Last week: Trump threatened China with 100% tariffs; US stocks, Oil and BTC dropped; Gold and Silver at record highs

WEEKLY TRENDS

WEEKLY TRENDS

- It was long overdue, Trump hit the news late Friday with a 100% new tariffs threat to China (1st Nov start), tit for tat after China’s decision to have restrictions on its rare-earth exports

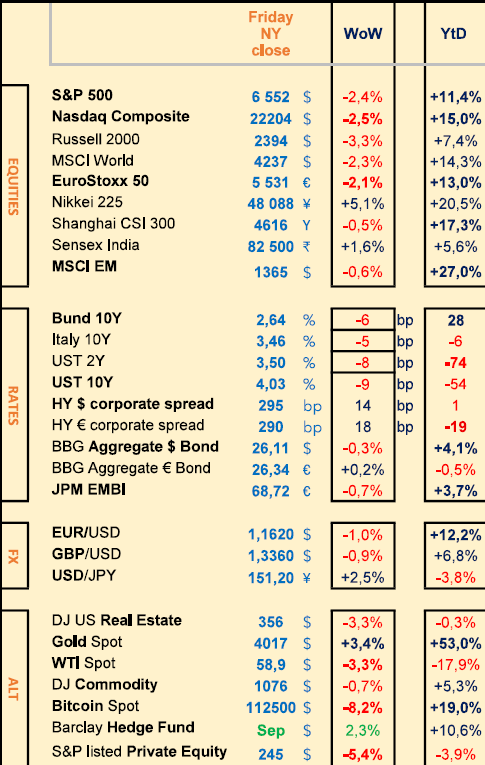

- Stocks dropped on Friday (Asia was closed already) so did Oil (mostly after the ceasefire in the Middle East) and risky assets like BTC fell too. Silver and Gold rallied, the previous broke the $50 an ounce, a level not seen since 1980 (Silver is up +76% YTD). Bond yields were lower across the board (-5 to -10bps) except for JGBs, while corporate spreads were tighter (+15 to +20bps). After hitting a new record high at $126000, BTC dropped on Friday to reach $112500 on Saturday morning

- Note that due to the US shutdown, the US statistics releases (CPI, PPI and the NFP job report) have been postponed (possibly rescheduled for this coming week)

- Meanwhile, we shall have the first releases of 3rd quarter corporate earnings next week with US banks : JPM, Wells Fargo, BlackRock, Citigroup and GS on Tuesday, followed by BofA and MS on Wednesday, and StateStreet on Friday. Together with other names : LVMH, BP, Vinci, Rio Tinto, Nestlé, ABB, Essilor Luxottica.

MARKETS

Equities

Specific stock weekly performances:

AMD (+30% on its deal with OpenAI), Figma (+15%), Abivax (+10%)

Ferrari (-19% on poor outlook), BMW (-9%), Thales (-6%), Leonardo (-6%)

Analysts: ASML (JPM ‘o/w’ target €1000), Richemont (Citi ‘buy’ target ₣163)

Rates

US curve (2-10 years) steepening unchanged at 53bps

HY corporate spreads higher +15bps (US at 295bps) ; EU at 290bps

Japan JGB 30 and 40 year yields at all time highs

Commodities

Oil price lower (-3.5%) on ME ceasefire and Trump’s new threat on tariffs

Gold price higher (+3.5%) breaking the $4000 level - Silver breaking the $50 an ounce level, last seen in 1980. NB record $3 backwardation Futures vs Spot price; Tether added 19t of Gold to its B/S in H1

EM

Argentina received a $20bn FX credit line from the US to support its peso

Crypto

BTC lower (-8%) after hitting a new record high at $126000

Under the watch

US Supreme court in November, could possibly agree with previous lower courts decisions (Trump cannot use the International emergency economic powers Act to impose broad tariffs) $165bn custom duties may be refunded

Nota Bene

FED/FOMC meeting minutes showed members were likely to ease policy further this year with majority emphasizing upside risks to inflation (no near-term urgency to change balance sheet runoff)

