Last week: France on negative watch at Moody’s; US CPI released; Gold hit by take profits; Oil surged on new sanctions

WEEKLY TRENDS

WEEKLY TRENDS

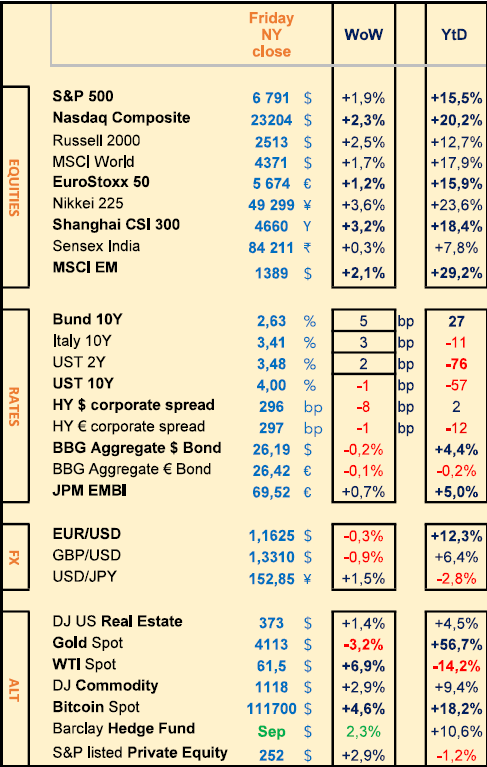

- US Q3 corporate earnings continue to beat estimates (85% of reporting US firms have so far surpassed profit forecasts) while Quantum computing stocks, then at ATH, fell globally (-10%). So did Gold after a 9 consecutive week rally

- US Sep CPI was finally and exceptionally released at 3% vs 3.1% expected, ahead of next week’s FED/FOMC rate decision (29 Oct) forecast to go for a -25bps rate cut

- Oil price rose by a massive +7% on new US sanctions against Russian Oil producers Rosneft and Lukoil

- US trade talks with Canada were suspended by Trump after an Ontario paid ad against US tariffs was released

- October German business activity surged the most since 2023 and France managed to keep its existing long term debt rating at Moody’s late Friday (simply put under negative watch by the US agency). France’s new budget vote remains under huge pressure, hopes remain, maintained by a thread held by the socialist party’s vote

- Aside, the FED and the ECB meetings next week, investors will focus on the US / China meetings and new Q3 US corporate earnings releases including Apple, Amazon, Meta, Alphabet and Microsoft.

MARKETS

Equities

Weekly performances after earnings:

GM (+19%), Volvo (+47%), Accor (+8%), Kering (+7%), Edenred (+25%)

Tesla (-2%), Intel (+2%), Roche (-3%), Thales (+2%), L’Oréal (-4%)

Dassault Sys (-12%), STMicro (-13%), BNPP (-8%), Netflix (-9%)

Analysts: Edenred (GS ‘buy’ target €39), STMicro (BNPP ‘o/w’ target €26), Nexans (GS ‘buy’ target €139), Galderma (GS ‘buy’ target ₣167)

Rates

US curve (2-10 years) steepening slightly lower at 52bps vs 55bps prior

HY corporate spreads lower -10bps (US and EU at 295)

Commodities

Oil price higher (+7%) on new US sanctions against Russia

Gold price lower (-3%) falling 6% on Tuesday due to take profits after hitting a new ATH on Monday at $4381 (GS still predicts $4900 by the end of 2026)

US

Sep CPI was finally released, despite the US government shutdown, at +3% vs +3.1% expected and +2.9% in August (Core released at +3%)

EU

Oct German PMI released at 53.8 vs 51.5 expected and 52 in September

Crypto

BTC higher (+4.5%) JPM is to allow institutional investors to use BTC and ETH as collateral for loans by the end of the year

Under the watch

GAFAM Q3 earnings releases next week

US private credit (Wells Fargo is the biggest lender with $60bn)

