Last week: Ahead of April 2nd US tariffs ’Liberation Day’ stocks were down globally, Gold was up, Copper is at record high

WEEKLY TRENDS

WEEKLY TRENDS

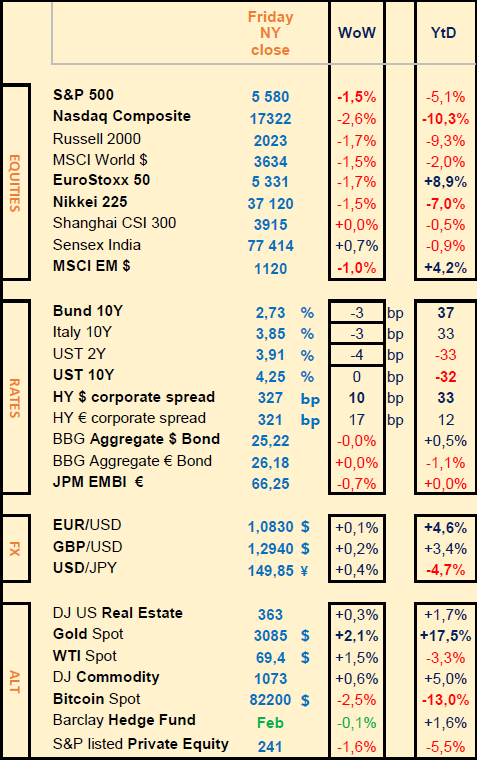

- Take profits or continued correction before this coming Tuesday ‘Liberation Day’, led to stocks being sold off on Friday which brought a negative weekly return for all indices but India (automotive sector being the most impacted)

- Gold remains the hottest thing in town, with a stunning +17% YtD return, followed by EU, UK, EM stocks returning 9%, 5% and 4% so far this year. Government Bond yields were slightly lower with HY credit spreads higher

- US Feb PCE inflation data was released slightly higher, PMI composite and services were better with yet a deteriorating manufacturing, leading to a new expectation of 3 more FED rate cuts this year (CME FedWatch)

- Globally US Q4 earnings season showed a reduction in 2025 earnings growth expectation from 12% to 10% (still above historical trend of 6-7%).

- Over Q1, the USD weakened by 4% so did Oil. Note Copper Futures are at record high with +26% in Q1.

MARKETS

Equities

Q4 earnings released (weekly stock performance):

Next (+12%)

Lululemon (-10%), Gamestop (-15%), Chewy (-6%), H&M (-2%)

NB: Super Micro Computer was down -16% on the week, Alstom (-11%), Porsche (-8%), Novo Nordisk (-10%), Broadcom (-11%)

Analysts:

Richemont (UBS ‘buy’ target CHF184); Ferrari (Barclays ’o/w’ target $523); Total (Citi ’buy’ target €70); Informa (GS ’buy’ target £10.6); Sodexo (GS ’o/w’ target €122); Nestlé (GS ‘buy’ target CHF98)

BASF (JPM ’u/w’ target €45); Sodexo (GS ‘neutral’ €73)

Rates

US curve (2-10 years) steepening rose by 5bps to 35bps. Government Bond yields lower across the board

HY corporate spreads higher at around 325bps

Commodities

Oil price up (due to new US sanctions on Venezuela and Iran exports)

Gold price up (GS forecasts $3300 and BofA $3500 within 2 years)

Copper price at record high (BNP Paribas forecast prices will collapse after tariffs kick in)

US

Feb PCE inflation Headline at 2.5%, Core +2.8% (excluding food & energy) vs 2.6% prior, consumer spending accelerated more than expected

Cryptos

Fidelity launched a new Spot Solana ETF

Under the watch

10yr Japan Bond yield at its highest level since the 2008 GFC

Nota Bene

Q1 2025 US corporate quarterly earnings releases will start on April 11th with JPM, Wells Fargo, MS, BlackRock and BONY

CALENDAR

Macro economic data:

US March ISM Manufacturing (1 April), March ISM Services (3 April), March NFP job report (4 April)

EU flash March inflation (1 April)

WHAT ANALYSTS SAY

UBS Global Wealth Management, 28 March 2025

Author: Mark Haefele, CIO UBS GWM

From an investment perspective, 2025 has either felt “tariff-ying” or “tariff-ic,” depending on your regional focus.

