Potential new stimulus in China, Central Banks cuts ahead, further US nominations led to new records for stocks and BTC

WEEKLY TRENDS

WEEKLY TRENDS

- New economic stimulus is set in China within the next few days, in response to potential new 20% US tariffs and boost an economy that needs further help

- Last Friday’s US NFP report showed resurgent job creations but with a higher unemployment rate, leading the path for a FED cut on Dec 18

- Trump nominated David Sacks (Paypal) as a Crypto AI adviser, Paul Atkins (lawyer) as the new head of the SEC, Powell delivered a bullish speech for the US economy last week that helped US stocks reached new highs (except for the Russell SMEs index)

- OPEC+ decided to postponed their Oil production revival by a further 3 months until April 2025

- EU PMI in November were weak (48.3) which could trigger the ECB to go for a larger cut this coming week

- NB Trump is threatening the BRICS with 100% tariffs if they chose to abandon the USD for their trade payments and Syrian Assad’s regime has fallen to rebels.

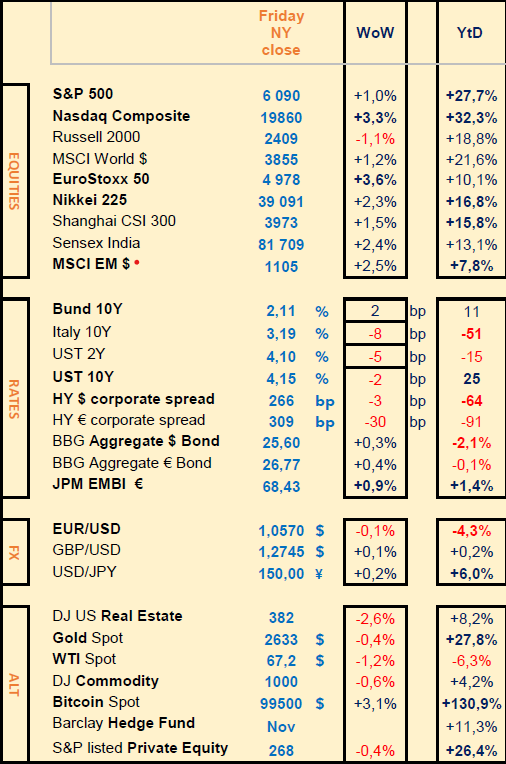

MARKETS

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Salesforce (+9%), Hochtief (+10%), Legal & General (+7%), Watches of Switzerland (+21%)

- - - Swiss Life (-4%), Safran (-3%)

M&A:

Aviva raised its offer from GBP 3.3bn to 3.6bn to buy Direct Line Insurance. Amundi is interested in buying Allianz Global Investors at the same time as its parent Credit Agricole wants to raise its equity participation in BPM to 15.1%.BlackRock bought credit firm HPS ($12bn all-stock deal)

Rates

US curve (2-10 years) steepening remained stable at a mere 5bps. Bond yields slightly lower across the board, HY corporate spreads too. The FED and the ECB are both expected to lower their rates mid December, -25bps for the FED and possibly -50bp for the ECB this coming week.

Commodities

Oil price remained under pressure (new OPEC+ decision in April 2025)

Gold price slightly lower (-0.5%) despite lower US Treasuries yields

US

NFP in Nov released at +227k, Oct was revised up from +12k to +36k. Unemployment rate was slightly raised from 4.1% to 4.2%. ISM services in Nov lower at 52.1 vs 56 prior, Manufacturing higher at 48.4 vs 46.5 prior

EU

PMI composite for the euro zone in November fell to 48.3 (France at 45.9)

Crypto

BTC reached a new record high of $104k last week that triggered a major flash crash (from $104k to $95k in 43 seconds, said to be due to institutional selling like Chinese Meitu for $650m)

Nota Bene

BTC has become the World’s 6th largest investment vehicle ($2trn)

MicroStrategy (large owner of BTCs) could soon enter the Nasdaq 100

CALENDAR

WHAT ANALYSTS SAY

World Gold Council, 6 Dec 2024 - Gold market structure & trends

Authors: Ray Jia, Research Head, China

Stabilising Demand

Central banks reported 60t of net purchases this month (November) – the highest amount recorded y-t-d.

The Reserve Bank of India (RBI) led the field, adding 27t of gold to its reserves, followed by Turkey and Poland – 17t and 8t respectively.