End of FED QT (possible FED tilt towards a yearend liquidity support)

Nota Bene

34th ATH of the year, for the SP500 on Friday

CALENDAR

Q3 earnings releases:

US Microsoft, Alphabet, Meta (29 Oct), Amazon, Eli Lilly, Apple (30), Chevron, Exxon (31)

EU Novartis, BNPP (28 Oct), Total, Volkswagen (30)

Central Banks meetings:

US FED/FOMC (29 Oct), EU ECB (30), UK BOE/MPC (6 Nov)

WHAT ANALYSTS SAY

Edmond de Rothschild, 24 October 2025

Author: Michael Nizard, Multi-Assets and Overlay Director

The earnings season is looking good, with 58% of European companies and 84% of American companies exceeding expectations.

Donald Trump is preparing to meet Xi Jinping, while pressure is mounting on China due to threats of American restrictions on the purchase of critical American software. Despite these tensions, the prospect of this meeting with the US President is seen as a positive sign for GDP growth, although third-quarter figures showed signs of weakness.

GDP growth stands at 4.8% (below the 5% target), penalised by weak domestic demand, as evidenced by retail sales at +3% (against +4.4% expected). On the other hand, external demand stimulated growth by supporting industrial production and exports.

In Europe, economic indicators vary from country to country.

In Germany, the composite PMI exceeded expectations (53.8 vs. 51.5) thanks to growth in services.

In France, services led to a decline in the composite PMI, which came in at 46.8 versus 48.4 expected. In addition, the rating agency S&P downgraded France's sovereign rating from AA- to A+, anticipating an increase in public debt to 121% of GDP by 2028 and risks to fiscal consolidation.

Fiscal difficulties are also a concern for the British government, which is planning tax increases and budget cuts to correct past imbalances. Headline inflation remains at +3.8%, while core inflation is slowing to +3.5%, which could prompt the Bank of England to consider gradual rate cuts.

Despite this economic backdrop, the earnings season has been strong, with 58% of European companies exceeding expectations. In the United States, the figures are even more encouraging, with 84% of companies posting better-than-expected results. However, a few disappointments among large companies call for caution.

With regard to Russia, Donald Trump announced sanctions against two major Russian oil companies following the lack of progress with Vladimir Putin on peace in Ukraine, pushing the price of Brent crude to $65.

This move is amplified by India, which is reviewing its purchases of Russian oil. European leaders also plan to halt imports of Russian liquefied gas at the end of 2026, a year earlier than planned.

In Japan, the Liberal Democratic Party, in coalition with the reformist Ishin party, sees Sanae Takaichi become Prime Minister, leading to a rise in Japanese stocks in anticipation of favourable fiscal policies and measures to increase the purchasing power of the Japanese people, while the latest inflation figures stand at 2.9%, down from the peak of 3.7% reached in May. However, the coalition has 231 seats, slightly below the 233 needed to govern.

This uncertain environment prompts us to take a cautious approach to risky assets, despite the promising start to the earnings season.

We maintain a favourable stance on duration, particularly for emerging market bonds, and favour the highest-rated corporate bonds.

ALLIANZ GLOBAL INVESTORS, 24 October 2025

Author: Michael Krautzberger, Global CIO Fixed Income

After a nine-month hiatus, the Federal Reserve resumed its cycle of rate cuts in September, following a change in its reaction function aimed at placing greater emphasis on its employment mandate. Amid unprecedented political pressure, Chairman Powell described the move as a ‘risk management cut,’ easing monetary policy from moderately restrictive levels to mitigate potential risks of a labour market slowdown despite persistently high inflation.

In his latest speech at the National Association for Business Economics (NABE) conference on 14 October, Mr Powell noted that the economic outlook had changed little since the September meeting, while highlighting the increasing downside risks to employment. In this context, and given the limited data available between meetings due to the federal government shutdown, we believe policymakers will follow the path of least resistance and cut rates by another 25 basis points at the next meeting.