In the US, the Trump administration’s tariffs have moved faster and gone further than expected. The S&P 500 is down 3% year to date and 7% from its February peak. Meanwhile, both Europe and China have responded to US actions.

Europe has demonstrated its willingness to increase defense spending to be less reliant on the US.

China announced further policy stimulus aimed at boosting domestic consumption. Equity markets in Europe and China are up around 15% and 17% this year, respectively (MSCI EMU and MSCI China indices).

Market volatility is likely to remain elevated in the near term. President Donald Trump this week announced a 25% tariff on auto imports. We expect the US to announce further tariffs on most major trading partners on 2 April, and we believe the direct and indirect effect of tariffs will feature prominently during the first-quarter earnings season starting in mid-April.

But despite stagflation concerns, we expect news flow to become more positive toward the second half of the year. Recent comments from the Trump administration suggest some flexibility on its reciprocal tariff plans, potentially implying a willingness to find “deals” to ease tariffs.

A budget reconciliation bill could refocus attention on market-positive aspects of the Trump agenda. We also expect the Federal Reserve to cut interest rates at its 18 June meeting if it sees signs of the labor market softening.

From current levels, we expect US equities to outperform their European and Asian counterparts over the balance of 2025. Positioning and sentiment data suggest that the long-held “US exceptionalism” view is no longer as widely held—suggesting greater scope for positive surprises—and despite tariff risks, we are confident about US economic prospects and the earnings growth potential for leading AI companies.

Conversely, sharp year-to-date rallies in Eurozone and Chinese stocks suggest that European fiscal stimulus, Chinese AI developments, and a more pro-business stance from the Chinese government may be priced in the near term, while tariffs remain a threat.

Investors who are under allocated can take advantage of near-term volatility by phasing into broad US equities and stocks exposed to AI. Following the recent rally, we maintain a more selective approach in Europe and Asia, with a focus on beneficiaries from European fiscal spending, the Taiwanese market, and state-owned enterprises in mainland China. We also like companies exposed to the power and resources value chain.

Beyond equities, we believe investors should seek durable income in quality bonds, as yields remain relatively high. In currencies, we believe the US dollar could rally in the near term, but that its strength is likely to fade later this year. We expect the US dollar to end the year close to current levels, presenting an opportunity to “trade the range.” We also believe gold remains appealing amid geopolitical uncertainty, and persistent private and institutional investor demand.

DNCA, 20 March 2025

Author: Pascal Gilbert

An era is over, when government debt was seen as a safe haven and traded at a discount to the risk-free rate.

In the short term, the US economic slowdown is inevitable in the light of Donald Trump's programme of reducing immigration and raising tariffs. In the long term, these measures also reduce growth potential.

The fall in the 10-year Treasury yield is justified because growth has been above 2% in recent years and has exceeded expectations. The perception that US growth would be high for a long time had an impact on real rates. This perception has now been reversed in response to anti-immigration measures, the drive to reduce public spending (DOGE) and the increase in customs duties. If growth eases to around 1.5%, we do not believe at all in the scenario of a US recession.

We must remain humble in the face of the three main unknowns at the moment :

customs barriers, the resolution of the conflict in Ukraine and the implementation of the German recovery plan, coupled with the possible abandonment of the debt brake and the possibility of additional military spending that would not be taken into account in the deficit ratio. These three major criteria could give rise to major surprises over the coming months, and short-term volatility on the markets. A resolution to the conflict in Ukraine would not have the same impact on the dollar and interest rates as if it did not materialise.

We have seen years of savings glut. From now on, a considerable demand for investment will have to be financed by a corresponding demand for savings. The new equilibrium rate should be higher, according to Isabel Schnabel, member of the ECB's Executive Board. This means that all yield curves need to be ‘re-priced’.

It is possible that the market will gradually become aware of government risk. We've been saying this for a year now. In any case, the result is increasing pressure on governments whose finances are very unbalanced. I hope that this will not result in a lasting change in trend. But an era is over, when government debt was seen as a safe haven and traded at a discount to the risk-free rate (swap rate).