EM stocks enjoy their strongest rally in over 15 years

Germany’s ind prod collapsed in Aug heading for 3rd year of recession

CALENDAR

Q3 earnings releases: JPM, Wells Fargo, GS, BlackRock, Citi (14 Oct), BofA, MS (15), StateStreet (17)

Macro releases (possibly): US Sep CPI, (15 Oct), PPI (16), Sep NFP (17), UK Aug GDP (16), EU Sep CPI (17)

WHAT ANALYSTS SAY

WisdomTree, 10 October 2025

Author: Doville Silenskyte, Head of Research in Digital Assets

Buying an exchange-traded product (ETP) linked to crypto assets is no different from buying an exchange-traded fund (ETF).

For example, you enter a ticker symbol, place an order, and your exposure to cryptocurrency appears. But behind that simple click lies a complex infrastructure of market makers, authorised participants, custodians, and cold storage vaults. This invisible mechanics determines whether the exposure is secure, efficient, and worthy of institutional trust.

The real question is not just what is held, but how it is held. In crypto investing, structure is not a detail. It is the determining factor of credibility.

Think of a crypto ETP as a finely tuned supply chain. Each link must function perfectly to provide safe and efficient exposure.

Trade execution : Investors place their orders on secondary markets – exchanges or brokers. Market makers provide liquidity, quoting throughout the day to maintain tight spreads and prices aligned with fair value.

Primary market, settlement and acquisition : authorised participants exchange crypto-assets for new shares (or redeem them). To settle these transactions, they procure crypto-assets via regulated platforms or over-the-counter counters.

Custody : assets are transferred to segregated cold storage, legally separate from the issuer's balance sheet. Independent audits, multi-signature controls and insurance protect against operational failures.

Continuous reconciliation : issuers, fund administrators and custodians perform daily reconciliation to align assets with outstanding units. Any inconsistency erodes trust.

Transparency : credible issuers publish the composition of assets and cryptocurrency rights per share on a daily basis. This is the lifeline of trust. If a single link weakens – custody, liquidity or transparency – the entire chain is compromised.

Crypto ETFs democratise access. They wrap a relatively new asset in a familiar format. For institutions, they offer a regulatory-compliant gateway without the hassle of wallets, private keys, or exchange accounts. But not all wrappings are created equal. Some issuers neglect custody, transparency, or the quality of their execution partners. In these cases, the ETP obscures risks rather than reducing them. Investors often only discover these weaknesses in times of stress.

Globally, ‘physical’ crypto ETPs have reached $224 billion in assets under management, but not all of them reduce the risks associated with direct ownership of crypto assets. Some amplify them, creating an illusion of security.

Before allocating capital, investors must ask a few fundamental questions, which form the backbone of due diligence.

The answers distinguish between vehicles that merely provide exposure and those that offer genuine security and institutional-level confidence. Crypto combines both potential linked to scarcity and a history of fragility: platform bankruptcies and opaque custody models have marked the sector.

Understanding the entire life cycle is not an operational detail — it is an essential step in due diligence.

Fees, custody and credibility are not separate levers: they reinforce each other.

Union Bancaire Privée, 10 October 2025

Author: Marc Elliott, Investment Specialist

Nvidia and OpenAI plan to deploy several mega data centres totalling 10 gigawatts – the equivalent of ten nuclear reactors, enough to power Berlin or Madrid! These large-scale projects are expected to multiply as a result of tax breaks granted to companies investing in data centres. Given their energy appetite, sufficient electricity availability is now a prerequisite for their success.

According to forecasts by the International Energy Agency, global electricity consumption is expected to grow by 4% per year between now and 2027, compared with 2.3% in 2023, driven in particular by the development of AI and cloud infrastructure. In developed economies, and in the United States in particular, these large-scale data centres will put increased pressure on electricity grids. Their consumption already accounts for nearly 3% of total demand and could exceed 8% by 2035 – or even sooner, according to some analysts.