The Central Bank of the Republic of Turkey added 17t, making October the 17th consecutive month of net purchases and the highest reported monthly figure on record since December 2023. October’s figures have surpassed the quarterly total of Q2 and Q3. On a y-t-d basis Turkey added 72t, representing around 34% of its total reserves

The National Bank of Poland recorded net buying of 8t during the month, its seventh consecutive month of net buying. On a y-t-d basis, Poland added 69t, making up 17% of its total reserves. The NBP's annual report2 highlights its commitment to accumulating gold, with the central bank targeting a 20% allocation as a percentage of its total official reserve assets

The National Bank of Kazakhstan added 5t of gold to its reserves after five months of net selling. However, Kazakhstan remains a net seller y-t-d, down 4t in 2024

The Czech National Bank (CNB) added 2t of gold, making October its 20th consecutive month of net buying. The CNB has accumulated 37t of gold over this period, lifting its total gold reserves to 49t

Kyrgyzstan added 2t of gold to its reserves, bringing its y-t-d purchases close to 6t and making October the highest reported monthly net buying on record since September 2023

Data made available by the Bank of Ghana shows that its gold reserves now amount to 28t. The country’s gold reserves have increased steadily since May 2023, when they stood at just under 9t. Ghana added a further 1t during the month.

November sees outflows again

In November, global gold ETFs saw their first monthly outflow since April, led by Europe, while North America was the only region reporting inflows. Total AUM fell 4% in the month, although y-t-d flows have remained positive at US$2.6bn. But the 29t fall in holdings last month flipped y-t-d demand to negative. Global gold trading volumes kept rising, mainly driven by active trading of futures and ETFs.

Looking ahead, we see stabilising in both demand sectors: while the gold jewellery demand weakness may narrow, investment growth could slow in 2025.

Goldman Sachs Briefings, 6 Dec 2024 - AI spending; China’s stimulus measures

Authors: Elsie Peng, research analyst; Hui Shan, Chief China Economist

· What's next for the boom in AI infrastructure?

Growing investment in data centers and hardware for AI technology will provide a boost to US corporate spending next year, according to forecasts by Goldman Sachs Research.

Our analysts' proprietary tracker for investment into AI uses information on data center construction spending from the Census Bureau as well as technology company sales of data center hardware to monitor real (inflation-adjusted) spending on AI.

Spending on data centers and hardware soared in 2023 following the launch of ChatGPT, Goldman Sachs Research analyst Elsie Peng writes in the team's report. Since then, it has continued to grow at a strong pace, reaching $45 billion in the third quarter of 2024.

The team expects corporate spending on AI infrastructure to continue to grow next year, albeit at a slightly slower pace than in 2024.

More broadly, US capital expenditure declined on net over the past two quarters once a rebound in airplane production has been taken into account.

But Goldman Sachs Research projects that capital spending will rebound to 5% in the fourth quarter of 2025 from a year earlier, supported by continued AI investments, which could add half a percentage point to US capex growth.

Lower interest rates, improved business sentiment, and reinstatements of tax incentives are also set to drive an increase in capital expenditure.

· China's stimulus may partially offset US tariffs in 2025

China's economy is projected by Goldman Sachs Research to grow at a slower pace in 2025, as the government's stimulus efforts partially offset the impact of potential tariffs from the US.

Real GDP growth is predicted to decelerate to 4.5% next year from 4.9% in 2024.

Goldman Sachs Research's forecast assumes a 20 % increase in the effective tariff rate imposed by the incoming Trump administration on Chinese goods, which would weigh on China's real GDP by 0.7 percentage point in 2025.

The forecast also assumes that Chinese policymakers will introduce fresh stimulus to blunt the impact of tariffs.

“The choice in front of Chinese policymakers is simple: either to provide a large dose of policy offset or to accept a notably lower headline real GDP growth,” Chief China Economist Hui Shan writes in the team's report. “We expect them to choose the former.”

Pictet, 2 Dec 2024 - House View Outlook 2025

Authors: Cesar Perez Ruiz, Head of Investments & CIO ; Géraldine Sundstrom, Head of Investment Offering

Core positioning: favour US equities; privilege EUR and CHF investment grade bonds; play USD strength

Convictions: favour cash-rich companies and financials ; profit from increased M&A activity ; benefit from private equity’s revival

Optionality: positive surprise: European equities or US Treasuries ; negative surprise: look for safe havens (Gold and CHF)

· Liquidity

Cash is no longer king.