German debt is trading 13 to 15 basis points above the 10-year swap rate, European debt between 50 and 100 basis points and US debt between 50 and 100 basis points on the long end of the curve. These are significant returns. As an investor, this is a good thing, but we need to look at the causes of this additional yield, and therefore of this additional risk. In my opinion, this spread will not decrease and it is even possible that it will increase. In reality, only a major external factor, such as quantitative easing by the ECB similar to that which took place during the covid, can reduce the spread.

Since last autumn, we have been stressing the good health of the private sector, from businesses to households. In terms of bonds, the visibility of corporate debt is almost better than that of public debt. Companies will also benefit from the German stimulus plan, and therefore from higher growth. It is possible that the spread on US or European corporate debt will be lower than that on government debt.

We have adapted our choices to recent events. From a 5-year perspective, investors are starting to earn around 3% on European government debt, with no great risk of inflation between now and 2026. If short-term rates reach 2.25% or 2%, this situation may persist for some time. The market also offers a small 3-year risk premium. We are trying to capture it. It's not an absolute buy, but we have some protection with this 3% yield.

On the other hand, we remain cautious about long-term debt in view of the increased demand for capital needed for the stimulus programme.Analysis of the curves reveals a rise in real rates in Europe. But they remain fairly low in a scenario where growth accelerates and demand for capital increases. Short-term real rates (0.3% for 3 years, 0.67% for 5 years and 0.46% for 10 years) do not seem to me to be sufficient to invest massively over the long term.

The European Bond spread is already 80 basis points at 10 years, above the swap rate, due to the lack of collateral. It's a question of confidence. I note that the European debt issuance programme is higher than was imagined three months ago. This requires an increased risk premium. In our view, volatility will remain high in the short term. There should be a lull thereafter, but I am more concerned about the effects of the increase in demand for capital. We have changed regime, as Isabel Schnabel says.

We are trying to diversify, a little in emerging stocks and across the spread. The fundamentals of some emerging markets are sometimes better than ours. We are interested in certain countries in Latin America (Mexico, Brazil) and Eastern Europe (Romania, Hungary, Poland).

We are also looking for securities from countries with sound monetary positions and visible public finances, which offer opportunities on the long end of the curve and which have suffered the aftershocks of German stimulus. We find them in Oceania, for example.

In terms of currencies, I'm used to saying that if we're not wrong on the dollar, we won't be wrong on the interest rate markets. I remain convinced that European cohesion remains complicated with 27 participants around the table. The dollar remains a strong currency because Europe is being built, albeit painfully. The United States is in a slowdown phase, but what Donald Trump is trying to achieve (reducing the trade deficit and attracting businesses) suggests that the greenback will remain strong. In the medium term, it is not certain that his action will be positive, but what other currency offers more safe-haven value? Only a collapse in the US economy will cause the dollar to fall, but that's not our scenario.

Note on 10year Swiss Bonds, yield is 0.7% with a volatility of 5%. Our objective is to seek an attractive yield in relation to volatility. For the long-term investor, Swiss debt is attractive because of its protection, but protection is not really cheap.

Equities

Q4 earnings released (weekly stock performance):

Next (+12%)

Lululemon (-10%), Gamestop (-15%), Chewy (-6%), H&M (-2%)

NB: Super Micro Computer was down -16% on the week, Alstom (-11%), Porsche (-8%), Novo Nordisk (-10%), Broadcom (-11%)

Analysts:

Richemont (UBS ‘buy’ target CHF184); Ferrari (Barclays ’o/w’ target $523); Total (Citi ’buy’ target €70); Informa (GS ’buy’ target £10.6); Sodexo (GS ’o/w’ target €122); Nestlé (GS ‘buy’ target CHF98)

BASF (JPM ’u/w’ target €45); Sodexo (GS ‘neutral’ €73)

Rates

US curve (2-10 years) steepening rose by 5bps to 35bps. Government Bond yields lower across the board

HY corporate spreads higher at around 325bps

Commodities

Oil price up (due to new US sanctions on Venezuela and Iran exports)