Historically, pre-emptive cuts have rarely been one-off events. A further accommodative move would therefore not only reflect the sequence of three consecutive rate cuts totalling 100 basis points between September and December last year, but would also be in line with past ‘pre-emptive cycles’, as in three out of four cases since 1980, the Fed has made a further cut within 90 days of the first move.

Given the low visibility of the economic, political and trade environment, and the ‘curious equilibrium’ in the labour market, where labour supply and demand have slowed sharply this year, policy decisions remain highly data-dependent. Upcoming inflation or labour market data (the September employment report is still delayed due to the federal government shutdown) could influence the FOMC's decision, although it would take significant upside surprises in either area to prevent a cut.

Conversely, escalating tensions in the regional banking or private credit sectors could prompt the FOMC to consider a larger 50-basis-point reduction. However, this would need to be weighed against the potential negative effect this could have, namely that the Fed perceives the economy or the financial system to be much more fragile than it had previously indicated. Powell also indicated in his speech to the NABE that the Fed could end its balance sheet reduction in the coming months, citing ‘some signs’ of tightening in money markets. While bank reserves remain ‘abundant’, officials are closely monitoring funding conditions and liquidity indicators to determine when to end the reduction. We believe policymakers will end quantitative tightening no later than the first quarter of next year, with an announcement likely in October or December.

From a market perspective, a 25-basis-point cut, already fully priced in, appears to be the least risky solution for the Fed. A decision to maintain the status quo would be a major surprise that could trigger volatility and at least a temporary correction in asset prices. More generally, the impact of any easing will depend on the perceived motivation. In the most constructive scenario, the Fed makes pre-emptive cuts to guard against risks of a slowdown in growth and employment that ultimately do not materialise, while the rise in inflation is credibly viewed as transitory. A less favourable scenario would occur if the easing were seen as politically motivated, particularly if inflation proved more persistent. In this case, any rate cut could be poorly received by investors, particularly at the long end of the Treasury yield curve. It could also continue to fuel the rise in Gold, unlike past episodes of monetary easing.

In any case, the risk of a significant policy error remains exceptionally high, especially given the Fed's new tendency to view tariff-induced inflation as a mere ‘transitory’ supply shock, which could echo its misjudgement in 2021-2022.

JULIUS BAER, 24 October 2025

Author: Yves Bonzon, Head of Investment Management, CIO

Our view on the new wave of trade tensions between the US and China remains fundamentally unchanged. The current political manoeuvring follows a familiar script. Both Washington and Beijing have a clear interest in reaching an agreement by the end of the month. Admittedly, although the trade conflict has eased after some immediate retaliation following Liberation Day, the underlying strategic rivalry between the two countries has never disappeared. In other words, the risk of increased market volatility caused by a new flare-up of trade tensions is likely to remain present for the foreseeable future, but a permanent and disruptive trade war still seems unlikely. Furthermore, Chinese exports have held up surprisingly well despite a drop in shipments to the United States. In fact, these losses have been more than offset by increased shipments to other destinations, putting the United States in a relatively weakened negotiating position. As far as risky assets are concerned, we may have entered a consolidation phase that is likely to last for some time, heavily dependent on the degree of escalation of tensions between the two sides ahead of their meeting at the end of the month at the Asia-Pacific Economic Cooperation summit in South Korea.

The fate of the US dollar remains a major concern for investors. This year's decline has penalised non-USD-denominated portfolios, with the strong performance of US equities only recently beginning to offset the simultaneous decline of the dollar in their portfolios. After a sharp fall in early January 2025, which intensified in the second quarter, the US currency has been trading largely sideways since mid-year, as we anticipated – a development that has gone largely unnoticed until now. The US dollar index continues to enjoy strong support around the key 96 level. Admittedly, the bearish scenario for the dollar remains fairly clear against real assets such as equities and gold, as the US administration erodes confidence in the country's institutional pillars. On the other hand, this scenario is much less obvious against other G7 currencies, as fiscal dominance weighs on all of the group's currencies.