Compared to traditional facilities, which consume between 1 and 5 megawatts (MW), these digital data centres require an unprecedented level of consumption of over 100 MW per site. This energy appetite – which is almost continuous and close to full capacity 24 hours a day – is therefore at odds with networks designed to support daily cycles, with loads of 30 to 40% at night and 70 to 90% at peak times between 7 a.m. and 6 p.m.

Successfully integrating these energy-intensive needs while maintaining grid stability poses a major technical and financial challenge for energy systems. The cost of this adaptation is increasingly weighing on new entrants (operators), while regulators are trying to avoid higher bills for households. The latter have already begun to rise, posing a political challenge for governments. In some regions of the United States, grids are already operating at full capacity, making access to electricity a strategic priority for industry players.

To ensure uninterrupted power supply, tech giants are being encouraged to pay high premiums to secure access to stable energy sources, foremost among which is nuclear power.

The shortfall in supply calls for a response on the production side, but the implementation of new capacity remains a major constraint.

Acquiring new gas turbines currently requires a five-year wait, while solar installations can be set up in 18 months but are subject to intermittent production.

Solar systems coupled with batteries require 18 months, but it is difficult to ensure a load factor of more than 90% on a continuous basis.

Onshore wind power can be deployed in 18 to 24 months, compared to three to four years for offshore wind power.

As for nuclear power, any project must realistically be considered over a period of at least 10 years.

Faced with these challenges, these digital heavyweights will have to adapt their projects to their ability to secure their electricity supply, which should lead them to set up their infrastructure in regions where access to this energy is less limited, as is the case in Europe.

Loomis Sayles, 8 October 2025

Author: Craig Burelle, Macro strategies Analyst

The credit market should remain resilient, supported by solid fundamentals and the absence of excessive signs of indebtedness in most sectors. According to our credit research team's bottom-up fundamental analysis, 85% of the sectors in the Bloomberg US Aggregate Index are currently in the expansion phase of the credit cycle. We believe that cyclical sectors—such as large banks, retail and construction materials—are also in this expansion phase, which is a positive cyclical indicator for the future. Overall, our credit research team's forward-looking outlook improved during the quarter. Credit trends, profit margins and free cash flow are now on a more solid footing.

The future impact of tariffs remains highly uncertain and will vary across sectors. Overall, however, the outlook for the impact of tariffs is less negative than it was in June 2025. According to Loomis Sayles' internal risk premium model, the expected default rate for the US high-yield segment is a low 3.4% for the twelve months ending August 2026. Credit risk premiums remain narrow. While corporate bonds continue to offer attractive carry relative to US government bonds, opportunities for additional returns from spread tightening are becoming more limited.

Central banks are seeking to bring their key interest rates back to neutral levels without compromising global economic expansion or reigniting inflationary pressures. Public debt levels are high, but remain manageable for most countries. Markets appear to be aware of the risks associated with fiscal policy, which should prevent long-term yields from skyrocketing. Since the beginning of the year, developed market rates have risen across 10- and 30-year maturities. Steeper yield curves typically coincide with periods of economic expansion. Over the past year, US Treasury yields have fallen across the curve, despite a steepening of its slope.

We expect global yield curves to maintain their current slope and potentially steepening further through 2026. We believe the Fed is likely to make two further 25 basis point cuts (in late October and early December 2025), followed by a third in March 2026, before pausing to assess how close rates are to their neutral level. The European Central Bank appears to have reached a policy rate close to neutral. Compared to the Fed, the Bank of England is also approaching neutrality, although it may still cut rates between now and summer 2026. We favour emerging market sovereign and local currency bonds over long-term developed market bonds, with some countries offering yields above those of US Treasuries. The Fed could therefore cut rates twice more in 2025, while the European and Japanese central banks appear to be taking a break. However, the Bank of Japan could raise rates again by mid-2026, bucking the trend set by its counterparts.