Gold price up (GS forecasts $3300 and BofA $3500 within 2 years)

Copper price at record high (BNP Paribas forecast prices will collapse after tariffs kick in)

US

Feb PCE inflation Headline at 2.5%, Core +2.8% (excluding food & energy) vs 2.6% prior, consumer spending accelerated more than expected

Cryptos

Fidelity launched a new Spot Solana ETF

Under the watch

10yr Japan Bond yield at its highest level since the 2008 GFC

Nota Bene

Q1 2025 US corporate quarterly earnings releases will start on April 11th with JPM, Wells Fargo, MS, BlackRock and BONY

CALENDAR

Macro economic data:

US March ISM Manufacturing (1 April), March ISM Services (3 April), March NFP job report (4 April)

EU flash March inflation (1 April)

WHAT ANALYSTS SAY

- UBS: Monthly Investment Letter (Tariff-ying or Tariff-ic)

- DNCA : real short-term rates in Europe are insufficient

UBS Global Wealth Management, 28 March 2025

Author: Mark Haefele, CIO UBS GWM

From an investment perspective, 2025 has either felt “tariff-ying” or “tariff-ic,” depending on your regional focus.

In the US, the Trump administration’s tariffs have moved faster and gone further than expected. The S&P 500 is down 3% year to date and 7% from its February peak. Meanwhile, both Europe and China have responded to US actions.

Europe has demonstrated its willingness to increase defense spending to be less reliant on the US.

China announced further policy stimulus aimed at boosting domestic consumption. Equity markets in Europe and China are up around 15% and 17% this year, respectively (MSCI EMU and MSCI China indices).

Market volatility is likely to remain elevated in the near term. President Donald Trump this week announced a 25% tariff on auto imports. We expect the US to announce further tariffs on most major trading partners on 2 April, and we believe the direct and indirect effect of tariffs will feature prominently during the first-quarter earnings season starting in mid-April.

But despite stagflation concerns, we expect news flow to become more positive toward the second half of the year. Recent comments from the Trump administration suggest some flexibility on its reciprocal tariff plans, potentially implying a willingness to find “deals” to ease tariffs.

A budget reconciliation bill could refocus attention on market-positive aspects of the Trump agenda. We also expect the Federal Reserve to cut interest rates at its 18 June meeting if it sees signs of the labor market softening.

From current levels, we expect US equities to outperform their European and Asian counterparts over the balance of 2025. Positioning and sentiment data suggest that the long-held “US exceptionalism” view is no longer as widely held—suggesting greater scope for positive surprises—and despite tariff risks, we are confident about US economic prospects and the earnings growth potential for leading AI companies.

Conversely, sharp year-to-date rallies in Eurozone and Chinese stocks suggest that European fiscal stimulus, Chinese AI developments, and a more pro-business stance from the Chinese government may be priced in the near term, while tariffs remain a threat.

Investors who are under allocated can take advantage of near-term volatility by phasing into broad US equities and stocks exposed to AI. Following the recent rally, we maintain a more selective approach in Europe and Asia, with a focus on beneficiaries from European fiscal spending, the Taiwanese market, and state-owned enterprises in mainland China. We also like companies exposed to the power and resources value chain.

Beyond equities, we believe investors should seek durable income in quality bonds, as yields remain relatively high. In currencies, we believe the US dollar could rally in the near term, but that its strength is likely to fade later this year. We expect the US dollar to end the year close to current levels, presenting an opportunity to “trade the range.” We also believe gold remains appealing amid geopolitical uncertainty, and persistent private and institutional investor demand.

DNCA, 20 March 2025

Author: Pascal Gilbert

An era is over, when government debt was seen as a safe haven and traded at a discount to the risk-free rate.

In the short term, the US economic slowdown is inevitable in the light of Donald Trump's programme of reducing immigration and raising tariffs. In the long term, these measures also reduce growth potential.

The fall in the 10-year Treasury yield is justified because growth has been above 2% in recent years and has exceeded expectations. The perception that US growth would be high for a long time had an impact on real rates. This perception has now been reversed in response to anti-immigration measures, the drive to reduce public spending (DOGE) and the increase in customs duties. If growth eases to around 1.5%, we do not believe at all in the scenario of a US recession.