The recent bankruptcy of an American auto parts manufacturer, which had borrowed billions through private debt agreements, sent shockwaves through the private market investment community. Structurally, much of risky corporate financing migrated from public to private markets after the 2008 global financial crisis, as commercial banks were heavily regulated and restricted in their lending practices. Assets under management by private debt funds and business development companies (BDCs) have grown rapidly in recent years. Although this area is opaque, publicly traded BDCs in the United States offer one of the few real-time price signals for gauging the health of the market. Most listed BDCs have fallen sharply in recent weeks – one of the main US BDC indices is down 7% since the start of the year, underperforming US high-yield bonds by 14%, which have risen by around 7%. This correction has been exacerbated by the fact that the majority of BDC loans are variable rate, with a yield premium over short-term rates, making their performance sensitive to a decline in those rates. It is no coincidence that the decline began in September, when the Fed resumed its cycle of rate cuts. The divergence in performance relative to listed high-yield bonds raises questions about the extent of capital misallocation, encouraged by a prolonged period of near-zero or even negative interest rates. Private debt remains a blind spot for asset allocators, and its opacity is an inherent feature of the process, not a flaw that will be corrected anytime soon.

Equities

Weekly performances after earnings:

GM (+19%), Volvo (+47%), Accor (+8%), Kering (+7%), Edenred (+25%)

Tesla (-2%), Intel (+2%), Roche (-3%), Thales (+2%), L’Oréal (-4%)

Dassault Sys (-12%), STMicro (-13%), BNPP (-8%), Netflix (-9%)

Analysts: Edenred (GS ‘buy’ target €39), STMicro (BNPP ‘o/w’ target €26), Nexans (GS ‘buy’ target €139), Galderma (GS ‘buy’ target ₣167)

Rates

US curve (2-10 years) steepening slightly lower at 52bps vs 55bps prior

HY corporate spreads lower -10bps (US and EU at 295)

Commodities

Oil price higher (+7%) on new US sanctions against Russia

Gold price lower (-3%) falling 6% on Tuesday due to take profits after hitting a new ATH on Monday at $4381 (GS still predicts $4900 by the end of 2026)

US

Sep CPI was finally released, despite the US government shutdown, at +3% vs +3.1% expected and +2.9% in August (Core released at +3%)

EU

Oct German PMI released at 53.8 vs 51.5 expected and 52 in September

Crypto

BTC higher (+4.5%) JPM is to allow institutional investors to use BTC and ETH as collateral for loans by the end of the year

Under the watch

GAFAM Q3 earnings releases next week

US private credit (Wells Fargo is the biggest lender with $60bn)

End of FED QT (possible FED tilt towards a yearend liquidity support)

Nota Bene

34th ATH of the year, for the SP500 on Friday

CALENDAR

Q3 earnings releases:

US Microsoft, Alphabet, Meta (29 Oct), Amazon, Eli Lilly, Apple (30), Chevron, Exxon (31)

EU Novartis, BNPP (28 Oct), Total, Volkswagen (30)

Central Banks meetings:

US FED/FOMC (29 Oct), EU ECB (30), UK BOE/MPC (6 Nov)

WHAT ANALYSTS SAY

- Edmond de Rothschild: The earnings season is looking good

- ALLIANZ GLOBAL INVESTORS: End of QT discussions with a decision likely in October or December

- JULIUS BAER: A welcome break in the surge of risky assets

Edmond de Rothschild, 24 October 2025

Author: Michael Nizard, Multi-Assets and Overlay Director

The earnings season is looking good, with 58% of European companies and 84% of American companies exceeding expectations.

Donald Trump is preparing to meet Xi Jinping, while pressure is mounting on China due to threats of American restrictions on the purchase of critical American software. Despite these tensions, the prospect of this meeting with the US President is seen as a positive sign for GDP growth, although third-quarter figures showed signs of weakness.

GDP growth stands at 4.8% (below the 5% target), penalised by weak domestic demand, as evidenced by retail sales at +3% (against +4.4% expected). On the other hand, external demand stimulated growth by supporting industrial production and exports.