Foreign currencies are expected to continue performing strongly, but at a slower pace than since the start of the year. In this global risk-friendly environment, we believe it makes sense to diversify portfolios and hold non-sterling exposure. Globally, the probability of a recession has been declining for several months – rightly so, in our view. Demand for safe-haven assets is no longer supporting the US dollar. The US administration's willingness to negotiate trade agreements with its main partners introduces further upside potential for our already positive view on assets denominated in currencies other than the dollar. In Europe, and particularly in Germany, the shift towards more expansionary fiscal policies should raise long-term trend growth rates. The euro/dollar exchange rate therefore has potential for appreciation in the long term. A stable to improving global growth environment should continue to attract capital from US investors. This trend could continue for several quarters, both in developed and emerging markets. We recommend non-dollar exposure via local currency debt. Our preferred markets include Brazil, South Africa, eurozone governments, Sweden, Norway and Mexico.

Equities

Specific stock weekly performances:

AMD (+30% on its deal with OpenAI), Figma (+15%), Abivax (+10%)

Ferrari (-19% on poor outlook), BMW (-9%), Thales (-6%), Leonardo (-6%)

Analysts: ASML (JPM ‘o/w’ target €1000), Richemont (Citi ‘buy’ target ₣163)

Rates

US curve (2-10 years) steepening unchanged at 53bps

HY corporate spreads higher +15bps (US at 295bps) ; EU at 290bps

Japan JGB 30 and 40 year yields at all time highs

Commodities

Oil price lower (-3.5%) on ME ceasefire and Trump’s new threat on tariffs

Gold price higher (+3.5%) breaking the $4000 level - Silver breaking the $50 an ounce level, last seen in 1980. NB record $3 backwardation Futures vs Spot price; Tether added 19t of Gold to its B/S in H1

EM

Argentina received a $20bn FX credit line from the US to support its peso

Crypto

BTC lower (-8%) after hitting a new record high at $126000

Under the watch

US Supreme court in November, could possibly agree with previous lower courts decisions (Trump cannot use the International emergency economic powers Act to impose broad tariffs) $165bn custom duties may be refunded

Nota Bene

FED/FOMC meeting minutes showed members were likely to ease policy further this year with majority emphasizing upside risks to inflation (no near-term urgency to change balance sheet runoff)

EM stocks enjoy their strongest rally in over 15 years

Germany’s ind prod collapsed in Aug heading for 3rd year of recession

CALENDAR

Q3 earnings releases: JPM, Wells Fargo, GS, BlackRock, Citi (14 Oct), BofA, MS (15), StateStreet (17)

Macro releases (possibly): US Sep CPI, (15 Oct), PPI (16), Sep NFP (17), UK Aug GDP (16), EU Sep CPI (17)

WHAT ANALYSTS SAY

- WisdomTree

- Union Bancaire Privée

- Loomis Sayles

WisdomTree, 10 October 2025

Author: Doville Silenskyte, Head of Research in Digital Assets

Buying an exchange-traded product (ETP) linked to crypto assets is no different from buying an exchange-traded fund (ETF).

For example, you enter a ticker symbol, place an order, and your exposure to cryptocurrency appears. But behind that simple click lies a complex infrastructure of market makers, authorised participants, custodians, and cold storage vaults. This invisible mechanics determines whether the exposure is secure, efficient, and worthy of institutional trust.

The real question is not just what is held, but how it is held. In crypto investing, structure is not a detail. It is the determining factor of credibility.

Think of a crypto ETP as a finely tuned supply chain. Each link must function perfectly to provide safe and efficient exposure.

Trade execution : Investors place their orders on secondary markets – exchanges or brokers. Market makers provide liquidity, quoting throughout the day to maintain tight spreads and prices aligned with fair value.

Primary market, settlement and acquisition : authorised participants exchange crypto-assets for new shares (or redeem them). To settle these transactions, they procure crypto-assets via regulated platforms or over-the-counter counters.

Custody : assets are transferred to segregated cold storage, legally separate from the issuer's balance sheet. Independent audits, multi-signature controls and insurance protect against operational failures.