· Fixed Income

We prefer credit over Treasuries. In a nutshell,

· Equities

We prefer US and Japan. In a nutshell,

· Currencies

The US dollar is king. In a nutshell,

· Private Equity

To benefit from the expected recovery of IPO activity and deregulation

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.

Equities

Q3 earnings releases last week (stock WoW performance):

+++ Salesforce (+9%), Hochtief (+10%), Legal & General (+7%), Watches of Switzerland (+21%)

- - - Swiss Life (-4%), Safran (-3%)

M&A:

Aviva raised its offer from GBP 3.3bn to 3.6bn to buy Direct Line Insurance. Amundi is interested in buying Allianz Global Investors at the same time as its parent Credit Agricole wants to raise its equity participation in BPM to 15.1%.BlackRock bought credit firm HPS ($12bn all-stock deal)

Rates

US curve (2-10 years) steepening remained stable at a mere 5bps. Bond yields slightly lower across the board, HY corporate spreads too. The FED and the ECB are both expected to lower their rates mid December, -25bps for the FED and possibly -50bp for the ECB this coming week.

Commodities

Oil price remained under pressure (new OPEC+ decision in April 2025)

Gold price slightly lower (-0.5%) despite lower US Treasuries yields

US

NFP in Nov released at +227k, Oct was revised up from +12k to +36k. Unemployment rate was slightly raised from 4.1% to 4.2%. ISM services in Nov lower at 52.1 vs 56 prior, Manufacturing higher at 48.4 vs 46.5 prior

EU

PMI composite for the euro zone in November fell to 48.3 (France at 45.9)

Crypto

BTC reached a new record high of $104k last week that triggered a major flash crash (from $104k to $95k in 43 seconds, said to be due to institutional selling like Chinese Meitu for $650m)

Nota Bene

BTC has become the World’s 6th largest investment vehicle ($2trn)

MicroStrategy (large owner of BTCs) could soon enter the Nasdaq 100

CALENDAR

- Corporate earnings: US Oracle (9 Dec), Adobe (11), Broadcom, Costco (12), Charles Schwab (13 Dec), Others : TSMC (10 Dec)

- Rate decisions: Australia (10 Dec), Canada (11Dec), ECB and SNB (12 Dec)

- Macro: US CPI for Nov (11 Dec)

WHAT ANALYSTS SAY

- World Gold Council - Gold market structure & trends

- Goldman Sachs Briefings - AI spending continue to grow ; China’s stimulus measures to blunt US tariffs

- Pictet - House View Outlook 2025

World Gold Council, 6 Dec 2024 - Gold market structure & trends

Authors: Ray Jia, Research Head, China

Stabilising Demand

Central banks reported 60t of net purchases this month (November) – the highest amount recorded y-t-d.

The Reserve Bank of India (RBI) led the field, adding 27t of gold to its reserves, followed by Turkey and Poland – 17t and 8t respectively.

The Central Bank of the Republic of Turkey added 17t, making October the 17th consecutive month of net purchases and the highest reported monthly figure on record since December 2023. October’s figures have surpassed the quarterly total of Q2 and Q3. On a y-t-d basis Turkey added 72t, representing around 34% of its total reserves

The National Bank of Poland recorded net buying of 8t during the month, its seventh consecutive month of net buying. On a y-t-d basis, Poland added 69t, making up 17% of its total reserves. The NBP's annual report2 highlights its commitment to accumulating gold, with the central bank targeting a 20% allocation as a percentage of its total official reserve assets

The National Bank of Kazakhstan added 5t of gold to its reserves after five months of net selling. However, Kazakhstan remains a net seller y-t-d, down 4t in 2024

The Czech National Bank (CNB) added 2t of gold, making October its 20th consecutive month of net buying. The CNB has accumulated 37t of gold over this period, lifting its total gold reserves to 49t

Kyrgyzstan added 2t of gold to its reserves, bringing its y-t-d purchases close to 6t and making October the highest reported monthly net buying on record since September 2023

Data made available by the Bank of Ghana shows that its gold reserves now amount to 28t. The country’s gold reserves have increased steadily since May 2023, when they stood at just under 9t. Ghana added a further 1t during the month.