In Europe, economic indicators vary from country to country.

In Germany, the composite PMI exceeded expectations (53.8 vs. 51.5) thanks to growth in services.

In France, services led to a decline in the composite PMI, which came in at 46.8 versus 48.4 expected. In addition, the rating agency S&P downgraded France's sovereign rating from AA- to A+, anticipating an increase in public debt to 121% of GDP by 2028 and risks to fiscal consolidation.

Fiscal difficulties are also a concern for the British government, which is planning tax increases and budget cuts to correct past imbalances. Headline inflation remains at +3.8%, while core inflation is slowing to +3.5%, which could prompt the Bank of England to consider gradual rate cuts.

Despite this economic backdrop, the earnings season has been strong, with 58% of European companies exceeding expectations. In the United States, the figures are even more encouraging, with 84% of companies posting better-than-expected results. However, a few disappointments among large companies call for caution.

With regard to Russia, Donald Trump announced sanctions against two major Russian oil companies following the lack of progress with Vladimir Putin on peace in Ukraine, pushing the price of Brent crude to $65.

This move is amplified by India, which is reviewing its purchases of Russian oil. European leaders also plan to halt imports of Russian liquefied gas at the end of 2026, a year earlier than planned.

In Japan, the Liberal Democratic Party, in coalition with the reformist Ishin party, sees Sanae Takaichi become Prime Minister, leading to a rise in Japanese stocks in anticipation of favourable fiscal policies and measures to increase the purchasing power of the Japanese people, while the latest inflation figures stand at 2.9%, down from the peak of 3.7% reached in May. However, the coalition has 231 seats, slightly below the 233 needed to govern.

This uncertain environment prompts us to take a cautious approach to risky assets, despite the promising start to the earnings season.

We maintain a favourable stance on duration, particularly for emerging market bonds, and favour the highest-rated corporate bonds.

ALLIANZ GLOBAL INVESTORS, 24 October 2025

Author: Michael Krautzberger, Global CIO Fixed Income

After a nine-month hiatus, the Federal Reserve resumed its cycle of rate cuts in September, following a change in its reaction function aimed at placing greater emphasis on its employment mandate. Amid unprecedented political pressure, Chairman Powell described the move as a ‘risk management cut,’ easing monetary policy from moderately restrictive levels to mitigate potential risks of a labour market slowdown despite persistently high inflation.

In his latest speech at the National Association for Business Economics (NABE) conference on 14 October, Mr Powell noted that the economic outlook had changed little since the September meeting, while highlighting the increasing downside risks to employment. In this context, and given the limited data available between meetings due to the federal government shutdown, we believe policymakers will follow the path of least resistance and cut rates by another 25 basis points at the next meeting.

Historically, pre-emptive cuts have rarely been one-off events. A further accommodative move would therefore not only reflect the sequence of three consecutive rate cuts totalling 100 basis points between September and December last year, but would also be in line with past ‘pre-emptive cycles’, as in three out of four cases since 1980, the Fed has made a further cut within 90 days of the first move.

Given the low visibility of the economic, political and trade environment, and the ‘curious equilibrium’ in the labour market, where labour supply and demand have slowed sharply this year, policy decisions remain highly data-dependent. Upcoming inflation or labour market data (the September employment report is still delayed due to the federal government shutdown) could influence the FOMC's decision, although it would take significant upside surprises in either area to prevent a cut.

Conversely, escalating tensions in the regional banking or private credit sectors could prompt the FOMC to consider a larger 50-basis-point reduction. However, this would need to be weighed against the potential negative effect this could have, namely that the Fed perceives the economy or the financial system to be much more fragile than it had previously indicated. Powell also indicated in his speech to the NABE that the Fed could end its balance sheet reduction in the coming months, citing ‘some signs’ of tightening in money markets. While bank reserves remain ‘abundant’, officials are closely monitoring funding conditions and liquidity indicators to determine when to end the reduction. We believe policymakers will end quantitative tightening no later than the first quarter of next year, with an announcement likely in October or December.