Continuous reconciliation : issuers, fund administrators and custodians perform daily reconciliation to align assets with outstanding units. Any inconsistency erodes trust.

Transparency : credible issuers publish the composition of assets and cryptocurrency rights per share on a daily basis. This is the lifeline of trust. If a single link weakens – custody, liquidity or transparency – the entire chain is compromised.

Crypto ETFs democratise access. They wrap a relatively new asset in a familiar format. For institutions, they offer a regulatory-compliant gateway without the hassle of wallets, private keys, or exchange accounts. But not all wrappings are created equal. Some issuers neglect custody, transparency, or the quality of their execution partners. In these cases, the ETP obscures risks rather than reducing them. Investors often only discover these weaknesses in times of stress.

Globally, ‘physical’ crypto ETPs have reached $224 billion in assets under management, but not all of them reduce the risks associated with direct ownership of crypto assets. Some amplify them, creating an illusion of security.

Before allocating capital, investors must ask a few fundamental questions, which form the backbone of due diligence.

The answers distinguish between vehicles that merely provide exposure and those that offer genuine security and institutional-level confidence. Crypto combines both potential linked to scarcity and a history of fragility: platform bankruptcies and opaque custody models have marked the sector.

Understanding the entire life cycle is not an operational detail — it is an essential step in due diligence.

Fees, custody and credibility are not separate levers: they reinforce each other.

Union Bancaire Privée, 10 October 2025

Author: Marc Elliott, Investment Specialist

Nvidia and OpenAI plan to deploy several mega data centres totalling 10 gigawatts – the equivalent of ten nuclear reactors, enough to power Berlin or Madrid! These large-scale projects are expected to multiply as a result of tax breaks granted to companies investing in data centres. Given their energy appetite, sufficient electricity availability is now a prerequisite for their success.

According to forecasts by the International Energy Agency, global electricity consumption is expected to grow by 4% per year between now and 2027, compared with 2.3% in 2023, driven in particular by the development of AI and cloud infrastructure. In developed economies, and in the United States in particular, these large-scale data centres will put increased pressure on electricity grids. Their consumption already accounts for nearly 3% of total demand and could exceed 8% by 2035 – or even sooner, according to some analysts.

Compared to traditional facilities, which consume between 1 and 5 megawatts (MW), these digital data centres require an unprecedented level of consumption of over 100 MW per site. This energy appetite – which is almost continuous and close to full capacity 24 hours a day – is therefore at odds with networks designed to support daily cycles, with loads of 30 to 40% at night and 70 to 90% at peak times between 7 a.m. and 6 p.m.

Successfully integrating these energy-intensive needs while maintaining grid stability poses a major technical and financial challenge for energy systems. The cost of this adaptation is increasingly weighing on new entrants (operators), while regulators are trying to avoid higher bills for households. The latter have already begun to rise, posing a political challenge for governments. In some regions of the United States, grids are already operating at full capacity, making access to electricity a strategic priority for industry players.

To ensure uninterrupted power supply, tech giants are being encouraged to pay high premiums to secure access to stable energy sources, foremost among which is nuclear power.

The shortfall in supply calls for a response on the production side, but the implementation of new capacity remains a major constraint.

Acquiring new gas turbines currently requires a five-year wait, while solar installations can be set up in 18 months but are subject to intermittent production.

Solar systems coupled with batteries require 18 months, but it is difficult to ensure a load factor of more than 90% on a continuous basis.

Onshore wind power can be deployed in 18 to 24 months, compared to three to four years for offshore wind power.

As for nuclear power, any project must realistically be considered over a period of at least 10 years.

Faced with these challenges, these digital heavyweights will have to adapt their projects to their ability to secure their electricity supply, which should lead them to set up their infrastructure in regions where access to this energy is less limited, as is the case in Europe.

