The S&P 500 Index is one of the most important benchmarks in the global financial market. Whether you're just starting your investment journey or looking to strengthen your portfolio, understanding the S&P 500 can provide a solid foundation for long-term success.

What is the S&P 500 Index?

The S&P 500 (Standard & Poor’s 500) represents the 500 largest and most well-known companies in the United States. It is a list that tracks changes in the stock prices of these companies.

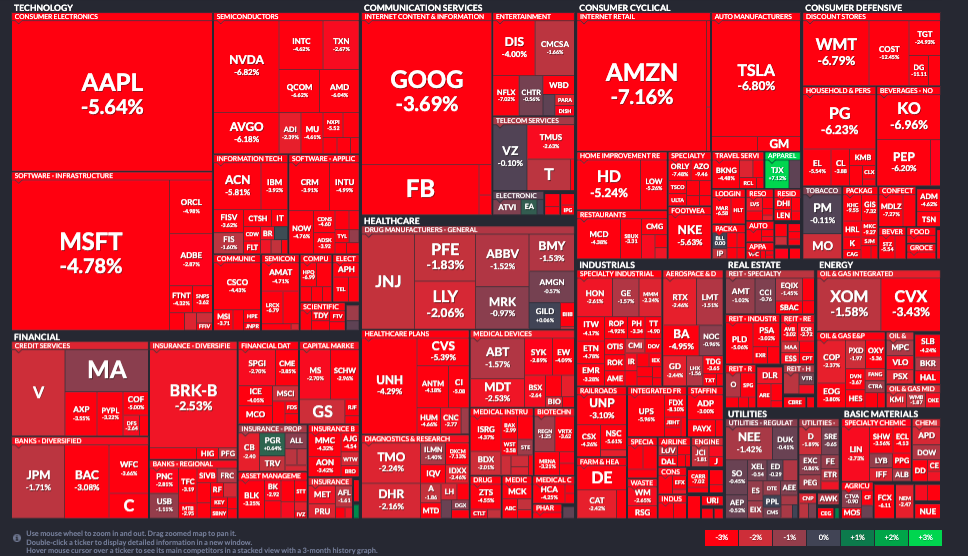

It includes global giants such as Apple, Amazon, Microsoft, Coca-Cola, Netflix, and many others. These companies operate across various sectors, including technology, healthcare, consumer goods, financial services, and more.

It includes global giants such as Apple, Amazon, Microsoft, Coca-Cola, Netflix, and many others. These companies operate across various sectors, including technology, healthcare, consumer goods, financial services, and more.

To be included in the index, a company must meet strict criteria, such as being registered in the U.S. and having a market capitalization of at least $14.5 billion. If a company no longer meets the requirements, it can be removed from the index.

The S&P 500 is made up of companies that together account for nearly 80% of the total value of the U.S. stock market. This makes it a reliable indicator of the overall market’s health.Can You Invest in the S&P 500?

You can’t invest directly in the index, but there are several easy ways to gain exposure to its performance:

1. Index Funds and ETFs

The S&P 500 is made up of companies that together account for nearly 80% of the total value of the U.S. stock market. This makes it a reliable indicator of the overall market’s health.Can You Invest in the S&P 500?

You can’t invest directly in the index, but there are several easy ways to gain exposure to its performance:

1. Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) aim to mirror the performance of the S&P 500. This means if the index rises, your investment should rise too — and vice versa.

Some ETFs even focus on specific sectors within the S&P 500, such as technology or healthcare.

These funds are ideal for beginners because they:

- Index Funds: These are mutual funds that track the S&P 500 and are usually available through investment platforms or retirement accounts.

- ETFs: These trade like stocks and can be bought or sold throughout the day. Popular options include:

- SPDR S&P 500 ETF (SPY)

- Vanguard S&P 500 ETF (VOO)

- iShares Core S&P 500 ETF (IVV)

Some ETFs even focus on specific sectors within the S&P 500, such as technology or healthcare.

These funds are ideal for beginners because they:

- Offer diversification

- Are cost-effective

- Don’t require you to pick individual stocks

- Can be accessed via most brokerage accounts

2. Individual Stocks

Another option is to buy shares in specific companies that are part of the S&P 500. If you believe in the long-term growth of a company like Microsoft or Amazon, you can buy its shares directly through a share dealing platform.

However, this approach requires more research and carries greater risk, since your portfolio isn’t automatically diversified.

Does the S&P 500 Pay Dividends?

The S&P 500 itself doesn't pay dividends because it’s an index, not a company. But many of the companies within it do. If you invest through a mutual fund or ETF that holds these dividend-paying stocks, you’ll receive dividends based on the number of fund shares you own.

Key Tips Before Investing

- Think long-term: Investing in the S&P 500 is typically best suited for a time horizon of 5 years or more.

- Build an emergency fund: This helps prevent you from selling investments during a downturn.

- Understand the risks: Investments can rise and fall in value. You may get back less than you invest.

- Start with your goals: Consider your financial objectives and risk tolerance before you invest.

CONCLUSION

The S&P 500 provides an opportunity to invest in some of the world’s largest and most stable companies while diversifying risks at the same time. Whether you choose an ETF, an index fund, or individual stocks, it’s an excellent starting point for your investment journey.

HOW TO INVEST?

Open a free brokerage account with Unibank Invest and start investing. The Unibank Invest app provides access to the world’s largest stock exchanges, enabling you to purchase international investment instruments, such as stocks, bonds, and ETFs.

To open a brokerage account, fill out the online application or call +374 43 004 382.