBC, Rio Tinto, Glencore (19), Schneider Elec, Airbus (20), Air Liquide, StandChart (21)

WHAT ANALYSTS SAY

- AMUNDI - Global Investment Views - Markets: a tug of war between inflation fears and optimism

Amundi, 14 Feb 2025 - Markets: a tug of war between inflation fears and optimism

Authors: Vincent Mortier, Group CIO ; Monica Defend, Head of Amundi Investment Institute

The Trump2.0 era is upon us and markets have already become extremely sensitive to inflation data, a trend that will likely last in the coming months. Higher inflation sensitivity has also turned equity/bond correlation back to positive. Markets are currently influenced by two opposing forces: the prospect of Trumponomics reinforces the narrative of US exceptionalism, while the imposition of tariffs introduces uncertainty into global supply chain dynamics and inflation trajectories. As the battle between these two narratives will keep volatility high, investors should focus on:

· Earnings trajectory amid US fiscal policy, tariffs and AI. While fiscal loosening and deregulation may provide a temporary boost to GDP, the negative effects of tariffs and reduced immigration are likely to weigh on economic performance in the last part of the year. Tariffs will also impact corporate earnings, with potential risks of revisions in H2, while short-term focus will be on how the recent announcement of a new low-cost AI model by Chinese DeepSeek could affect global players.

· Asynchrony in central banks' actions. The Fed is on pause, with cuts likely to come later in 2025 if inflation data retains a downward trend. In Europe, we expect both the ECB and the BoE to cut rates sooner, while the Bank of Japan (BoJ) remains in the hiking mode.

· US dollar volatility, rising oil prices and China’s stimulus are key themes for Emerging Markets. Uncertainty remains high amid high geopolitical risks and expectations of Trump’s tariffs.

From an investment perspective, the backdrop remains mildly supportive for risky assets thanks to a resilient growth outlook, accommodative central bank policies and abundant liquidity.

· In Fixed Income, ongoing yield volatility calls for an active and tactical duration approach. Globally, current yield levels are historically appealing, so we have slightly increased our duration stance, particularly in Europe. In the US, while rates are attractive, we expect high rates volatility and favour the intermediate part of the yield curve on a risk-reward basis. We maintain a positive stance on global IG credit, where we have been seeking opportunities in the primary market. Overall, we continue to favour IG over HY and financials over industrials. We also like HY alternatives, such as leveraged loans, due to their more attractive valuations.

· In Equities, we are positive overall with a focus on global diversification to play the broadening rally. In the US, we prefer equal-weighted indices compared to the overvalued cap-weighted indices. We like financials and materials, and focus on companies likely to benefit from Trump policies but that remain unpriced, and defensives that have reasonable valuations. In Europe, with expected rate cuts and inflation moderation, we see potential in defensive consumer staples and healthcare stocks with price leadership, as well as quality banks with strong balance sheets and lower sensitivity to rate changes.

· In Emerging Markets (EM) we continue to be selective. We maintain a neutral stance on global EM equities due to uncertainty surrounding Trump’s policies. In bonds, the outlook for EM Hard Currency debt is constructive. Overall, we favour local rates in nations offering high nominal and real yields, and that are less exposed to the new US administration's policies. We look for selective opportunities in HY credit, expecting no significant spread widening as new issuances are well absorbed.

· In Asset Allocation, the positive backdrop for risk assets leads us to maintain a mildly positive risk stance in global equities. We have also become more positive on Euro Investment Grade (IG) credit , while we moved to a neutral stance on EM debt. We believe investors should maintain a focus on equity hedges in the US market due to tight valuations and diversify with Gold to better cope with the potential volatility arising from geopolitical and inflation risks.

Multi-Asset : Risk on, but with hedges and Gold

We continue to expect a benign overall economic outlook, with Developped Market (DM) countries running at different speeds and China stimulating the economy in an effort to mitigate structural downtrend and tariff risks. In the US, economic growth is normalising, but Trump policies raise uncertainties on various fronts– risks of labour supply shortages due to restrictive immigration policies, tariffs and fiscal policy. In the Eurozone we expect some modest and heterogeneous recovery with downside risks linked to tariffs. All in all, this paints a benign but uncertain outlook, which leads us to remain positive on risky assets, while at the same time we believe investors should increase hedges on equities and favour Gold to enhance diversification.

Therefore, we maintain our positive stance on global equities. We believe it is important to diversify by regions and styles. Growth opportunities are more prominent in the US, while Japan and the UK offer more value-oriented investments. The Eurozone still faces significant challenges, but much of this risk is already priced in to valuations which remain appealing compared to the US. We remain close to neutral in EM equity and are cautiously optimistic on China, due to its appealing valuations and expectations of policy support.

Fixed Income : we remain positive on the 2-year Treasury and maintain our view of a steepening yield curve in 5-30 year maturities. We maintain our positive stance on EU rates and UK rates as well, and we remain cautious on JGBs. We also remain positive on Italian BTPs versus German Bunds. In credit, we have become more constructive on European IG credit due to strong demand and solid fundamentals. In EM debt, we have moved to a neutral stance on EM local debt as disinflation slows and the capacity for EM central banks to cut rates is fading, while we remain neutral on Hard Currency debt.

We actively diversify the overall allocation with currencies by keeping a preference for USD vs CHF and for JPY vs CHF. We keep a cautious view on the trade-weighted EUR as Eurozone is weaker and the ECB is dovish. In EM, we still like BRL but we are no longer positive on INR.

Trump 2.0 policies are likely to diverge from current market expectations as 2025 unfolds.

Inflation will be a key factor in evaluating the Fed's trajectory, with Trump’s policies potentially limiting future Fed easing unless a significant growth shock occurs.

At current levels, global fixed income markets provide attractive yields, serving as a buffer against macro economic and monetary policy uncertainties, which makes them appealing as income generators and portfolio diversifiers.

Global investors should also look at opportunities in Europe, which offer higher visibility on the ECB's direction and in EM hard currency debt. Here the outlook remains positive, supported by attractive absolute yields, although careful country selection is key.

Equities : Market rotation in favour of Europe and US-ex mega caps

Recent volatility, driven first by uncertainty around interest rates and more recently by the DeepSeek announcement, has continued to favour a broadening of the rally, particularly in European equities and sectors outside technology.

High valuations leave little room for disappointment ; however, lower expected taxes for corporates and reduced regulation should benefit US domestic stocks and global companies with significant US operations.

All eyes will now be on the earnings season, which could further support the continuation of the recent rotation.

Against this backdrop, we continue to see opportunities in Europe, in US large caps-ex mega caps and financials, while remaining more cautious on Emerging Markets for the time being.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.