Loomis Sayles, 8 October 2025

Author: Craig Burelle, Macro strategies Analyst

The credit market should remain resilient, supported by solid fundamentals and the absence of excessive signs of indebtedness in most sectors. According to our credit research team's bottom-up fundamental analysis, 85% of the sectors in the Bloomberg US Aggregate Index are currently in the expansion phase of the credit cycle. We believe that cyclical sectors—such as large banks, retail and construction materials—are also in this expansion phase, which is a positive cyclical indicator for the future. Overall, our credit research team's forward-looking outlook improved during the quarter. Credit trends, profit margins and free cash flow are now on a more solid footing.

The future impact of tariffs remains highly uncertain and will vary across sectors. Overall, however, the outlook for the impact of tariffs is less negative than it was in June 2025. According to Loomis Sayles' internal risk premium model, the expected default rate for the US high-yield segment is a low 3.4% for the twelve months ending August 2026. Credit risk premiums remain narrow. While corporate bonds continue to offer attractive carry relative to US government bonds, opportunities for additional returns from spread tightening are becoming more limited.

Central banks are seeking to bring their key interest rates back to neutral levels without compromising global economic expansion or reigniting inflationary pressures. Public debt levels are high, but remain manageable for most countries. Markets appear to be aware of the risks associated with fiscal policy, which should prevent long-term yields from skyrocketing. Since the beginning of the year, developed market rates have risen across 10- and 30-year maturities. Steeper yield curves typically coincide with periods of economic expansion. Over the past year, US Treasury yields have fallen across the curve, despite a steepening of its slope.

We expect global yield curves to maintain their current slope and potentially steepening further through 2026. We believe the Fed is likely to make two further 25 basis point cuts (in late October and early December 2025), followed by a third in March 2026, before pausing to assess how close rates are to their neutral level. The European Central Bank appears to have reached a policy rate close to neutral. Compared to the Fed, the Bank of England is also approaching neutrality, although it may still cut rates between now and summer 2026. We favour emerging market sovereign and local currency bonds over long-term developed market bonds, with some countries offering yields above those of US Treasuries. The Fed could therefore cut rates twice more in 2025, while the European and Japanese central banks appear to be taking a break. However, the Bank of Japan could raise rates again by mid-2026, bucking the trend set by its counterparts.

Foreign currencies are expected to continue performing strongly, but at a slower pace than since the start of the year. In this global risk-friendly environment, we believe it makes sense to diversify portfolios and hold non-sterling exposure. Globally, the probability of a recession has been declining for several months – rightly so, in our view. Demand for safe-haven assets is no longer supporting the US dollar. The US administration's willingness to negotiate trade agreements with its main partners introduces further upside potential for our already positive view on assets denominated in currencies other than the dollar. In Europe, and particularly in Germany, the shift towards more expansionary fiscal policies should raise long-term trend growth rates. The euro/dollar exchange rate therefore has potential for appreciation in the long term. A stable to improving global growth environment should continue to attract capital from US investors. This trend could continue for several quarters, both in developed and emerging markets. We recommend non-dollar exposure via local currency debt. Our preferred markets include Brazil, South Africa, eurozone governments, Sweden, Norway and Mexico.

Contacts

Main office

1-5, № 53, 12 Charents Str., Yerevan, 0025

+374 43 00-43-82

Broker

broker@unibankinvest.am

research@unibankinvest.am

Disclaimer

The information presented in the document contains a general overview of the products and services offered by Unibank OJSC (registered trademark – Unibank Invest, hereinafter referred to as the Bank).

The information is intended solely for the attention of the persons to whom it is addressed. Further dissemination of this information is allowed only with the prior consent of the Bank.

The information is only indicative, is not exhaustive and is provided solely for discussion purposes. The information should not be regarded as a public offer, request or invitation to purchase or sell any securities, financial instruments or services. The Bank reserves the right to make a final decision on the provision of these products and/or services to a specific customer, including refusing to provide products and/or services if such activities would be contrary to applicable law.

No guarantees in direct or indirect form, including those stipulated by law, are provided in connection with the specified information and materials. The information presented above cannot be considered as a recommendation for investing funds, as well as guarantees or promises of future profitability of investments.