We must remain humble in the face of the three main unknowns at the moment :

customs barriers, the resolution of the conflict in Ukraine and the implementation of the German recovery plan, coupled with the possible abandonment of the debt brake and the possibility of additional military spending that would not be taken into account in the deficit ratio. These three major criteria could give rise to major surprises over the coming months, and short-term volatility on the markets. A resolution to the conflict in Ukraine would not have the same impact on the dollar and interest rates as if it did not materialise.

We have seen years of savings glut. From now on, a considerable demand for investment will have to be financed by a corresponding demand for savings. The new equilibrium rate should be higher, according to Isabel Schnabel, member of the ECB's Executive Board. This means that all yield curves need to be ‘re-priced’.

It is possible that the market will gradually become aware of government risk. We've been saying this for a year now. In any case, the result is increasing pressure on governments whose finances are very unbalanced. I hope that this will not result in a lasting change in trend. But an era is over, when government debt was seen as a safe haven and traded at a discount to the risk-free rate (swap rate).

German debt is trading 13 to 15 basis points above the 10-year swap rate, European debt between 50 and 100 basis points and US debt between 50 and 100 basis points on the long end of the curve. These are significant returns. As an investor, this is a good thing, but we need to look at the causes of this additional yield, and therefore of this additional risk. In my opinion, this spread will not decrease and it is even possible that it will increase. In reality, only a major external factor, such as quantitative easing by the ECB similar to that which took place during the covid, can reduce the spread.

Since last autumn, we have been stressing the good health of the private sector, from businesses to households. In terms of bonds, the visibility of corporate debt is almost better than that of public debt. Companies will also benefit from the German stimulus plan, and therefore from higher growth. It is possible that the spread on US or European corporate debt will be lower than that on government debt.

We have adapted our choices to recent events. From a 5-year perspective, investors are starting to earn around 3% on European government debt, with no great risk of inflation between now and 2026. If short-term rates reach 2.25% or 2%, this situation may persist for some time. The market also offers a small 3-year risk premium. We are trying to capture it. It's not an absolute buy, but we have some protection with this 3% yield.

On the other hand, we remain cautious about long-term debt in view of the increased demand for capital needed for the stimulus programme.Analysis of the curves reveals a rise in real rates in Europe. But they remain fairly low in a scenario where growth accelerates and demand for capital increases. Short-term real rates (0.3% for 3 years, 0.67% for 5 years and 0.46% for 10 years) do not seem to me to be sufficient to invest massively over the long term.

The European Bond spread is already 80 basis points at 10 years, above the swap rate, due to the lack of collateral. It's a question of confidence. I note that the European debt issuance programme is higher than was imagined three months ago. This requires an increased risk premium. In our view, volatility will remain high in the short term. There should be a lull thereafter, but I am more concerned about the effects of the increase in demand for capital. We have changed regime, as Isabel Schnabel says.

We are trying to diversify, a little in emerging stocks and across the spread. The fundamentals of some emerging markets are sometimes better than ours. We are interested in certain countries in Latin America (Mexico, Brazil) and Eastern Europe (Romania, Hungary, Poland).

We are also looking for securities from countries with sound monetary positions and visible public finances, which offer opportunities on the long end of the curve and which have suffered the aftershocks of German stimulus. We find them in Oceania, for example.

In terms of currencies, I'm used to saying that if we're not wrong on the dollar, we won't be wrong on the interest rate markets. I remain convinced that European cohesion remains complicated with 27 participants around the table. The dollar remains a strong currency because Europe is being built, albeit painfully. The United States is in a slowdown phase, but what Donald Trump is trying to achieve (reducing the trade deficit and attracting businesses) suggests that the greenback will remain strong. In the medium term, it is not certain that his action will be positive, but what other currency offers more safe-haven value? Only a collapse in the US economy will cause the dollar to fall, but that's not our scenario.

Note on 10year Swiss Bonds, yield is 0.7% with a volatility of 5%. Our objective is to seek an attractive yield in relation to volatility. For the long-term investor, Swiss debt is attractive because of its protection, but protection is not really cheap.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.