From a market perspective, a 25-basis-point cut, already fully priced in, appears to be the least risky solution for the Fed. A decision to maintain the status quo would be a major surprise that could trigger volatility and at least a temporary correction in asset prices. More generally, the impact of any easing will depend on the perceived motivation. In the most constructive scenario, the Fed makes pre-emptive cuts to guard against risks of a slowdown in growth and employment that ultimately do not materialise, while the rise in inflation is credibly viewed as transitory. A less favourable scenario would occur if the easing were seen as politically motivated, particularly if inflation proved more persistent. In this case, any rate cut could be poorly received by investors, particularly at the long end of the Treasury yield curve. It could also continue to fuel the rise in Gold, unlike past episodes of monetary easing.

In any case, the risk of a significant policy error remains exceptionally high, especially given the Fed's new tendency to view tariff-induced inflation as a mere ‘transitory’ supply shock, which could echo its misjudgement in 2021-2022.

JULIUS BAER, 24 October 2025

Author: Yves Bonzon, Head of Investment Management, CIO

Our view on the new wave of trade tensions between the US and China remains fundamentally unchanged. The current political manoeuvring follows a familiar script. Both Washington and Beijing have a clear interest in reaching an agreement by the end of the month. Admittedly, although the trade conflict has eased after some immediate retaliation following Liberation Day, the underlying strategic rivalry between the two countries has never disappeared. In other words, the risk of increased market volatility caused by a new flare-up of trade tensions is likely to remain present for the foreseeable future, but a permanent and disruptive trade war still seems unlikely. Furthermore, Chinese exports have held up surprisingly well despite a drop in shipments to the United States. In fact, these losses have been more than offset by increased shipments to other destinations, putting the United States in a relatively weakened negotiating position. As far as risky assets are concerned, we may have entered a consolidation phase that is likely to last for some time, heavily dependent on the degree of escalation of tensions between the two sides ahead of their meeting at the end of the month at the Asia-Pacific Economic Cooperation summit in South Korea.

The fate of the US dollar remains a major concern for investors. This year's decline has penalised non-USD-denominated portfolios, with the strong performance of US equities only recently beginning to offset the simultaneous decline of the dollar in their portfolios. After a sharp fall in early January 2025, which intensified in the second quarter, the US currency has been trading largely sideways since mid-year, as we anticipated – a development that has gone largely unnoticed until now. The US dollar index continues to enjoy strong support around the key 96 level. Admittedly, the bearish scenario for the dollar remains fairly clear against real assets such as equities and gold, as the US administration erodes confidence in the country's institutional pillars. On the other hand, this scenario is much less obvious against other G7 currencies, as fiscal dominance weighs on all of the group's currencies.

The recent bankruptcy of an American auto parts manufacturer, which had borrowed billions through private debt agreements, sent shockwaves through the private market investment community. Structurally, much of risky corporate financing migrated from public to private markets after the 2008 global financial crisis, as commercial banks were heavily regulated and restricted in their lending practices. Assets under management by private debt funds and business development companies (BDCs) have grown rapidly in recent years. Although this area is opaque, publicly traded BDCs in the United States offer one of the few real-time price signals for gauging the health of the market. Most listed BDCs have fallen sharply in recent weeks – one of the main US BDC indices is down 7% since the start of the year, underperforming US high-yield bonds by 14%, which have risen by around 7%. This correction has been exacerbated by the fact that the majority of BDC loans are variable rate, with a yield premium over short-term rates, making their performance sensitive to a decline in those rates. It is no coincidence that the decline began in September, when the Fed resumed its cycle of rate cuts. The divergence in performance relative to listed high-yield bonds raises questions about the extent of capital misallocation, encouraged by a prolonged period of near-zero or even negative interest rates. Private debt remains a blind spot for asset allocators, and its opacity is an inherent feature of the process, not a flaw that will be corrected anytime soon.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.