November sees outflows again

In November, global gold ETFs saw their first monthly outflow since April, led by Europe, while North America was the only region reporting inflows. Total AUM fell 4% in the month, although y-t-d flows have remained positive at US$2.6bn. But the 29t fall in holdings last month flipped y-t-d demand to negative. Global gold trading volumes kept rising, mainly driven by active trading of futures and ETFs.

Looking ahead, we see stabilising in both demand sectors: while the gold jewellery demand weakness may narrow, investment growth could slow in 2025.

Goldman Sachs Briefings, 6 Dec 2024 - AI spending; China’s stimulus measures

Authors: Elsie Peng, research analyst; Hui Shan, Chief China Economist

· What's next for the boom in AI infrastructure?

Growing investment in data centers and hardware for AI technology will provide a boost to US corporate spending next year, according to forecasts by Goldman Sachs Research.

Our analysts' proprietary tracker for investment into AI uses information on data center construction spending from the Census Bureau as well as technology company sales of data center hardware to monitor real (inflation-adjusted) spending on AI.

Spending on data centers and hardware soared in 2023 following the launch of ChatGPT, Goldman Sachs Research analyst Elsie Peng writes in the team's report. Since then, it has continued to grow at a strong pace, reaching $45 billion in the third quarter of 2024.

The team expects corporate spending on AI infrastructure to continue to grow next year, albeit at a slightly slower pace than in 2024.

More broadly, US capital expenditure declined on net over the past two quarters once a rebound in airplane production has been taken into account.

But Goldman Sachs Research projects that capital spending will rebound to 5% in the fourth quarter of 2025 from a year earlier, supported by continued AI investments, which could add half a percentage point to US capex growth.

Lower interest rates, improved business sentiment, and reinstatements of tax incentives are also set to drive an increase in capital expenditure.

· China's stimulus may partially offset US tariffs in 2025

China's economy is projected by Goldman Sachs Research to grow at a slower pace in 2025, as the government's stimulus efforts partially offset the impact of potential tariffs from the US.

Real GDP growth is predicted to decelerate to 4.5% next year from 4.9% in 2024.

Goldman Sachs Research's forecast assumes a 20 % increase in the effective tariff rate imposed by the incoming Trump administration on Chinese goods, which would weigh on China's real GDP by 0.7 percentage point in 2025.

The forecast also assumes that Chinese policymakers will introduce fresh stimulus to blunt the impact of tariffs.

“The choice in front of Chinese policymakers is simple: either to provide a large dose of policy offset or to accept a notably lower headline real GDP growth,” Chief China Economist Hui Shan writes in the team's report. “We expect them to choose the former.”

Pictet, 2 Dec 2024 - House View Outlook 2025

Authors: Cesar Perez Ruiz, Head of Investments & CIO ; Géraldine Sundstrom, Head of Investment Offering

Core positioning: favour US equities; privilege EUR and CHF investment grade bonds; play USD strength

Convictions: favour cash-rich companies and financials ; profit from increased M&A activity ; benefit from private equity’s revival

Optionality: positive surprise: European equities or US Treasuries ; negative surprise: look for safe havens (Gold and CHF)

· Liquidity

Cash is no longer king.

- Yields on cash are less attractive than on credit

- Yields on cash were falling faster than on corporate bonds even before the November elections, highlighting the changing investment landscape. This means corporate bonds are becoming more appealing.

· Fixed Income

We prefer credit over Treasuries. In a nutshell,

- Higher US rates (tariffs likely to limit FED’s cutting cycle. Revival of fiscal concerns

- Lower RoW (Rest of the World) rates, lower terminal rate expected on the back of lower inflation

- Stable credit spreads, resilient earnings growth, subdued high yield supply, higher investor appetite for carry

· Equities

We prefer US and Japan. In a nutshell,

- Earnings, expect EPS growth to improve

- Margins, modest increase in US margins, no margin expansion in EU

- Valuations, prudent to assume equity valuations are flat over 12 month horizon

· Currencies

The US dollar is king. In a nutshell,

- USD strong, election ‘red sweep’, higher US rates than anticipated, cycle softening but robust

- CHF best of the weak, the only real safe haven currency, SNB pushing policy rate below neutral

- Gold good for now, geopolitical and fiscal risks, lower central bank demand due to high price, ETF demand rising, but still weak

· Private Equity

To benefit from the expected recovery of IPO activity and deregulation

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+37410 59-55-56

Broker

+374 43 00-43-82

broker@unibankinvest.am

research@unibankinvest.am

info@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.